Automated Storage and Retrieval System Market Report by 2032

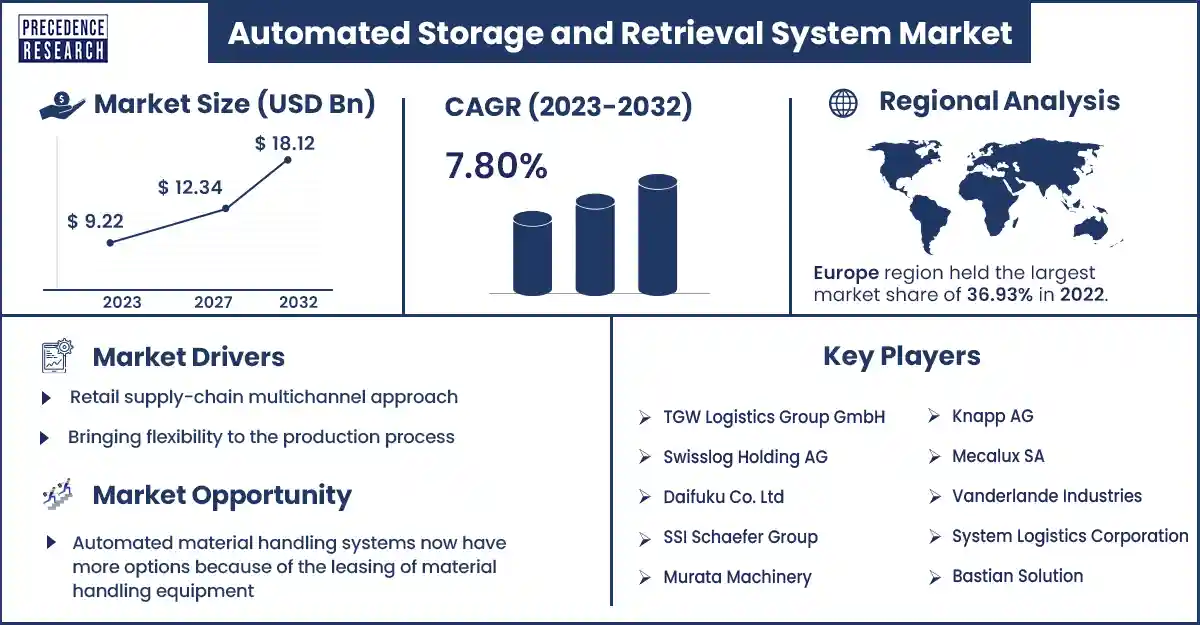

The global automated storage and retrieval system market size reached USD 9.22 billion in 2023 and is estimated to hit around USD 18.12 billion by 2032, growing at a CAGR of 7.80% from 2023 to 2032. Reduced labor costs for moving goods into and out of inventory, lower inventory levels, more precise inventory tracking, and space savings are all advantages of an AS/RS system.

Market Overview

The automated storage and retrieval system market functions in manufacturing, distribution, retail, wholesale, and institutional settings where AS/RS systems are installed. A range of computer-controlled devices are used in automated storage and retrieval systems (ASRS or AS/RS) to place and retrieve loads from predetermined storage sites automatically. Having an efficient automated storage and retrieval system (AS/RS) may improve supply chain management in many ways. An AS/RS system helps reduce wasteful components and goods in storage, enhances warehouse management, and allows for high-density storage, all of which can result in cost savings for businesses. Automation also lowers labor expenses while raising safety.

Additionally, an AS/RS system facilitates the logical representation of physical storage facilities, allowing businesses to expedite the selection, packaging, and shipping processes by grouping items together or positioning them close to the delivery location. Companies may better prepare for market needs and supply by controlling inventory levels and making the most use of warehouse space by keeping track of where items are placed.

Better space utilization in different industries drives automated storage and retrieval system market growth.

In warehouses and distribution facilities, shelving and appropriate item grouping are essential. Regular replenishment of stocks of raw materials, work-in-progress, and finished commodities is necessary to maintain uninterrupted processes. To have a healthy bottom line, distribution centers, and warehouses must both use their space effectively. Compared to facilities that need aisle room for both human workers and machinery like forklifts to pass through, sometimes with bi-directional traffic, most AS/RS solutions call for smaller aisles. Narrower aisles allow warehouses and DCs to store more products without having to enlarge their facilities since they free up more storage space for goods and resources. Because automated storage and retrieval systems can more readily reach higher storage sites than human workers, facilities may also make greater use of vertical space.

However, both routine upkeep and occasional repairs are needed for these systems.

Furthermore, compared to typical warehouse equipment like forklifts or conveyor systems, fixing AS/RS equipment may be more expensive due to the potential need for specialized knowledge. The cost of upkeep and repairs should thus not be disregarded, even when AS/RS solutions save some of the expenses related to physical work. When implementing since/RS solutions, organizations should factor in the cost of downtime and production disruptions for equipment breakdowns since maintenance efforts may need a partial or total shutdown of operations. Businesses without an in-house maintenance specialist endure longer downtimes as they wait for outside personnel to arrive.

Automated Storage and Retrieval System Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 9.22 Billion |

| Projected Forecast Revenue by 2032 | USD 18.12 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.80% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automated Storage and Retrieval System Market Top Companies

- SSI Schaefer Group (Germany)

- Bastian Solution (U.S.)

- Beumer Group (Germany)

- Daifuku Co. Ltd. (Japan)

- Swisslog Holding AG (Switzerland)

- TGW Logistics Group GmbH (Austria)

- Mecalux SA (Spain)

- System Logistics Corporation (Italy)

- Dematic GmbH & Co. KG (Germany)

- Vanderlande Industries (Netherlands)

- Murata Machinery (Japan)

- Kardex Group (Switzerland)

- Knapp AG (Austria)

Recent Development by SSI Schaefer Group

- In April 2024, SSI Schaefer, a global pioneer in cold-chain storage systems and warehouse automation, is revealing the outcomes of its collaboration with Noatum Logistics. The cooperation installed the biggest mobile racking system installation for deep-freeze cool rooms in the UAE by utilizing SSI Schaefer's movable pallet racking system, which boosts storage capacity by over 90%. The system was successful in increasing warehouse safety due to its many failsafe mechanisms and state-of-the-art programmable logic controller (PLC) that allows customized and automated operation, in addition to increasing cooling efficiency and storage density.

Recent Development by Daifuku Co. Ltd.

- In December 2023, in its new high-rise testing facility at its main manufacturing base, Daifuku Co., Ltd. announced that it had begun operational testing its newest high-speed, high-rise automated storage and retrieval system (AS/RS) stacker cranes. The firm plans to leverage this facility to expedite the development and testing of its most recent stacker cranes, therefore enhancing its competitiveness in international markets. The business will also employ standby power optimization, weight reduction, and the use of high-efficiency components to minimize power consumption and lessen the environmental effect of the cranes throughout development.

Regional Stance

Asia Pacific is expected to grow at the fastest rate during the forecast period. Asia Pacific is the biggest region and provides great opportunities for the growth of the automated storage and retrieval system market. The region is focusing on technological development and providing growth opportunities in developing countries. Apart from this, the region has developed countries like China, Japan, South Korea, and India, which utilize AS/RS in various sectors.

China is among the top countries and is leading in various markets. Technological advancements, innovations, and government support demand from developing underdeveloped, and developed countries push the country to come up with better and more effective solutions. China's logistics companies are growing quickly, and they are managed in accordance with international norms.

As a result, management insights derived from this data can also offer recommendations for businesses located abroad. The rising demand for fresh food in China is a result of the country's efforts to diversify its diet and raise living standards. This has also increased demand for cold chain logistics. In addition to actively contributing to the quick growth of China's automated cold chain sector, Daifuku has supplied cold storage AS/RS to a number of well-known Chinese clients. Daifuku can already provide its Chinese clients with fully automated equipment for transportation and storage in a freezing environment, as well as equipment for picking, sorting, and storing in a cold storage environment.

Europe dominated the automated storage and retrieval system market in 2023. When it comes to the application of automation in warehouses, Northern Europe has been the most advanced market. In addition to the high cost of labor, the factory's working conditions have led to the adoption of sophisticated and advanced automation. Germany is also adopting more industrial robots as a result of the expansion of several industrial businesses and the rising use of automation in processing and storage, mostly as a result of rising labor costs and safety regulations.

The UK is a great prospect for logistics automation because of its high labor expenses in comparison to the rest of Europe and its enormous volume of e-commerce orders. Logistics firms that automate will have an advantage over their competitors thanks to the correct solutions, which will boost productivity and add essential capacity.

Market Potential and Growth Opportunity

Technological advancements

The requirement to verify the validity of data will increase along with the use of it. Transparency and imperviousness to tampering data transfers might be made possible by blockchain technology. Imagine warehouse workers with AR glasses that can quickly navigate intricate warehouse layouts, indicate objects that need to be picked, and deliver real-time information. Ground-based robots are becoming more and more ubiquitous, but warehouse drones may soon take to the skies to conduct inventory checks and provide an aerial perspective of warehouse operations.

Automated Storage and Retrieval System Market News

- In February 2024, Skechers USA, a well-known international footwear and clothing brand, turned to Hai Robotics ("Hai"), a well-known worldwide provider of Automated Storage and Retrieval Systems (ASRS). Skechers is optimizing order accuracy, fulfillment speed, and warehouse operating efficiency with Hai's automated goods-to-person system. Hai's solution was selected due to its capacity to reduce the amount of real estate required, optimize storage, readily adjust to fluctuations in demand, address labor scarcity concerns, and facilitate sustained company expansion.

- In June 2023, an ASRS called NEO was released by Falcon Autotech, a pioneer in intralogistics automation systems worldwide. NEO is automating the storage and retrieval of items by utilizing modern sensors, robots, and artificial intelligence, as stated in an official statement. Without requiring sophisticated engineering, the ASRS allows for the storage and retrieval of products inside the warehouse's four walls in an overlaying grid. Compared to typical material handling systems, it is adaptable and can be installed swiftly and affordably."

Market Segmentation

By Application

- Storage

- Order Picking

- Kitting

- Buffering

- Others

By End Use

- Automotive

- Semiconductor and Electronics

- General Manufacturing

- Retail and Warehousing or Logistics

- Aviation, Chemicals

- Rubber, and Plastics

- Healthcare

- Food and Beverage

- Postal and Parcel

By Type

- Vertical Lift Modules

- Carousels

- Crane-Based

- Vertical Buffer Modules

- Robotic Shuttles

- Floor Robots

By Load

- Unit Load

- Mid Load

- VLM

- Carousel

- Mini Load

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2384

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308