Point of Care Lipid Test Market Size and Forecast 2025 to 2034

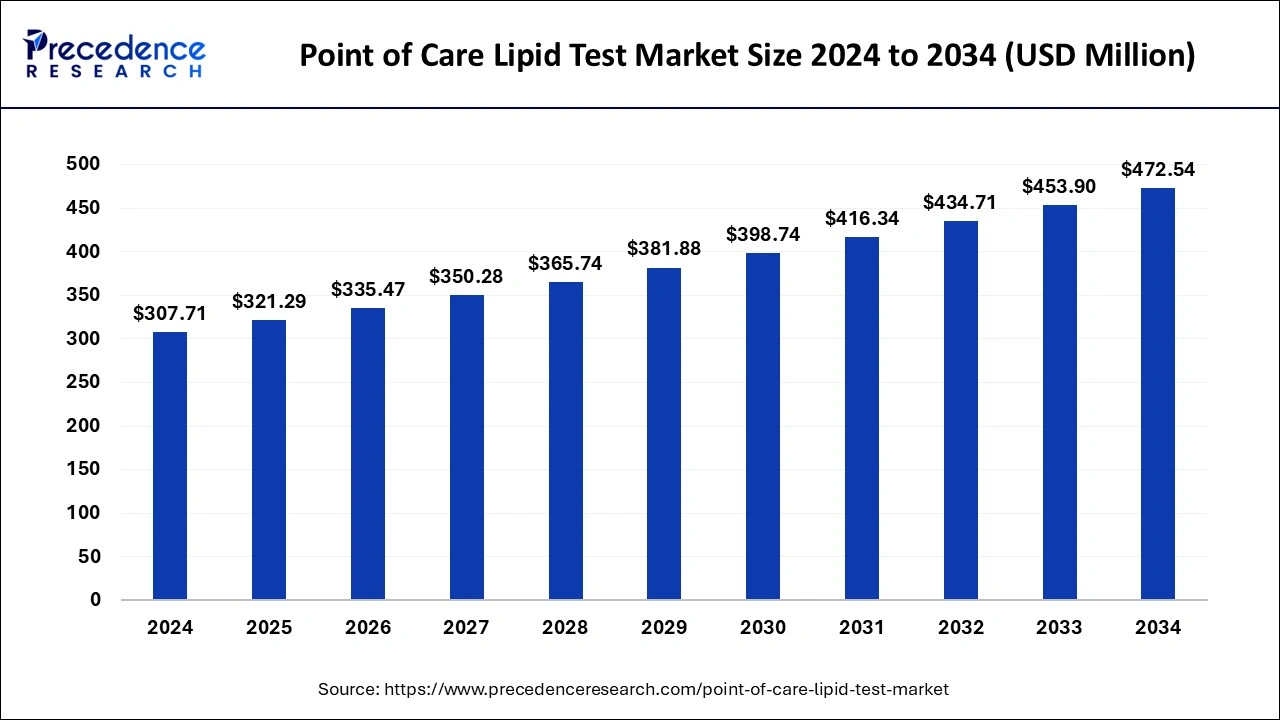

The global point of care lipid test market size was estimated at USD 307.71 million in 2024 and is predicted to increase from USD 321.29 million in 2025 to approximately USD 472.54 million by 2034, expanding at a CAGR of 4.38% from 2025 to 2034. The rising prevalence of target diseases such as cardiovascular diseases, diabetes, and dyslipidemia is identified as a key driving factor of the point of care lipid test market.

Point of Care Lipid Test MarketKey Takeaways

- The global point of care lipid test market was valued at USD 307.71 million in 2024.

- It is projected to reach USD 472.54 million by 2034.

- The point of care lipid test market is expected to grow at a CAGR of 4.38% from 2025 to 2034.

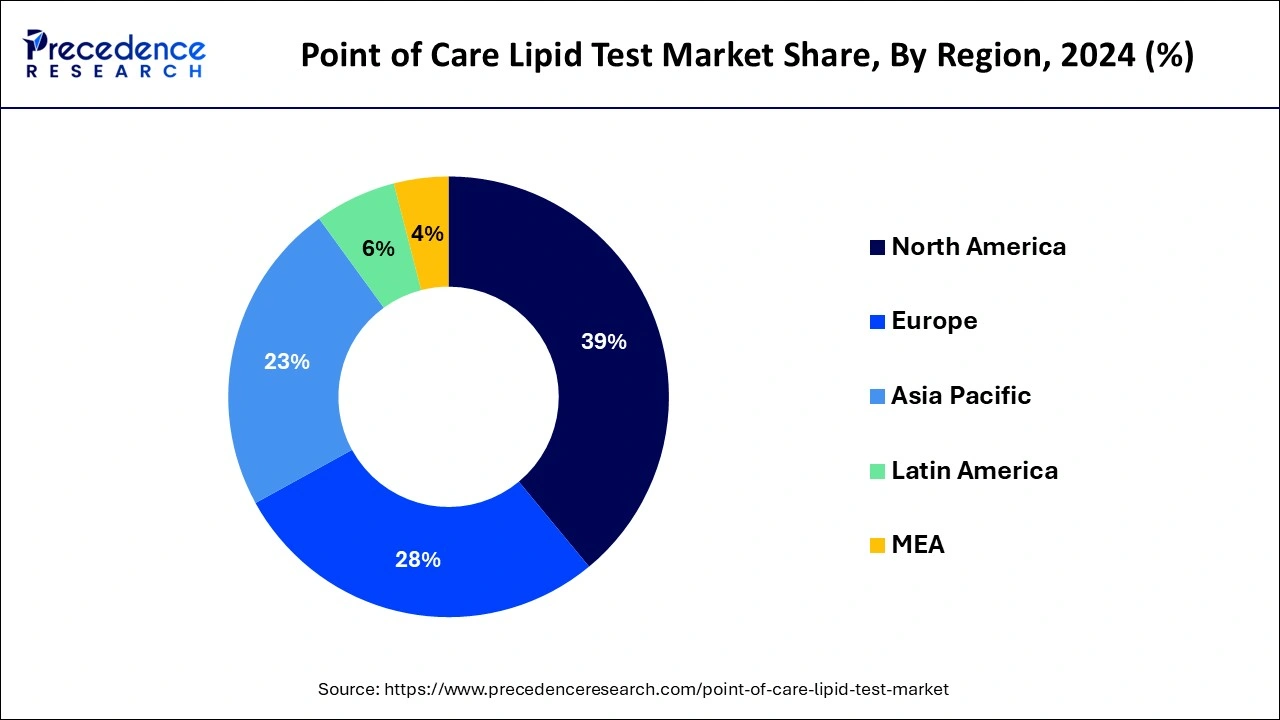

- North America held a significant share of in the point of care lipid test market in 2024 with 39%.

- Asia Pacific is anticipated to experience the highest growth in the upcoming years.

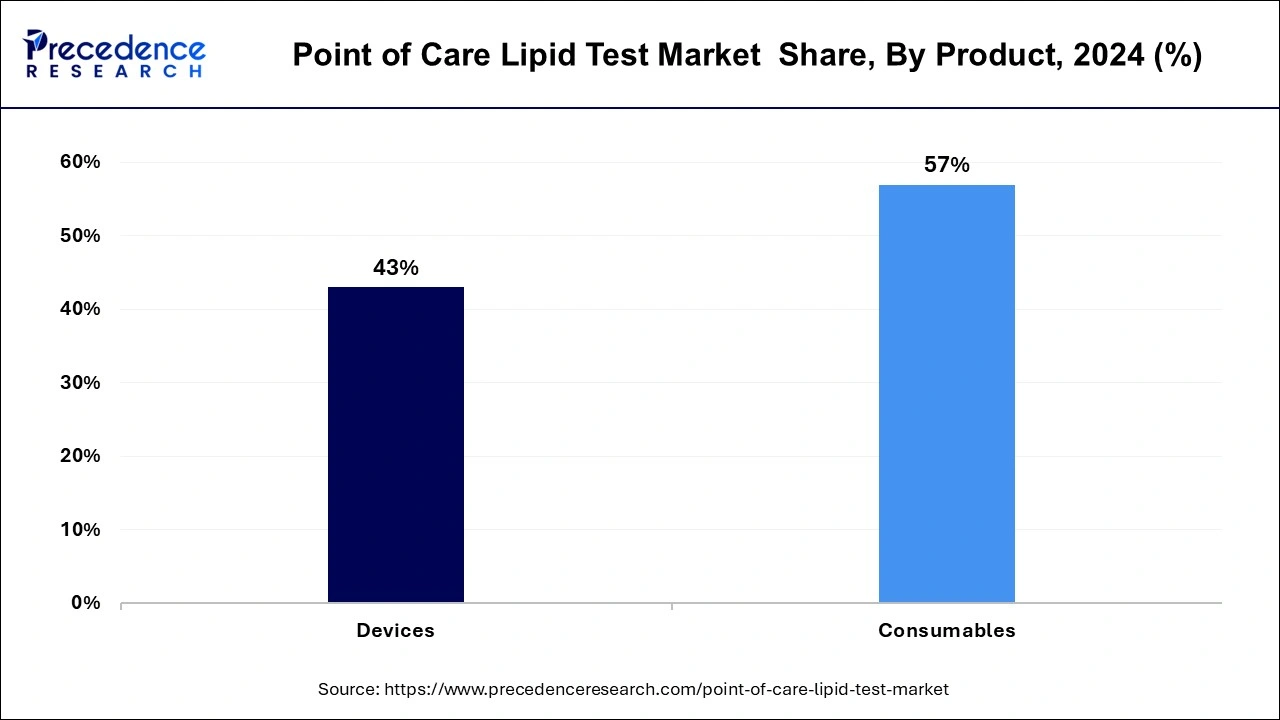

- By product, the consumables type segment has accounted market share of 57% in 2024.

- By application, in 2024, the endogenous hyperlipidemia segment dominated the market with 46% revenue share.

- By end use, the diagnostic centers segment has held largest market share of 56% in 2024.

U.S.Point of Care Lipid Test Market Size and Forecast 2025 to 2034

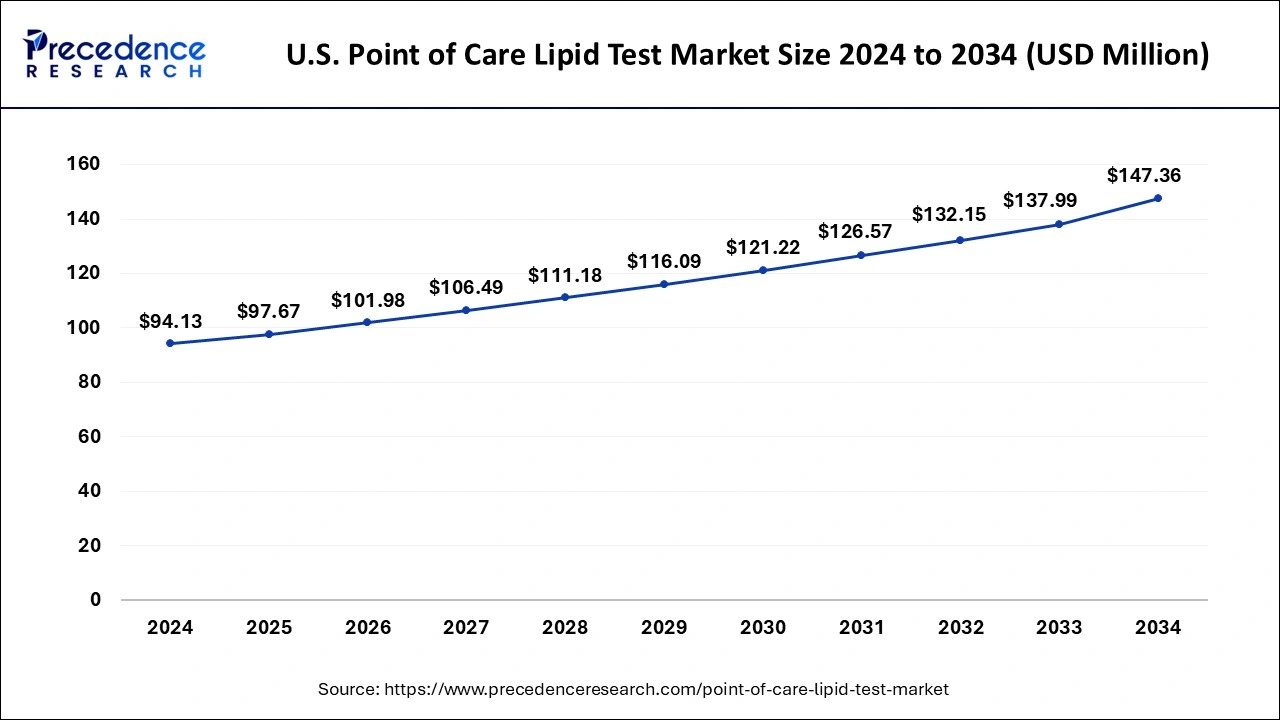

The U.S. point of care lipid test market size was estimated at USD 94.13 million in 2024 and is projected to surpass around USD 147.36 million by 2034 at a CAGR of 4.58% from 2025 to 2034.

North America held a significant share of the point of care lipid test market in 2024and is projected to remain dominant during the projected period. This is due to major pharmaceutical and biopharmaceutical companies in the region. Additionally, increasing emphasis on preventive healthcare is expected to drive market growth. Efforts by both government and private sectors to promote healthy lifestyles are likely to contribute to market expansion in the region.

- In January 2023, Heska Corporation, a US-based company and a global provider of advanced veterinary diagnostic and specialty products and solutions, acquired MBio Diagnostics, Inc. Heska Corporation manufactures, develops, and sells advanced veterinary diagnostic and specialty healthcare products, including POC testing instruments.

- In the year 2022, the report of the World Cancer Research Fund International (WCRF) stated that nearly 101,703 cancer cases were diagnosed in Mexico.

Asia Pacific is anticipated to experience the highest growth in the upcoming years.This is attributed to the increasing prevalence of chronic diseases like diabetes, cardiovascular diseases, and infectious diseases in the region. Point-of-care diagnostics have become crucial for the timely detection and monitoring of these conditions, leading to better disease management outcomes.

Countries across the Asia Pacific are investing significantly in improving their healthcare infrastructure, especially in remote and rural areas. The growing awareness among patients about these diseases and the unmet medical needs in the region are expected to drive the demand for point of care lipid test market.

- In November 2022, UK-based LumiraDx Healthcare launched its highly sensitive C-Reactive Protein (CRP) point of care (POC) antigen test across India. The point of care CRP test can be used in multiple clinical settings to help reduce unnecessary antibiotic prescribing that leads to antimicrobial resistance (AMR).

Market Overview

Point of care testing (POCT) is a type of medical diagnostic testing that allows healthcare professionals to obtain lab-quality diagnostic data quickly and accurately. POCT devices use immunoassays and lateral flow chromatography principles to evaluate whole blood. These tests serve multiple purposes, such as pregnancy testing, blood gas assays, electrolyte analysis, fecal occult blood analysis, drug abuse screening, rapid coagulation testing, and rapid cardiac marker diagnosis.

Point-of-care lipid tests specifically measure triglyceride, lipoprotein, and cholesterol levels in the blood. High cholesterol levels can lead to serious health issues, as they can cause plaque buildup in the arteries, restricting blood flow to the heart and increasing the risk of heart attack. Point-of-care lipid tests help doctors measure and analyze blood fat content quickly and efficiently.

Point of Care Lipid Test MarketGrowth Factors

- The presence of favorable regulatory policies for diagnosis is anticipated to fuel point of care lipid test market growth shortly.

- A rise in the geriatric population globally can also contribute to the expansion of the point of care lipid test market over the projected period.

- Increasing awareness among most of the population regarding the fatal cause of cardiovascular diseases is also expected to boost the point of care lipid test market.

- Growing demand for technologically advanced self-testing handheld devices that enhance accuracy, speed, and user-friendliness are estimated to create market opportunities for the point of care lipid test market.

- Rise in unhealthy food habits along with sedentary lifestyles is also one of the key factors for the occurrence of cardiovascular disease.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 321.29 Million |

| Market Size by 2034 | USD 472.54 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.38% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Innovation in the production of point-of-care lipid test products

The pharmaceutical industry's growth and innovation in manufacturing point-of-care lipid test products, driven by a large pool of health-conscious consumers, presents an opportunity in the market. The expansion of the point-of-care lipid test market is anticipated due to the high potential in untapped emerging markets. These markets benefit from improved healthcare infrastructure, addressing unmet healthcare needs, increasing prevalence of cardiovascular disease, and growing demand for the point of care lipid test market instruments and consumables.

The healthcare industry in emerging economies is progressing rapidly, supported by heightened demand for improved healthcare services, substantial government investments in healthcare infrastructure, and the development of medical tourism. These factors collectively contribute to the growth of the point of care lipid test market.

- In January 2023, Cipla expanded its diagnostics portfolio by launching a point-of-care testing device. Another addition to its product offerings for diagnostics laboratories is Cipla's device named Cippoint, which offers a wide range of testing parameters, including cardiac markers, diabetes, infectious diseases, fertility, thyroid function, inflammation, metabolic markers, and coagulation markers.

Restraint

Challenges in interpreting electronic results can hamper market growth

Long-term challenges related to cost, difficulties in interpreting electronic results, and the requirement for fasting before cholesterol testing may significantly restrict the use of cholesterol and lipid tests in the coming years. Similarly, the absence of LDL and HDL testing features will hinder the growth of the point of care lipid test market.

Understanding the results of some at-home cholesterol test kits can be challenging due to their complexity. Users may not obtain accurate results if the kit is not used correctly. Additionally, electronic testing kits or cholesterol test kits that measure triglycerides, LDL, and HDL levels may be more costly.

Opportunities

Rising prevalence of chronic diseases

The global market for point of care lipid tests is expected to grow due to the increasing prevalence of chronic diseases such as liver and renal diseases, as well as diabetes, during the forecast period. Cardiovascular disease (CVD) is a significant cause of mortality in people with chronic kidney disease (CKD). One of the key factors contributing to CVD in CKD patients is the increased formation of atherosclerotic plaques, likely due to factors such as hyperlipidemia, uremic toxins, inflammation, and endothelial dysfunction.

- According to the U.S. Department of Health and Human Services, CKD affects more than one in every seven adults in the U.S., totaling approximately 37 million individuals. These factors are anticipated to create lucrative market opportunities.

Opportunities in emerging economies

The demand for point of care lipid test market is seen in developed countries as well as developing nations like China, Brazil, and India, driving market growth. Various key strategies implemented by different players, such as acquisitions, collaborations, product development, and launches, further enhance point-of-care lipid test market growth during the forecast period.

Cardiovascular diseases have emerged as one of the deadliest disorders globally, becoming the leading cause of death worldwide. Over the past three decades, cardiovascular diseases have significantly increased in prevalence and become the most prominent cause of both mortality and morbidity.

Product Type Insights

The consumables type segment dominated the global point of care lipid test market in 2024 and is expected to continue doing so throughout the forecast period. This is attributed to the rise in the aging population and awareness of healthcare issues regarding the difficulties and availability of point-of-care lipid test devices in the market by different key players. In addition, it offers benefits such as portability, ease of use, and accuracy.

- In July 2023, Quest Diagnostics launched a consumer-initiated genetic test kit. The Genetic Insights test uses a saliva specimen to analyze 36 genes to determine one's potential risk of having nearly two dozen inheritable conditions, including heart and blood disorders, breast and colon cancer, and the carrier status for sickle-cell anemia, cystic fibrosis, and Tay-Sachs disease.

Application Insights

The endogenous hyperlipidemia segment dominated the point of care lipid test market in 2024 and will maintain its position in the foreseen future. This is linked to the increasing incidence of hyperlipidemia globally. Furthermore, the segment is also driving because of the rising geriatric population, which is more prone to cardiovascular disorders and high cholesterol, fueling the market growth further.

- In November 2023, an article published by News Medical Life Sciences points out that High cholesterol in midlife can linked to later-life dementia. A leading medical expert who has been analyzing the latest research is now calling for cholesterol level testing for everyone aged 40-60 to help reduce their chances of developing dementia or Alzheimer's when they are older.

End-user Insights

The diagnostic centers segment held the largest share of the point of care lipid test market in 2024 and is expected to witness significant growth in the projected period. These centers are medical facilities where various diagnostic tests and procedures are conducted to identify different medical conditions and illnesses. Diagnostic services aim to provide timely, cost-effective, and high-quality diagnostic care in safe environments. They encompass clinical services such as pathology and laboratory medicine, radiology, and nuclear medicine.

Point of Care Lipid Test Market Com[panies

- Callegari Sinocare Inc.

- Abbott Laboratories

- Mico Bio Med

- Nova Biomedical Corporation

- VivaChek Biotech (Hangzhou) Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Zoetis Inc.

- Menarini Group

- SD Biosensor, Inc.

Recent Developments

- In October 2022 Genes2Me Pvt. Ltd launched Rapi-Q- Point of Care RT PCR solution for human papillomavirus (HPV) and tuberculosis. The device is easy to use and gives faster results in less than 45 minutes. This CE-IVD-marked POC solution delivers superior performance, high sensitivity, and stable detection.

- In March 2022, Visby Medical announced that it received funding of USD 25.5 million from the U.S. Biomedical Advanced Research and Development Authority to develop a rapid flu-COVID-19 PCR test for home use. At present, the test is in the under-developing phase, and the design is ready as a PCR device that can detect COVID-19, influenza A, and B from a single sample.

- In March 2022, Canada-based Company BioLytical Laboratories Inc. received a CE marking for the iStatis COVID-19 Antigen Home Test.

- In May 2022, Qiagen Inc. launched the NeuMoDxHSV 1/2 Quant Assay for the quantification and differentiation of herpes simplex virus type 1 (HSV-1) DNA and herpes simplex virus type 2 (HSV-2) with approval from the European Commission. The emergence of this assay is allowing the company to expand its product portfolio in laboratory testing, which ultimately helps the market grow owing to the innovative tests.

- In March 2022, Mindray launched the BC-700 Series, a hematology analyzer series that assists in both blood count and erythrocyte sedimentation rate tests.

Segments Covered in the Report

By Product Type

- Devices

- Consumables

By Application

- Endogenous Hyperlipemia

- Combined Hyperlipidemia

- Familial Hypercholesterolemia

- Others

By End-user

- Hospitals And Clinics

- Diagnostic Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting