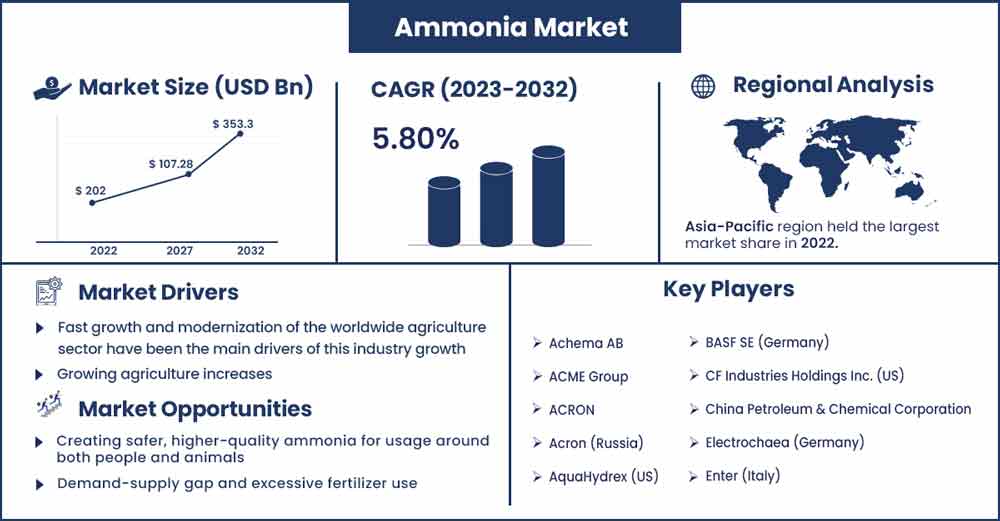

Ammonia Market Size To Attain USD 353.3 Billion By 2032

The global ammonia market size was evaluated at USD 202 billion in 2022 and is expected to attain around USD 353.3 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032.

In the upcoming assessment period, a significant shift towards zero-carbon via carbon reduction is anticipated to increase the usage of greener ammonia. The key factors driving a booming market are the rapid growth of end-use industries like fertilizer, transportation, and electric generation, the implementation of severe environmental regulations, and the rising popularity of ecological fertilizers. Additionally, significant technology advancements, growing private and public investment, and the rapidly declining cost of generating renewable energy are all expected to boost market growth.

Furthermore, during the next ten years, a greater variety of greener ammonia uses in various large factories will fuel green ammonia's economic growth. Greener ammonia is becoming increasingly popular in the transportation sector as a marine and also maritime solid fuel to this low emission of carbon dioxide and sulfur content, which is projected to support the development of the green ammonia sector. However, despite bright prospects, several challenges are likely to prevent market growth. These limitations include a high initial cost for the better environmental ammonia plant, ignorance about green ammonia, and the technology involved in its production, among many more.

Report Highlights:

The need for ammonium in the agricultural sector and its increased use in the manufacture of explosives are two of the key drivers driving the ammonia market's expansion. The ammonia market is expected to rise, but the implications of concentrated ammonia remain unclear. However, it is anticipated that the expanding usage of ammonia as just a coolant would present a market opportunity. The region of Asia-Pacific now controls the majority of the global ammonia industry, with countries like China and India accounting for the majority of consumption. During the projected period, the region is also anticipated to dominate the worldwide ammonia industry.

Ammonia Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 83.36 Billion |

| Projected Forecast Revenue in 2032 | USD 353.3 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.8% |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshots:

The market is primarily driven by rising demand in the agricultural sector and rising explosives manufacturing from ammonia. The dangers associated with excessive ammonia are expected to impede market expansion. However, during the projected period, the usage of ammonium as refrigeration is likely to present a market potential. With the highest consumption coming from nations like China and India, Asia-Pacific dominated the industry globally, and it is anticipated that this would continue in the future.

Market Dynamics:

Drivers:

The agricultural sector has experienced tremendous global expansion as a result of the desire for crops to be produced in higher quantity, quality, and yield. Agriculture contributes reasonably well to a country's GDP, particularly in rising nations. The need for other agrochemicals, such as fertilizer, rises as agriculture expands, which thus indirectly drives up the price of ammonia. Due to the expanding need for fertilizer, ammonia usage has increased, which will raise the industry's value throughout the course of the projected period.

Additionally, government fertilizer subsidies will benefit farmers, increasing the area’s need for ammonia. The primary forces behind the rapid expansion of the ammonia business have been the modernization and rapid growth of the global agricultural sector. Due to the highest population boom in history, farmers are being compelled to significantly increase agricultural production to meet the expanding demand for various types of grains and other commodities. This requires a large quantity of expensive fertilizer, which can only be produced using ammonia. Today, the fertilizer industry uses 60% of the yearly global ammonia production.

Restraints:

Sales of ammonium for the manufacturing of fertilizers within the area are expected to be impacted by Australia's agricultural company's high reliance on fertilizer imported from China as well as other nations. Additionally, it is anticipated that seasonal variations in fertilizer use may decrease the need for ammonium, particularly in Queensland & Victoria. Therefore, it is assumed that the mentioned factors would restrain the market expansion for Australian ammonia throughout the anticipated year. Owing because of its toxicity and humidity nature, ammonia like a coolant spread quickly among most body parts, including the throat, eyes, or nose, and can cause serious burn damage. Additionally, the employment of ammonia as a coolant can result in several respiratory and skin conditions. Therefore, during the course of the projected timeframe, the expansion of the Australian market is likely to be constrained by health concerns caused by exposure to ammonium as a coolant.

Opportunities:

Ammonia is playing a bigger role in the solution that refrigerators and other cooling devices use to preserve food frozen or at extremely low temperatures. The makers of ammonia are aware of this. They are investing a lot of money in research and development to produce a new kind of ammonium that has safer usage around people, more creative uses in a variety of professions and businesses, and greater quality.

Challenges:

The largest challenge facing ammonia producers may be the creation of better-quality ammonia that is safe to use around people and animals, while also expanding its uses and keeping a competitive price level. As a result, these areas are extremely dependent on imports. To meet its needs, North America must export ammonia, which compels the region to deal with a range of problems like price volatility and a lack of suppliers, which in turn places certain restrictions on the ammonia business. Additionally, due to the widespread use of chemical fertilizers and pesticides, soil quality has substantially decreased throughout the world. The demand for sustainable agriculture practices that lower risk output and carbon emissions have increased the market for natural fertilizer.

Recent Developments:

- At LSB Industries' facility in Pryor, Oklahoma, Thyssen Krupp Uhde USA, and Bloom Energy will start producing around 30,000 tonnes of cleaner ammonia annually in 2022. An American fertilizer manufacturer is LSB Businesses. Thyssen Krupp Uhde will develop the engineering strategy to convert a small portion of Pryor's existing conventional ammonium output into greener ammonia.

- In April 2021, Green Fuel and Haldor Topsoe signed a Memorandum of Agreement to search for practical and scaleable solutions for the manufacture of ecologically approachable ammonia in Iceland. The deal intends to provide the two companies the latitude to look into other environmentally friendly ammonia business opportunities.

- By the end of March 2020, OCI NV will have established a maritime supply chain and commercialized ammonia & methanol as potential future cargo biofuels as a result of a partnership with MAN Renewable Technologies, Hartmann Company, and Eastern Pacific Transport.

- Industries On August 23, 2020, at a conference, Qatar's Board of Directors approved the planned acquisition of Qatar Petroleum's 25% stake in Qatar Fertilizer Company, which the nation considers to be one of the region's key industries. IQ has decided to buy QP's ownership in QAFCO to advance its financial position and create riches.

Major Key Players:

- Achema AB

- ACME Group

- ACRON

- Acron (Russia)

- AquaHydrex (US)

- BASF SE (Germany)

- CF Industries Holdings Inc. (US)

- China Petroleum & Chemical Corporation

- Electrochaea (Germany)

- Enter (Italy)

- ENGIE (France)

- EuroChem Group AG (Switzerland)

- EXTRON (Germany)

- Fertiglobe plc

- Green Hydrogen Systems (Denmark)

- Greenfield Nitrogen LLC

- Group DF (Ukraine)

- Haifa Chemicals Ltd.

- Haldor Topsoe (Denmark)

- Helm AG

- Hiringa Energy (New Zealand)

- Honeywell International

- Hydrogenics (Canada)

- Incitec Pivot Ltd

- Indian Farmers Fertiliser Cooperative Limited (India)

- ITM Power (UK)

- Jiangsu Huachang Chemical Co. Ltd.

- Koch Fertilizer, LLC (US)

- Linde Group

- Maire Tecnimont S.p.A.

- MAN, Energy Solutions (Germany)

- McPhy Energy (France)

- Mitsubishi Gas Chemical Co., Ltd.

- Nel Hydrogen (Norway)

- Nutrien Ltd. (Canada)

- OCI NV (Netherlands)

- Orica Limited (Australia)

- Ostchem Holding

- Potash Corp

- Praxair, Inc.

- Qatar Fertiliser Company (Qatar)

- Queensland Nitrates Pty Ltd (Australia)

- SABIC (Saudi Arabia)

- Siemens Energy (Germany)

- Starfire Energy (US)

- Sumitomo Chemical

- The Dow Chemical Company

- ThyssenKrupp AG (Germany)

- Togliattiazot (Russia)

- Trammo Inc

- Ube Industries

- Uniper (Germany)

- Uralchem JSC (Russia)

- Yara International (Norway)

Market Segmentation:

By Product Form

- Liquid

- Gas

- Powder

By Application

- Fertilizers

- Refrigerants

- Pharmaceuticals

- Textile

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2420

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333