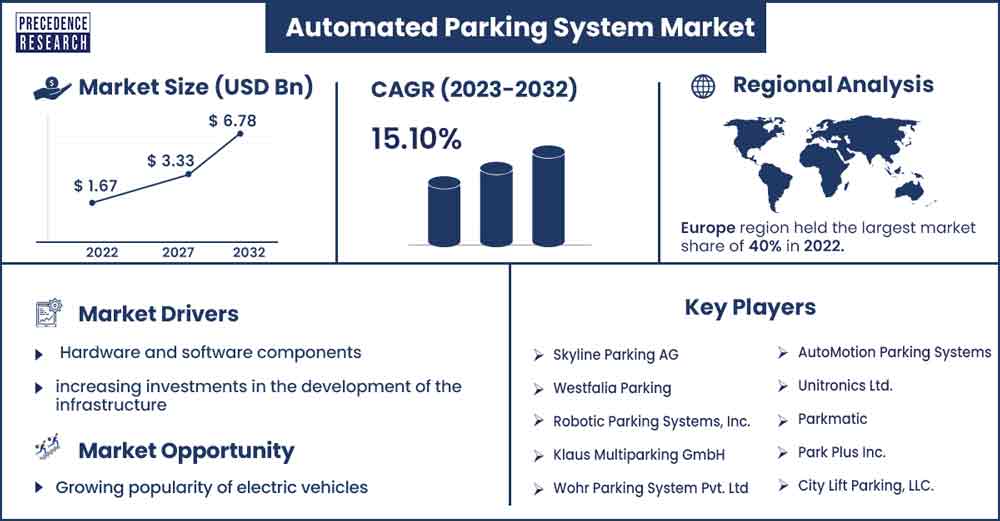

Automated Parking System Market Size to Attain 6.78 Bn by 2032

The global automated parking system market size exceeded USD 1.67 billion in 2022 and is projected to be worth USD 6.78 billion by 2032, growing at a CAGR of 15.1% from 2023 to 2032.

Market Overview

A mechanical device called an automated parking system (APS) is made to reduce the amount of parking space and volume. It has several levels stacked vertically to maximize parking spots and use the least amount of land possible. APS uses hydraulic or electric motors to move automobiles to and from locations. One early and prevalent form of APS is the paternoster.

The first automated parking systems (APS) were created in Paris in 1905 and were put to use that same year. In the 1920s, the paternoster system—a type of APS that resembled a Ferris wheel—became well-liked because it could fit eight cars in a typical parking spot. In 1951, the first autonomous parking garage debuted in Washington, D.C., but office space took its place as land values increased. Long wait periods and mechanical issues caused interest in APS to decline in the United States.

Regional snapshot

Europe dominated the automated parking system market share of 40% in 2023. Automated parking systems (APS) are increasingly being adopted in Europe, particularly in crowded urban areas, to increase parking availability, reduce traffic, and enhance sustainability. Europe dominated the automated parking system market in 2023. European countries are crowded and use personal vehicles, especially four-wheelers, which require automated parking systems.

Asia-Pacific is expected to be the fastest growing in the forecasting period and is considered the most opportunistic automated parking system market. In Asia, cities like Seoul, Busan, and Tokyo have adopted APS due to urbanization and population growth. Singapore and India are also exploring APS solutions. Although adoption is still in its infancy, it is expected to increase as towns explore solutions.

In North America, the automated parking system market is growing and becoming increasingly common, especially in crowded urban areas where parking is expensive and scarce. Several cities, including New York City, San Francisco, Los Angeles, Chicago, Boston, Miami, Toronto, and Vancouver, are investigating APS solutions to solve parking issues in their upscale residential and commercial projects. Big cities like Boston, Miami, and Chicago are also thinking about APS for their innovative city projects.

Automated Parking System Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.91 Billion |

| Projected Forecast Revenue by 2032 | USD 6.78 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.1% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Hardware and software components

Automated parking systems require a mix of hardware and software components to work correctly. While sophisticated software algorithms interpret sensor data and regulate vehicle movements, sensors identify the presence of vehicles, pedestrians, and obstructions. All these factors can positively impact the growth of the automated parking system market. Vehicle motion is accomplished via actuators, which must be accurate and dependable. Real-time monitoring and optimization necessitate a vital networking and connection architecture.

Interaction requires a user interface that is easy to use. Safety systems are essential. Examples of these are collision detection systems and emergency stop devices. Integrating with the building infrastructure is crucial, which frequently entails working with management and security systems. Energy-efficient components and optimization methods are essential, making energy efficiency crucial. Regular maintenance and support are necessary for a system to perform and be reliable.

For instance, Stuttgart Airport will soon have seven Mercedes-Benz models equipped with highly automated and autonomous parking systems.

Environmental benefits

Numerous environmental advantages of automated parking systems include lower carbon emissions, energy efficiency, preservation of green space, management of stormwater, decrease in urban heat islands, encouragement of sustainable transportation, adoption of electric vehicles, and long-term sustainability. Compared to conventional garages, these solutions take up less space, lowering greenhouse gas emissions and driving car miles.

Additionally, they reduce energy, protecting natural areas and green spaces and permitting rainfall to naturally seep in. They also advance sustainable transportation by supporting long-term sustainability, integrating electric vehicle charging infrastructure, and encouraging alternate forms of transportation. Because of their robustness and recyclable nature, these systems lessen the environmental effect of routinely maintaining or replacing parking infrastructure and increase the growth of the automated parking system market.

Restraints

High initial cost

Due to equipment and technology expenses, labor costs, regulatory compliance, finance, risk reduction, insurance, and market uncertainty, automated parking systems have significant initial costs. Purchasing and installing hardware components, such as robotic platforms and control systems, can be costly. Additional expenses include site preparation and specialist knowledge of robotics, electrical, mechanical, and software development. Getting permission and adhering to regulations can be expensive as well. Risk reduction and insurance may be required to reduce the risks associated with capital investments and financing, which can be complex processes. Determining the automated parking systems' return on investment (ROI) might take much work.

Power and connectivity-dependent

As automated parking systems depend on power and communication, they have several limitations. Power outages can cause system functionality to be disrupted, yet an uninterrupted power supply is essential for optimal operation. Real-time communication depends on network connectivity, yet outages may hamper system control, which needs to improve. Reliable internet connectivity is necessary for remote monitoring and maintenance, but it may also involve an initial financial outlay and continuing upkeep. Sensitive information must be protected with solid methods, making data security and privacy equally important. Connectivity with IoT devices and smart grids is also crucial, but it cannot be easy to remain compatible with changing ecosystems and may need constant investments and updates. These difficulties emphasize the necessity of solid cybersecurity defenses and continuous upkeep.

Opportunities

Electric and shared mobility trends

The growing popularity of electric vehicles is expected to be advantageous for the automated parking system market. It is possible to link these cars with infrastructure for charging, making parking and charging convenient. Automatic parking systems can support battery swapping stations, which will shorten charging times and ease worries about range anxiety. By offering safe storage and retrieval, they can oversee shared mobility fleets, such as ride-hailing and car-sharing services. Additionally gaining popularity are demand-responsive parking solutions, which come with electric vehicle charging stations, car tracking, and dynamic reservation systems. By promoting revenue sharing and improving the customer experience, partnerships with mobility service providers can further enhance the integration of parking and mobility services.

Recent Developments

- In December 2023, ARAPL and its subsidiary, ARAPL RaaS, partnered to develop India's first million-square-meter robotic car parking system using advanced autonomous vehicles (AAVs).

- In September 2023, Hyundai Mobis developed the 'MPS 1.0P (Premium)', an improved version of its 2021 next-generation parking control system, solidifying its position in the high-performance parking control sector.

Key Market Players

- Skyline Parking AG

- Westfalia Parking

- Robotic Parking Systems, Inc.

- Klaus Multiparking GmbH

- Wohr Parking System Pvt. Ltd

- AutoMotion Parking Systems

- Unitronics Ltd.

- Parkmatic

- Park Plus Inc.

- City Lift Parking, LLC.

Market Segmentation

By Platform Type

- Palleted

- Non-Palleted

By Automation

- Semi-Automated

- Fully Automated

By Structure Type

- Silo System

- AVG System

- Puzzle System

- Tower System

- Shuttle System

- Rail Guided Cart System

By Component

- Software

- Hardware

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1392

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308