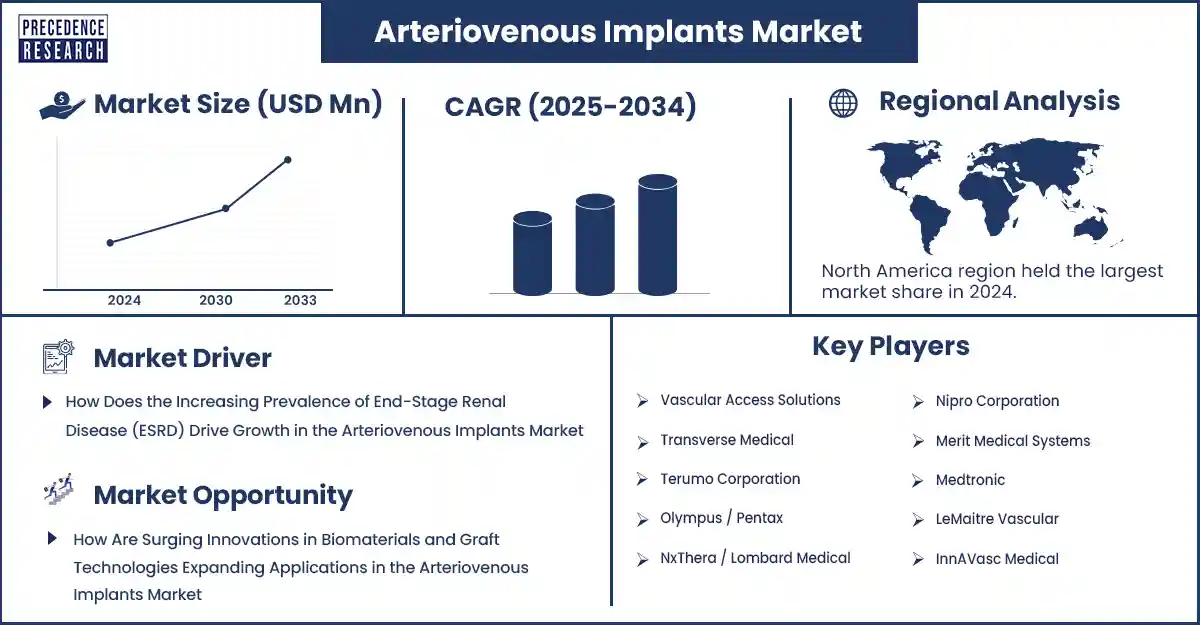

Arteriovenous (AV) Implants Market Revenue and Forecast by 2033

Arteriovenous (AV) Implants Market Revenue and Trends 2025 to 2033

The global arteriovenous (AV) implants market is driven by advancements in biocompatible materials and minimally invasive implant techniques. The AV implants market is rising due to increasing prevalence of end-stage renal disease (ESRD), growing numbers of haemodialysis procedures globally, aging populations, and technological innovations improving vascular access outcomes.

Key drivers enabling the growth of the Arteriovenous (AV) Implants Market:

The increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) worldwide has created an urgent need for dependable vascular access for haemodialysis. CKD is on the rise primarily due to diabetes, hypertension, and the aging population. Clinicians and patients have an emerging preference for AV fistulas (AVFs) and grafts (AVGs) over central venous catheters, because of a decreased rate of infection, better patency, and fewer complications, resulting in an increasing use of AV implants.

Segment Insights

- By device/product type, prosthetic AV grafts and surgical AVF-related implants dominate the field of functional haemodialysis access devices with high adoption rates in clinical settings due to a successful track record.

- By material/technology, ePTFE and proven synthetic graft materials dominate, as they are recognized for great biocompatibility, lower rates of thrombosis and durability.

- By indication/clinical use, initial access creation and replacement for haemodialysis, is the dominating segment of this market, as patient populations with chronic kidney disease require reliable first-line vascular access primarily and repeat interventions to promote dialysis survival are required.

- By procedure type/approach, open surgical procedures dominate as the preferred procedure type for AVF or AVG placement, due to familiarity with surgical technique, predictable outcomes, and better long-term patency compared to other minimally invasive procedures.

- By revascularization/salvage device type, Balloon angioplasty with standard bare devices leads by quite a margin as the device for interventional management of stenotic lesions in AVFs and grafts because they provide reliable restoration of patency.

- By product ownership/commercial type, commercial and branded originator grafts and established stent platforms capabilities dominate current implants both as a reflection of clinician trust in products granted regulatory approval and clinical efficacy based on evolving evidence or independent registries.

- By end-user/treatment setting, hospital based vascular surgery and interventional suites are the dominating implanting centres for AV implants, probably for some or all of the reasons clinicians are drawn.

- By patient type/demographics, adult dialysis population dominates the market as patients of all ESRD globally are adults with repeat or maintained vascular access for on-going long-term haemodialysis.

- By distribution channel, direct OEM and distributor options dominate commercial channels, giving outstanding continuity of supply (just-in-time), cost and taxation competitive advantages and strong association with hospitals

Arteriovenous (AV) Implants Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

The North American market is the global leader (U.S. being the primary contributor), possessed of the most advanced healthcare infrastructure, high rates of ESRD, robust reimbursement frameworks, and early adoption of AV implantations. Many of the key players make large investments in clinical trials and obtaining the requisite regulatory approvals in the U.S., which enhances supply and access for patients.

The Asia-Pacific region is growing at the fastest rate based on increased CKD and ESRD rates in China and India, increasing healthcare spending in the region, and growing hospitals providing advanced vascular access procedures. Increasing awareness and government incentives to access dialysis are facilitating the increased use of AV implants, both in urban and semi-urban practice setting.

Arteriovenous (AV) Implants Market Key Players

- B. Braun Melsungen AG

- BD (Becton, Dickinson & Company) / BD Interventional

- Boston Scientific

- Cook Medical (Cook Group)

- Gore & Associates (W. L. Gore)

- InnAVasc Medical

- LeMaitre Vascular

- Medtronic (Ellipsys system)

- Merit Medical Systems

- Nipro Corporation

- NxThera / Lombard Medical (stent/graft makers)

- Olympus / Pentax (interventional accessories via partners)

- Terumo Corporation

- Transverse Medical (novel graft designs)

- Vascular Access Solutions / Access Vascular (regional specialists)

Recent Developments

- In June 2024, Xeltis received FDA IDE approval in June 2024 to begin a pivotal trial for its aXess conduit, a restorative arteriovenous dialysis implant that enables creation of a living blood vessel combining AVF like safety with AVG-like speed to use. (Source- https://ysioscapital.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6773

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344