What is the Power Device Analyzer Market Size?

The global power device analyzer market size is calculated at USD 557.94 million in 2025 and is predicted to increase from USD 588.18 million in 2026 to approximately USD 941.75 million by 2035, expanding at a CAGR of 5.37% from 2026 to 2035.

Power Device Analyzer Market Key Takeaways

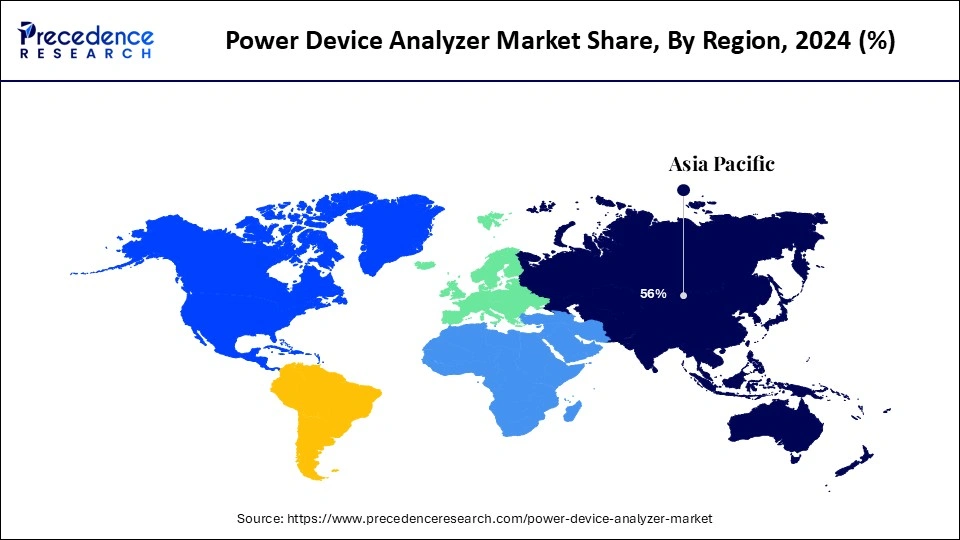

- Asia Pacific held the largest market share of 56% in 2025.

- North America is projected to experience the fastest growth during the forecast period.

- By type, the both AC and DC segment led the market in 2025.

- By current, the below 1000A segment dominated the market in 2025.

- By end-user, the automotive segment held the major market share in 202.

- By end-user, the consumer electronics & appliances segment is expected to expand rapidly in the coming years.

What is the Power Device Analyzer?

A power analyzer is utilized to measure the flow of power in an electrical system. This means the rate of electrical transferal between a sink and a power source. The measurement of power flow is an important aspect. These analyzers are widely used to measure the power flow in direct current (DC) systems or alternating current (AC) systems. The rising demand for power for various purposes is a key factor boosting the growth of the power device analyzer market. These devices have a broad scope of application across different end-use industries.

The growing consumption of highly engineered as well as energy efficient electronic products is further contributing to market expansion. The increasing demand for electric-powered devices in the automotive and healthcare industries and the rising production and consumption of consumer electronic devices are anticipated to drive the growth of this market. In addition, stringent regulations regarding energy efficiency encourage manufacturers to adopt power device analyzers.

Impact of AI on the Power Device Analyzer Market

Artificial Intelligence is playing an important role in revolutionizing the landscape of many industries. AI and Machine Learning algorithms can analyze huge amounts of data from power device analyzers to identify and detect patterns that can help in making informed decisions. Manufacturers of power analyzer devices can benefit from the adoption of AI technology. The AI-driven tools can help optimize operational processes, streamline production, perform predictive maintenance, and maintain consistency in quality. Integrating AI algorithms into these devices can open up new avenues of applications. With AI technology, these devices can help improve the reliability and efficiency in detecting faults and managing energy. In addition, AI can enhance the accuracy and precision of power device analyzers, reducing energy waste.

Power Device Analyzer Market Growth Factors

- The rising demand for smart electronic devices is a key factor boosting the growth of the market.

- The growing focus on energy efficiency and the rising government initiatives and regulations regarding energy efficiency to reduce carbon emissions contribute to market growth.

- The increasing electrification of vehicles is likely to propel the market growth.

- Rapid industrialization, especially in developing countries, support market expansion.

Market Outlook

- Industry Growth Overview: The industry has grown rapidly since growth in the market is catalyzed by the adoption of energy-saving electronics in the automotive and consumer industries.

- Trends in sustainability: The rise of renewable energy and the advancement of electric mobility drive the need to have power analyzers that are efficient in their use.

- Global Expansion: Asia-Pacific is the most successful region, as it has manufacturing opportunities and also concentrates on the production of electric vehicles.

- Key Investors: The most notable investors include Keysight Technologies, Yokogawa Electric Corporation, Fluke Corporation, and Rohde and Schwarz.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 941.75 million |

| Market Size in 2025 | USD 557.94 million |

| Market Size in 2026 | USD 588.18 million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.37% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Current, End-user and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand from the Automotive Industry

The growing demand for power device analyzers from the automotive industry is a major factor driving the growth of the market. The rising sales of automobiles, including passenger cars, transportation vehicles, and electric vehicles, worldwide directly contribute to market growth. Electric vehicles (EVs) especially utilize power device analyzers for various components, such as batteries and electrical systems. The rising awareness amongst people regarding energy efficiency and stricter regulations regarding environmental sustainability are boosting the sales of electric vehicles. For instance, in 2024, 853,000 out of 1.595 million units of passenger cars sold in China were EVs. China's NEV (New Energy Vehicles) production increased by 28.8% in 2024. In addition, the rapid shift toward renewable energy sources, such as wind and solar power, is boosting the demand for power device analyzers to ensure the reliability and efficiency of these systems.

Restraint

Shortage of Skilled Personnel

Power device analyzers need specifically trained and highly skilled personnel to operate and handle these devices. These devices generate, transform, consume, or measure electrical parameters like current, phase, voltage, power, harmonics, etc. This requires a strong technical background to comprehend the methodologies to conduct tasks properly. There is a significant shortage of skilled personnel to operate these devices smoothly, which limits the growth of this market. The lack of experienced and skilled personnel in developed and emerging countries is holding back the expansion of this market. In addition, the high cost of these devices limits the growth of the power device analyzer market.

Opportunity

Increasing Demand for IoT Devices

The increased penetration of the internet globally has encouraged the adoption of smart and Internet of things devices, which create immense opportunities in the power device analyzer market. IoT devices generate vast amounts of data about power consumption. Analyzing power data from these devices helps reduce energy waste. Moreover, power device analyzers ensure the efficiency and reliability of IoT devices by monitoring power fluctuations. In addition, technological advances are likely to propel the market's growth in the near future. Technological advancements enable the development of more compact and user-friendly power device analyzers.

Segment Insights

Type Insights

The both AC and DC segment dominated the power device analyzer market with the largest share in 2024. Both AC and DC analyzers are used in various industries since they provide detailed insights into power quality and fluctuations. The encouragement from many governments worldwide to conduct regular inspections to adhere to regulations regarding energy efficiency further bolstered the segment. These analyzers are widely utilized in the automotive industry to check power flow in electric vehicles. The rise in demand for electric vehicles also supported the segment's dominance.

The AC segment is expected to grow at a notable rate throughout the projection period. This is mainly due to the increasing usage of AC analyzers in home and business applications since they widely use alternating current. The increasing usage of consumer electronics and IoT devices further propels the segment's growth.

Current Insights

The below 1000A segment led the market in 2024 and is likely to sustain its growth trajectory over the studied period. Many industries commonly utilize below 1000A power device analyzers. They are used in industries like automotive, energy, healthcare, manufacturing, aerospace, and defense to check power fluctuations and quality in various equipment. It also offers sufficient flexibility for various applications, making it a preferred choice in various industries.

End-user Insights

The automotive segment led the power device analyzer market by capturing the largest share in 2024. This is mainly due to the increased production of vehicles and automotive components. Power analyzers are regularly used in the automotive industry to check power flow in electrical systems, drivetrains, and batteries. These devices are increasingly being used in electric vehicles. Various government policies around the world promoting environmentally sustainable practices encourage the usage of electric vehicles on a larger scale, further supporting the segment's growth.

The consumer electronics & appliances segment is projected to expand at a rapid pace during the forecast period. The increasing production and adoption of numerous electronic devices, like TVs, smartphones, laptops, refrigerators, and smartwatches, drive segmental growth. Power analyzers play a crucial role in monitoring power fluctuations in these devices, ensuring efficiency and reliability.

Regional Insights

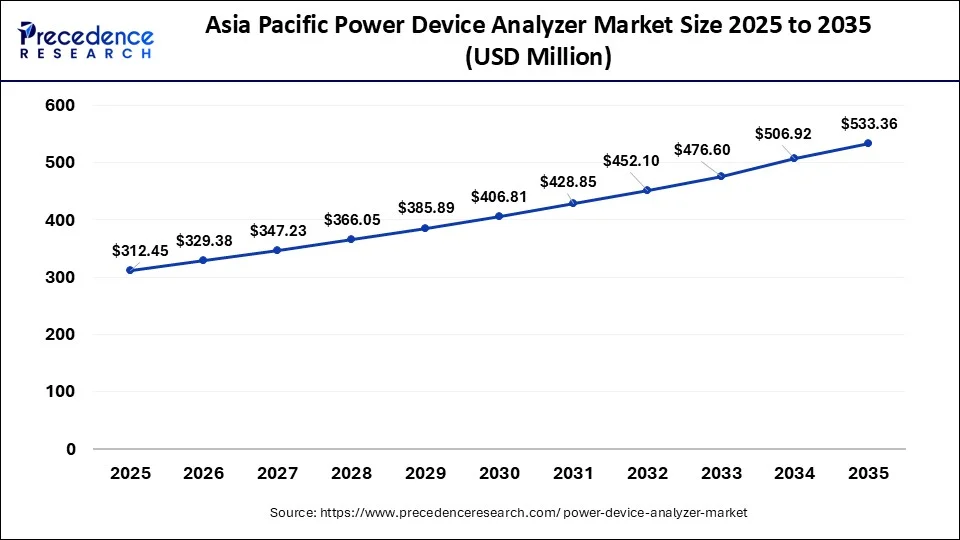

What is the Asia Pacific Power Device Analyzer Market Size?

Asia Pacific power device analyzer market size was exhibited at USD 312.45 million in 2025 and is projected to be worth around USD 533.36 million by 2035, growing at a CAGR of 5.49% from 2026 to 2035.

Asia Pacific dominated the power device analyzer market with the largest share in 2025. This is mainly due to the increased production of electronic devices. The rapid pace of industrialization further supported the region's dominance. This region has become a prominent hub for industrial production, with countries like China, South Korea, and India leading the way. There is a robust automobile industry, boosting the production of electric vehicles. Moreover, there are stringent regulations and policies that promote energy efficiency, contributing to regional market growth.

India and China are major contributors to the Asia Pacific power device analyzer market. The Indian government is constantly making efforts to promote renewable energy. A rise in disposable income, awareness about sustainable practices, and a rapid shift toward renewable energy sources are boosting the growth of the market in India. Moreover, China is the world's largest producer of vehicles, boosting the adoption of power device analyzers in the automotive industry. Countries like China, Japan, South Korea, and Taiwan are the largest producers of electronics, supporting market expansion in the region.

North America is projected to witness the fastest growth in the market in the coming years. The presence of well-established industries and leading automakers in the region is a key factor supporting the growth of the market in the region. There is a strong emphasis on energy efficiency to reduce carbon emissions. Thus, various industries are using power analyzers to optimize energy consumption. Well-known automotive companies like Tesla, Volkswagen, and BMW have manufacturing plants in North America that create lucrative growth opportunities in the market. The rising development of smart grid infrastructure also contributes to regional market growth since smart grids require power analyzers for monitoring power quality and fluctuations to avoid downtime.

U.S. Power Device Analyzer Market Trends:

The power device analyzer market in the U.S. is characterized by its maturity and reliance on innovation. The main demand comes from sophisticated analyzers with a high degree of automation. Besides, electrification in the automotive industry heavily affects the use of these analyzers. There is a constant flow of money into research and development.

The demands of the regulations often determine the choice of the equipment. The customers in all testing environments want precision, reliability, and digital connectivity as their main characteristics.

Europe is expected to witness noticeable growth throughout the forecast period. There is a rapid shift toward renewable energy, which is a major factor driving the growth of the market in the region. The European government has implemented stringent regulations to reduce carbon emissions, prompting manufacturing industries to prioritize energy efficiency to reduce environmental impact. Moreover, European countries are investing heavily in smart grid infrastructure, requiring power analyzers for grid management.

Germany Power Device Analyzer Market Trends:

Germany's market is in line with the energy transition that is taking place across Europe. The integration of renewables is the main reason for the increasing demand for analyzers. The stability of the grid requires accurate measurement. The car industry maintains high consumption of goods. The main factors in buying decisions are quality and safety. Compliance with EU standards continues to be vital. The precision engineering culture encourages the use of industrial testing facilities.

Value Chain Analysis of the Power Device Analyzer Market

- Resource Extraction: The efficient sourcing of pricing electronic components and materials, and the quality management of the suppliers and input quality in production.

Key Players: ExxonMobil, Shell - Distribution Network Management: Organizing of storage, logistics, tracking, and timely delivery of completed analyzers to clients.

Key Players: Power Grid Corporation of India (PGCIL), Honeywell, Siemens - Regulatory Compliance and Energy Trading of Power Device Analyzer: Making sure that the standards comply and assisting in energy management and transactions between the analyzer and related transactions.

Key Players: Central Electricity Regulatory Commission (CERC), Power Exchange India Ltd (PXIL)

Power Device Analyzer Market Companies

- Fluke Corporation: Delivers a full set of the best power quality analyzers and instruments for calibration that support precise diagnostics, industrial evaluations, and the entire electrical system performance assessment.

- Keysight Technologies: Offers up-to-date modular dynamic power device analyzers with double-pulse testing solutions, which the latter is specially made for the detailed characterization of GaN and SiC devices.

- Yokogawa Electric Corporation: Sells multi-channel power analyzers with the highest precision that are specifically designed for the evaluation of electrical components that are quite complex.

Other Major Key Players

- Iwatsu Electric

- Hioki E E Corporation

- Newtons4th

- Rohde & Schwarz

- Carlo Gavazzi

- Vitrek

- Circutor

- ZES ZIMMER Electronic Systems

- Texas Instruments

- PCE Instruments

- Extech Instruments

- Dewetron

- Magtrol

- Dewesoft D O O

- Janitza Electronics

- Arbiter Systems

- Valhalla Scientific

Recent Developments

- In December 2025, ABB launched Sensi+ NG, an advanced multi-gas contaminant analyzer for biogas and natural gas. It incorporates oxygen measurement alongside trace monitoring of hydrogen sulfide, water vapor, and carbon dioxide, enabling real-time tracking of critical gas components, enhancing safety, productivity, and reliability in operations. (Source:https://new.abb.com )

- In November 2025, Ookla launched Speedtest Pulse, a handheld device for field technicians to analyze and troubleshoot Wi-Fi performance in homes and businesses. The device connects via Ethernet to the router, collects data, and transfers it to an app that generates reports and offers recommendations. (Source: https://www.lightreading.com )

- In April 2024, Rohde & Schwarz launched a new range of power analyzers. These power analyzers are available in the market in three models. The new models are designed to meet the necessary requirements for voltage measurement, power, current and complete harmonic distortion on both AC and DC sources.

- In March 2023, a leading company, Yokogawa, launched WT5000 Precision Power Analyzer. This new product finds applications where high stability performance and high accuracy are essential.

Segments Covered in the Report

By Type

- Both AC and DC

- AC

- DC

By Current

- Below 1000 A

- Above 1000 A

By End-user

- Automotive

- Energy

- Telecommunication

- Consumer Electronics and Appliances

- Medical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting