Port Electrification Market Size and Forecast 2025 to 2034

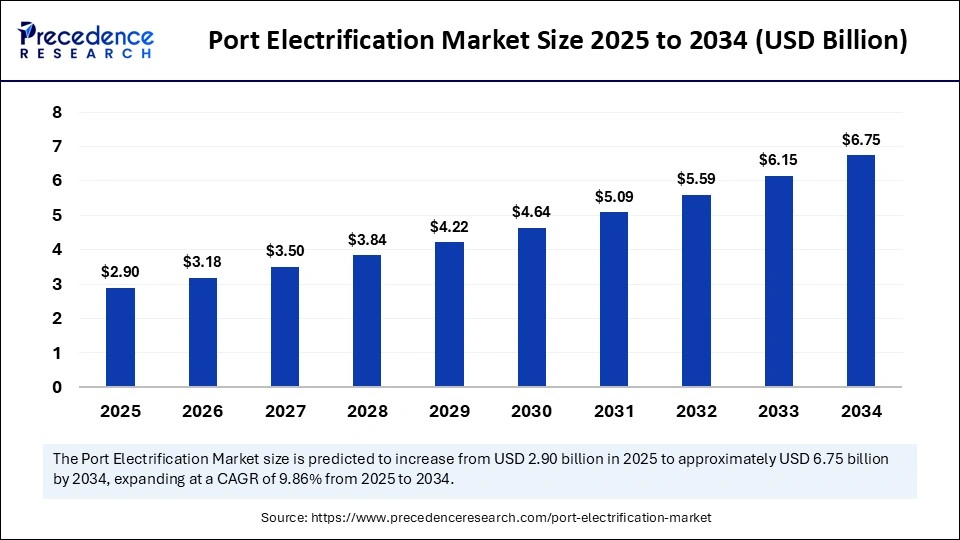

The global port electrification market size accounted for USD 2.64 billion in 2024 and is predicted to increase from USD 2.90 billion in 2025 to approximately USD 6.75 billion by 2034, expanding at a CAGR of 9.86% from 2025 to 2034.The growth of the port electrification market is driven by stringent environmental regulations and supportive government policies and funding programs.

Port Electrification MarketKey Takeaways

- In terms of revenue, the port electrification market is valued at $2.90 billion in 2025.

- It is projected to reach $6.75 billion by 2034.

- The market is expected to grow at a CAGR of 9.86% from 2025 to 2034.

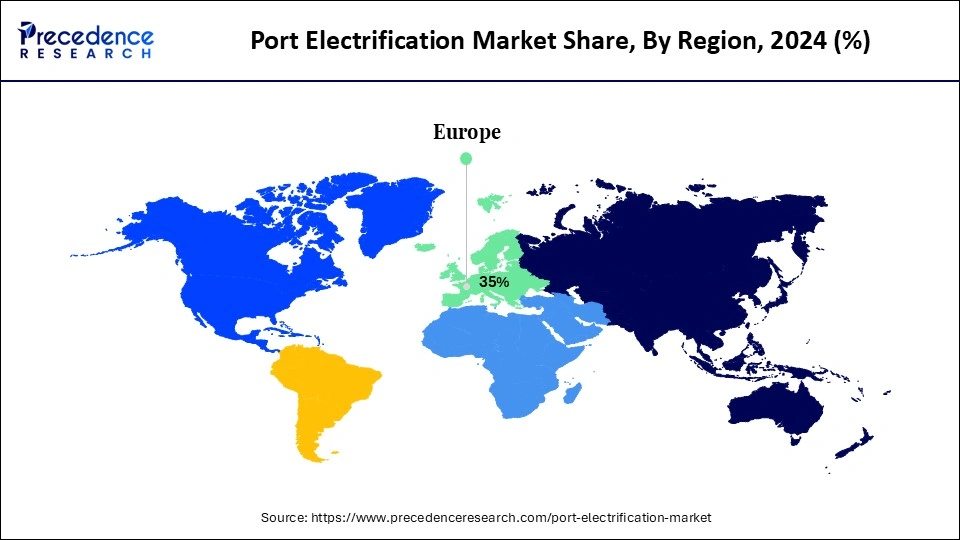

- Europe accounted for the largest revenue share of 35% in 2024.

- North America is expected to grow at the fastest rate during the forecast period.

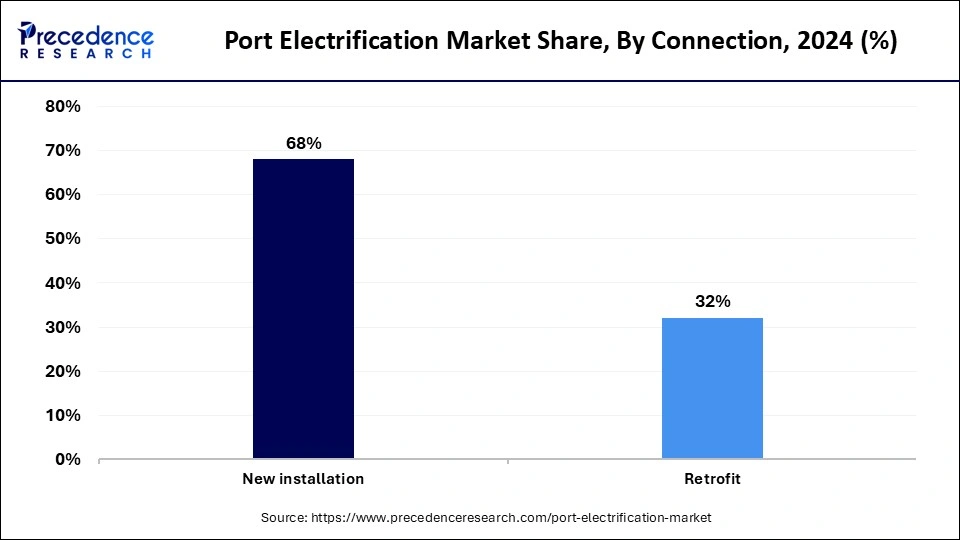

- By connection, the new installation segment held a significant revenue share of 68% in 2024.

- By connection, the retrofit segment is expected to expand at the fastest rate over the forecast period.

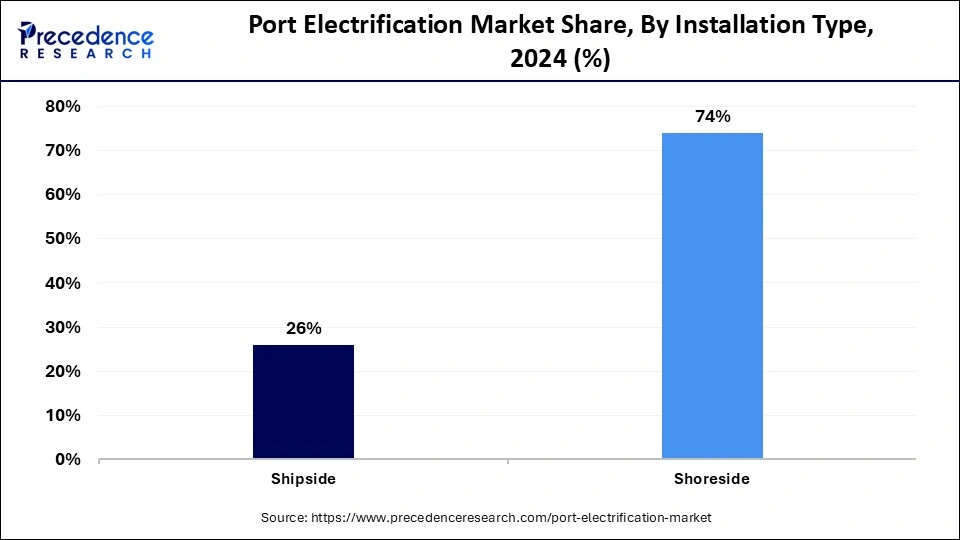

- By installation type, the shoreside segment contributed the highest revenue share of 74% in 2024.

- By installation type, the shipside segment is expected to expand at a considerable growth rate in the upcoming period.

- By component, the transformers segment captured the highest revenue share of 33% in 2024.

- By component, the frequency converters segment is expected to grow at a rapid pace over the forecast period.

- By port equipment type, the electric cargo handling equipment segment generated the major revenue share of 63% in 2024.

- By port equipment type, the electric marine vessels segment is expected to grow at the highest CAGR in the coming years.

How is AI Transforming the Port Electrification Market?

Ports operators are increasingly integrating artificial intelligence technology to track maritime activities while efficiently managing electricity consumption from various sources like solar and wind. AI optimizes power consumption based on weather conditions, enabling ports to utilize clean energy. Proper maintenance scheduling enabled by AI extends the usability and efficiency of electric cranes, forklifts, and terminal tractors. AI streamlines port operations and reduces energy consumption by optimizing vessel schedules and organizing cargo, thus cutting down congestion in ports.

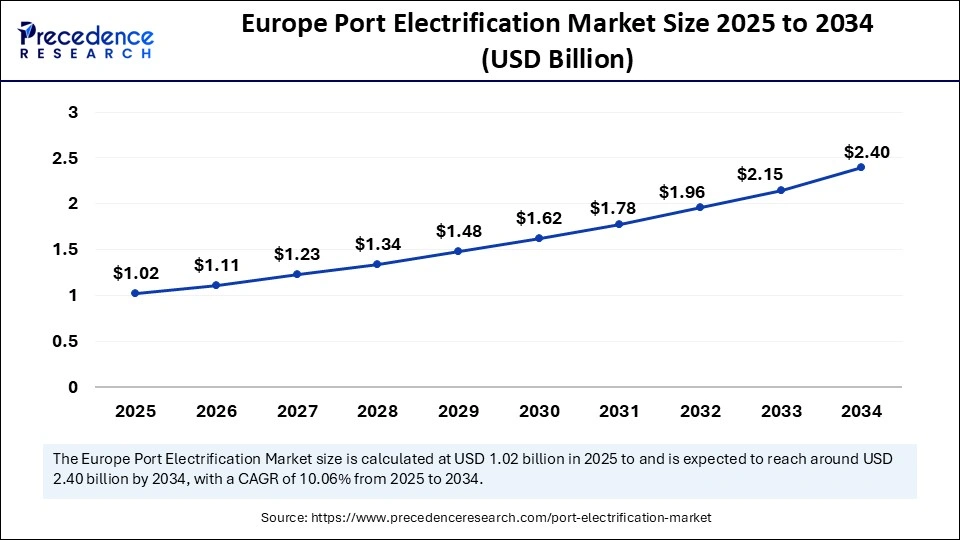

Europe Port Electrification Market Size and Growth 2025 to 2034

Europe port electrification market size was exhibited at USD 0.92 billion in 2024 and is projected to be worth around USD 2.40 billion by 2034, growing at a CAGR of 10.06% from 2025 to 2034.

Why Did Europe Dominate the Port Electrification Market in 2024?

Europe dominated the port electrification market with the largest share in 2024, driven by stringent environmental regulations and a variety of green technologies being used in the shipping industry. There is rapid shift toward cleaner energy sources to reduce greenhouse gas emissions, harmful air pollutants, and noise pollution, particularly in residential areas near ports. Subsidies, innovative financing models, and public-private partnerships further support electrification by providing financial and technical assistance.

- In June 2024, Kempower presented its electric vehicle (EV) fast charging technology for ports at TOC Europe 2024, which was held on June 11-to-13, 2024, in Rotterdam, and intends to showcase its recent innovations and products, especially the Megawatt charging system (MCS), Kempower Satellite, Kempower ChargEye, and Kempower Control Unit.

(Source: https://kempower.com)

North America is expected to grow at the fastest rate during the forecast period. Increased public demand for climate action, improved health, and better transport infrastructure is driving the adoption of electric equipment and vehicles at Canadian and American ports. Electrification is promoted to mitigate the environmental impact of ports on urban coastal communities, particularly concerning air quality and noise pollution. Port electrification in the U.S. is accelerating due to government policies, technological advancements, and a focus on sustainability. Major ports like Los Angeles, Long Beach, New York, and Seattle are implementing shore power, transitioning from diesel to electric machinery, and integrating modern grid systems. Financial support has facilitated the introduction of new technologies, with port authorities and utilities collaborating with clean tech companies.

- In May 2025, The Port of Seattle in Washington, US released its Strategy for Clean Energy at the Waterfront, designed to support the electrification of buildings, vehicles, vessels, and equipment on port-owned properties Developed in collaboration with The Northwest Seaport Alliance and Seattle City Light, the strategy outlines the investments and infrastructure upgrades needed to achieve a zero-emission maritime sector by 2050.

(Source: https://www.portstrategy.com)

Asia Pacific is expected to grow at a notable rate in the upcoming period. This is mainly due to the rapid industrialization, expanding ocean shipping, and growing environmental concerns. Ports across China, Japan, South Korea, Singapore, and Australia are prioritizing electrification to combat environmental degradation. The adoption of electric cranes, forklifts, and terminal tractors is increasing in ports, enhancing efficiency and aiding compliance with stringent air and water pollution standards. There is rising integration of smart grid and energy storage technologies, alongside solar and wind power, to meet diverse daily electricity demands.

- In July 2023, Japan announced its aim to build shore power facilities at all its main ports to lower pollution and protect the environment. The new policy aims to give every port the latest kind of zero-emission charger. When connected to these power facilities on the shores, vessels will be able to draw electricity, so they don't require their diesel engines and give out less pollution.

(Source: https://mykn.kuehne-nagel.com)

Market Overview

Port electrification consists of key elements such as electronic monitoring and tracking systems and charging infrastructure for vehicles and terminal tractors. The rising port electrification aids in the reduction of carbon emissions within the global maritime and logistics sectors. Many ports around the world are choosing to work with electric-powered machines rather than fossil fuel-powered alternatives. Local and international guidelines are pushing ports to reduce emissions and improve air quality. For some regions, clean energy becomes more economical when fuel costs are high and electricity costs are low. Because of advancements in batteries, smart grid technology, and reliable software, electricity providers can support more electricity-dependent activities. Government support, special grants, and collaborations are contributing to the rapid installation of electric systems.

What are the Major Factors Boosting the Growth of the Port Electrification Market?

- Environmental Regulations: Stringent environmental regulations are driving ports to reduce pollution from transportation activities. Governmental support through organizations like the IMO encourages ports to adopt sustainable practices, like electrification, to ensure that certain environmental standards are met.

- Advancements in Technology: Ongoing advances in smart grid systems, real-time monitoring, and battery storage are enabling ports to manage energy more efficiently. This includes optimizing energy use, stabilizing the grid, and reducing energy costs.

- Government Incentives and Funding Program: Governments are providing financial incentives, grants, and subsidies to promote green infrastructure in ports. These programs help offset the initial costs of electrification and develop low-carbon initiatives, fostering green development within the industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.75 Billion |

| Market Size in 2025 | USD 2.90 Billion |

| Market Size in 2024 | USD 2.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.86% |

| Dominating Region | Europe |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Connection, Installation Type, Component, Port Equipment Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent Environmental Regulations

The implementation of stringent environmental regulations is a major factor driving the growth of the port electrification market. Ports have been known to cause pollution because of the large number of diesel vehicles, stationary ships, and other gas-dependent tools being used. Ports are facing increasing pressure to reduce emissions. The International Maritime Organization (IMO) is actively working to reduce greenhouse gas emissions from ships, promoting the adoption of clean alternatives, including on-shore power supply that vessels can use to turn off their engines and receive energy from the local electricity grid while docked. Because of stringent environmental regulations, many ports are making investments in necessary upgrades and transitions to electric power. Besides improving air quality, such regulations help lessen climate change by reducing carbon emissions from ships. These regulations are encouraging ports to switch to sustainable practices, supporting market growth.

Restraint

High Initial Capital Investment

The market's expansion is hampered by the substantial costs associated with port electrification and the necessary modifications to ship vessels. Setting up an on-shore power supply requires the installation of intricate electrical systems, upgrades to nearby power grids, and enhancements to electricity distribution capabilities. Improving this infrastructure typically requires significant financial outlays, creating a burden on smaller ports. Moreover, a lot of existing ships lack the capacity to connect to shore power, necessitating either costly upgrades or complete replacement with vessels designed for electrification.

Opportunity

Growing Demand for Sustainable and Green Port Operations

The focus on sustainability and emission reduction around the world creates immense opportunities for port electrification. Due to stringent environmental regulations, ports are rapidly switching to clean energy systems to combat air pollution and meet strict regulations like the EU's Green Deal. This shift reduces emissions from ships while docked. Advancements in renewable energy technology, smart grid technology, and battery storage enable ports to reduce reliance on fossil fuels and operate more efficiently with fewer costs. Increasing government support and incentives for green technologies further encourage the shift toward electrification.

Connection Insights

What Made New Installation the Dominant Segment in 2024?

The new installation segment dominated the port electrification market with the largest revenue share of 68% in 2024. This is mainly due to the expansion of ports, especially in economically thriving areas. During new installations, installers select electric equipment from the very beginning so that diesel-powered cranes, trucks, and yard devices are no longer needed. Governments and port operators are planning to increase the use of renewable energy to create smarter, more sustainable ports. This shift toward sustainability means new installations can incorporate energy-saving, renewable power, and smart grid options.

The retrofit segment is expected to expand at the fastest rate over the forecast period. The growth of the segment can be attributed to the rising need to modernize existing ports. In retrofitting, diesel machinery and terminal tractors are changed to use electric energy. By retrofitting, emissions can be decreased and air as well as noise pollution lowered near ports, especially in areas where people live closely. Also, government and environmental bodies are providing incentives for retrofitting to achieve national decarbonization goals, contributing to the growth of the segment.

Installation Type Insights

Why Did the Shoreside Segment Contribute the Most Revenue in 2024?

The shoreside segment dominated the port electrification market by holding more than 74% of revenue share in 2024. Shoreside systems feature high-voltage substations, electrical distribution networks, and automatic systems for managing energy supply and safety. Various ports are choosing renewable energy in their shore power supplies to make operations greener. The smart ports and shoreside installations are regarded as vital and receive much help through government budgets, green bonds, and joint efforts with the private sector.

The shipside segment is expected to expand at a considerable growth rate in the upcoming period. Shipside installations are the equipment that allows vessels to consume shore power, as well as the necessary equipment to obtain shore power while mutually docked. Shipside installations require essential equipment needed for vessels to shore electricity while docked. Higher standards from the authorities, along with well-equipped ports and increased wishes from shipping enterprises to be more sustainable, are driving this segment's progress.

Components Insights

Why Did the Transformers Segment Dominate the Port Electrification Market in 2024?

The transformers segment dominated the port electrification market with the highest revenue share of 33% in 2024. Transformers prevent voltage from changing and limit the amount of wasted energy, which is important in high-energy areas such as port docks. At the port, transformers are increasingly being deployed at the docks in large amounts, thanks to increased expenditures on smart grid systems, renewables, and electrical infrastructure at ports. Additionally, concerns over power stability and reducing damage to the environment prompts market players to develop new designs, such as safe and more environmentally responsible transformers.

The frequency converters segment is expected to grow at a rapid pace over the forecast period. This is mainly due to the rising use of shore power. The installation of shore power at ports is increasing worldwide, which means there is a much higher demand for reliable and flexible frequency converters. Furthermore, due to advances in power electronics and control systems, converters have become smaller, less expensive, and more efficient. Subsequently, frequency converters are also being adopted more widely.

Port Equipment Type Insights

What Made Electric Cargo Handling Equipment the Dominant Segment in the Market in 2024?

The electric cargo handling equipment segment dominated the market with a major revenue share of 63% in 2024 and is expected to grow at a steady rate throughout the projected period. This is mainly due to the rising need for clean and efficient services at ports. The electrification of forklifts, terminal tractors, straddle carriers, reach stackers, and cranes is included in this segment because they all play major roles in handling cargo in the port. Shipping companies in different countries are switching to electric cargo handling, thanks to strategies focused on sustainability and the joint efforts of battery, infrastructure, and AI advancements.

- In May 2024, Amazon.com unveiled the first of a dozen Volvo electric big rigs to pick up cargo from the busiest container seaport in southern California. (Source: https://www.business-standard.com)

- The electric marine vessels segment is expected to grow at the highest CAGR in the coming years. Fully electric vessels are used for pilots and short-distance shipments inside port boundaries. Fully electric vessels reduce noise and emissions, unlike ordinary diesel ships. Stringent environmental regulations that focus on emissions in ports, plus an increase in clean shipping methods in coastal and inland waterways, are supporting the expansion of this sector. The grants, environmental shipping initiatives, and port authorities are trying to reach zero emissions, support new investments in the field.

Recent Developments

- In May 2025, Port of Bilbao continues with the second stage of electrifying its docks. The Bilbao Port Authority's Board has given around €50 million (US$57 million) to create new electrical infrastructure at the port so ships can be hooked up to the electricity grid.

(Source:https://container-news.com)

- In May 2025, Yinson GreenTech and Wilhelmsen Ships Service opened a charging station for electric vessels at WSS's facility located in Singapore. For the first time, the two companies have joined forces to build a ship, which is a sign of plans to expand the technology's use across the shipping industry.

(Source:https://www.haropaport.com)

- In May 2025, HAROPA PORT partnered with eight European organizations through the BREEZE project to ensure shore power for ports and vessels is up to EU requirements by 2030. BREEZE is included in the portion of the INTERREG Europe programme that encourages regions to work with partners and share answers in economic growth, an ecological shift, and a digital shift.

(Source:https://futurefuels.in)

Port Electrification Market Companies

- ABB

- Siemens

- Schneider Electric

- Cavotec

- Enel X

- Alstom

- Prysmian Group

- GE Grid Solutions

- Eaton

- APM Terminals

- DP World

- Adani Group

Segments Covered in the Report

By Connection

- New installation

- Retrofit

By Installation Type

- Shipside

- Shoreside

By Component

- Cables & accessories

- Frequency converters

- Switchgear devices

- Transformers

- Others

By Port Equipment Type

- Electric cargo handling equipment

- Electric yard cranes

- Electric reach stackers

- Electric straddle carriers

- Electric terminal tractors

- Electric warehouse equipment

- Electric forklifts

- Electric yard trucks

- Electric terminal buses

- Electric marine vessels

- Electric harbor tugs

- Electric service vessels

- Other electric equipment

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting