Alcohol Packaging Market Size To Rake USD 74.94 Bn By 2032

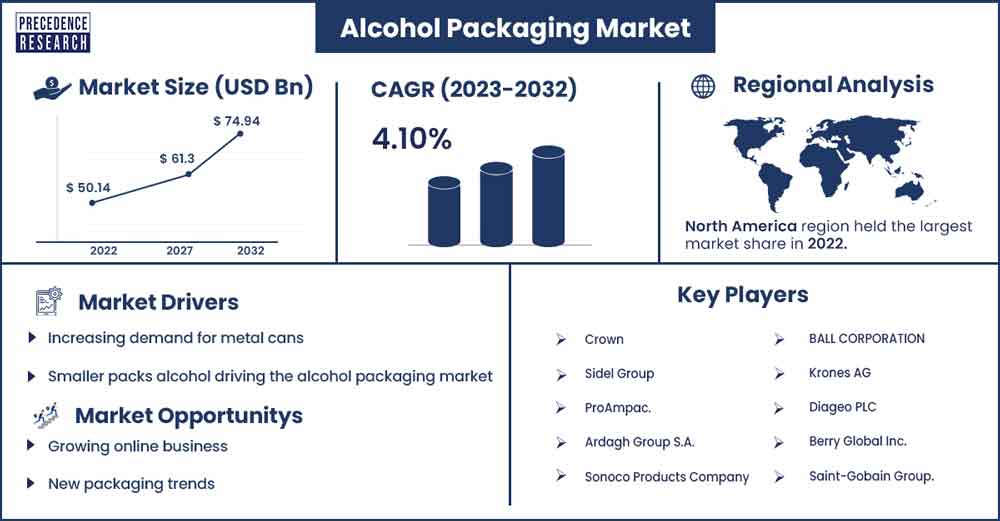

The global alcohol packaging market size surpassed USD 50.14 billion in 2022 and it is expected to rake around USD 74.94 billion by 2032, poised to grow at a CAGR of 4.10% from 2023 to 2032.

Market Overview

The process of securing, improving brand visibility, and enhancing brand marketing are all included in the definition of alcohol packaging, and all three have a significant influence on consumer choice. Customers favor brands that offer simple-to-open packaging options. The alcohol can be packaged in various ways, including a bag in a tube, a bag in a box, whiskey pouches, ceramic glass bottles, and others. Numerous alcohol brands have recognizable packaging. The Tax and Trade Bureau, or TTB, enforces the laws governing bottle size and related fill standards for wine products sold in the United States, according to Federal Register Gov.

The shift in consumer demand results from a greater understanding of alcohol. With exposure, consumers are diverse in age, gender, and demographics. As a result, alcohol manufacturers must categorically define customer needs. As a result of this strategy, businesses are compelled to consider novel packaging designs to attract customers, setting the stage for the growth of the global alcohol packaging market.

Report Highlights

- By material, Alcohol packaging bottles that cannot be damaged or broken during transport are made using plastic bottles and flexible bags in boxes instead of glass bottles.

- By packaging type, the primary packaging type dominates the market. The package that comes into direct contact with the product is the primary packaging, also called the customer's unit.

- By end use, the beer market will dominate the global market for alcoholic beverages. Beer is a popular party beverage among millennials, and it is a crucial component of the feast, promoting social group cohesion.

Alcohol Packaging Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 52.2 Billion |

| Projected Forecast Revenue by 2032 | USD 74.94 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.10% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot

Due to countries like Canada, the United States, and Mexico, which have high urbanization rates, and expanding disposable income, high living standards leading to increased demand in this region, the North American region holds the largest market share globally. Several significant prominent players are another factor that boosts market demand.

The second-largest market share in the global market is held by the European region, which can be attributed to its well-established and technologically advanced infrastructure, which creates a greater demand for advanced packaging and more potential prospects. Rising disposable income is another factor fueling a demand increase in the market.

Due to highly populated countries like China and India, South Korea, Japan, and other countries, which drive market demand in this region, the Asia-Pacific region holds the third-largest share of the market in the global marketplace. Increasing commercial and residential construction also fuels the demand for goods and services.

Market Dynamics

Driver

Increasing demand for metal cans

The rising popularity of metal cans will drive the market for alcohol packaging. Alcoholic beverages are packaged in metal cans, which are used for both distribution and storage. Metal cans are both affordable and very durable. Due to its rigidity and strength, it is simple to fill cans more quickly without any alcohol loss. Its attractive form of packaging, combined with colourful graphic printing and a beautiful metallic luster, helps to increase demand.

Smaller packs alcohol driving the alcohol packaging market

Consumer engagement and loyalty are known to be significantly influenced by packaging design and innovation. The pack size can be slightly altered to improve significantly consumer engagement strategies.

Alcohol producers quickly realize that making the pack smaller is a great way to draw in consumers who are wary of alcohol and expand their customer base. Selling alcohol in smaller pack sizes to customers who want to drink less is also a successful strategy.

Restraint

Limited availability of material

Limited availability of packaging materials for alcoholic products can lead to supply shortages and inconsistency in the supply chain. This may limit companies to plan their production schedules and meet customers' needs, leading to delays and increased costs. Limited availability also limits the choice of alcohol packaging materials and designs, which can restrict the flexibility and creativity of companies in designing their packaging solutions; this slowdown the adoption of expensive packaging by companies and consumers. Hence, the limited availability or shortage of materials for alcohol packaging is observed to act as a major restrain for the market’s growth.

Opportunity

Growing online business

However, other indirect factors that are anticipated to boost the growth rate of the alcoholic beverage packaging market include the expanding e-commerce sector, particularly in developing economies, the rise in consumer preferences for retail formats, increasing levels of modernization, westernization, and urbanization, the steadily rising world population, and rising personal disposable income. Long-term market expansion for alcoholic beverage packaging may be facilitated by consumers' increasing brand awareness.

Challenge

Complexity in packaging process

Packaging for alcoholic beverages involves multiple materials and complex designs to achieve the desired functionality; this can result in higher production costs, which can deter companies from adopting packaging solutions. Packaging materials may not be compatible with existing supply chain infrastructure, such as recycling facilities or packaging machinery. This can result in additional costs and complexity to retrofit or upgrade existing infrastructure to accommodate packaging. Packaging is subject to various regulations and standards that can add complexity and uncertainty to the design and production process, making it difficult for companies to navigate the regulatory landscape and ensure compliance with the applicable requirements.

Recent Developments

- August 2022- the Haig Club launched a new range of alcoholic beverages with canned packaging solution, Haig Club Clubman Canned Cocktails. The canned drinks are crafted with a base material of whiskey, soda and natural flavours. The Haig Club canned cocktails are designed for warm weather, and the company has planned to make them available across Florida.

- August 2022- Hard Rock International launched ‘Hard Rock 10% ABV Grab n Go Cocktail’ by joining the category of hard seltzers. The Hard Rock Grab n Go Cocktail is available in canned packaging with Long Island Iced Tea and Hurricane flavours.

- June 2022, the world’s top-selling dark rum brand, The Kraken Rum, announced its entry into the ready-to-drink category by launching three new cocktails in canned packaging solutions. The newly launched Kraken rum cocktails are available in three exciting flavours- Kraken Rum Punch, Kraken & Ginger Beer, and Kraken & Cola.

Major Key Players

- Amcor plc.

- Bemis Manufacturing Company, Nampak Ltd.

- Crown

- Sidel Group

- ProAmpac.

- Ardagh Group S.A.

- Sonoco Products Company

- BALL CORPORATION

- Krones AG

- Diageo PLC

- Berry Global Inc.

- Saint-Gobain Group.

- Brick Packaging

- Tetra Pak Group

- O-I Glass, Inc.

- Orora Packaging Australia Pvt Ltd.

- Vetreria Etrusca

- Creative Glass

Segments Covered in the Report:

By Material

- Glass

- Plastic

- Metal

- Others

By Packaging Type

- Primary

- Secondary

By End Use

- Beer

- Wine

- Spirit

- Other

By End Use

- Beer

- Wine

- Spirit

- Other

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2859

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333