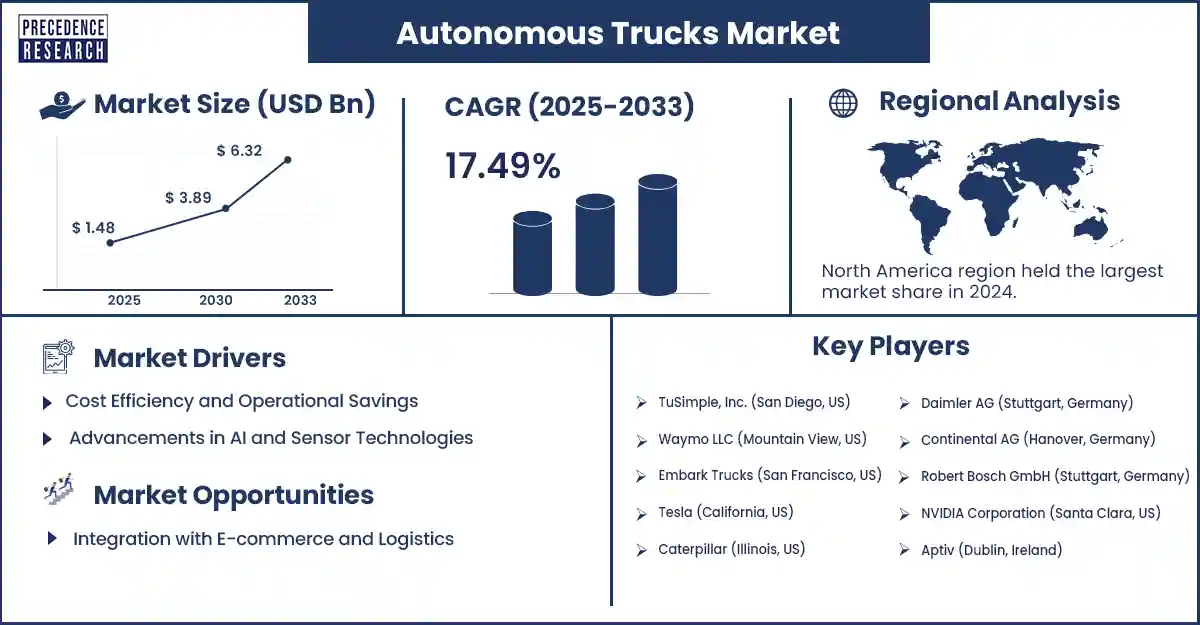

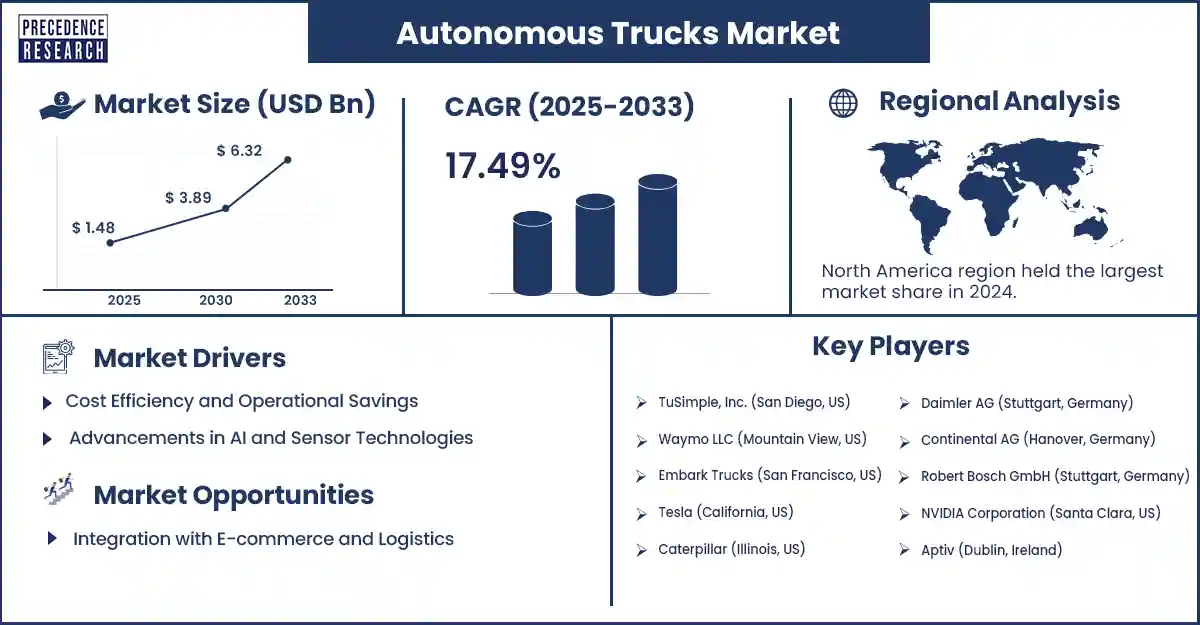

Autonomous Trucks Market Revenue to Attain USD 6.32 Bn by 2033

Autonomous Trucks Market Revenue and Trends 2025 to 2033

The global autonomous trucks market revenue reached USD 1.74 billion in 2025 and is predicted to attain around USD 6.32 billion by 2033 with a CAGR of 17.49%.

The growth of the market is driven by advancements in technology, rising demand for logistics automation, and increasing need for safer and more efficient freight transport.

Market Overview

Self-driving trucks, also known as autonomous trucks, use sensors and machine learning algorithms to control and operate on their own with minimal involvement from their drivers. As global freight demand surges and driver shortages persist, the market for autonomous trucks is gaining momentum. Running these vehicles is more cost-efficient than regular cars, optimizing fuel economy and reducing human errors.

Major companies in the transportation sector, including Tesla, Daimler, Volvo, and TuSimple, are strongly supporting R&D to introduce vehicles suitable for autonomous freight transportation. In 2024, the U.S. Department of Transportation (USDOT) allowed style testing for autonomous trucks on highways in a few states.

On the other hand, China and Germany are imposing regulations to help autonomous commercial vehicles be integrated on a large scale. Furthermore, the rising trend of online shopping, increasing awareness about climate change, and government support are boosting the growth of the market.

(Sources: https://www.transportation.gov)

Major Trends in the Autonomous Trucks Market

Rapid Advancements in AI and Sensor Technologies

Autonomous trucks rely heavily on artificial intelligence to process sensory data and make informed decisions. Breakthroughs in deep learning, edge computing, and real-time analytics have significantly enhanced the ability of autonomous trucks to interpret road conditions and traffic behavior. NVIDIA unveiled a new computing system for self-driving vehicles in 2024, making it five times more powerful than its prior model, created especially for long-haul trucks. These technologies offer safety and enhanced performance by minimizing laggy communication. Source: https://www.nvidia.com/en-in/self-driving-cars/news/

Growing Investment in Autonomous Freight Corridors

Rising investments in autonomous freight corridors reflect a worldwide trend to improve freight system infrastructure. Autonomous freight corridors with advanced road lanes and facilities, especially for self-driving trucks, are being built in partnership by governments and private enterprises. In 2024, both Texas and California declared they were forming a partnership to construct a 400-mile route with smart design, AI signals and stations for autonomous electric vehicles. Such routes are introduced to reduce traffic and track how much air pollution is released. Furthermore, as the corridors grow, they are changing logistics across the supply chain and raising the standard for automated transport.

(Source: https://www.txdot.gov)

(Source: https://www.oecd.org)

Popularity of Electric Vehicles (EVs)

Freight transport is quickly becoming cleaner and smarter as EVs are becoming more accessible. More autonomous truck makers are now using electric engines as part of their decarbonization aims. Tesla, Einride, and Volvo are introducing battery-powered autonomous trucks for use on short and long routes. This helps companies handle automation needs and also meet sustainability goals. The DG MOVE branch of the European Commission is launching the 2024 initiative to fund electric trucks on automated routes that support harmonized charging in many nations. Moreover, the growing focus on logistics in a sustainable way is expected to fuel the market in the coming years. (Source: https://climate.ec.europa.eu)

Enhanced Cybersecurity for Autonomous Systems

The development of connected freight technology now heavily relies on cybersecurity for autonomous systems. As trucks drive themselves, concerns over cyber threats are increasing. Manufacturers founded the Autonomous Vehicle Security Consortium (AVSC) to establish set guidelines for encrypting data, updating the vehicle remotely and detecting intrusions. The European Commission’s DG MOVE began auditing the safety of autonomous freight routes in Europe, checking for resistance to coordinated cyberattacks. This marks the industry’s effort to protect itself as autonomous freight systems change and advance.

Report Highlights of the Autonomous Trucks Market

Type Insights

The heavy-duty trucks segment held the largest share of the market in 2024. This is mainly due to their widespread use in long-haul and cross-border freight operations. These trucks benefit most from autonomous systems, which reduce driver fatigue and enhance safety on long-distance routes.

Level of Autonomy Insights

The semi-autonomous segment dominated the market in 2024 as they balance automation with human oversight, aligning well with current regulatory environments. Semi-autonomous vehicles are already in operation under controlled conditions, particularly for highway driving, where autonomy is easiest to implement.

ADAS Insights

The blind spot detection segment dominated the market by capturing the maximum share in 2024 as it addresses one of the most critical safety concerns in freight transport. Large commercial vehicles often have significant blind spots that increase accident risks during lane changes or turns. Blind spot detection feature reduces the risks of accidents and enhances vehicle safety.

Component Insights

The sensors segment held the major share of the market in 2024. Sensors are the backbone of autonomous driving systems, making them the leading component type. Sensors collectively enable perception, navigation, and real-time environment mapping. Advancements in sensor technology have improved the efficiency of autonomous trucks, supporting segmental growth.

Drive Type Insights

The electric segment is capturing the highest share of the market due to growing environmental regulations and sustainability goals. Autonomous electric trucks offer reduced emissions and are increasingly compatible with smart logistics hubs and automated charging systems.

Regional Outlook

Asia Pacific registered dominance in the autonomous trucks market in 2024. This is mainly due to China’s aggressive rollout of autonomous trucks and strong governmental support. In 2024, Baidu, a Chinese multinational technology company, and Foton Motor, a Chinese commercial vehicle manufacturer, signed an agreement to launch 10,000 systems for self-driving trucks by 2027. Autonomous delivery vehicles are being increasingly used by Japan and South Korea. In 2024, the China Ministry of Transport found that more than 500 autonomous trucks had been tested in logistics zones in Guangdong and Shandong provinces. Additionally, the progress in autonomous vehicles is making Asia Pacific a leader in the market.

North America is projected to experience rapid growth, driven by high investment in R&D, supportive regulatory frameworks, and strong logistics demand. There is a high demand for self-driving vehicles in the logistics and e-commerce sectors. Walmart’s self-driving cars were tested in both Arkansas and Arizona as one of the major deployments in 2024.

The U.S. and Canada are making efforts to build better freight infrastructure for autonomous logistics. The U.S. Department of Transportation (USDOT) launched a USD 120 million initiative in 2024 to advance smart freight corridors for autonomous vehicles. Moreover, in 2024, Canada’s Ministry of Transport joined forces with local governments to build special AV freight routes in Alberta and Ontario to collect and experiment with real-world data. At the same time, the Transportation Research Board (TRB) examined how AVs were performing on North American trade routes and looked at safety, performance, and polluting emissions.

Autonomous Trucks Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.74 Billion |

| Market Revenue by 2033 | USD 6.32 Billion |

| CAGR from 2025 to 2033 | 17.49% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomous Trucks Market News

- In May 2025, Aurora Innovation, Inc. has begun regular driverless customer hauls between Dallas and Houston after closing its safety case and logging more than 1,200 incident-free miles with its Aurora Driver system. The company, now the first to operate a commercial heavy-duty, self-driving trucking service on public roads, plans to extend the route network to El Paso, Texas, and Phoenix, Arizona before year-end 2025.

- In February 2025, Autonomous-driving startup Waabi has signed a joint development agreement with Volvo Autonomous Solutions to co-create and deploy self-driving Class 8 trucks, marking Volvo’s second partnership with an AI trucking firm. The collaboration follows Volvo’s May 2024 unveiling of the Volvo VNL Autonomous, developed with Aurora, and accelerates Waabi’s path toward a commercial launch.

- In November 2024, Silicon Valley start-up Plus has made a major step forward in its driverless trucking program by releasing its Level 4 autonomous software in tandem with Traton Group brands Scania, MAN and International. After months of testing in both the U.S. and Europe, the Beta 5.0 version of Plus’s AI-based SuperDrive tech is now operational in trucks on both continents.

(Sources: https://ir.aurora.tech)

(Source: https://techcrunch.com)

(Source: https://www.iotworldtoday.com)

Autonomous Trucks Market Key Players

- TuSimple, Inc. (San Diego, US)

- Waymo LLC (Mountain View, US)

- Embark Trucks (San Francisco, US)

- Tesla (California, US)

- Caterpillar (Illinois, US)

- AB Volvo (Gothenburg, Sweden)

- Daimler AG (Stuttgart, Germany)

- Continental AG (Hanover, Germany)

- Robert Bosch GmbH (Stuttgart, Germany)

- NVIDIA Corporation (Santa Clara, US)

- Aptiv (Dublin, Ireland)

Market Segmentation

By Types

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

By Level of Autonomy

- Semi-Autonomous

- Fully Autonomous

By ADAS

- Adaptive Cruise Control

- Lane Departure Warning

- Intelligent Park Assist

- Highway Pilot

- Automatic Emergency Braking

- Blind Spot Detection

- Traffic Jam Assist

- Lane Keeping Assist System

By Component Types

- LIDAR

- RADAR

- Camera

- Sensors

By Drive Type

- IC Engine

- Electric

- Hybrid

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2880

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344