Automotive Thermal Systems Market Size to Hit USD 64.29 Bn by 2032

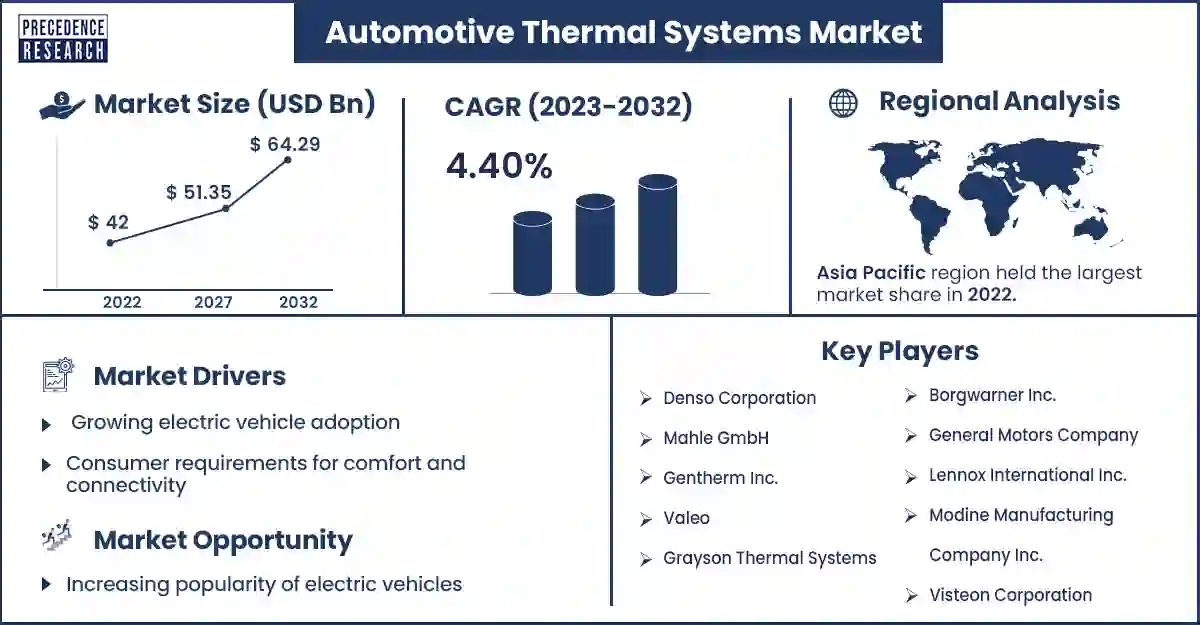

The global automotive thermal systems market size surpassed US$ 42 billion in 2022 and is estimated to hit around USD 64.29 billion by 2032, growing at a CAGR of 4.40% between 2023 and 2032.

Market Overview

The automotive thermal systems market deals with the maintenance and regulation of the desired temperature. It monitors the temperature of the battery, motor, cabin, and other parts of the body. It offers higher performance, enhanced company, and superior comfort. It reduces temperature fluctuation and prevents breakdown.

The automotive thermal system manages the temperatures of essential vehicle parts. It regulates the temperature of components, such as the engine, battery, and passenger compartment, to optimize performance, fuel efficiency, and overall comfort. This system ensures proper operating temperatures are maintained, helping to prevent overheating or freezing, which could lead to issues and reduced vehicle performance.

Electric and hybrid vehicles are rising, spurring automakers to create electronic systems designed for these new vehicles. For electric vehicles (EVs), many companies have focused on developing devices such as electric chillers and battery-cooling equipment.

Regional Snapshot

The automotive thermal systems market was dominated by the Acia-Pacific region in 2023. A major factor contributing to the market's growth is the increasing utilization of compressors in A/C systems to expel warm air from the vehicle's interior.

China will continue to lead in expanding the electric vehicle (EV) market. This year, about 11.5 million new EVs are expected to be sold in China, representing a 44% share of all new car sales. China dominates the global EV market, accounting for 69% of all new EV sales in December. In 2022, the country saw a significant 37% annual growth in EV sales, with approximately 9 million new EVs sold and a market share of 34%. The Chinese government has ambitious plans to increase EV penetration in the country further. It has set a target of achieving a 45% EV market share by 2027, higher than the originally planned 40% by 2030. As local Chinese automakers continue to consolidate and strengthen their position in the automotive thermal systems market, this shift opens a crucial window of opportunity for non-Chinese automakers to establish a presence in the world's largest EV market.

Europe region is estimated to grow fastest in the forecast period. Due to the implementation of rigorous emission standards in numerous European nations, there has been a rise in automotive sales, which has impacted the European automotive thermal system industry. Introducing these regulations has contributed to the region's position in the automotive thermal systems market. Europe is estimated to be the next biggest market due to growing electric and autonomous vehicle sales and high vehicle ownership rates.

Automotive Thermal Systems Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 43.64 Billion |

| Projected Forecast Revenue by 2032 | USD 64.29 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.40% |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing electric vehicle adoption

Electric vehicles produce heat not only from the powertrain but also from the large battery during charging and discharging. Efficient thermal management is critical to maintaining optimal temperatures of these components, which impacts battery life, safety, and performance. Advanced cooling solutions like liquid cooling systems and thermal interface materials are used in automotive thermal systems in EVs to ensure the battery pack and electric drivetrain operate consistently and safely. Cabin heating and cooling are also vital in EVs, as temperature control affects the driving range by reducing the load on the battery. The increasing demand for EVs will boost the growth of automotive thermal systems market

Consumer requirements for comfort and connectivity

Today's vehicle purchasers seek ecologically conscious and effective vehicles and ones that prioritize comfort and connectivity, which creates opportunities for the automotive thermal systems market. Automotive thermal systems are crucial in managing cabin temperature and enhancing passenger comfort in extreme weather and everyday commutes. Advanced HVAC systems with zone-specific temperature control, air purification, and intelligent connectivity are becoming increasingly common. These systems provide personalized comfort and contribute to driver alertness and overall road safety.

In addition, as vehicles increasingly adopt advanced technologies and interconnectivity, efficient thermal management becomes crucial. This is because the operation of onboard electronics, infotainment systems, and sensors generates heat, which must be effectively managed to maintain optimal performance and extend the lifespan of these components. Implementing thermal solutions is essential, as it ensures reliable performance and prevents overheating.

Restraints

Loss of refrigerant

Insufficient cooling in a vehicle's interior is often caused by refrigerant loss. This is especially noticeable during fall and winter when the cooling system is rarely used. The prolonged dryness in the cooling system prevents proper operation and creates leaks. To resolve this, have your car serviced at a repair shop to inspect and refill the refrigerant levels.

An issue with electrical system

Electrical problems can affect the proper functioning of thermal systems, negatively impacting the automotive thermal systems market. If the system does not have power, it could be because of damaged wires or a tripped fuse. Replacing a blown fuse is doable, but if you cannot identify the cause of the problem, seek professional help from an auto repair shop specializing in electrical systems.

Opportunity

Increasing popularity of electric vehicles

Electric vehicles have gained immense popularity in China, the US, and Europe in recent years. Automakers are striving to create efficient, affordable, and long-range battery-powered cars. A vehicle's performance, driving range, and lifespan depend largely on thermal systems for batteries, traction motors, and other components. The automotive industry is also advancing partially autonomous and fully driverless vehicles. These thermal systems also manage engine cooling, interior heating, and ventilation for enhanced vehicle performance.

Recent Developments

- In September 2023, Mitsubishi Heavy Industries Thermal Systems launched a new refrigeration unit named TEJ35GAM. The unit runs on electricity and is specially developed for small and medium-sized trucks. The unit was awarded the “Technology Award” and the “Agency for Natural Resources and Energy Commissioner’s Award.” TEJ35GAM is able to switch between different modes for better optimization. In the future, the company will focus on developing better units to reduce CO2 emissions.

- In September 2023, Marelli launched smart actuators for thermal and transmission management in electric vehicles. The actuators include an electronic module that works autonomously, controls itself, and is able to connect with the vehicle's electronic network.

- In June 2023, a new thermal management system was launched by ZF, a technology company. A lot of energy is consumed by thermal systems, which reduces the efficiency of electric vehicles. The new system will tackle these issues and increase the EV range by 0ne-third in the winter. The system not only improves efficiency but also consumes less energy and is lightweight and compact.

Key Players in the Market

- Denso Corporation

- Mahle GmbH

- Gentherm Inc.

- Valeo

- Grayson Thermal Systems

- Borgwarner Inc.

- General Motors Company

- Lennox International Inc.

- Modine Manufacturing Company Inc.

- Visteon Corporation

Segments Covered in the Report

By Component

- Compressor

- Heating Ventilation Air Conditioning (HVAC)

- Powertrain Cooling

- Fluid Transport

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Front and Rear A/C

- Engine and transmission

- Seat

- Battery

- Motor

- Waste Heat Recovery

- Power Electronics

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1520

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308