What is Port Construction Market Size?

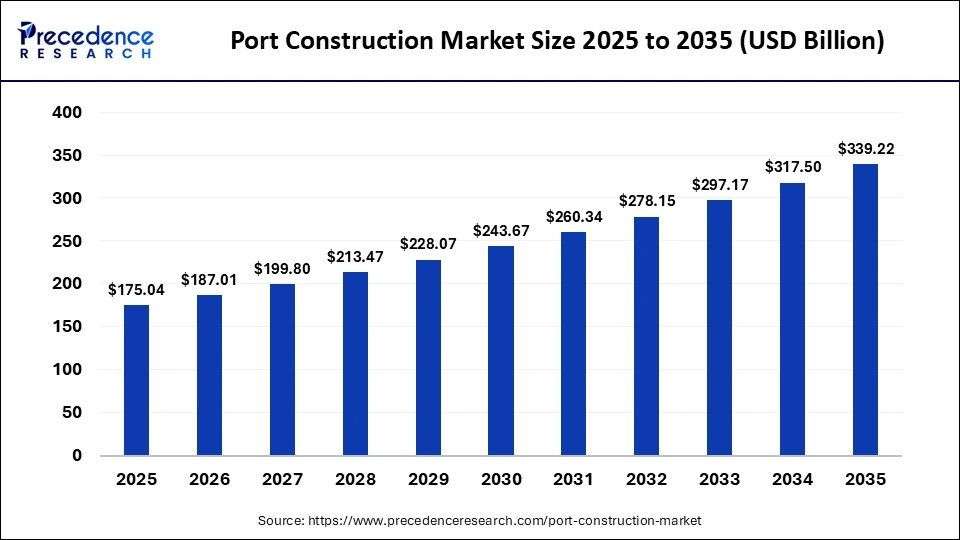

The global port construction market size was calculated at USD 175.04 billion in 2025 and is predicted to increase from USD 187.01 billion in 2026 to approximately USD 339.22 billion by 2035, expanding at a CAGR of 6.84% from 2026 to 2035. The market is rapidly growing due to the rapid growth in global trade and economic developments, the rising need for mega-vessel accommodation, and the growing investment in smart ports and digitalization.

Market Highlights

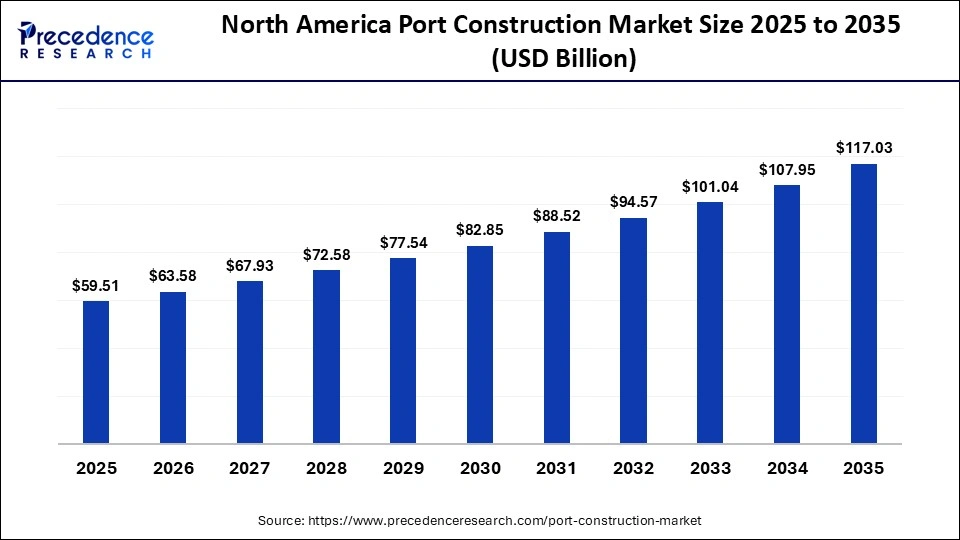

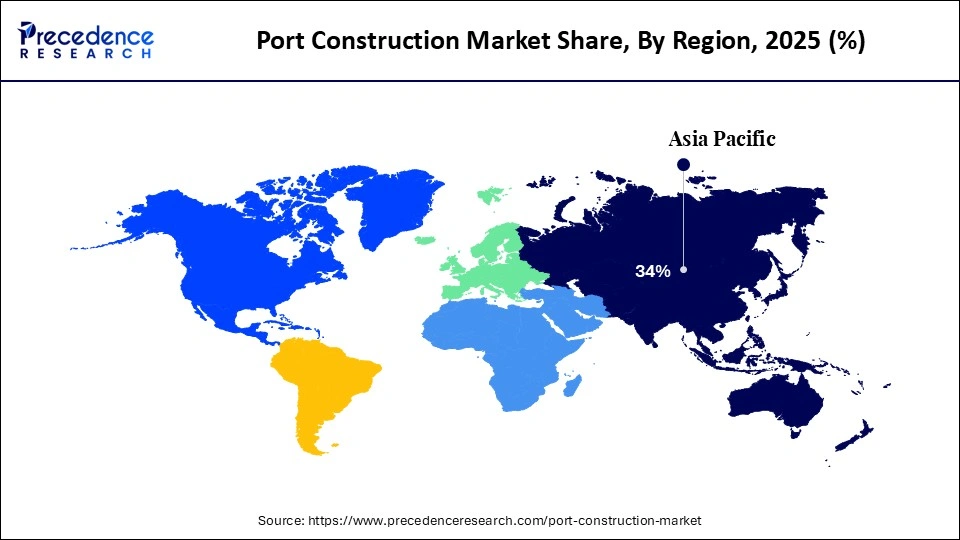

- North America held the largest market share of 34% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR during the foreseeable period.

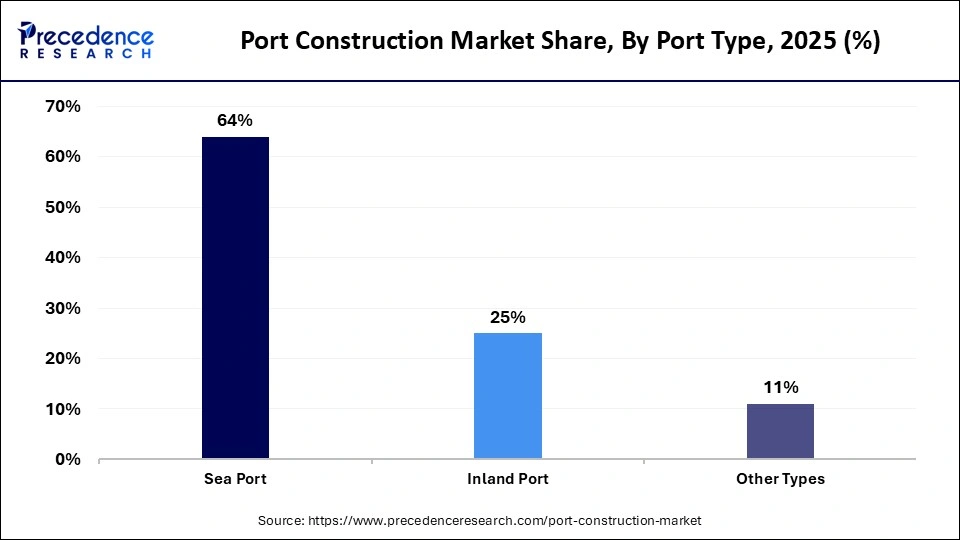

- By port type, the sea port segment contributed the the biggest market share of 64% in 2025.

- By port type, the inland port segment is expected to grow at the fastest CAGR during the forecast period.

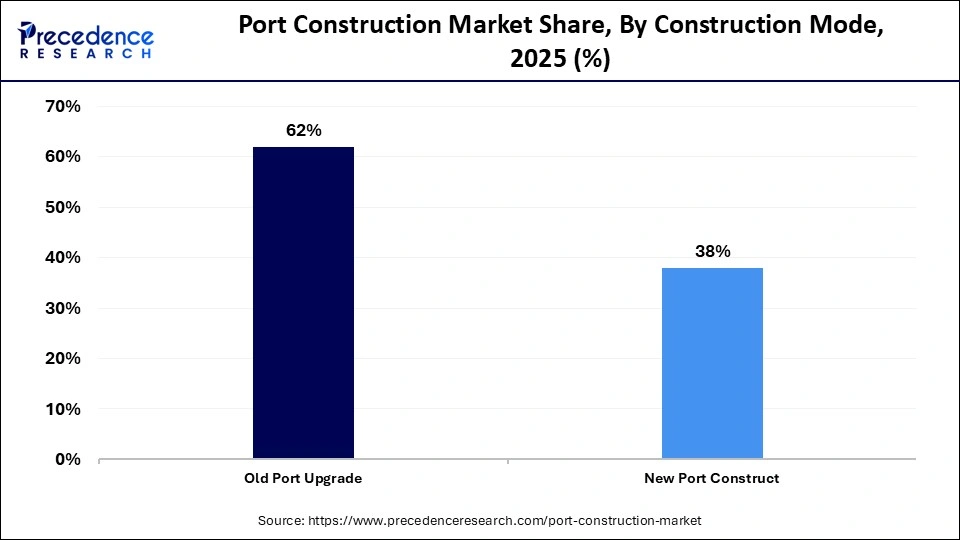

- By construction mode, the old port upgrade segment accounted for the highest market share of 62% in 2025.

- By construction mode, the new port construct segment is expected to grow at the fastest CAGR during the foreseeable period.

- By terminal type, the intermodal and container terminals segment held a dominant market share in 2025.

- By terminal type, the dry bulk terminals segment is expected to grow significantly in the coming years.

What is Port Construction?

The global port construction market comprises the strategic development and lifecycle management of maritimes, protective breakwaters, and deep-water berthing, which are critical for optimizing global supply chains and scaling international trade operations. By investing in port construction, stakeholders unlock significant competitive advantages, including the ability to accommodate ultra-large vessels, streamline multi-model logistics, and catalyse regional economic development through job creation and enhanced trade flow. These projects support various applications, ranging from container terminal expansion and bulk cargo handling to the development of specialized berths for offshore wind energy.

Port Construction Market Trends

- Ports are heavily adopting green technologies to reduce their environmental impact, focusing on constructing infrastructure that supports renewable energy, such as solar or wind power, and installing shore power systems to reduce ship emissions while docked.

- Construction projects are increasingly integrating technologies, such as IoT, artificial intelligence (AI), and 5G connectivity, to create smart ports.

- To accommodate the increasing size of modern container ships, there is a strong focus on deepening harbors, widening channels, and extending berth lengths. This involves significant dredging operations and quay wall reinforcement to handle the increased load and draft requirements of ultra-large container ships.

- With rising sea levels and more frequent extreme weather events, port construction is increasingly focused on resilience to ensure long-term viability. This trend includes building higher seawalls, designing flood-resistant, modular infrastructure, and enhancing drainage systems to withstand storms and coastal erosion.

- To combat labor shortages and reduce on-site construction time, builders are utilizing prefabricated and modular components constructed in factory-like settings.

How is AI Influencing the Port Construction Market?

The integration of Artificial intelligence is transforming the port construction industry by accelerating the shift towards smart and automated infrastructure. It is revolutionizing the planning phase through generative design, which allows engineers to simulate various structural scenarios and optimize layout efficiency before breaking ground. Furthermore, AI technologies, including machine learning and computer vision, are increasingly utilized on-site to enhance safety by identifying potential hazards and facilitating predictive maintenance, thereby reducing equipment downtime. Data-driven algorithms are optimizing the entire construction life cycle, from material usage to resource allocation, resulting in lower costs and faster completion times for complex port projects.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 175.04 Billion |

| Market Size in 2026 | USD 187.01 Billion |

| Market Size by 2035 | USD 339.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Port Type,Construction Mode,Terminal Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Port Type Insights

Why Did the Sea Port Segment Lead the Port Construction Market?

The sea port segment led the market in 2025. This is because of scaling facilities to accommodate ultra-large vessels and integrating high-tech automation, port operators are securing their role as vital economic engines. These multi-billion-dollar strategic expansions not only drive operational efficiency but also reinforce regional competitiveness within the global supply chain. Ultimately, the transition toward digitized, high-capacity maritime hubs represents a fundamental shift in ensuring long-term commercial and economic resilience.

The inland port segment is expected to show the fastest growth over the forecast period due to massive sovereign investments like the US Infrastructure Act and India's Sagarmala project. These facilities leverage superior intermodal connectivity to drive regional economic growth. By prioritizing low-emission rail and waterway transport, they align logistics operations with global sustainability mandates and ESG frameworks. Furthermore, the integration of smart-port automation ensures these inland hubs remain high-efficiency anchors within an increasingly digitized global supply chain.

Construction Mode Insights

Why Did the Old Port Upgrade Segment Dominate the Port Construction Market?

The old port upgrade segment held a major revenue share of the market in 2025. By prioritizing the brownfield optimization of prime-location facilities, port authorities can achieve rapid gains in operational efficiency and regulatory compliance with significantly lower capital risk than greenfield developments. This trend reflects a global shift toward reinforcing existing supply chain nodes to meet evolving ESG and safety standards.

The new port construct segment is expected to witness the fastest growth in the market over the forecast period due to increased container traffic and the expansion of supply chains. New construction is required to build deeper harbors and larger terminals to handle modern, massive vessels. Significant investment in growing infrastructure, modernization, sustainability, and economic development in emerging markets.

Terminal Type Insights

Which Terminal Type Segment Led the Port Construction Market?

The intermodal and container terminals segment led the market in 2025, due to the shift towards containerization and ultra-large vessel operations, mandating a fundamental reconfiguration of maritime infrastructure to support high-velocity, high-volume trade. By integrating seamless intermodal connectivity and AI-driven automation, ports are achieving a 30% reduction in turnaround times, directly enhancing supply chain throughput and cost-efficiency.

The dry bulk terminals segment is expected to show lucrative growth in the market during the projection period due to the strategic expansion of high-capacity dry bulk and intermodal terminal networks. This capital-intensive growth is being optimized through the integration of AI-driven logistics and green automation, which significantly reduces vessel turnaround times while ensuring strict compliance with evolving environmental mandates. The development of sophisticated inland container depots further enhances this ecosystem, creating a seamless, multimodal bridge between maritime hubs and interior markets.

Regional Analysis

How Big is the North America Port Construction Market Size?

The North America port construction market size is estimated at USD 59.51 billion in 2025 and is projected to reach approximately USD 117.03 billion by 2035, with a 7.00% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Port Construction Market?

North America registered its dominance in the market in 2025. This is mainly due to the offshore energy transition and e-commerce-driven logistics, necessitating high-velocity, automated facilities that prioritize both throughput and climate resilience. By integrating AI-driven systems and sustainable "green port" engineering, the region is enhancing its competitive standing in the global trade arena. Consequently, these strategic investments ensure that North American maritime hubs serve as resilient, future-ready anchors for both traditional commerce and the emerging renewable energy sector.

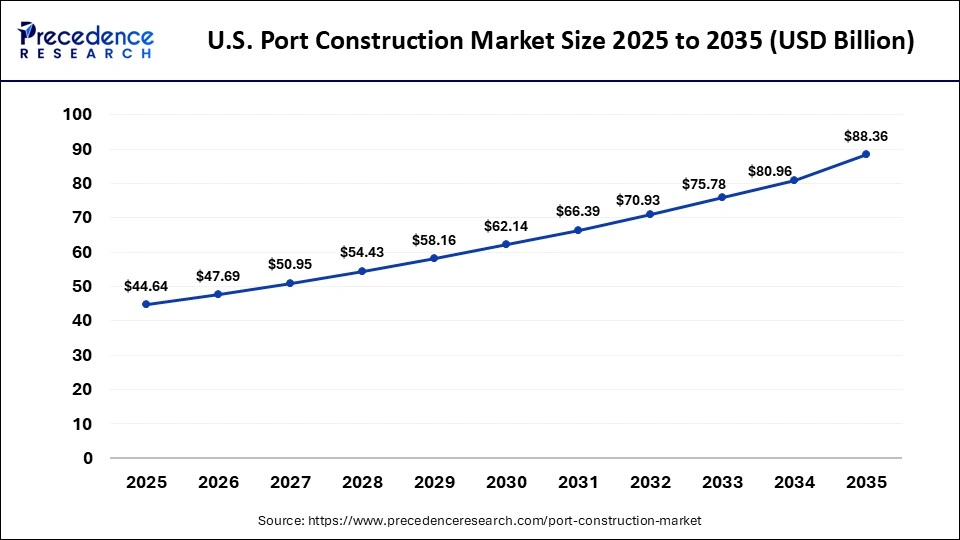

What is the Size of the U.S. Port Construction Market?

The U.S. port construction market size is calculated at USD 44.64 billion in 2025 and is expected to reach nearly USD 88.36 billion in 2035, accelerating at a strong CAGR of 7.07% between 2026 to 2035.

U.S. Market Analysis

The market in the U.S. is growing due to a strategic convergence of high-tech automation and climate-adaptive engineering, aimed at securing long-term operational resilience. Supported by robust federal grants and record industrial demand in hubs like Houston and Savannah, port authorities are prioritizing deep-water dredging and autonomous systems to maintain a competitive edge. While project backlogs remain stable through 2029, stakeholders must navigate persistent headwinds, including specialized labor shortages and high material volatility.

Why is Asia-Pacific Rapidly Expanding in the Port Construction Market?

The Asia-Pacific is expected to grow at the fastest CAGR during the foreseeable period due to targeted federal funding for climate-resilient engineering and deep-water dredging in high-growth hubs. Driven by sustained industrial demand, these strategic upgrades ensure long-term stability for contractor backlogs and regional logistics networks. Ultimately, these investments solidify a future-ready infrastructure capable of supporting larger vessels while insulating supply chains from environmental and economic volatility.

India Market Analysis

In India, the market is evolving due to FDI and robust public-private partnerships (PPP) involving major players like Adani and JSW, who are prioritizing green energy integration and AI-driven automation. By enhancing multi-modal connectivity via the Sagarmala Initiative, the government is drastically reducing logistics costs and improving turnaround times for specialized cargo.

Will Europe Grow in the Port Construction Market?

Europe is expected to grow at a notable CAGR in the foreseeable future as the region is transforming traditional maritime hubs into high-tech renewable energy centers. To accommodate the next generation of automated, ultra-large container vessels, operators are prioritizing capital-intensive infrastructure upgrades, including the deepening of berths and terminal expansion.

These developments are accelerated by stringent green deal regulations, which mandate the integration of eco-friendly "smart" port technologies to achieve lower emissions. Furthermore, robust Public-Private Partnerships (PPPs) in key logistics corridors like the Netherlands and the UK are fortifying hinterland connectivity through integrated rail and road networks.

U.K. Market Analysis

U.K.'s strategic shift toward green energy infrastructure, with massive investments in heavy-lift facilities specifically designed to support the offshore wind transition in the Celtic and North Seas. This modernization is coupled with the deployment of AI-driven automation and smart terminal technology, which are essential for optimizing turnaround times for the next generation of ultra-large container vessels. To ensure long-term viability, projects are integrating climate-resilient engineering and enhanced intermodal connectivity, bridging the gap between deep-water berths and hinterland logistics networks.

What Made Latin America Significant Growing in the Port Construction Market?

Latin America is considered to be a significantly growing area, due to the rising demand for critical minerals like lithium and copper, and the strategic necessity of enhancing trade corridors. This modernization is largely fueled by PPPs, which now facilitate over 70% of cargo movement in major economies like Brazil and Chile. By prioritizing deep-water harbor development and the integration of AI-driven logistics, the region is successfully scaling its capacity to accommodate larger vessels while improving operational transparency.

Brazil Port Construction Market Analysis

Brazil is focused on modernizing aging infrastructure to support the nation's booming agricultural exports. The industry is integrating green technologies and digital logistics tools to enhance operational throughput at strategic gateways, such as Pecém and Paranaguá. Ultimately, these upgrades ensure Brazil remains a high-capacity, sustainable node in the global maritime trade network.

Which Factors Drive the Port Construction Market in the Middle East & Africa?

The Middle East and Africa are expected to grow at a considerable CAGR in the upcoming period. The region's port construction sector is defined by a strategic shift toward economic diversification, with Saudi Arabia's Vision 2030 and UAE initiatives transforming the region into a global logistical powerhouse. Leveraging their position at the crossroads of the Suez Canal and Red Sea trade routes, sovereign wealth funds are financing mega-infrastructure projects designed to accommodate ultra-large vessels and the increased throughput of the AfCFTA.

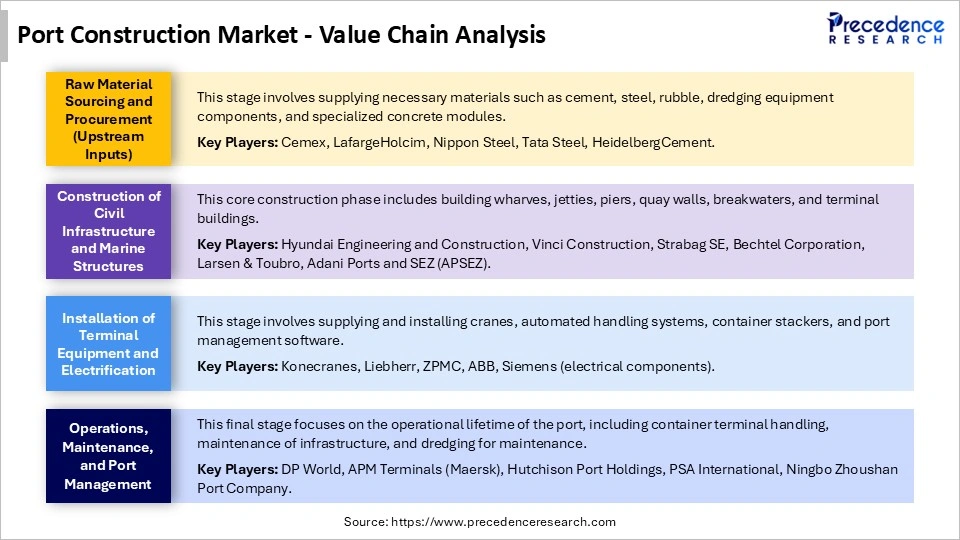

Port Construction Market Value Chain Analysis

Who are the major players in the global port construction market?

The major players in the port construction market include China State Construction Engineering Corporation Ltd. (China), Hyundai Engineering and Construction Co. Ltd (South Korea), Grupo ACS (Spain), DEME Group (Belgium), Ningbo Zhoushan Port Company Ltd. (China), VINCI Construction (France), CK Hutchison Holding Ltd. (Hong Kong), Van Oord (Netherlands), Hindustan Construction Company Ltd. (India), and Adani Group (India)

Recent Developments in the Port Construction Market

- In January 2026, Union Minister Sarbananda Sonowal launched port infrastructure and digital governance projects worth ₹235 crore across Chennai Port Authority and Kamarajar Port Limited to strengthen Tamil Nadu's maritime capacity and advance India's maritime-led growth. This aligns with the Center's commitment to building globally competitive, climate-resilient, and digitally-enabled ports.

- In January 2026, Jawaharlal Nehru Port Authority (JNPA) has integrated indigenous Harbor Management Systems (HMS) and Integrated Vessel Traffic Systems (iVTS) to enable IoT-based, real-time resource allocation and vessel scheduling. The system also enables pilotage data, safety monitoring, and sustainability tracking.

- In October 2025, DP World partnered with Deendayal Port and European firm Nevomo to implement MagRail Booster technology, a magnetic propulsion system for automated, zero-carbon cargo movement. The collaboration was made to enable DP World to leverage Nevomo's proprietary MagRail Booster technology. (Source:https://www.dpworld.com)

Segments Covered in the Report

By Port Type

- Sea Port

- Inland Port

- Other Types

By Construction Mode

- Old Port Upgrade

- New Port Construct

By Terminal Type

- Intermodal and Container Terminals

- Break Bulk Terminals

- Dry Bulk Terminals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting