What is the Smart Port Market Size?

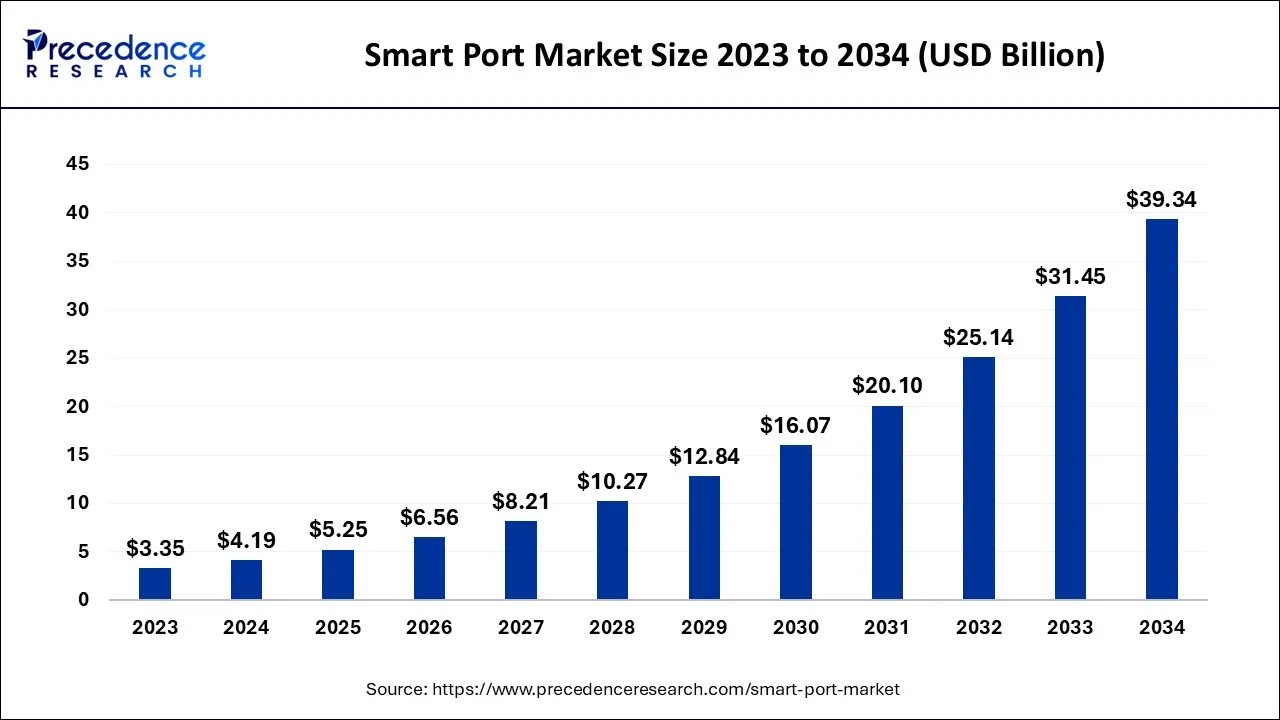

The global smart port market size accounted for USD 566.22 billion in 2025 and is predicted to increase from USD 597.36 billion in 2026 to approximately USD 962.89 billion by 2035, expanding at a CAGR of 5.45% from 2026 to 2035.

Smart Port Market Key Takeaways

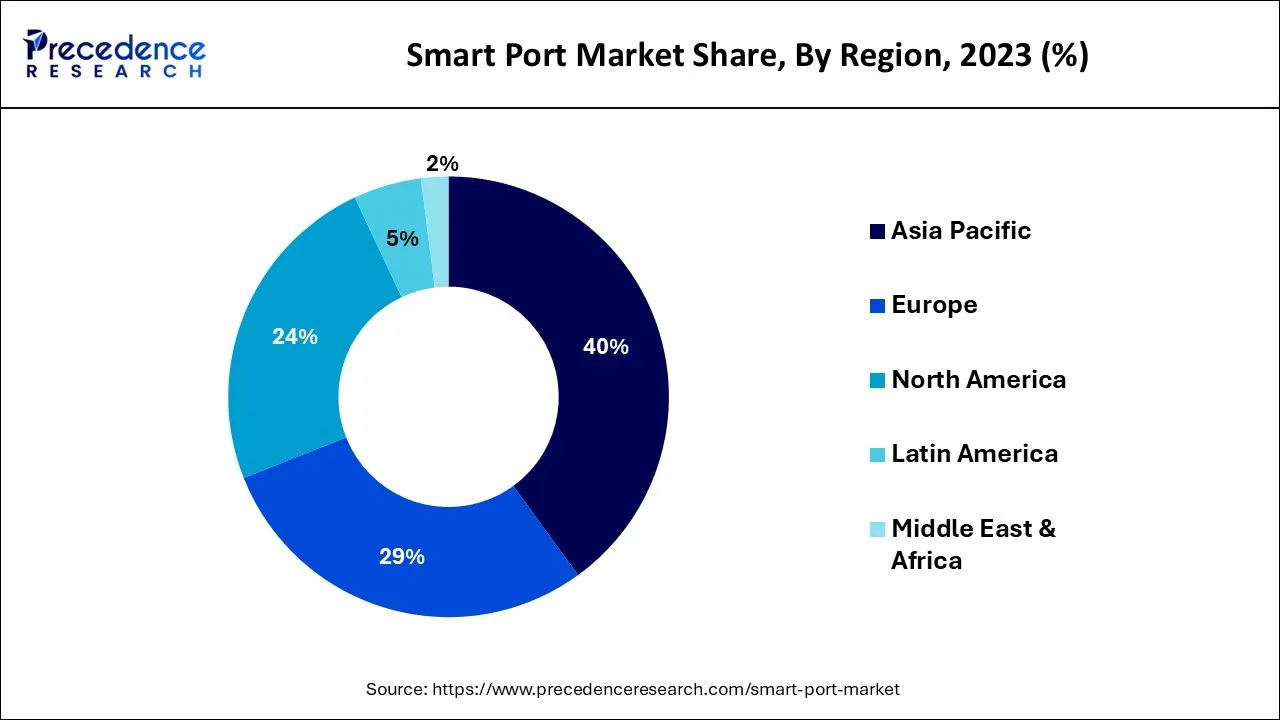

- Asia Pacific region generated more than 40% of the revenue share in 2025.

- By Technology, the process automation segment contributed more than 36% of revenue share in 2025.

- By Throughput Capacity, the extensively busy segment recorded more than 48% of the revenue share in 2025.

- By Port Type, the seaport segment generated more than 70% of the revenue share in 2025.

Market Overview

A smart port is a modern and innovative port that leverages advanced digital technologies, such as the Internet of Things (IoT), big data analytics, and automation, to enhance its operational efficiency, safety, and security. The aim of a smart port is to improve the entire port ecosystem, including its infrastructure, equipment, and workforce, in order to create a more sustainable, efficient, and resilient port.

Smart ports are specifically designed to overcome the challenges faced by conventional ports, including congestion, delays, inefficiencies, and environmental impacts. By integrating digital technologies, smart ports can automate and streamline numerous port operations, such as cargo handling, inventory management, and transportation logistics. This can significantly reduce the time and cost associated with port activities, as well as improves the safety and security of the port.

By using cloud computing, smart ports can store and process large amounts of data, which is critical for optimizing port operations. Blockchain technology enables secure and transparent data sharing among port stakeholders, facilitating efficient communication and collaboration. Additionally, artificial intelligence and machine learning are utilized to analyze data and provide insights to port operators, allowing them to make data-driven decisions that can enhance efficiency and reduce costs.

Smart Port Market Growth Factors

Seaport authorities have embraced smart technologies to curtail operational costs, access real-time information, and make data-driven decisions. These technologies encompass Artificial Intelligence (AI), the Internet of Things (IoT), blockchain, and process automation, which are leveraged to convert conventional ports into smart ports.

The deployment of these technologies individually or in conjunction enables the digitization of the traditional infrastructure. Smart ports have several advantages over conventional ports, including lower human-related disruptions, reduced operational costs, intelligent decision-making, and more predictable performance. These benefits enhance productivity, paving the way for the realization of Port 4.0, a visionary and cutting-edge concept for port infrastructure.

The smart port market is set to witness significant growth in the upcoming years, driven by several factors. The primary driver of this growth is the increasing demand for real-time information and supply chain visibility. In order to provide real-time data on cargo and equipment movement, port operators are turning towards digital technologies such as the Internet of Things (IoT), big data analytics, and automation, to optimize their operations and reduce costs. The complexity of global supply chains has driven the need for greater transparency and visibility, ensuring the timely delivery of goods.

Moreover, the need for greater efficiency and productivity is another driving factor in the growth of the smart port market. Traditional ports often face congestion, delays, and inefficiencies leading to increased costs and reduced competitiveness. Smart ports, on the other hand, leverage advanced technologies and streamlined processes, enabling them to reduce these inefficiencies and improve productivity. This is particularly relevant in regions where port infrastructure is outdated and struggling to keep up with the rising demand.

Furthermore, the adoption of automation technologies is another significant factor contributing to the growth of the smart port market. Technologies such as autonomous vehicles, robotics, and artificial intelligence are making port operations safer and more efficient by reducing the need for manual labor. Automation also minimizes the risk of human error, thereby improving accuracy and consistency in port operations. As these technologies continue to advance and become more widespread, they are expected to play an increasingly vital role in the smart port market.

The focus on environmental sustainability is also contributing to the growth of the smart port market. Smart ports are helping to reduce the environmental impact of port operations by optimizing resource usage, reducing energy consumption, and minimizing waste. For instance, IoT sensors can monitor energy consumption and identify areas where energy can be conserved. Automation technologies can also optimize cargo movement, reducing the need for excess handling and thereby minimizing greenhouse gas emissions.

Furthermore, the increasing complexity of global trade is driving the growth of the smart port market. With rising trade volumes and complex supply chains, the need for efficient and effective port operations has become crucial. Smart ports provide real-time data and analytics, enabling port operators to make informed decisions and optimize their operations. This is especially critical in regions where port infrastructure is struggling to keep up with demand.

In summary, the smart port market is expanding due to several factors including the focus on environmental sustainability, the need for efficient and effective port operations, and the adoption of smart technologies. By optimizing resource usage, reducing energy consumption, and minimizing waste, smart ports are helping to reduce the environmental impact of port operations. Additionally, by providing real-time data and analytics, smart ports are enabling port operators to make informed decisions and optimize their operations, managing the complexities of global trade.

Market Outlook

- Industry Growth Overview: The smart port market is growing due to the global shifts toward environmentally friendly practices. Ports are recognizing the importance of minimizing their carbon footprint and enhancing operational efficiency while ensuring economic growth.

- Sustainability Trends: Ports are adopting greener technologies, such as electric and hybrid cranes, energy-efficient lighting, and renewable energy sources like solar and wind power. These initiatives aim to reduce emissions and reliance on fossil fuels, contributing to a more sustainable port environment.

- Startup Ecosystems: The rise of startup ecosystems focused on maritime and logistics innovations is providing a fertile ground for new ideas. Startups are developing solutions that tackle specific challenges in the port industry, such as reducing turnaround times, enhancing cybersecurity, and improving cargo management processes. The involvement of startups fosters a culture of innovation and agility, which is critical for adapting to the fast-evolving demands of the port sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 962.89 Billion |

| Market Size in 2025 | USD 566.22 Billion |

| Market Size in 2026 | USD 597.36 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 24.46% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Throughput Capacity, Port Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for real-time information and supply chain visibility

The increasing demand for real-time information and supply chain visibility is a significant driver for the smart port market. As global trade volumes continue to rise, supply chains are becoming increasingly complex, and timely and accurate data on the movement of goods and equipment is essential.

Smart ports employ advanced technologies like IoT sensors, big data analytics, and automation to provide this real-time information, enabling port operators to optimize their operations and reduce costs. Real-time information is critical for effective supply chain management as it helps businesses quickly identify and resolve issues, improving the overall efficiency of the supply chain. Smart ports offer real-time data on cargo movement, inventory levels, and equipment location, among other factors, allowing port operators to monitor and manage their operations in real-time.

Key Market Challenges

High cost of implementation and maintenance

The high cost of implementing and maintaining advanced technologies is a significant challenge for the smart port market. Smart ports rely heavily on digital technologies like IoT sensors, big data analytics, and automation to provide real-time information and optimize operations. However, these technologies can be costly to implement and maintain, particularly for smaller ports or those in developing countries.

The cost of advanced technologies is a major barrier to entry for many port operators. For instance, implementing IoT sensors requires significant investments in hardware, and software, and developing sophisticated data analytics capabilities. Likewise, introducing automation technologies such as autonomous vehicles and robotics requires substantial investments in equipment and infrastructure.

Key Market Opportunities

Increasing adoption of green technologies and sustainable practices

The increasing adoption of green technologies and sustainable practices presents a significant opportunity for the smart port market. The shipping industry is a significant contributor to global greenhouse gas emissions, accounting for around 3% of global carbon dioxide emissions. As a result, the industry is under mounting pressure to reduce its environmental impact and transition towards more sustainable practices.

Smart ports are in a favorable position to benefit from this opportunity by adopting sustainable practices and green technologies that decrease their environmental footprint. This includes the adoption of renewable energy sources such as solar and wind power, implementing energy-efficient lighting and HVAC systems, and embracing electric and hybrid vehicles.

Segment Insights

Technology Insights

The process automation segment was responsible for over 36% of the global revenue share in 2024 and is anticipated to maintain a substantial compound annual growth rate throughout the projected period. A growing number of ports are adopting cloud-based software to support the automation process, leading to reduced human intervention for repetitive tasks like ship invoicing and port gate operations.

The extent of automation varies depending on the assignment, and in some cases, several technologies must be integrated with process automation software. However, process automation provides significant growth prospects for dock operators as a stand-alone technology. Other technologies, such as IoT, AI, and blockchain, are also part of this technology segment.

Docking operations produce a vast amount of quantitative data and paperwork, which can be overwhelming. By integrating technology, dock operations can be streamlined, resulting in long-term cost savings. For example, smart sensors can provide real-time assessments of each asset's performance, allowing seaport authorities to undertake preventive maintenance measures as required, which decreases operating costs.

Throughput Capacity Insights

In 2024, the most significant segment of the smart port market was the extensively busy segment, which accounted for more than 48% of the revenue share. This category comprises ports with a throughput capacity of over 18.5 million TEU, and its dominant share is attributed to their high capacity and a large number of operations. Seaport authorities have adopted some level of automation to improve operational efficiency in these ports.

Additionally, as these ports generate significant revenues, they have the financial capability to invest in automation technologies. The moderately busy and scarcely busy port segments include ports with throughput capacities of 5 to 18 million TEU and less than 5 million TEU, respectively. The moderately busy segment is expected to experience the highest adoption rate during the forecast period. This is due to its considerable investment capacity and fewer operations, resulting in less complexity involved in integrating technology, which is expected to drive segment growth.

Port Type Insights

In 2024, the seaport sector dominated the marketplace, comprising more than 70% of the revenue stake. The level of mechanization at every seaport differs depending on factors such as the mean number of tasks, capability, and magnitude. Moreover, seaport mechanization includes noteworthy monetary investment, which is a vital factor for technological adoption and implementation. Seaports handle an immense volume of load, ranging from petite to massive, as well as passenger flow, making intelligent technologies indispensable for efficient pier activities.

Inland ports, located in inner waterways like brooks and channels, are tinier in size compared to seaports. Nevertheless, with the upsurge in oceanic transportation, various inland ports, mainly in Europe, manage a substantial amount of container traffic, resulting in amplified operations and prospects for mechanization. Consequently, the inland port division is projected to undergo significant expansion in the forthcoming years.

Regional Insights

What is the Asia Pacific Smart Port Market Size?

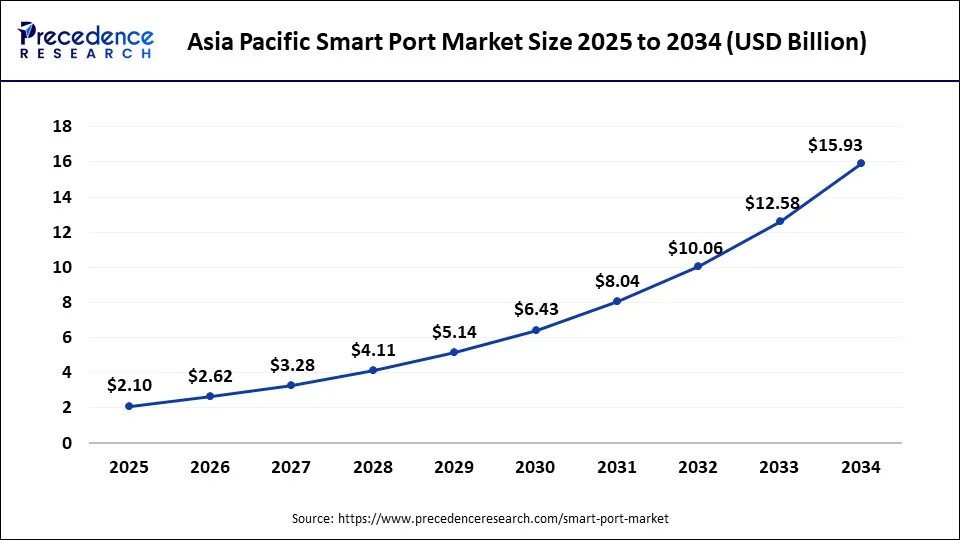

The Asia Pacific smart port market size is exhibited at USD 2.10 billion in 2025 and is projected to be worth around USD 18.73 billion by 2035, growing at a CAGR of 24.46% from 2026 to 2035.

The Asia Pacific smart port market is driven by the growing demand for goods and the need for efficient and reliable port operations. Major ports like Shanghai and Singapore have implemented advanced technologies such as automation and big data analytics to improve efficiency and reduce costs. The Asia Pacific market also focuses on innovation, with many ports investing in new technologies like blockchain and artificial intelligence to stay competitive in the market.

The North American smart port market is driven by the rising demand for containerized goods and the need for efficient and reliable port operations. With major ports like Los Angeles and Long Beach, the region has adopted advanced technologies such as automated container handling systems to increase efficiency and reduce costs. The North American market also focuses on sustainability, with many ports adopting green technologies and sustainable practices.

In Europe, the smart port market is fueled by the adoption of digital technologies and automation to improve port efficiency and competitiveness. Major ports such as Rotterdam and Hamburg have invested heavily in advanced technologies like autonomous vessels and smart containers. The European market also places a strong emphasis on sustainability, with many ports adopting green technologies and sustainable practices to reduce their environmental impact.

Asia-Pacific (APAC): Global Leader in Smart Ports

Asia Pacific continues to largely dominate the sector of smart ports due to existing infrastructure and investment. Singapore's Tuas Mega Port is on target to open the world's largest fully automated terminal with over 1,000 autonomous vehicles and nearly 1,000 automated yard cranes. In 2024, Singapore's Port handled 41 million TEUs and 622.9 million tonnes of shipments, clearly showing its importance in the global trade system. South Korea is also using AI, IoT, and 5G for port activity, as is Japan.

North America: Quick Growth in Smart Ports despite Trade Changes

The North American smart port market has shown rapid growth due to changes in infrastructure and trade changes taking place today. The Port of Los Angeles, the busiest port in the U.S., has invested in new cranes capable of servicing a ship up to 18,000 TEUs. Much of the unit volume has seen allocated shipments drop as much as 35% coming from China, but North America continues to develop its smart ports due to advancements in infrastructure improvements.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing significant growth in the smart port market, driven by the rising use of advanced technologies to make ports work better. There is a strong emphasis on reducing the number of ships waiting to make trade easier. There are more containers coming into the ports. Many countries in Latin America make a lot of money from exporting things. This is putting a lot of pressure on the ports. Thus, they are starting to use computers and other smart technologies to help. The government and private companies are working together to pay for these projects in the major ports.

The Latin American smart port market is expected to continue growing, despite challenges such as cybersecurity risks, system integration complexities, and budget constraints that make large-scale implementation difficult. Progress is being driven by governments recognizing ports as vital economic assets and collaborating with private partners to modernize infrastructure. These efforts are helping the region advance toward more efficient, technology-enabled port operations.

Brazil is the leader in the Latin American market because it has many ports and exports a wide range of goods, including food and manufactured goods. Mexico is also leading, as it serves as a transit point for goods heading to North America, and more containers are passing through its ports. Chile is strong at using digital systems to improve its ports' efficiency and transparency. Colombia is working to make its ports smarter so it can move goods quickly and easily. Peru is beginning to use digital systems to improve its ports, enabling it to export minerals and farm products.

What Potentiates the Market in the Middle East & Africa?

The smart port market in the Middle East & Africa is being potentiated by increasing trade volumes and intercontinental shipping, which drive demand for more efficient and automated port operations. Government and private initiatives, along with the adoption of digital integration and automated systems in leading ports, are further accelerating market growth. Additionally, the recognition of ports as critical economic assets is encouraging continued investment in smart infrastructure across the region.

Egypt is investing heavily in its ports to strengthen connectivity between Europe, Asia, and Africa. The UAE, Egypt, and Morocco are modernizing their ports, leveraging technology and digital systems to manage cargo and terminals more efficiently. Morocco's strategic location further enhances its position as a key regional trade hub.

Value Chain Analysis

- Raw Material Sources: Raw material sourcing for smart ports involves obtaining the necessary components and technologies, such as sensors, automation systems, and cybersecurity solutions, from reliable suppliers. These materials are crucial for enhancing port operations, improving efficiency, and ensuring seamless integration of digital systems.

- Component Manufacturing: Component manufacturing for smart ports involves the production of specialized equipment and technologies, such as automated cranes, RFID systems, and IoT devices, which are essential for streamlining port operations. This manufacturing process requires collaboration between technology developers and manufacturers to ensure that all components are compatible and meet the specific needs of modern port infrastructure.

Smart Port Market Companies

- Royal Dutch Shell plc

- IBM Corporation

- Wärtsilä Corporation

- Navis LLC

- Trelleborg AB

- Kongsberg Gruppen AS

- Cisco Systems, Inc.

- Liebherr-International AG

- Abu Dhabi Ports Company

- Port of Rotterdam

- Port of Singapore

- Intel Corporation

- Huawei Technologies Co., Ltd.

- ABB Ltd.

- Yokogawa Electric Corporation

Recent Developments

- In April 2025, FET launched an enterprise AI consulting platform, partners with TIPC to drive smart port operations. Far EasTone Telecommunications (FET) has taken a major step in this direction with the launch of its proprietary “FET AI Model Agent” platform for external clients.

- In February 2025, Indra launched a European port defense project featuring a combination of advanced technologies, including artificial intelligence, sonar, and unmanned underwater vehicles.

- Huawei's recent announcement of its latest customs and port solutions at HUAWEI CONNECT 2022 is expected to significantly contribute to the growth of the smart port market. The establishment of Huawei's Customs and Port Group is a strategic move that aims to facilitate the digitalization of port facilities and customs operations. The adoption of advanced technologies such as those offered by Huawei is helping to boost the growth of the smart port market. With the increasing demand for more efficient and reliable port operations; the availability of innovative solutions such as those offered by Huawei is expected to drive the growth of the market even further.

Segments Covered in the Report

By Technology

- Process Automation

- Blockchain

- Internet of Things (IoT)

- Artificial Intelligence (AI)

By Throughput Capacity

- Extensively Busy

- Moderately Busy

- Scarcely Busy

By Port Type

- Seaport

- Inland Port

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting