What is Veterinary Point of Care Diagnostics Market Size?

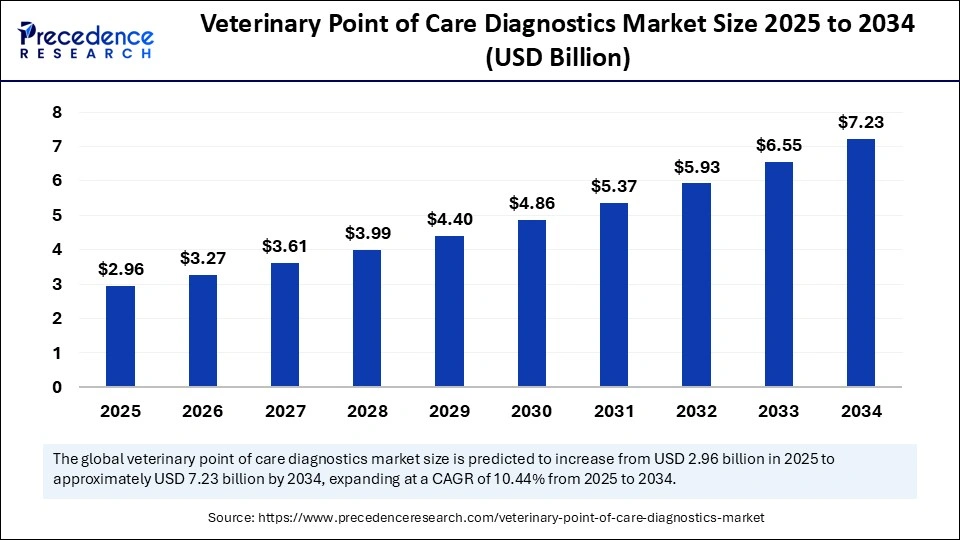

The global veterinary point of care diagnostics market size accounted for USD 2.96 billion in 2025 and is predicted to increase from USD 3.27 billion in 2026 to approximately USD 7.23 billion by 2034, expanding at a CAGR of 10.44% from 2025 to 2034. The growth of the market is attributed to the increasing demand for rapid, on-site diagnostic solutions that enable early disease detection and timely treatment in animals.

Market Highlights

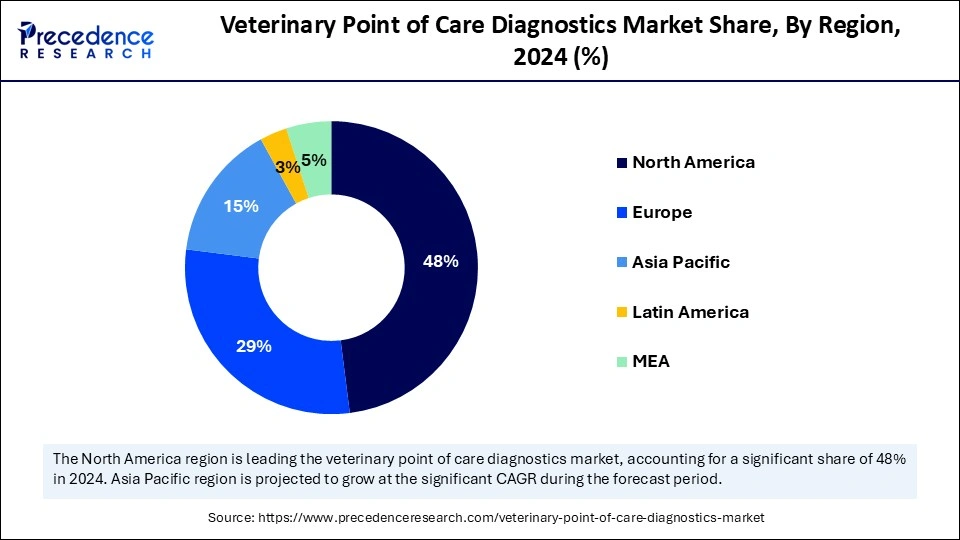

- North America contributed the largest revenue share of 48% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 14.2% from 2025 to 2034

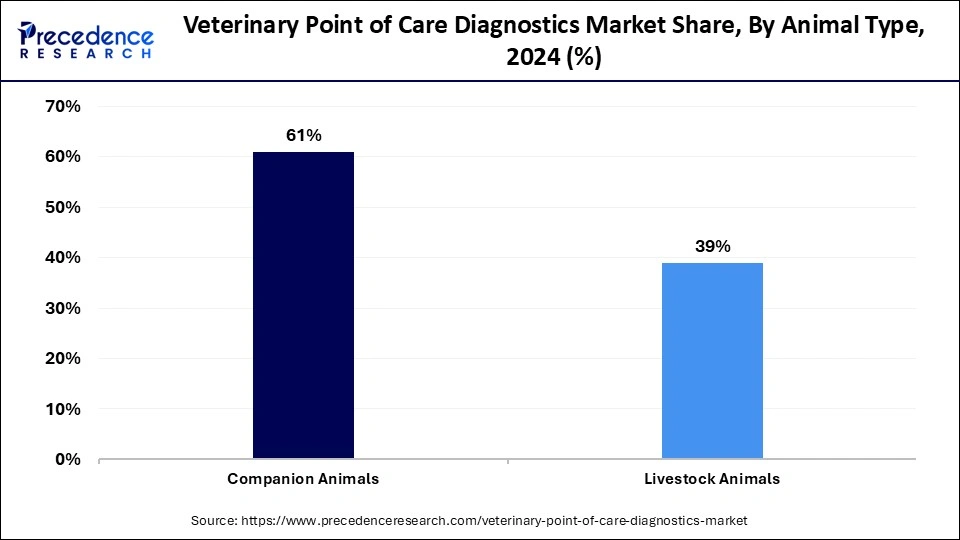

- By animal type, the companion animals segment contributed the highest revenue share of 61% in 2024.

- By animal type, the livestock animals segment is expected to expand at a significant CAGR from 2025 to 2034.

- By product, the consumables, reagents, and kits segment held the major revenue share in 2024.

- By product, the instruments and devices segment is expected to grow at the fastest CAGR of 10.80% from 2025 to 2034.

- By testing category, the parasitology segment dominated the market in 2024.

- By testing category, the hematology segment is expected to grow at the fastest rate during the forecast period.

By sample type, the blood/plasma/serum segment dominated the veterinary point of care diagnostics market with the largest share in 2024. - By sample type, the urine segment is expected to grow at the fastest rate from 2025 to 2034.

- By indication, the infectious disease segment dominated the market in 2024.

- By indication, the general ailments segment is expected to grow at the fastest rate from 2025 to 2034.

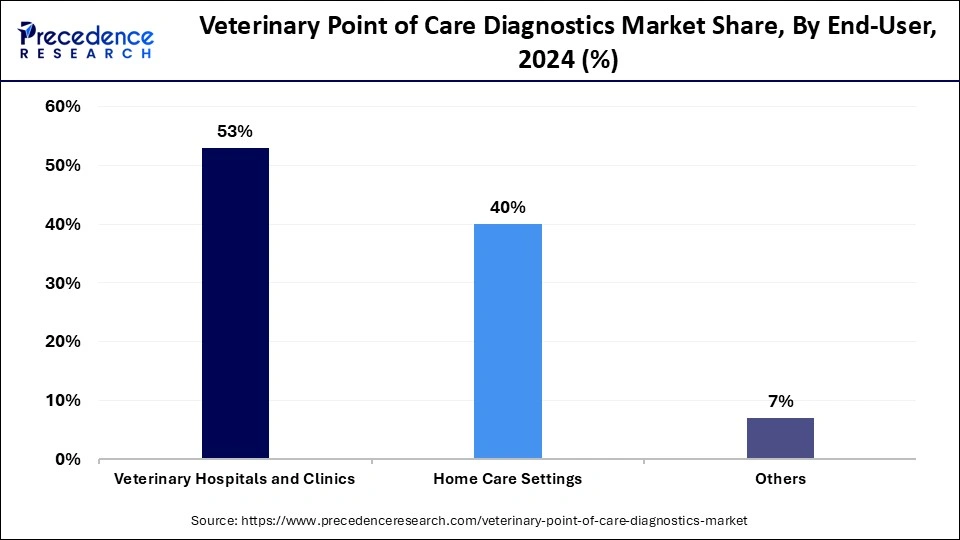

- By end-user, the veterinary hospitals and clinics segment captured the major revenue share of 53% in 2024.

Market Overview

Increased awareness of animal health and technological advancements are driving the rapid growth of the veterinary point of care diagnostics market. Fast on-site testing is made possible by these diagnostics, which speed up the process of deciding on treatments for both pets and livestock. Big players like IDEXX Laboratories and Zoetis are spending money on innovations to increase accuracy and efficiency. Despite issues like staffing shortages and inflation, there is still a growing need for rapid diagnostics. The need for early disease detection, rising pet ownership, and rising animal care expenses are the main drivers of market growth.

How is Artificial Intelligence Transforming Veterinary Point-of-care Diagnostics?

Artificial intelligence AI and machine learning are revolutionizing veterinary point-of-care diagnostics by facilitating quicker, more precise, and effective disease detection. Veterinarians can analyze complex data, spot trends, and make well-informed decisions instantly with the help of these advanced technologies. AI-powered Predictive analytics, digital pathology tools, and automated image recognition are making diagnostic procedures more dependable, cutting down on turnaround time and enhancing patient care. Additionally, the incorporation of AI technologies reduces human error, improves early disease detection, and facilitates precision treatment plans for livestock and pets.

Veterinary Point of Care Diagnostics MarketGrowth Factors

- Rising Pet Ownership: Increasing numbers of pet owners are prioritizing their animal's health, leading to higher demand for rapid diagnostic solutions.

- Advancements in Technology: Innovations in diagnostic tools, such as portable analyzers and AI-based solutions, are improving accuracy and efficiency.

- Increased Spending on Animal Healthcare: Pet owners and livestock farmers are investing more in preventive care and early disease detection.

- Growing Prevalence of Animal Diseases: The rising incidence of zoonotic and infectious diseases is boosting the need for quick and reliable diagnostics.

- Government and Industry Support: Various initiatives and funding programs are encouraging research and development in veterinary diagnostics.

Market Outlook

- Market Growth Overview: The Veterinary Point of Care Diagnostics market is expected to grow significantly between 2025 and 2034, driven by the rising pet ownership and the "humanization" trend, which has increased pet healthcare spending. Additionally, technological advancements fuel the market growth.

- Sustainability Trends:Sustainability trends involve antimicrobial stewardship, waste management and recycling programs, and eco-friendly materials and packaging.

- Major Investors: Major investors in the market include Mars and Thermo Fisher Scientific.

- Startup Economy: The startup economy is niche-focused on the expansion of At-home and tele-diagnostics, venture capital and strategic partnerships, and efficiency and connectivity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.96 Billion |

| Market Size in 2026 | USD 3.27 Billion |

| Market Size by 2034 | USD 7.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal Type, Product, Testing Category, Sample Type, Indication,End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rapid Disease Detection Needs

The rising need for rapid disease detection tools is a key factor driving the growth of the veterinary point of care diagnostics market. A quicker diagnosis enables early treatment, which lowers mortality rates and avoids complications. The SNAP tests from IDEXX Laboratories eliminate the need for lab-based testing by offering rapid results for infectious diseases like parvovirus and feline leukemia. The Vetscan, like from Zoetis, includes portable analyzers that provide electrolyte and blood chemistry testing in real-time, improving decision-making in urgent situations. The Element I + immunodiagnostic Analyzer from Heska Corporation allows veterinarians to test for infectious thyroid and cortisol disorders quickly. These quick diagnostic tools are crucial in situations where treatment delays could be fatal. Rapid and accurate POC diagnostics are becoming essential in veterinary care as the incidence of infectious and zoonotic diseases increases.

Rise in Veterinary Expenditure

Spending more on diagnostics is improving access to more sophisticated solutions. Multinational animal health corporation Virbac makes investments in cutting-edge veterinary diagnostics equipment to promote early disease detection and lower the expense of ongoing care. By enabling non-invasive and instantaneous imaging, FUJIFILM Healthcare's portable ultrasound devices enhance diagnostic capabilities in both pets and livestock. In keeping with the growing focus on disease prevention, Thermo Fisher Scientific has added PCR-based tests for early disease detection in farm animals to its portfolio of veterinary diagnostics. The demand for veterinary diagnostics is rising as a result of pet owners and livestock farmers being more prepared than ever to pay for regular checkups, immunizations, and urgent illnesses. Advanced veterinary healthcare solutions are becoming more and more popular due to the global trend of premium pet care and growing awareness of early disease intervention.

Restraints

Accuracy & Reliability Concerns

Rising accuracy and reliability concerns are likely to restrain the growth of the veterinary point of care diagnostics market. Some POC diagnostic tools are less sensitive and specific than centralized laboratory tests, even with recent technological advancements. Misdiagnosis resulting from inconsistent or inaccurate results can postpone appropriate treatment. Outside variables like environmental conditions, improper handling, and contaminated samples can also impact test reliability. Veterinarians frequently flavor laboratory-based testing techniques that go through stringent validation procedures to guarantee higher accuracy; it will take better quality control procedures and ongoing advancements in POC diagnostic technology to allay these worries.

Opportunities

Growth of Home-Based and Wearable Pet Diagnostics

Home-based diagnostics tools are becoming more and more popular as pet wellness and preventive care gain popularity. Businesses that provide cutting-edge solutions for early disease detection include FitBark (wearable pet health monitors) and Basepaws (pet genetic testing). To enable pet owners to keep an eye on their pets' blood sugar levels, kidney function, and other critical indicators, Zoetis has made investments in at-home testing kits. Pets can have continuous health tracking with wearable health monitoring devices like PetPace and Whistle, eliminating frequent veterinary checkups.

Expansion of Livestock Disease Management Programs

Preventing livestock diseases is becoming a greater priority for governments and international organizations to increase food security and economic stability. Rapid diagnostics kits are being developed by organizations such as Merck Animal Health and Thermo Fisher Scientific to track and manage diseases in pigs' poultry and cattle. Farmers are investing more in disease surveillance tools to ensure compliance and safeguard the health of their herds considering the words tighter food safety regulations. The need for POC testing in the livestock industry is also being driven using digital herd management systems that incorporate diagnostic data. Investments in rapid diagnostics for illnesses like African swine fever, avian influenza, and bovine tuberculosis are anticipated to increase because of this trend.

Segment Insights

Animal Type Insights

What Made Companion Animals the Dominant Segment in 2024?

The companion animals segment dominated the veterinary point of care diagnostics market with the largest revenue share of 61% in 2024, driven by rising healthcare costs and pet ownership. When it comes to advanced diagnostics for conditions like diabetes, kidney disease, and heart issues, pet owners are more proactive. Because they yield quick results and lessen stress for both pets and their owners, in-clinic diagnostic solutions are becoming more and more popular. Furthermore, more people can afford sophisticated diagnostic tools thanks to the growth of pet insurance. Veterinarians can now detect and treat illnesses more effectively thanks to biosensor technologies and AI-powered analyzers that are further improving diagnostic accuracy.

The livestock animals segment is expected to expand at a significant CAGR during the projection period, driven by growing worries about disease outbreaks, food safety, and international livestock trade laws. To ensure healthier livestock and lower financial losses, farmers and veterinarians are investing in cutting-edge diagnostic equipment to identify diseases early. In rural and agricultural areas, portable POC devices and molecular testing kits are becoming indispensable for enhancing herd management and facilitating speedier responses to outbreaks. Government programs supporting the productivity and well-being of animals are also driving market expansion.

Product Insights

How Consumables, Reagents, & Kits Segment Dominated the Veterinary Point of Care Diagnostics Market in 2024?

The consumables, reagents, & kits segment dominated the market with the largest share in 2024. This is mainly due to the prominent role of consumables and reagents in diagnostics. They are used to perform diagnostic tests. They typically perform tasks like sample collecting, handling, and processing. In-clinic testing is in high demand as pet owners look for quick, precise diagnoses for ailments like diabetes and kidney disease. Technological developments in biosensors and AI-powered analyzers further improve diagnostic effectiveness.

The instruments & devices segment is growing at a fastest CAGR of 10.80% in the coming years. The growth of the segment is attributed to the rising demand for POC testing instruments. Technological innovations, such as the integration of AI and digital technologies into POC testing instruments, are enhancing speed and accuracy. POC testing instruments are widely used by farmers to improve herd health, minimize financial losses, and detect diseases early. To improve disease management in rural areas, portable testing kits and molecular diagnostics are in high demand, supporting segmental growth.

Testing Category Insights

Why Did the Parasitology Segment Dominate in 2024?

The parasitology segment dominated the veterinary point of care diagnostics market with the largest share in 2024. This is because parasitic infections are very common in livestock and pets. In veterinary clinics and farms, quick diagnostic tools are frequently used to identify parasites such as intestinal worms' fleas and ticks. The increased need for rapid and precise testing, and increased knowledge of parasite control among farmers and pet owners, bolstered the segment's growth.

The hematology segment is expected to grow at the fastest CAGR in the coming years, driven by the rising need for early disease detection and the development of blood analysis technology. Hematology tests are crucial for both routine examinations and emergency care because they aid in the diagnosis of anemia infections and immune disorders in animals. Blood test accuracy and efficiency have increased even more with the development of AI-driven hematology analyzers

Sample Type Insights

What Factors Contributed to the Blood/Plasma/Serum Segment's Dominance in 2024?

The blood/plasma/serum segment dominated the veterinary point of care diagnostics market with the largest share in 2024. This is because of their vital role in identifying metabolic disorders, infections, and organ failure. These samples are frequently used to diagnose diseases in companion and livestock animals, such as diabetes, liver disease, and anemia. They provide detailed insights into past infections, current immune status, and allergic reactions. Thus, they are the most trusted for veterinary diagnostics. Furthermore, the rising demand for blood-based testing is likely to sustain segmental growth.

The urine segment is expected to expand at the fastest CAGR in the near future because it is a crucial sample in identifying diabetes, kidney diseases, and UTIs. Dipstick tests and portable urine analyzers are becoming more and more popular in veterinary clinics for easy and rapid diagnosis. The increasing need for early disease detection in livestock is expected to contribute to segmental growth. Urine is a vital sample in detecting infections and identifying metabolic abnormalities. Additionally, improvements in automated urine analysis technology are increasing the accuracy and efficiency of diagnostics.

Indication Insights

How Did the Infectious Diseases Segment Dominate the Veterinary Point of Care Diagnostics Market in 2024?

The infectious diseases segment dominated the market with the largest revenue share in 2024 because infections caused by bacteria, viruses, and parasites are very common in livestock animals. To stop epidemics, diseases like bovine tuberculosis, canine parvovirus, and feline leukemia need to be identified quickly and accurately. The dominance of this segment is further reinforced by increased awareness among pet owners and livestock farmers. Testing for infectious diseases is now an essential part of veterinary care. In addition, the demand for early and accurate diagnostics has increased due to a surge in the prevalence of zoonotic diseases and livestock-related infections, bolstering the segment.

The general ailments segment is growing at a notable CAGR in the coming years, driven by the growing emphasis on early disease detection and regular health examinations. The rising prevalence of diseases like obesity, diabetes, allergies, and digestive issues in pets and livestock is driving up demand for diagnostics. Growing awareness of preventive healthcare, easier access to veterinary care, and an increase in pet ownership are all contributing to this segment's growth. Furthermore, general health testing in veterinary clinics is becoming more accessible and efficient with the integration of AI and automated diagnostic tools.

End-User Insights

What Made Veterinary Hospitals & Clinics Segment the Dominant End-user in 2024?

The veterinary hospitals & clinics segment dominated the market by capturing the major revenue share of 53% in 2024. This is because of the large number of patients visiting and the availability of cutting-edge diagnostic equipment. These clinics handle a variety of diagnostic tests, including imaging, screening, and testing of infectious diseases. Hospitals & clinics act as the main point of care for pets and livestock. There is a high demand for sophisticated POC diagnostic tools due to the increased awareness among veterinarians about the benefits and importance of early disease detection and prevention. Veterinarians heavily use POC tests as they provide results instantly, enabling quicker treatment decisions and better patient outcomes. Veterinarians can make quick diagnoses without sending samples to outside labs thanks to portable analyzers, handheld devices, and in-clinic diagnostic kits.

Regional Insights

U.S. Veterinary Point of Care Diagnostics Market Size and Growth 2025 to 2034

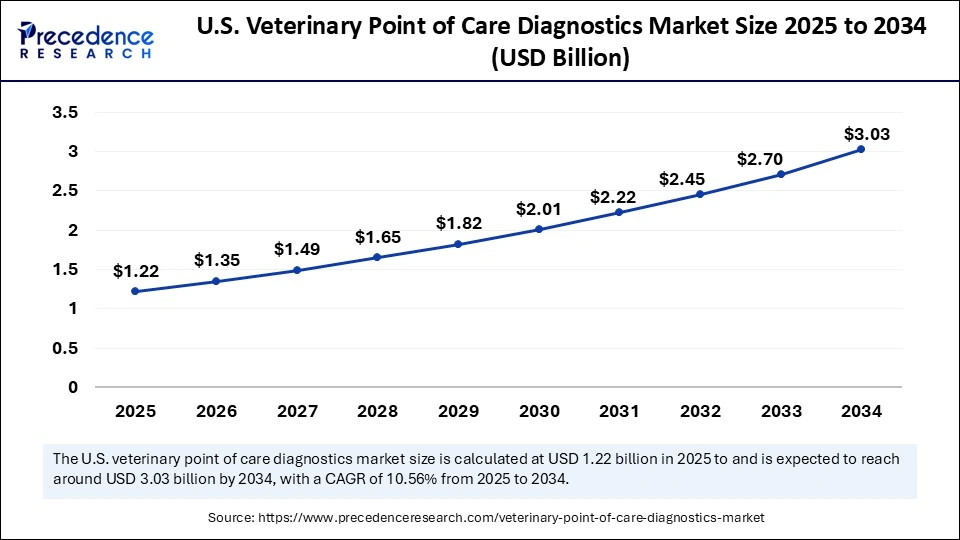

The U.S. veterinary point of care diagnostics market size is exhibited at USD 1.22 billion in 2025 and is projected to be worth around USD 3.03 billion by 2034, growing at a CAGR of 10.56% from 2025 to 2034.

What Factors Contributed to North America's Dominance in 2024?

North America registered dominance in the veterinary point of care diagnostics market with the largest revenue share of 48% in 2024. This is mainly due to increased pet ownership rates, availability of sophisticated veterinary facilities, and increased animal healthcare expenditures. The region is home to several major market participants. The region is at the forefront of innovations in healthcare technology. Ongoing technological innovations are enabling the development of advanced POC diagnostic tools. North America's dominance is further reinforced by government programs promoting animal health and growing awareness of zoonotic diseases. Additionally, the availability of pet insurance motivates pet owners to spend money on diagnostic and preventative care. The increased need to manage livestock diseases, especially in the rural areas of the U.S. and Canada, contributed to the growth of the market.

Asia Pacific is expanding at a remarkable CAGR of 14.2% during the forecast period, driven by growing livestock production and rising pet ownership. Pet owners have become more aware of the importance of pets' routine checkups, driving the need for POC testing for general ailments. Governments of various nations are investing heavily in advancing veterinary healthcare systems. The need for POC testing is rising due to the growing prevalence of zoonotic diseases among livestock.

China, India, and Japan play a major role in the veterinary point of care diagnostics market within Asia Pacific. The rising pet ownership and livestock population in these countries are likely to drive the growth of the market. Government programs aimed at promoting screening for animals are supporting market growth. There is a strong focus on improving food safety and managing livestock diseases, creating the need for POC tests. With the rising disposable income in these countries, spending on pet healthcare is rising, contributing to the market's growth.

Europe is considered to be a significantly growing area. The growth of the market in the region is attributed to strict laws pertaining to animal health and a well-developed veterinary healthcare system that has been in place for a long time. The demand for rapid diagnostic solutions is rising in the region, particularly for the management of livestock diseases. Technological developments and partnerships between diagnostic companies and veterinary research institutions further support market growth. Advanced diagnostic tools are being adopted more widely as a result of European nations' emphasis on biosecurity and sustainable livestock farming. To improve disease management and treatment results, veterinary clinics are investing in rapid and precise diagnostic tools. The growing incidence of zoonotic diseases and stringent regulations regarding animal welfare contribute to regional market growth.

U.S. Veterinary Point of Care Diagnostics Trends

U.S. regions' integration of AI and diagnostic solutions, adoption of telemedicine and wearable health monitors is a rapidly growing trend, acceptance by the pandemic. Shift towards in-clinic and on-site testing and emphasis on consumables and recurring revenue models. The intensifying R&D spending on advanced platforms like microfluidics, immunodiagnostics, and molecular testing.

China Veterinary Point of Care Diagnostics Market Trends

China's significant government initiatives targeting large livestock populations and food safety. The experiencing robust growth fueled by continuous technological advancements and strategic consolidation among key players.

Germany Veterinary Point of Care Diagnostics Trends

Germany's strong regulatory push for antimicrobial stewardship, high pet ownership and humanization, and significant livestock industry and disease surveillance. Germany benefits from a large number of institutes and universities that incorporate veterinary diagnostic techniques into their research purposes

Veterinary Point of Care Diagnostics Market Value Chain Analysis

- Research, Design, and Development (R&D)

This initial stage involves significant investment in R&D to discover and develop new diagnostic assays, biomarkers, and testing platforms.

Key Players: IDEXX Laboratories Inc., Zoetis Inc., Thermo Fisher Scientific Inc., Heska Corporation, university research centers, and AI health startups. - Raw Material & Component Sourcing

This stage involves the procurement of highly specialized raw materials and electronic components, such as reagents, antibodies, enzymes, plastic microfluidic chips, sensors, and electronic components for diagnostic devices.

Key Players: Sigma-Aldrich (Merck), various fine chemical suppliers, electronic component manufacturers, specialized biosensor companies. - Manufacturing and Assembly

In this stage, the raw materials are assembled into functional PoC diagnostic devices (analyzers, handheld devices) and accompanying consumables (test kits, cartridges, reagents).

Key Players: IDEXX Laboratories Inc., Zoetis Inc., Heska Corporation, scil animal care company GmbH, Thermo Fisher Scientific Inc. - Software Development and Integration

This critical stage involves developing the software that runs the diagnostic instruments, interprets results (often with AI/ML), and integrates with clinic management systems or cloud platforms.

Key Players: In-house software teams of major OEMs (Zoetis's Vetscan, IDEXX), specialized vet software companies, and AI health technology startups. - Distribution and Sales

The finished diagnostic products are distributed through direct sales teams, veterinary distributors, and online channels to clinics, farms, and research institutions globally.

Key Players: Henry Schein Animal Health, Covetrus, Patterson Companies, Inc., and manufacturers' direct sales forces.

Key Players in Veterinary Point of Care Diagnostics Market and Their Offerings

- IDEXX Laboratories, Inc.: IDEXX is a market leader providing a comprehensive portfolio of in-clinic PoC diagnostics, including instruments for clinical chemistry and immunodiagnostics, along with extensive software integration and reference lab services.

- Zoetis: Zoetis is a major player offering a wide range of animal health products, including their Vetscan PoC diagnostic analyzers that integrate advanced AI for rapid, accurate results and seamless clinic data management.

- Heska Corporation (Antech): Now part of Mars, Heska provides innovative PoC diagnostic instruments and a profitable subscription-based model for consumables, offering veterinarians cost-effective access to essential in-clinic testing solutions.

- Virbac: This global animal health company contributes through its range of diagnostic products and solutions that support veterinarians in both companion animal and livestock health management.

- Thermo Fisher Scientific, Inc.: Thermo Fisher provides a vast array of life science solutions and diagnostic instruments applicable to veterinary science, enabling advanced research and clinical testing through their extensive product portfolio.

- Mindray: Mindray provides medical devices and solutions across human and veterinary medicine, offering cost-effective and high-quality PoC diagnostic analyzers for global animal healthcare markets.

- Woodley Equipment Company Ltd:A UK-based company that acts as a global distributor and manufacturer of veterinary clinical laboratory equipment, contributing significantly to market access and providing private label options.

- FUJIFILM Corporation: Fujifilm contributes through its advanced imaging and diagnostic technologies, offering integrated systems that help veterinarians with rapid and accurate diagnoses in the clinic setting.

- Getein Biotech: Getein develops and manufactures PoC diagnostic products, including immunofluorescence analyzers used in veterinary medicine, particularly in the growing Asia-Pacific markets.

Recent Developments

- In October 2024, Quest Diagnostics announced a plan to launch a new H5N1 bird flu test by the end of the year, following contracts from the U.S. Centers for Disease Control and Prevention to support testing for bird flu and Oropounche virus. This move aligns with growing concerns over emerging infectious diseases in both humans and animals. The company's expansion into veterinary diagnostics strengthens its market presence beyond human healthcare.(Source: https://www.reuters.com)

- In December 2024, Zoetis Inc. launched its new screenless point-of-care hematology analyzer, Vetscan OptiCell, at the Veterinary Meeting & Expo (VMX) in Orlando, Florida. This cartridge-based, AI-powered diagnostic tool for veterinary hematology provided complete blood count (CBC) analysis for accurate insights in minutes.(Source: https://www.zoetisus.com)

Segments Covered in the Report

By Animal Type

- Companion Animals

- Dogs

- Cats

- Horses

- Others

- Livestock Animals

- Cattle

- Swine

- Poultry

- Others

By Product

- Consumables, Reagents, & Kits

- Instruments & Devices

By Testing Category

- Hematology

- Diagnostic Imaging

- Bacteriology

- Virology

- Cytology

- Clinical Chemistry

- Parasitology

- Serology

- Others

By Sample Type

- Infectious Disease

- General Ailments

- Others

By Indication

- Blood/Plasma/Serum

- Urine

- Fecal

- Others

By End-User

- Veterinary Hospitals & Clinics

- Home Care Settings

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting