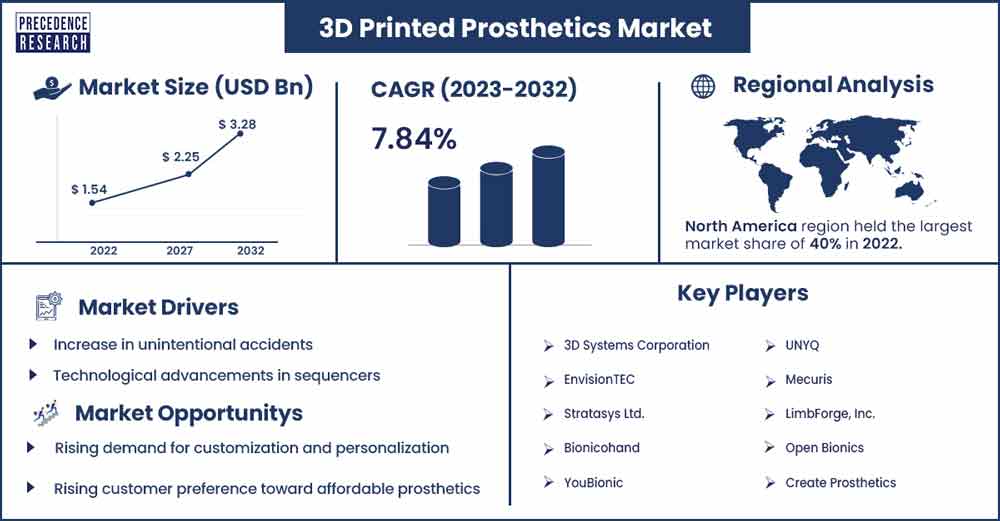

3D Printed Prosthetics Market Poised to Exceed CAGR 7.84% By 2032

The global 3D printed prosthetics market size was evaluated at USD 1.54 billion in 2022 and is expected to touch around USD 3.28 billion by 2032, growing at a noteworthy CAGR of 7.84 % from 2023 to 2032.

In contrast to conventional subtractive manufacturing techniques, 3D-printed prostheses use additive manufacturing technologies to make artificial body components.

Due to the use of additive manufacturing, the production prices of these medical products have decreased, making them more accessible to the general public. Because they are made of plastic and need to be precisely customized for each patient, orthotics and prostheses are excellent candidates for 3D printing technology.

According to the World Health Organization, 30 million people worldwide require prosthetic limbs. By using 3D printing, this number can be increased for people, particularly in isolated areas, at a reduced cost. High patient satisfaction levels and simple customization are anticipated to support the market's development.

People will be able to 3D scan their appendages and have prostheses made after them thanks to advancements in body modeling and 3D scanning technologies from companies like Body Labs, allowing for a more natural fitting and look.

The COVID-19 pandemic had an effect on the market for additive manufacturing because it caused supply chain delays and the closing of factories, mostly in the first months of 2020.

However, due to the disruptive nature of 3D printing and its ability to address medical device supply shortages, the market for these products saw a large uptick following the pandemic.

Additionally, the major participants in the market for 3D printed prosthetics reported higher sales in 2021, indicating that the market has recovered from the effects of COVID-19 and is anticipated to expand rapidly going forward.

One of the most noteworthy uses of 3D printing has been in the recently rapidly expanding health and medicinal sector. The most popular application of these inventions so far has been prosthetics, but everything from drugs to human parts has been manufactured. The American Orthotics and prostheses Association estimates that the expense of traditional prostheses is in the region of $1,500 and $8000. Instead of using their insurance, patients frequently pay for them out of pocket.

On the other hand, 3D manufactured prostheses start at just $50! Using 3D printing, it is also feasible to create prosthetic appendages more quickly; limbs can be made in just one day. Patients also like the option to personalize their purchases, which is another appealing aspect. They can alter the hue and style to fit their preferences and requirements. As a result, the market for 3D-printed prostheses is anticipated to expand during the given time.

3D Printed Prosthetics Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.66 Billion |

| Projected Forecast Revenue by 2032 | USD 3.28 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.84% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

- Throughout the projection period, the limbs type group is expected to rule the market. This is due to the demand being greater for 3D printed prosthetic extremities than other bodily components.

- Because it is a common material used in 3D printing, the polypropylene material sector is anticipated to expand quickly over the forecast period.

- Due to the fact that the majority of prosthesis therapy services are provided in a hospital setting by licensed prosthetists, the hospitals end-use sector ruled the market.

- Due to its widespread market influence and high knowledge of prosthetic treatments, North America made for the largest portion of the.

- The CAGR for the Asia Pacific area is predicted to be 8.5% due to an increase in the amount of accidents in Asian nations.

Regional Snapshots

In 2023, North America is anticipated to control the global market and generate more than 40% of global income. The rise in sports injuries, the rising need for high-quality healthcare services, the existence of several major market participants in this area, and the well-established healthcare infrastructure all contribute to the market's expansion.

Additionally, encouraging government programs to support R&D activities and subsidies to increase the uptake of 3D-printed prosthetics are likely to drive market development in the area.

Market Dynamics

Drivers

The market for 3D printed prosthetic products is expanding due to the increase in unintentional accidents. Accidental wounds can be very damaging to a person, and they occasionally result in amputation. The number of fatalities from automobile accidents in the US rose to 42915 in 2021, the greatest number in 16 years. Amputation instances increase by about 50,000 per year in the US, according to a study from the National Centre for Health Statistics. Sales of 3D printed prostheses are increasing as a result of an increase in amputation instances caused by other medical conditions like diabetes and vascular illnesses. For instance, a study that appeared in the American Journal of Managed Care estimated that 85% of patient limb amputations resulted from diabetic foot ulcers, with one patient leg being removed worldwide every 30 seconds.

Restraints

During the projection period, financial concerns may limit the development of the 3D printed prosthetics market due to inadequate reimbursement covering for treating accidental injuries and the high cost of prosthetic implant procedures. Similar to prosthetic devices, the development of the 3D printed prosthesis market during the projection period may be limited by the high risks and problems involved. The development of the global market for 3D printed prostheses may also be constrained by a dearth of public knowledge of the benefits of advanced technologies for artificial devices in developing nations.

Opportunities

The market for 3D prosthetics is expanding thanks to technologically advanced prosthetics. Increased spending on R&D to create highly sophisticated prosthetics, advantageous reimbursement policies, government efforts, and a preference for cutting-edge, innovative goods all contribute to the market's expansion.

Many businesses are developing a novel approach to prosthetics that is useful and aesthetically pleasing by combining the benefits of additive manufacturing and generative design. Prosthetics can be 3D made from materials like acrylic, polyurethane, polyethylene, and polypropylene.

The ability to create 3D-printed prosthetic implants according to patient morphology is another benefit of 3D printing technology that has increased demand for these implants. The market will expand as top producers of 3D-printed prosthetic implants increasingly concentrate on working with hospitals and therapy facilities.

Challenge

The development of the market for 3D-printed prosthetic devices may be hampered by insufficient compensation covering for the treatment of accidental instances. Additionally, a dearth of public knowledge of prosthetic implants' cutting-edge technologies will impede the market's expansion for 3D-printed implants. Additionally, the high cost of 3D-printed prostheses is limiting the market's expansion.

Recent Developments

- In October 2020, Braskem, the top biopolymer manufacturer in the United States, established the Braskem e-NABLE Chapter for the charitable design and manufacture of 3D-printed prosthetic devices. The e-NABLE Phoenix V3 prosthetic hand is one of the most frequently made e-NABLE prosthetic devices, so Braskem was chosen to be certified to make it.

- In order to be used in orthotics and prosthetics (O&P) operations, Protosthetics, a maker of 3D printed prosthetics, started its internal 3D printing program in 2022.

- Stratasys Ltd., a major competitor in the market for 3D printed prostheses, is concentrating on creating prosthetics for almost every bodily component, including dental treatments. As a result, the business is concentrating on tailoring it to the requirements of the patients or end-user sectors.

Key Market Players

- 3D Systems Corporation

- EnvisionTEC

- Stratasys Ltd.

- Bionicohand

- YouBionic

- UNYQ

- Mecuris

- LimbForge, Inc.

- Open Bionics

- Create Prosthetics

- Bio3D Technologies

- Laser GmbH

- Prodways Group

- Protosthetics

- 3T RPD Ltd.

- Formlabs

Segments Covered in the Report

By Type

- Sockets

- Limbs

- Joints

- Others

By Material

- Polyethylene

- Polypropylene

- Acrylics

- Polyurethane

By End-use

- Hospitals

- Rehabilitation Centers

- Prosthetic Clinics

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2818

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333