What is the Polyvinylpyrrolidone Market Size?

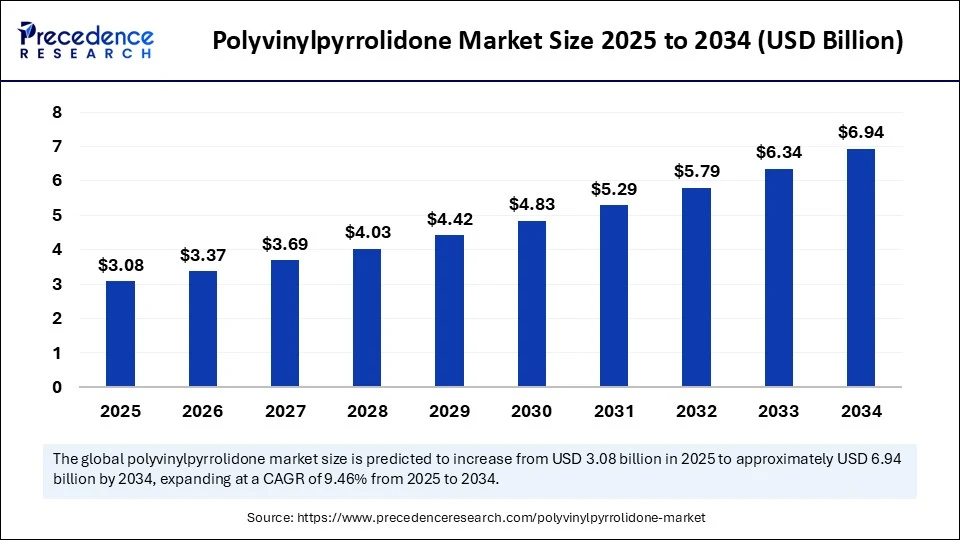

The global polyvinylpyrrolidone market sizeis accounted at USD 3.08 billion in 2025 and predicted to increase from USD 3.37 billion in 2026 to approximately USD 6.94 billion by 2034, expanding at a CAGR of 9.46% from 2025 to 2034. The market is experiencing substantial growth due to its rising demand in pharmaceuticals, cosmetics, and industrial applications. This growth is further supported by its versatile properties, such as solubility, film-forming capability, and strong binding characteristics. Additionally, its increasing use in drug formulation, personal care products, and food processing is expected to drive market expansion in the coming years.

Polyvinylpyrrolidone MarketKey Takeaways

- In terms of revenue, the global polyvinylpyrrolidone market was valued at USD 2.81 billion in 2024.

- It is projected to reach USD 6.94 billion by 2034.

- The market is expected to grow at a CAGR of 9.46% from 2025 to 2034.

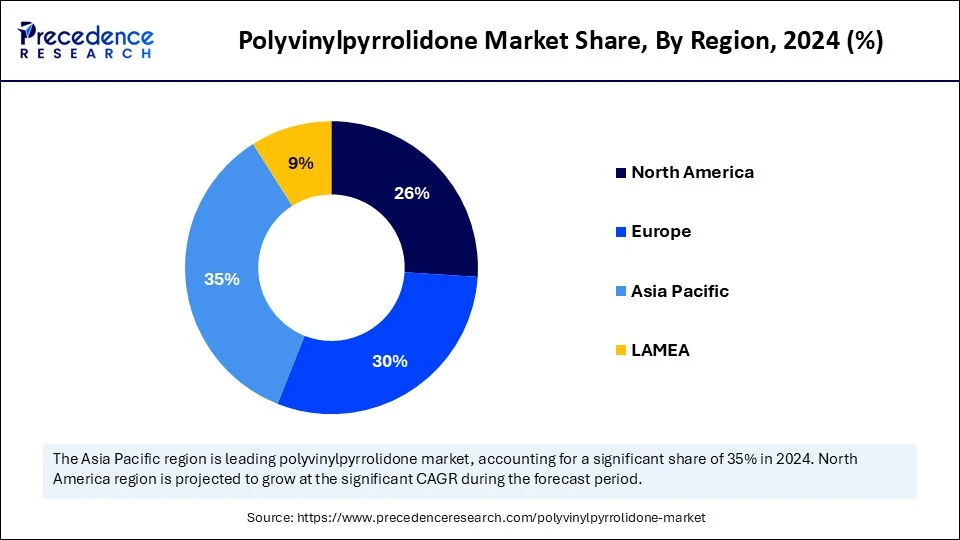

- Asia Pacific led the global market with the largest share of 35% in 2024.

- North America is expected to grow at a significant CAGR from 2025 to 2034.

- By grade, the K-value grades segment dominated the market in 2024 and is expected to grow further in the coming years.

- By form, the powder segment captured the largest market share of 60% in 2024.

- By form, the liquid (solution) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the pharmaceuticals segment led the market in 2024.

- By application, the cosmetics and personal care segment will grow at the fastest CAGR.

Artificial Intelligence: The Next Growth Catalyst in Polyvinylpyrrolidone

Artificial intelligence (AI) is revolutionizing the polyvinylpyrrolidone market by improving various processes from production to research and development. AI-powered tools optimize manufacturing, enhance product quality, and speed up drug discovery. AI analyzes real-time data from production lines to fine-tune parameters like temperature, pressure, and flow, resulting in more efficient, consistent PVP manufacturing. In pharmaceuticals, AI is used to screen potential drug candidates, optimize formulations, and predict interactions, potentially accelerating the development of new medications using PVP while ensuring adherence to standards and regulations.

Strategic Overview of the Global Polyvinylpyrrolidone Industry

Polyvinylpyrrolidone (PVP), also known as povidone or polyvidone, is a water-soluble polymer widely used across various industries due to its adhesive, film-forming, and stabilizing properties. It has significant applications in pharmaceuticals, cosmetics, adhesives, food processing, and other sectors. The market includes the production, distribution, and consumption of different grades and forms of PVP used in these industries, segmented by molecular weight, form, application, and region. The market is experiencing rapid growth driven by increasing uses in pharmaceuticals, personal care products, and food and beverages, along with ongoing technological advances and rising disposable incomes.

What Are the Key Trends in the Polyvinylpyrrolidone Market?

- Expanding Cosmetics Industry: The global cosmetics market is flourishing, which is increasing the demand for PVP. Its film-forming, antimicrobial, and moisture-retention properties make it a valuable ingredient in products like hair sprays, shampoos, and skin creams.

- Rising Construction Activities:Ongoing construction activities worldwide, particularly in the residential and commercial sectors, driven by rapid industrialization and manufacturing growth, are also contributing to the increased demand for polyvinyl pyrrolidone.

- Focus on Specialty Applications:Companies are investing in research and development to create new PVP formulations tailored for specific applications.

- Shift Towards Bio-based PVP:There is a growing trend for the development and use of bio-based and sustainable alternatives to PVP. Innovations in these bio-based and sustainable options are shaping the market's future.

Market Outlook:

- Market Growth Overview: The Polyvinylpyrrolidone market is expected to grow significantly between 2025 and 2034, driven by the growing personal care applications, expansion in water treatment and food & beverages, and focus on sustainability.

- Sustainability Trends: Sustainability trends involve the development of sustainable and bio-based PVP alternatives, expansion of sustainable production capacity, and adoption of a mass balance approach and certifications.

- Major Investors: Major investors in the market include BASF SE, Ashland Global Holdings Inc., Merck KGaA, Lotte Fine Chemical, and BlackRock.

- Startup Economy: The startup economy is focused on innovative application development, sustainable and bio-based alternatives, and venture capital funding.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.94 Billion |

| Market Size in 2025 | USD 3.08 Billion |

| Market Size in 2026 | USD 3.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.46% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Grade, Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of Pharmaceutical Industry

The main driver for the polyvinylpyrrolidone market is the expanding pharmaceutical industry. PVP is a versatile excipient used extensively in drug formulations such as tablets, capsules, and topical applications due to its binding, solubility enhancement, and film-forming properties. The rising prevalence of chronic diseases, an aging population, and increasing healthcare expenditure are all contributing to the growth of the pharmaceutical market, thereby boosting demand for PVP. The shift toward advanced drug delivery systems like orally disintegrating tablets and controlled-release formulations further increases PVP demand.

Restraints

Growing Regulatory Scrutiny and Environmental Concerns

The primary restraint in the polyvinylpyrrolidone market is the growing regulatory scrutiny and environmental concerns related to synthetic polymers, especially regarding biodegradability and microplastic pollution. This pressure compels manufacturers to develop more sustainable, bio-based alternatives and transparent supply chains. The push for sustainability in formulation strategies is encouraging manufacturers to explore options like bio-based PVP or adopt greener production processes. Although there are no recent product launches directly addressing these concerns, the overall trend toward sustainable solutions is evident.

Opportunity

Expanding Role in the Drug Delivery Systems

A key future opportunity for the polyvinylpyrrolidone market lies in its expanding role in advanced drug delivery systems, especially in nanotechnology and targeted therapies. This involves using PVP-based nanoparticles or microparticles to improve drug solubility, stability, and bioavailability. PVP nanoparticles can encapsulate drugs, enhancing delivery to specific tissues or cells and enabling more effective, targeted treatments. The focus on eco-friendly and sustainable options is driving the development of bio-based PVP and green chemistry methods, aligning with global environmental regulations. Additionally, PVP's increasing use in 3D printing and tissue engineering, where it serves as a bioink or support material for complex structures, is creating new opportunities.

Grade Insights

What Made the K-Value Grades Segment Lead the Polyvinylpyrrolidone Market?

The K-value grades segment led the market in 2024, with the K-30 (molecular weight) sub-segment holding the largest share of 45%. This is due to its versatility and suitability for many applications, especially in pharmaceuticals and cosmetics. Its medium molecular weight offers an ideal balance of viscosity and binding properties, making it suitable as a binder, stabilizer, and solubilizer in drug formulations, as well as a film-former and hair fixative in personal care products. PVP K-30's balance of viscosity, solubility, and film-forming ability makes it highly versatile for various formulations. Its medium molecular weight provides the right viscosity for both spray applications and those requiring higher viscosity, helping to drive demand for PVP K-30.

The K-60 (high molecular weight) sub-segment of the K-value grades segment is anticipated to have the fastest growth. This is mainly because of its superior solubility and performance in advanced drug delivery, especially in pharmaceuticals and cosmetics. Its ability to solubilize poorly soluble drugs improves bioavailability and efficacy in formulations. This growth is fueled by increasing demand for enhanced drug and cosmetic products, leveraging PVP's film-forming, stabilizing, and binding properties, which make it a popular ingredient in hair care and skincare items.

Form Insights

How Did the Powder Segment Dominate the Polyvinylpyrrolidone Market in 2024?

The powder segment dominated the market in 2024 mainly due to its versatility and widespread use across industries. Its popularity stems from excellent solubility, film-forming qualities, and role as a binder and stabilizer in many applications, particularly in pharmaceuticals and cosmetics. Powdered PVP is easier to handle, store, and transport than liquid forms, reinforcing its preferred status among manufacturers. Its strong solubility in water and organic solvents supports continued focus on bio-based PVP production.

The liquid (solution) segment is expected to grow the fastest due to its versatility and extensive use in pharmaceuticals, personal care, and cosmetics. Its solubility, binding ability, and capacity to form stable emulsions make it ideal for these sectors. Liquid PVP functions as a humectant and film-former in personal care products, helping retain moisture in skin and hair care items. It is also used in sprays, gels, and styling products.

Application Insights

How Did the Pharmaceuticals Segment Lead the Polyvinylpyrrolidone Market in 2024?

The pharmaceuticals segment led the market in 2024with the binder role in tablets and capsules sub-segment holding the largest share of 38%. Its excellent solubility, film-forming qualities, and biocompatibility make it essential for drug formulation and delivery. Its ability to act as a binder, stabilizer, and solubilizer in various drug forms, including tablets, capsules, and topical preparations, further drives its widespread use. The increasing prevalence of chronic diseases and demand for innovative drug delivery systems continue to support growth in the pharmaceutical sector, and consequently, the demand for PVP.

The cosmetics and personal care segment is the fastest-growing part of the market, particularly the hair care sub-segment. This is mainly due to its excellent film-forming, binding, and moisturizing properties, which are highly valued in hair styling and care products. Consumers are increasingly demanding high-performance, natural ingredients, driving the adoption of PVP in shampoos, conditioners, hair sprays, and styling gels. It binds individual hair strands together, providing hold and volume, and thickens formulations to improve texture. Additionally, the development of innovative hair care formulations using PVP and the rising popularity of organic and sustainable hair products continue to boost growth.

Regional Insights

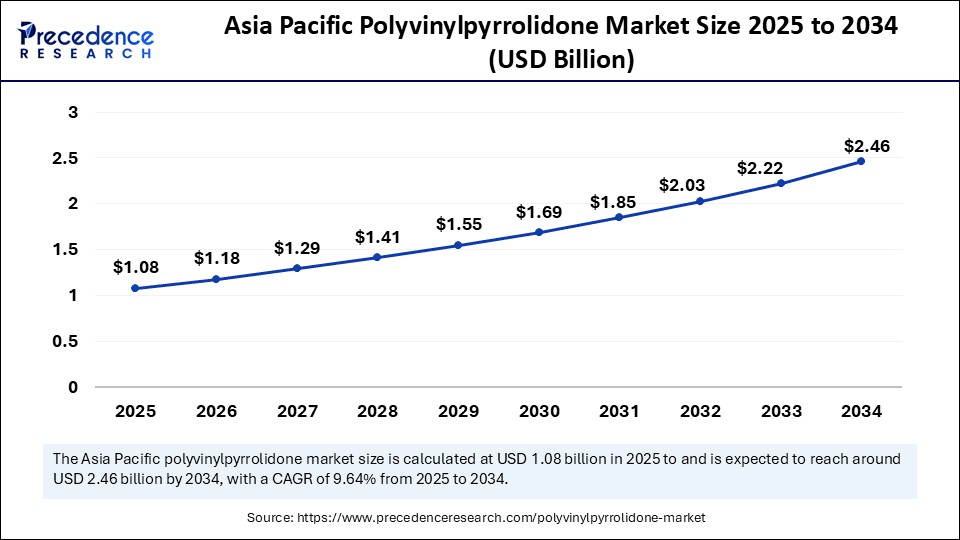

Asia Pacific Polyvinylpyrrolidone Market Size and Growth 2025 to 2034

The Asia Pacific polyvinylpyrrolidone market size is exhibited at USD 1.08 billion in 2025 and is projected to be worth around USD 2.46 billion by 2034, growing at a CAGR of 9.64% from 2025 to 2034.

How Did Asia Pacific Lead the Polyvinylpyrrolidone Market in 2024?

The Asia Pacific region led the polyvinylpyrrolidone market. This growth is mainly driven by strong expansion in key industries such as pharmaceuticals, cosmetics, and food & beverage, along with rapid industrialization, a large and growing population, and increasing disposable incomes. Countries like China, India, and Japan contribute significantly to this demand for PVP-based products.

Growing populations and rising incomes in these nations boost demand for products like cosmetics, pharmaceuticals, and alcoholic beverages containing PVP. The presence of major companies such as BASF SE, Ashland Global Holdings Inc., Boai NKY Pharmaceuticals Ltd., and Nippon Shokubai Co., Ltd., along with manufacturing hubs in China and India, further consolidates the region's dominance.

Shandong Xinhao Chemical Co., Ltd. increased its polyvinylpyrrolidone production capacity by 20% in early 2024 and is pursuing GMP certification. This indicates a strategic move toward higher-grade PVP products targeting regulated pharmaceutical markets. The increased capacity and GMP certification suggest a shift toward producing higher-quality PVP for demanding applications.

Asia Pacific: India Polyvinylpyrrolidone Market Trends

India holds a prominent and rapidly growing position in the global market, especially as a key hub for pharmaceutical manufacturing and exports. Its pharmaceutical sector, the third largest in the world by volume, relies heavily on PVP as a crucial excipient in various drug formulations, including tablets, capsules, and drug delivery systems, driving significant demand for pharmaceutical-grade PVP. The expanding personal care and cosmetics industries, fueled by rising incomes and a preference for natural, organic products, also contribute to the growth of the market.

North America: U.S. Polyvinylpyrrolidone Market Trends

North America is the fastest-growing region in the polyvinylpyrrolidone market. This growth is driven by a strong pharmaceutical and personal care industry, supported by innovation, research, and development. The region's increasing demand for advanced drug delivery systems, personal care products, and functional foods fuels this expansion. Major companies like Ashland Global Holdings Inc., BASF SE, and ISP Inc. contribute to market growth. The region also has a well-established pharmaceutical sector that relies heavily on PVP as a key excipient in drug formulations, especially for tablets and capsules.

The U.S. Polyvinylpyrrolidone Market Trends

The U.S. plays a vital role in the global market, mainly driven by its robust and growing pharmaceutical sector, with high demand for PVP in tablet formulations, drug delivery systems, and other innovative solutions in biopharmaceutical research further boosting its significance. Beyond pharmaceuticals, PVP demand in the U.S. also stems from the cosmetics, personal care, adhesives, and food industries, heightened by evolving consumer preferences and technological progress. Leading companies such as Ashland, BASF, and Merck are actively investing in R&D and strategic partnerships to seize emerging opportunities.

Why Did Europe Consider a Notable Region in the Polyvinylpyrrolidone Market in 2024?

Europe is a rapidly growing market for polyvinylpyrrolidone, mainly due to strong pharmaceutical and cosmetic industries, increased demand for food & beverage products, and supportive government policies. European authorities promote the development of sustainable and eco-friendly materials, including bio-based PVP alternatives, encouraging innovation and investment in this sector. The focus on green initiatives and sustainable practices has driven the development of bio-based and eco-friendly PVP options, further expanding the market size.

How Will Latin America Emerge in the Polyvinylpyrrolidone Market in 2024?

Latin America is an emerging player in the global market, driven by growing pharmaceutical and cosmetic applications, increased healthcare spending, and regulatory reforms. The rising prevalence of chronic diseases and expanding healthcare infrastructure boost the demand for PVP-based drugs and delivery systems. Government initiatives, such as faster drug approval processes in Brazil and stronger patent protections in Mexico, are attracting investments and fostering innovation in pharmaceutical companies adopting PVP solutions, which further fuels growth.

How Will the Middle East and Africa Make an Impact in the Polyvinylpyrrolidone Market in 2024?

The Middle East and Africa are experiencing notable growth in the global market. This is due to expanding pharmaceutical and cosmetic industries, increasing healthcare investments, and efforts to boost local manufacturing capabilities pharmaceutical, personal care, and food & beverage industries. This growth is further fueled by increasing urbanization, rising disposable incomes, and investments in healthcare infrastructure. The expanding food and beverage industry in MEA, particularly in countries like South Africa, Egypt, and the UAE, is also contributing to PVP consumption, especially in applications like clarifying beverages and extending shelf life. The broader economic development and diversification efforts across the region are creating a favorable environment for the growth of industries that utilize PVP.

Europe: Germany Polyvinylpyrrolidone Market Trends

Germany's market is driven by robust pharmaceutical sectors and a strong focus on high-performance applications across personal care and food and beverages. The industry's significant investment in sustainability, with major players like BASF and Ashland expanding sustainable production capacity and utilizing eco-friendly raw materials.

Latin America: Brazil Polyvinylpyrrolidone Market Trends

Brazil's market is growing due to rising demand from the pharmaceutical sector, where PVP is widely used as a binder, stabilizer, and solubilizing agent. The expanding cosmetics and personal care industry is further boosting consumption as PVP is increasingly utilized in hair styling products, skincare formulations, and beauty applications. Growth in the food and beverage sector is also supporting demand, with PVP used as a clarifying and stabilizing ingredient.

Middle East & Africa: The UAE Polyvinylpyrrolidone Market Trends

The UAE market is expanding as the country strengthens its pharmaceutical manufacturing capabilities and increases its reliance on high-quality excipients. Growing demand from the cosmetics and personal care sector is also driving PVP usage, particularly in hair care, skincare, and hygiene products. The food and beverage industry contributes to market growth as PVP is adopted for stabilization and clarification applications.

Value Chain Analysis of the Polyvinylpyrrolidone Market

- Raw Material Sourcing and Production

This foundational stage involves the sourcing of primary chemical feedstocks, primarily acetylene and formaldehyde, which are then used to synthesize intermediate chemicals like N-vinyl-2-pyrrolidone (NVP).

Key Players: BASF SE, Ashland Global Holdings Inc. - Manufacturing and Polymerization

This core stage involves the industrial polymerization of NVP to produce various grades of PVP, differentiated by molecular weight and properties that determine their application (e.g., K-value).

Key Players: BASF SE, Ashland Global Holdings Inc., Jiangsu Market Chemical Co., Ltd., and SEQENS (formerly Chemoxy) - Formulation and Product Development

In this stage, manufacturers blend and formulate PVP with other ingredients to create functional products tailored for specific industries, such as tablet binders for pharmaceuticals or hair fixatives for cosmetics.

Key Players: Ashland Global Holdings Inc. and BASF SE develop specific grades (e.g., Kollidon, Plasdone) - Outbound Logistics and Distribution

Activities in this stage focus on the secure storage, packaging, and transport of PVP products to manufacturers globally, ensuring product integrity and timely delivery.

Key Players: Brenntag SE, IMCD N.V., and Univar Solutions.

Top Companies in the Polyvinylpyrrolidone Market & Their Offerings:

- BASF SE: A global leader in the chemical industry, BASF manufactures a wide range of PVP products under the brand name "Kollidon," primarily for pharmaceutical and personal care applications. The company is actively investing in sustainable production processes and expanding capacity in key markets like Germany.

- Ashland Global Holdings Inc.: Ashland is a major supplier of specialty ingredients and materials, including a broad portfolio of PVP products used in pharmaceuticals and personal care. The company recently expanded its sustainable PVP production capacity in Germany, highlighting its commitment to eco-friendly solutions.

- ISP Corporation (now part of Ashland): Formerly an independent company, ISP was a significant producer of PVP and other specialty chemicals before being acquired by Ashland. Its integration into Ashland has consolidated market share and enhanced Ashland's product offerings.

- Merck KGaA: A leading science and technology company, Merck provides high-quality PVP as an excipient for pharmaceutical manufacturing under the brand name "Kollidon." The company's focus on quality and R&D supports the stringent requirements of the life science industry.

- Lotte Fine Chemical: A key player in the Asian chemical market, Lotte produces PVP and related chemical products for a variety of industrial and pharmaceutical uses. The company's expansion in production capacity helps meet growing demand in the Asia-Pacific region.

- Anhui Wanwei Group Co., Ltd.: This Chinese chemical group is a significant producer of specialty chemicals, including PVP, for domestic and international markets. The company plays a crucial role in supplying the raw materials and polymers needed by various industries.

- Nanjing Saibo Biotechnology Co., Ltd.: Focused on biotechnology and specialty chemicals, this company produces PVP and other polymers for applications in healthcare and industrial uses. It supports innovation in the Chinese and global markets.

- SNF Floerger: A global leader in water-soluble polymers, SNF produces a range of products used in water treatment, agriculture, and other industries, which can include PVP-related polymers. The company's vast product portfolio caters to diverse industrial needs.

- Zhejiang Tianyi Chemical Co., Ltd.: This Chinese chemical manufacturer specializes in PVP and its copolymers, serving a wide array of applications in pharmaceuticals, cosmetics, and technical fields. The company contributes significantly to the global supply chain for PVP.

- Nippon Shokubai Co., Ltd.: A major Japanese chemical company, Nippon Shokubai produces performance chemicals and materials, potentially including PVP, for a variety of industrial applications. The company is known for its innovation in chemical processes.

- Lomon Billions Group Co., Ltd.: While primarily a major producer of titanium dioxide pigments, Lomon Billions also produces related specialty chemicals used in various industries. The company's scale and reach support global supply chains.

- Wacker Chemie AG: A global chemical company, Wacker produces a variety of polymers and specialty chemicals, some of which may compete with or be used in conjunction with PVP products. Its focus on sustainable solutions aligns with current market trends.

- Zhejiang Hisun Pharmaceutical Co., Ltd.: As a pharmaceutical company, Hisun is a major end-user of PVP in its drug formulations. The company's demand for high-quality excipients drives the market for pharmaceutical-grade PVP.

- Changzhou Sun Chemical Co., Ltd.: This company specializes in the production of specialty chemicals and intermediates, including materials relevant to the PVP market. It provides key components for downstream manufacturers.

- Dymatic Chemicals Pvt. Ltd.: An Indian specialty chemicals producer, Dymatic focuses on providing innovative solutions for the textile, paper, and pharmaceutical industries, likely including PVP products. The company helps meet the rising demand in emerging markets.

- Kumho P&B Chemicals, Inc.: This Korean chemical company produces basic chemicals and intermediates used in the production of polymers like PVP. Its operations are vital for the upstream supply chain of the PVP market.

- Sinopec Group: A massive Chinese energy and chemical company, Sinopec produces a vast range of chemical products, including the feedstocks necessary for PVP production. Its immense scale influences global chemical supply and pricing.

- Chongqing Hongyan Chemical Group: This Chinese chemical group is involved in the production of various industrial chemicals, contributing to the domestic supply of raw materials for PVP.

- Jiangsu Huachang New Material Co., Ltd.: This company specializes in new chemical materials, including products relevant to the PVP market for various industrial and consumer applications.

- National Starch & Chemical Company: Now part of Ingredion, this company was historically a key player in specialty starches and polymers, producing alternatives and complementary products to PVP for industrial and food applications. Its legacy technology influences current market offerings.

Polyvinylpyrrolidone Market Companies

- BASF SE

- Ashland Global Holdings Inc.

- ISP Corporation (now part of Ashland)

- Merck KGaA

- Lotte Fine Chemical

- Anhui Wanwei Group Co., Ltd.

- Nanjing Saibo Biotechnology Co., Ltd.

- SNF Floerger

- Zhejiang Tianyi Chemical Co., Ltd.

- Nippon Shokubai Co., Ltd.

- Lomon Billions Group Co., Ltd.

- Wacker Chemie AG

- Zhejiang Hisun Pharmaceutical Co., Ltd.

- Changzhou Sun Chemical Co., Ltd.

- Dymatic Chemicals Pvt. Ltd.

- Kumho P&B Chemicals, Inc.

- Sinopec Group

- Chongqing Hongyan Chemical Group

- Jiangsu Huachang New Material Co., Ltd.

- National Starch & Chemical Company

Leaders' Announcements

- In April 2025, Ashland announced a US$10 million expansion of its pharmaceutical manufacturing plant in Brazil, enhancing capacities in tablet coating and R&D. This investment follows expansions in Ireland and China and emphasizes customized solutions and innovative technologies. Their actions reflect a commitment to global innovation and customer support. “Our focused actions continue to demonstrate Ashland's strategies to globalize, innovate and invest as a means of driving superior differentiation for customers and increase shareholder value,” said Guillermo Novo, chair and CEO, Ashland.(Source: https://www.pharmaceuticalprocessingworld.com)

Recent Developments

- In July 2023, VedaOils by Bo International launched a comprehensive range of cosmetic raw materials to meet the growing demand for reliable ingredients in the holistic wellness and beauty sectors. This range offers premium essential oils and natural products, enabling personal care brands to create unique, high-quality formulations.

(Source: https://www.prnewswire.com) - In April 2025, IPPON SHOKUBAI CO., LTD. signed an agreement with Kitakyushu City to establish a new plant for producing IONEL™, a lithium-ion battery electrolyte. This initiative addresses the rising demand for electric vehicle components and aims to strengthen Japan's battery supply chain. The location offers logistical advantages and a supportive environment for the automotive industry.(Source: https://www.shokubai.co.)

Segments Covered in the Report

By Grade

- K-Value Grades (Molecular Weight)

- K-15 (Low molecular weight)

- K-30 (Medium molecular weight)

- K-60 (High molecular weight)

- Others (e.g., K-25, K-90)

- Specialty Grades

- Pharmaceutical Grade

- Cosmetic Grade

- Food Grade

- Industrial Grade

By Form

- Powder

- Granules

- Liquid (Solution)

- Others (e.g., film, tablets)

By Application

- Pharmaceuticals

- Binder in Tablets and Capsules

- Film Coating

- Disintegrant

- Solubilizer and Stabilizer

- Cosmetics & Personal Care

- Hair Care Products

- Skin Care Products

- Oral Care Products

- Others (e.g., deodorants)

- Adhesives

- Wood Adhesives

- Paper Adhesives

- Other Industrial Adhesives

- Food & Beverages

- Food Additives

- Clarifying Agent in Beverages

- Food Packaging

- Others

- Printing Inks

- Paints and Coatings

- Detergents

- Textile Processing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting