Ambulatory Cardiac Monitoring Devices Market Size, Growth, Report 2032

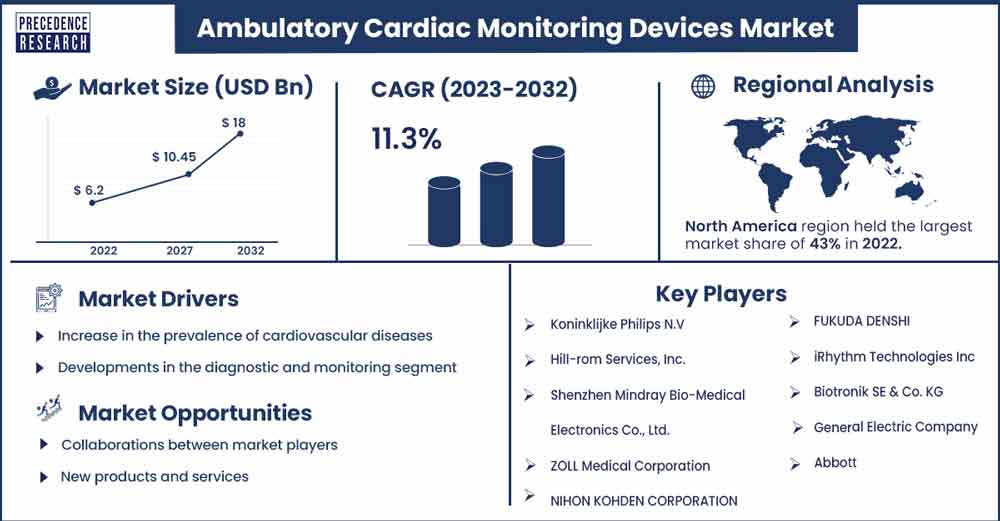

The global ambulatory cardiac monitoring devices market revenue reached USD 6.2 billion in 2022 and is projected to attain USD 18 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

Market Overview

Ambulatory cardiac monitors are compact and portable electrocardiograph devices designed to record and analyze the heart's rhythm over an extended period. These devices are worn by patients during their daily activities, allowing for continuous monitoring outside of a clinical setting. The primary purpose of ambulatory cardiac monitors is to detect and document irregularities in the heart's electrical activity that may occur occasionally. Ambulatory cardiac monitors play a vital role in assisting healthcare professionals in identifying signs of cardiac disorders early.

The ambulatory cardiac monitoring devices market is a part of the medical device industry that focuses on creating portable, wearable, or implantable gadgets designed to monitor a patient's heart activity beyond traditional clinical settings. These devices are essential for diagnosing and managing various cardiac conditions, including irregular heart rhythms and arrhythmias. The increase in the number of heart-related diseases across the globe caused by factors such as diabetes mellitus, high cholesterol and blood sugar, smoking, obesity, and other ailments related to sedentary lifestyles are anticipated to be the significant growth factors widely driving the growth of the market.

A notable trend in this sector revolves around the rising occurrence of cardiovascular diseases, driving the need for ambulatory cardiac monitoring devices. As heart-related conditions become more common, these devices play a crucial role in early detection and continuous monitoring, enabling healthcare professionals to offer more accurate diagnoses and timely interventions. Furthermore, advancements like remote monitoring and wireless connectivity are transforming the industry. These technological advancements provide patients and healthcare providers immediate access to real-time data, improving patient care and treatment outcomes.

Regional Snapshot

North America dominates the ambulatory cardiac monitoring devices market due to a high prevalence of cardiovascular diseases, an ageing population, and a robust healthcare infrastructure. Early adoption of advanced technologies, favorable reimbursement policies, and strategic partnerships further contribute to the region's market leadership. Furthermore, the North American region is set for growth with the expected increase in product approvals and launches during the forecast period. iRhythm Technologies, Inc. and Duke Health shared groundbreaking insights during the American Heart Association's 2023 Scientific Sessions. They underlined that prolonged ECG monitoring markedly improves the ability to predict hospitalizations due to heart failure. These discoveries can transform how we manage individuals at risk of heart failure.

- In January 2022, the United States awarded a comprehensive patent to Medilynx Cardiac Monitoring for continuous ECG streaming, analysis, and monitoring from a remote location.

- In March 2023, hackers accessed personal data from over 1 million current and former users of Zoll's wearable defibrillator.

- In October 2022, GE Healthcare partnered with AMC Health to incorporate AMC Health's Remote Patient Monitoring (RPM) platform into GE's existing product lineup.

Ambulatory Cardiac Monitoring Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6.87 Billion |

| Projected Forecast Revenue by 2032 | USD 18 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.3% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase in the prevalence of cardiovascular diseases

The data published by the British Heart Foundation in August 2022 revealed that approximately 7.6 million people are living with cardiac-related disorders in the UK. The increasing prevalence of cardiovascular diseases (CVD) is a major driving force behind the growth of the ambulatory cardiac monitoring devices industry. CVDs, including conditions like irregular heart rhythms, arrhythmias, and atrial fibrillation, have seen a notable rise in their occurrence worldwide. This has created a pressing demand for advanced cardiac monitoring solutions, with ambulatory monitoring devices leading the way in meeting this critical need.

Developments in the diagnostic and monitoring segment

As more people are diagnosed with or are at risk of cardiovascular diseases (CVDs), the need for early detection and continuous monitoring has become extremely important. Ambulatory cardiac monitoring devices provide a patient-friendly, non-invasive way to monitor heart activity for extended periods, allowing quick identification of irregularities. Therefore, these devices are vital in improving patient care, controlling healthcare costs, and enhancing healthcare outcomes. The mobile cardiac telemetry (MCT) segment is expected to grow at a substantial annual rate of 13.7% during the projected period.

Restraint

Lack of awareness

The market faces some significant challenges due to less awareness and high costs of the devices. Both healthcare professionals and patients may not have sufficient knowledge about the benefits and accessibility of these monitoring devices, restricting their widespread adoption. Many individuals, including some medical practitioners, may need to fully understand the advantages of continuous cardiac monitoring compared to traditional methods. This lack of awareness can result in inadequate utilization and missed early detection and intervention opportunities.

Opportunities

Collaborations between market players

Collaborations in the ambulatory cardiac monitoring devices industry, involving device manufacturers, healthcare providers, insurers, and other stakeholders, offer comprehensive solutions for patients and providers. These partnerships streamline cardiac care by providing bundled services, including device provision, continuous monitoring, and timely treatment. This integrated approach improves patient care, simplifies healthcare delivery, and reduces administrative burdens and costs.

Moreover, partnerships provide broader market access, leveraging healthcare providers' networks for wider adoption of monitoring solutions. In the era of value-based care, collaborations support outcome-driven healthcare, enhancing patient outcomes and reducing costs, especially in managing cardiac conditions. In summary, partnerships shape the future of ambulatory cardiac monitoring, nurturing innovation, improving patient care, and strengthening device manufacturers' market presence.

New products and services

Frequent product launches significantly influence the market in the relevant segment. Many companies have created wireless ECG monitors. These devices are designed for continuous monitoring of patients with cardiovascular disease (CVD) to detect issues early, making treatment more accessible and avoiding costly and life-threatening emergency admissions.

- In January 2022, Philips introduced a twelve-lead ECG solution for use at home in dispersed clinical trials.

- In October 2022, Dozee announced its plan to introduce an ambulatory electrocardiogram (ECG) patch to monitor cardiovascular disease patients. This user-friendly ECG patch improves the company's remote patient monitoring system, powered by artificial intelligence (AI).

Recent Developments

- In June 2023, AliveCor announced its revolutionizing collaboration with Europe's top remote patient monitoring provider, Luscii. As a global leader in personal electrocardiogram (ECG) technology, AliveCor's launch aims to rebrand itself as the world's first 'virtual heart clinic in a box'. This would revolutionize cardiac care by enabling hospitals and GPs to quickly deliver high-quality remote patient monitoring to millions.

- In August 2022, the 7 L patch was introduced by Smart Cardia in India. As a cutting-edge 7-lead cardiac monitoring patch, this advanced device integrates artificial intelligence with healthcare wearable technology to offer predictive and personalized patient insights through remote monitoring.

- In February 2022, AlveCor launched the KardiaMobile card, the thinnest and most convenient personal ECG device available. The KardiaMobile card incorporates sophisticated AI in a highly suitable form factor.

Key Market Players

- Koninklijke Philips N.V

- Hill-rom Services, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- ZOLL Medical Corporation

- NIHON KOHDEN CORPORATION

- FUKUDA DENSHI

- iRhythm Technologies Inc

- Biotronik SE & Co. KG

- General Electric Company

- Abbott

Market Segmentation

By Device Type

- ECG Devices

- Holter Monitors

- Event Monitors

- Implantable Loop recorders

- Mobile Cardiac Telemetry

By End-use

- Ambulatory Care Centers

- Hospitals & Clinics

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3387

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308