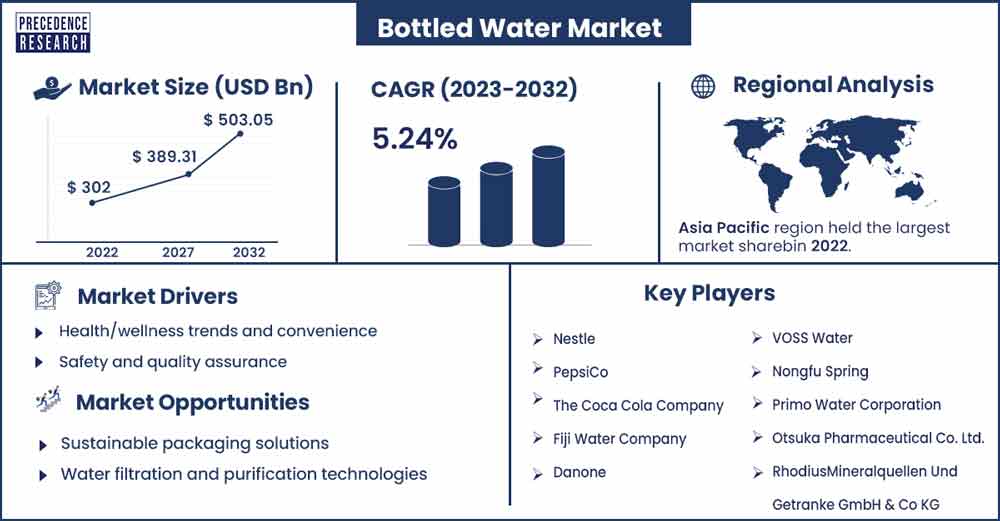

Bottled Water Market Size to Rise USD 503.05 Billion By 2032

The global bottled water market size surpassed USD 302 billion in 2022 and is expected to rise around USD 503.05 billion by 2032, poised to grow at a CAGR of 5.24% from 2023 to 2032.

Market Overview

The bottled water market is a thriving segment of the global beverage industry, driven by consumer preferences for convenience, hydration, health consciousness, and on-the-go consumption. The global market has experienced significant growth in recent years and is expected to continue expanding. Factors such as urbanization, population growth, increasing disposable incomes, changing lifestyles, and water quality and safety concerns contribute to market growth. They market various types of bottled water, including still water, sparkling water, flavored water, and functional water.

The bottled water market exhibits regional variations in consumption patterns, market penetration, regulatory frameworks, and competitive landscapes. Developed markets such as North America and Western Europe have high per capita consumption of bottled water, driven by health trends, environmental concerns, and convenient packaging options. Emerging markets in Asia-Pacific, Latin America, and Africa are experiencing rapid urbanization, rising disposable incomes, and increasing demand for packaged beverages, fueling market growth and expansion opportunities. Challenges in this market include concerns about plastic pollution, environmental sustainability, water scarcity, and competition from tap water and alternative beverages.

Regional Snapshots

In the Asia-Pacific region, China’s bottled market is one of the largest and fastest-growing globally, driven by urbanization, rising disposable incomes, and concerns about water quality and safety. Bottled water consumption in China is driven by a preference for safe, convenient hydration options, especially in urban areas with limited access to clean tap water. Domestic brands like Nongfu Spring, Tingyi Holding (Master Kong), and Wahaha dominate the Chinese bottled water market alongside international players like Danone and Coca-Cola.

India’s bottled market is expanding rapidly, fuelled by population growth, increasing urbanization, and improving living standards. Bottled water consumption in India is driven by water contamination, inadequate municipal infrastructure, and changing consumer preferences. Packaged drinking water brands, including Bisleri, Aquafina, Kinley, and local/regional players, cater to diverse consumer segments across urban and rural areas.

In the North American region, the bottled water market in the United States is mature and highly competitive, driven by consumer preferences for health-conscious beverages, convenience, and on-the-go hydration. Bottled water consumption has surpassed that of carbonated soft drinks, reflecting shifting consumer trends towards healthier beverage options. Major US market players include Coca-Cola Company (Dasani), PepsiCo (Aquafina), and private-label brands. Regulatory oversight by the US Food and Drug Administration (FDA) ensures product safety, quality standards, and compliance with labeling requirements.

Bottled Water Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 317.67 Billion |

| Projected Forecast Revenue by 2032 | USD 503.05 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.24% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health/wellness trends and convenience

Growing consumer awareness about health and wellness is a significant driver of the bottled water market. Consumers are increasingly choosing bottled water over sugary beverages due to its perceived health benefits, such as hydration, zero calories, and the absence of artificial additives or sweeteners. Bottled water is often perceived as a healthier alternative to sugary sodas and other beverages, driving demand among health-conscious consumers. Bottled water offers convenience and portability, making it an ideal choice for on-the-go hydration.

Its availability in various packaging formats, including single-serve bottles, multipacks, and larger containers, caters to diverse consumer preferences and consumption occasions. The market is widely accessible in retail outlets, convenience stores, vending machines, and food service establishments, enabling consumers to stay hydrated anytime, anywhere.

Safety and quality assurance

Concerns about tap water safety, contaminants, and waterborne diseases drive demand for bottled water as a reliable source of clean drinking water. Bottled water undergoes rigorous quality control measures, including filtration, purification, and sterilization, to ensure compliance with regulatory standards and microbiological safety. Consumers perceive bottled water as a trusted and convenient option for accessing safe drinking water, especially in regions with inadequate municipal water infrastructure or water quality issues.

Restraints

Competition from tap water

Despite its convenience and perceived safety, bottled water faces competition from tap water, often available at a lower cost or free of charge in many regions. Public drinking water systems are regulated by government agencies and subject to quality testing and treatment processes to ensure safe drinking water. Promoting tap water as a sustainable and cost-effective alternative to bottled water poses a challenge for the bottled water industry, particularly in regions where tap water quality meets regulatory standards and consumer confidence is high.

Environmental concerns

One of the primary restraints faced by the bottled water market is the growing concern over plastic pollution and its environmental impact. Plastic bottle production, distribution, and disposal contribute to ecological degradation, including littering, marine pollution, and greenhouse gas emissions. Increasing awareness of plastic waste and calls for sustainable packaging solutions pose challenges for bottled water companies to address environmental concerns and reduce their carbon footprint.

Opportunities

Sustainable packaging solutions

Environmental awareness and concerns about plastic pollution have led bottled water manufacturers to adopt eco-friendly packaging materials and sustainability initiatives. Companies increasingly invest in lightweight packaging, recyclable materials, and innovative packaging solutions to minimize environmental impact and promote circularity. Initiatives such as bottle recycling programs, sustainable sourcing practices, and the use of recycled PET (rPET) contribute to reducing the ecological footprint of bottled water products and addressing consumer concerns about plastic waste. Urbanization, changing lifestyles, and increasing urban consumers, including office workers, commuters, students, and active individuals, rely on the bottled water market for hydration during daily activities, travel, and recreational pursuits.

- In January 2024, Petainer and Oonly launch reusable PET water bottles in Hungary.

Water filtration and purification technologies

Advances in water filtration and purification technologies present opportunities for bottled water market companies to enhance product quality, safety, and taste while reducing environmental impact and production costs. Investing in state-of-the-art filtration systems, reverse osmosis technology, UV sterilization, and advanced treatment processes improves water purity, removes contaminants, and enhances product consistency. Innovations in water treatment technologies enable bottled water companies to differentiate their products based on superior taste, clarity, and microbiological safety, appealing to discerning consumers seeking high-quality bottled water options.

Expansion into emerging markets

Emerging markets offer significant growth opportunities for bottled water companies seeking to expand their global footprint and tap into growing consumer demand for packaged beverages. Rapid urbanization, rising disposable incomes, and changing lifestyles in emerging economies drive demand for bottled water as a convenient and safe hydration option. Strategic investments in distribution networks, market entry strategies, and localized product offerings help capture market share and capitalize on demographic trends in emerging markets across Latin America and Africa.

Recent Developments

- In September 2023, PepsiCo’s Gatorade brand is jumping into the alkaline bottled water market with an electrolyte-infused entry called Gatorade Water, which will be available early next year.

- In June 2023, the five-time Ballon d'Or winner was in Madrid to launch Ursu9, his new mineral water brand.

Key Players in the Market

- Nestle

- PepsiCo

- The Coca Cola Company

- Fiji Water Company

- Danone

- VOSS Water

- Nongfu Spring

- Primo Water Corporation

- Otsuka Pharmaceutical Co. Ltd.

- RhodiusMineralquellen Und Getranke GmbH & Co KG

Market Segmentation

By Product

- Purified

- Spring

- Mineral

- Distilled

- Sparkling

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Grocery Stores

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1314

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308