What is the Plant-based Food Market Size?

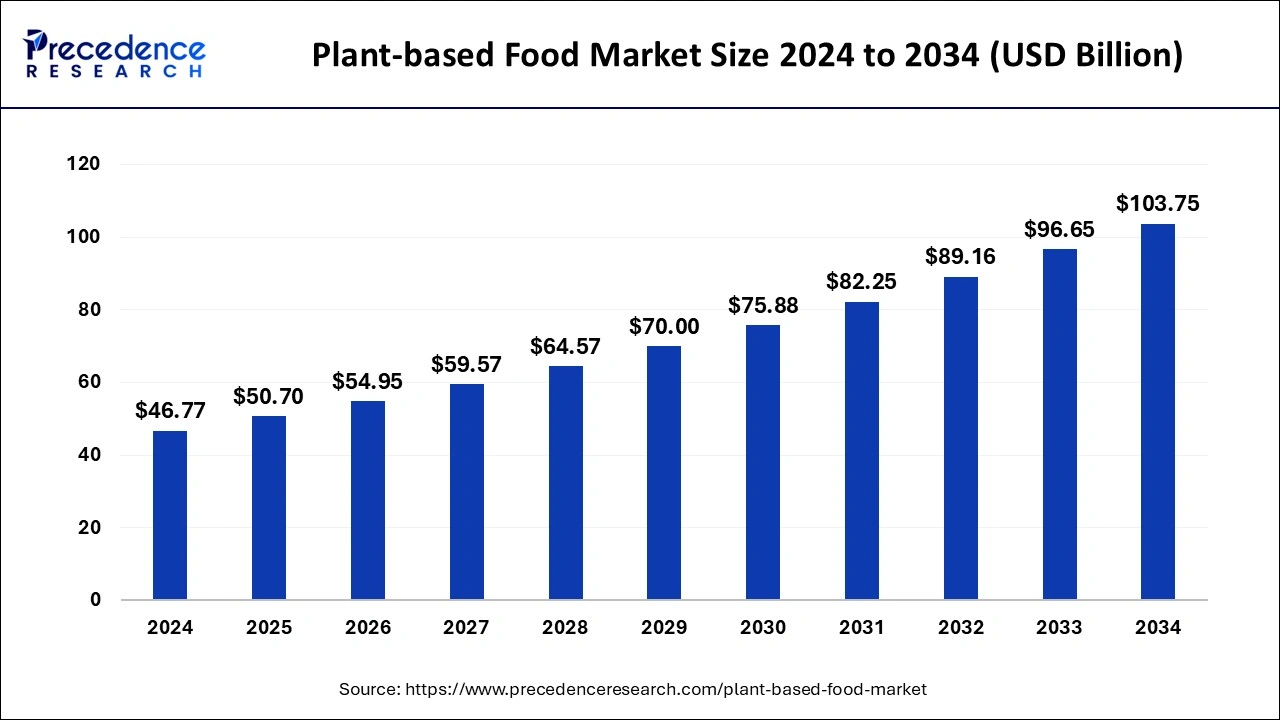

The global plant-based food market size was accounted for USD 50.70 billion in 2025, and is expected to reach around USD 103.75 billion by 2034, expanding at a CAGR of 8.29% from 2025 to 2034.

Market Highlights

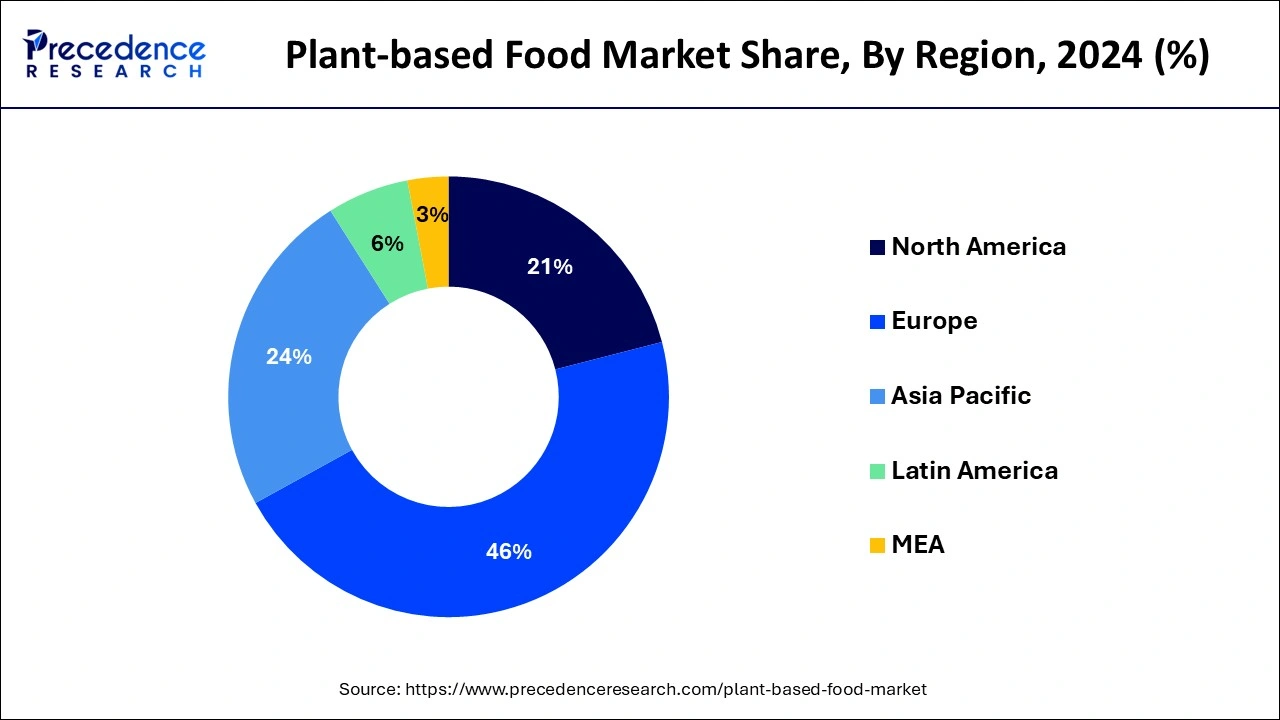

- By geography, the Europe region holds the maximum market share of 46% in 2024.

- By product type, the dairy alternatives segment will represent the maximum share of the global market.

- By source, the soy segment holds the largest share of the global market.

- By distribution channel, The HoReCa segment will represent the highest share of the global market.

Market Size and Forecast

- Market Size in 2025: USD 50.70 Billion

- Market Size in 2026: USD 54.95 Billion

- Forecasted Market Size by 2034: USD 103.75 Billion

- CAGR (2025-2034): 8.29%

- Largest Market in 2024: Europe

Market Overview

Plant-based foods are dairy-free or meat-free foods developed or prepared from plant-based sources. Meat alternatives are goods that taste, smell, and look like genuine meat yet are healthy than meat. They are typically made up of materials like soy, wheat, peas, and others. Plant-based foods are packed with protein, minerals, and nutrients, and their popularity is expanding rapidly.

Due to its high levels of nutrients and environmentally friendly character, the plant-based meal industry is expected to rise steadily in the future years. Recognizing the rising acceptability of plant-based meals and food, several firms are producing plant-based food items with clean-label and plant-based components. However, the rising expense of plant-based meals is likely to stifle expansion, particularly in nations with low consumer per capita income.

Plant-based Food Market Growth Factors

The significant factors which are leading to the growth of the plant-based food market are the increase of vegan and vegetarian populations interested in eating clean labeling products and food products that are made from plant sources. An increase in lactose intolerance in the global population is another factor that will contribute to the growth of the market.

The various advantage of the use of plant-based food for individuals is pushing the demand of the plant-based food market

- The rise in vegan population

- The rise in lactose intolerant population

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 50.70 Billion |

| Market Size in 2026 | USD 54.95 Billion |

| Market Size by 2034 | USD 103.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.29% |

| Dominating Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Source, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rise in the vegan population: A vegan is someone who does not consume any food products that are derived from an animal source. With growing awareness of animal cruelty, veganism has grown as a movement. This trend has resulted in a rise in the amount of money that individuals are ready to spend on vegan items.

According to a vegan society-commissioned report, the number of vegans in the UK doubled between 2014 and 2018. Vegans made up around 1.16% of the population in 2019, and veganism was introduced in the UK. The surge in the vegan population has increased interest in plant-based foods.

According to a poll commissioned by the UK government, the majority of vegans in the country are relatively new to the lifestyle, with 63% having begun in the previous five years. Furthermore, the vast majority of British vegans (81%) migrated to vegetarianism, many of whom have been eliminating meat from their daily meals.

Increase in lactose-intolerant population: Lactose intolerance is characterized by a reduced capacity to digest lactose. Lactose intolerance in adults is caused by the decrease in the function of the LCT gene, which implies that people may have increased difficulty in digesting lactose as they advance in age.

According to National Centre for Biotechnology Information (NCBI), lactose intolerance affects around 65% of the adult human population. It causes bloating, nausea, vomiting, and diarrhoea prompting to seek lactose-free plant-based foods in the market. The rise in the number of lactose-intolerant people throughout the globe has consequently contributed towards the growth of plant-based foods.

Increase in per capita disposable income: Global per capita has witnessed a strong growth rate over the past few years, particularly in emerging nations. An increase in urbanization, growth in population, and surge in the rate of female participation in the labor force in many developing and developed markets has encouraged the adoption of convenience-oriented lifestyles, making plant-based foods more desirable.

The increase in the middle-class population and rise in personal disposable income is having a positive impact on the plant-based food market. The lifestyle of people in recent years have been improved to an extent and have been changed drastically in countries like India and China. The growth in the middle-class population has been expected to surge the demand for the plant-based food market in the upcoming years.

Key Market Challenges

High prices of plant-based foods impede market growth: Since plant-based goods are intended to be used for a longer period of time, they require specific care at every step of production. Advanced processes are necessary for these items during phases such as manufacture, packaging, and distribution. Its whole procedure needs experienced supervision and contemporary equipment. These items are expensive because of the complex procedures involved and the high level of oversight required.

According to the Good Food Institute, those who buy plant-based foods have a greater basket ring, spending 61% more than the typical shopper, and 37% of plant-based meat purchaser households make more than $100,000 each year. Because of the high pricing of the items, it is expensive for the populace to purchase plant-based seafood products, which can stifle market growth.

The inability of plant-based seafood to mimic original seafood taste: Plant-based seafood is unable to mimic the taste of original seafood which restrains the growth of the market. According to the report of the good food Institute, 27% of people don't use plant-based meat substitutes just because they don't like the taste, whereas 73% of consumers agree that plant-based meat should mimic the taste of meat. Manufacturers are innovating to make plant-based seafood taste similar to original seafood which may help in overcoming this restrain.

Opportunities

To make most of the opportunity's vendors are advised to focus on growth prospects in the fastest-growing segments while being rigid in the slow growing segment.

- Strong branding and promotion to entice the consumer's interest

- Technological advancement in plant-based foods.

Segments Insights

Product Type Insights

On the basis of product type, plant-based food is segmented into dairy alternatives, meat alternatives, seafood alternatives, baked goods and confectionery, RTD beverages, RTE meals, and others. The dairy alternatives category will represent the majority share of the plant-based food industry.

The growing lactose-intolerant population, growing moral considerations among consumers about animal exploitation in current dairy farming techniques, and the nutritive value given by plant-based dairy products all contribute to this segment's substantial market share.

Source Insights

On the basis of source, plant-based food is segmented into soy, wheat, peas, canola, lentil, and others. The soy category will represent the majority share of the plant-based food industry.

The cardiovascular benefits of soy-based alternative seafood are fuelling the demand for plant-based seafood among the adult and geriatric populations.

Distribution Channel Insights

On the basis of distribution channel, the HoReCa category will represent the majority share of the plant-based food industry. The growth of this segment is attributable to rapid urbanization, rising disposable income, and growing penetration of hotels, restaurants, and cafes across the globe.

The Asia-Pacific is anticipated to provide lucrative growth opportunities for the HoReCa segment. Nations such as India, China, and Indonesia are still developing and hotels and restaurants have a lot of scope to serve the huge population of these developing nations.

Regional Insights

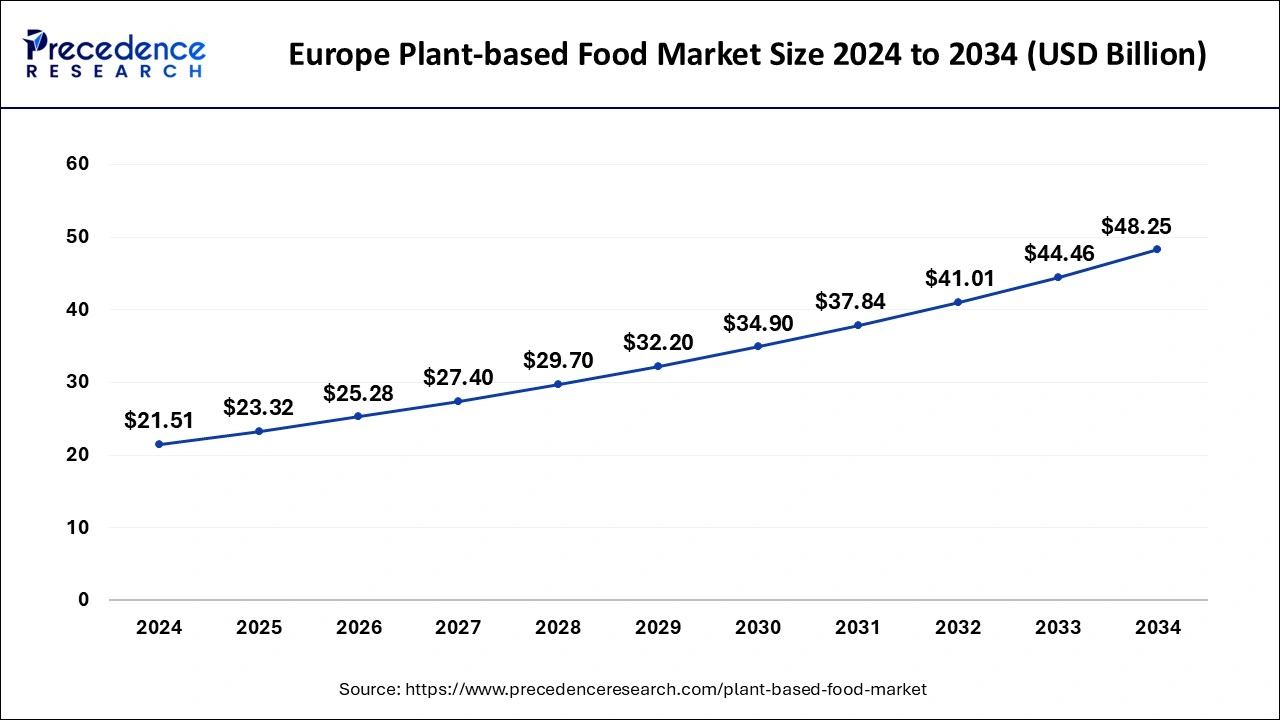

Europe Plant-based Food Market Size and Growth 2025 to 2034

The Europe plant-based food market size was estimated at USD 21.51 billion in 2024 and is predicted to be worth around USD 48.25 billion by 2034, at a CAGR of 8.41% from 2025 to 2034.

On the basis of geography, the plant-based food market has been expected to experience the majority of the market share and market growth from Europe during the forecast period. Europe is the most lucrative plant-based seafood market region, holding the highest growth potential. Europe represents the most profitable plant-based foods market region, with the most potential for expansion.

According to the European Union (Europa.eu), sales of plant-based meat and seafood substitutes have increased dramatically in Europe over the last two years, with Germany leading the way with a 226% increase, trailed by Austria with an 82% increase.

In the last two years, plant-based meat and seafood sales in Romania increased by 154%, whereas sales in France increased by 100%. Germany was the top consumer of plant-based seafood in 2021, accounting for 14.6% of the market, followed by the United Kingdom (11.0%) and France (9.8%).

Plant-based Food Market Companies

- Bayer AG

- Abbott

- Koninklijke DSM N.V.

- DuPont.

- Amway

- The Nature's Bounty Co.

- GlaxoSmithKline plc.

- Nestlé

- RiceBran Technologies

- Mead Johnson & Company, LLC.

- Medifast, Inc.

- Premier Nutrition Corporation

- TOOTSI IMPEX Inc.

- U.S. Spice Mills, Inc.

- Health Food Manufacturers' Association

- NOW Foods

- Glanbia PLC

- Herbalife International of America, Inc.

- Bionova

- Puris

- Ingredion GmbH

- Morning Star Farms

- Sotexpro

- Tyson Food, Inc.

- Glanbia Plc

- Ocean Hugger Foods

- Good Catch Foods

- Impossible Foods, Inc.

- New Wave Foods

- Sophie's Kitchen, Inc.

- Gardein

- Quorn (Monde Nissin Corporation)

Recent Developments

- Danone announced the new dairy & plants mix infant formula on July 5th, 2022, to satisfy parents' demand for the correct dietary alternatives for a vegetarian, flexible, and plant-based diet while meeting their baby's unique nutritional needs. Danone has retained dominance in 50 decades of scientific breast milk research and plant-based foods and has produced this innovative dairy and plant-based infant formula formulation via well-known brands such as Alpro and Silk.

- Nestle introduced plant-based minced, ground meat and an upgraded version of the fantastic burger, in various European nations like Germany, Norway, Austria, and Sweden in August 2019.

- On September 8, 2020, India createdvegan foodsafety guidelines, including the creation of a new emblem to identify vegan food packs and proper registration for vegan food makers. The proposed Food Safety and Standards (Vegan Food) Regulations 2021 were developed by the Food Safety and Standards Authority of India (FSSAI).

- For the very first time in India, the proposed laws identified vegan food and provided safety restrictions and labeling criteria to identify vegan food items.

Segments Covered in the Report

By Product Type

- Dairy Alternatives

- Meat Alternatives

- Seafood Alternatives

- Baked Goods and Confectionery

- RTD Beverages

- RTE Meals

- Others

By Source

- Soy

- Wheat

- Pea

- Canola

- Lentil

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- HoReCa

- Convenience Stores

- Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting