Autonomous Mobile Robots Market Size To Attain USD 19.78 Bn By 2032

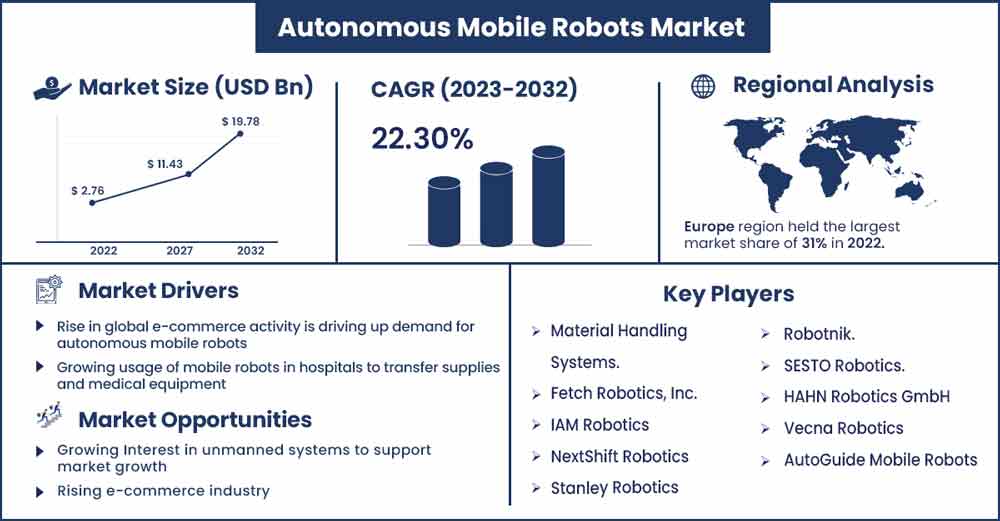

The global autonomous mobile robots market size was evaluated at USD 2.76 billion in 2022 and is projected to attain around USD 19.78 billion by 2032, growing at a CAGR of 22.3% during the forecast period from 2023 to 2032.

Autonomous mobile robots are machines that are programmed to carry out particular behaviors and actions. The primary roles of the robots are locomotion, localization, mapping, and navigation. Robots that operate autonomously are often utilized in the shipping, inspection, and surveillance industries. Robots are also employed by the military, the mining and metals industry, the electronics and electrical sector, the oil and gas industry, and the automobile industry. These robots are made to carry out duties without the aid of humans and to change and adapt to new tasks without causing damage to things, people, or the environment.

The internet of things has its most visible and well-known use in the linked automobile. The true IoT growths in the auto industry, however, are happening behind the scenes because today's cars are increasingly driven by software. Both software manufacturers and carmaker producers claim to be in control. Additionally, the introduction of the autonomous mobile robot market promotes the need for automated devices that assist in the analysis of real-time data on drivers and fleet operators. It also has a connection to the smart automotive internet, which enables three different forms of communication: in-vehicle, vehicle-to-vehicle, and vehicle-to-infrastructure.

The process of integrating internet of things (IoT) technology into the automobile industry includes making cars smarter, more efficient, more comfortable, and more intelligent. By connecting computer devices, digital devices, and mechanical equipment to deliver the data transmission automatically, it makes it possible to use smart applications. The goal of IoT development in the automotive industry is to deliver real-time data and information regarding vehicle occupants.

The increasing use of robots in different industrial sectors, technical improvement, the expansion of the applications for autonomous robots, and the rising public awareness of the advantages of such robots are factors that are propelling the market. the spread of cutting-edge driver assistance technologies, the rising demand for smart devices in cars, and the enforcement of strict telematics rules by various governments.

Regional Snapshots:

The rise in global e-commerce activity is driving up demand for autonomous mobile robots. Additionally, the market is anticipated to rise as a result of factors including rising warehouse automation and increased acceptance of these robots across multiple sectors due to their capacity to freely navigate in complex situations. Additionally, the market is anticipated to develop as a result of rising automated material handling usage and trends like lights-out automation throughout the projected period.

The market's expansion is, however, anticipated to be somewhat constrained by restrictions on load size and the high cost of installing an AMR system.

For the participants in the autonomous mobile robot market, on the other hand, the growing usage of mobile robots in hospitals to transfer supplies and medical equipment to patient rooms is anticipated to open up attractive growth prospects in the coming years.

Autonomous Mobile Robots Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6.24 Billion |

| Projected Forecast Revenue in 2032 | USD 19.78 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 22.3% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- In 2020, the hardware industry's revenue share was over 68%, which was the highest.

- In 2020, more than 50% of the revenue share came from the category for goods-to-person picking robots. The large percentage is due to the ongoing usage of autonomous robots to replace manual and paper-based picking methods.

- During the forecast period, a discernible shift in demand for self-driving forklifts is envisaged.

- With a market share of more than 50% in 2020, the lead battery market sector maintained its top spot. Lead batteries' cheap cost advantages over other battery types are responsible for a significant share.

- In 2020, the manufacturing sector had the biggest revenue share at about 77%; a significant percentage of this growth can be attributed to the continued process automation in the manufacturing sector worldwide.

- In 2020, Europe dominated the autonomous mobile robot market with a revenue share of over 30%. This may be related to the fact that existing players in the industrial sector need material handling equipment more and more.

Market Dynamics:

Drivers:

The rise in global e-commerce activity is driving up demand for autonomous mobile robots. Additionally, the market is anticipated to rise as a result of factors including rising warehouse automation and increased acceptance of these robots across multiple sectors due to their capacity to freely navigate in complex situations. Additionally, the market is anticipated to develop as a result of rising automated material handling usage and trends like lights-out automation throughout the projected period.

The market's expansion is, however, anticipated to be somewhat constrained by restrictions on load size and the high cost of installing an AMR system. For the participants in the autonomous mobile robot market, on the other hand, the growing usage of mobile robots in hospitals to transfer supplies and medical equipment to patient rooms is anticipated to open up attractive growth prospects in the coming years.

Restraints:

The initial, huge expenditure needed to construct automated distribution facilities and stores in order to achieve optimum productivity and efficiency was found to be the limiting factor. Due to poor manufacturing output and long-delayed return on investment ratios, makes it difficult for small and medium-sized businesses to park capital. High costs for accessories, programming, integration, and other costs are limiting the expansion of the worldwide industry. Additionally, since the service providers must integrate the robots into their existing operations, inventory management controls might occasionally cause anxiety. The market for autonomous mobile robots is consequently constrained by these limitations.

Opportunities:

Growing Interest in unmanned systems to support market growth. In the military industry, unmanned vehicles are generally employed to provide ammunition to soldiers during conflict, conduct rescue operations during natural catastrophes, and find, neutralize, or explode explosives. Additionally, the employment of UGVs in the business sector is growing as a result of their versatility in performing duties like perimeter security of hazardous locations, disaster rescue operations, and the handling of hazardous chemicals.

In the military industry, unmanned vehicles are generally employed to provide ammunition to soldiers during conflict, conduct rescue operations during natural catastrophes, and find, neutralize, or explode explosives. Additionally, the employment of UGVs in the business sector is growing as a result of their versatility in performing duties like perimeter security of hazardous locations, disaster rescue operations, and the handling of hazardous chemicals.

Challenge:

Waypoints and objectives must be created for an autonomous mobile robot configuration. Additionally, setting up autonomous robots to perform independently in a factory or office is a challenging process. This could lead to additional setup expenses that aren't immediately apparent, like the cost of hiring a vendor or robotics to configure the robot, lost time from building modifications or adaptations, hours spent creating and editing maps, and time spent training staff on how to set up and use the robots.

Furthermore, it is projected that the expansion of autonomous mobile robots during the projection period would be hampered by the complexity of managing the value chain due to the poor returns associated with the installation of such expensive systems and the rise in costs of microprocessing components.

Recent Developments:

- In order to provide automated material handling solutions for industrial and storage facilities, ForwardX Robots developed a broad range of AMRs under its Max robotics line in January 2021.

- August 2020: Sesto Robotics presented a new mobile autonomous robot that automates material handling tasks in the manufacturing, retail, and healthcare sectors.

Key Market Players

- Material Handling Systems.

- Fetch Robotics, Inc.

- IAM Robotics

- NextShift Robotics

- Stanley Robotics

- Robotnik.

- SESTO Robotics.

- HAHN Robotics GmbH

- Vecna Robotics

- AutoGuide Mobile Robots

- SoftBank Robotics

Market Segmentation:

By Component

- Hardware

- Software

- Services

By Type

- Goods-to-Person Picking Robots

- Self-Driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-Based Battery

- Others

By End Use

- Manufacturing

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Others

- Wholesale & Distribution

- E-commerce

- Retail Chains/Conveyance Stores

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2385

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333