Botulinum Toxin Market Revenue to Attain USD 19.68 Bn by 2033

Botulinum Toxin Market Revenue and Trends 2025 to 2033

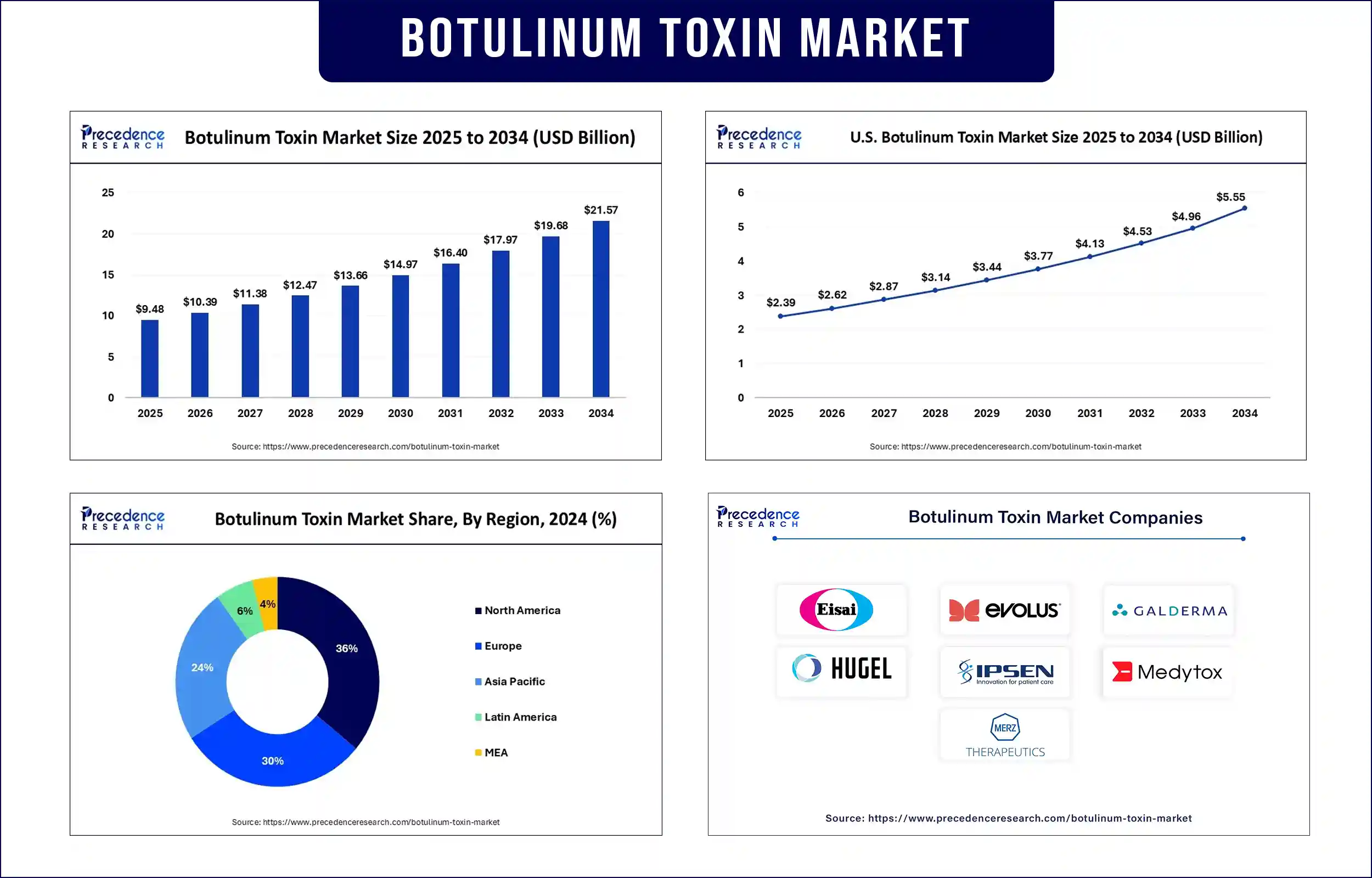

The global botulinum toxin market revenue is estimated USD 9.48 billion in 2025 and is predicted to attain around USD 19.68 billion by 2033 with a CAGR of 9.57%. The global botulinum toxin market is projected to witness significant growth during the forecast period, primarily driven by the rising demand for aesthetic procedures, increasing number of neurological disorder cases, and rising approvals for botulinum toxin-based products.

Market Overview

Botulinum toxin ae used in a range of therapeutic and cosmetic applications. These agents find application in both medical and aesthetic purposes to reduce muscle activity. They help treat medical disorders, including chronic migraine, cervical dystonia, blepharospasm, and spasticity. They are used in cosmetic treatments for facial wrinkle reduction. The U.S. FDA had already approved OnabotulinumtoxinA (BTX-A) for the treatment of neurogenic detrusor overactivity in pediatric patients. According to the World Health Organization (WHO), neurological disorders are major contributors to disability and death worldwide, highlighting the need for botulinum toxin therapies.

Major Trends in the Botulinum Toxin Market

Rising Popularity of Minimally Invasive Aesthetic Procedures

The popularity of low-interventional aesthetic procedures is rising as people have become more aware of their benefits. According to the American Society of Plastic Surgeons (ASPS), over 7 million botulinum toxin type A procedures were performed in 2023, making them the most popular cosmetic procedures globally. The rising awareness about botulinum toxin therapy and its affordability is encouraging younger populations to adopt it. In 2024, the U.S. FDA highlighted ongoing safety monitoring of botulinum toxin products used in cosmetic applications, emphasizing their continued safe use when administered by trained professionals. Modern lifestyle and healthcare routines continue to integrate minimally invasive cosmetic procedures, supporting the market’s growth.

Expanding Therapeutic Applications Beyond Aesthetics

The medical community now uses botulinum toxin to treat conditions including chronic migraine, hyperhidrosis, and overactive bladder. Recently, the National Institutes of Health (NIH) published a research report highlighting botulinum toxin's efficacy in treating depression and gastrointestinal disorders, expanding its therapeutic landscape. Expanding the scope of applications of botulinum toxin further increases the number of clinical trials. The NIH also revealed a study demonstrating botulinum toxin's role in managing chronic pelvic pain syndrome, a condition with few effective long-term treatments.

Regulatory Support and Approvals

The market is growing as regulatory bodies are encouraging the development of innovative formulations for expanding therapeutic applications. Botulinum toxin products are receiving approvals from both the FDA and EMA. In 2024, the FDA granted orphan drug designation to a botulinum toxin formulation for the treatment of focal limb dystonia.

Aging Population

The growing number of older individuals in the world is likely to contribute to market expansion due to the increasing prevalence of aging muscle disorders among them. According to the United Nations World Population Ageing Report 2023, individuals aged 65+ will make up over 16% of the global population by 2050. Aging populations are expected to elevate the need for aesthetic procedures, such as botulinum toxin for treating wrinkles and mobility issues. Several studies validate that botulinum toxin therapy serves as a crucial method for maintaining functional independence and improving the quality of life among elderly patients.

Report Highlights of the Botulinum Toxin Market

Product Type Insights

The type A segment dominated the market with the largest share in 2024. Botulinum A is preferred for its high efficacy and broad therapeutic and aesthetic applications. The product’s consistent performance in both cosmetic and medical treatments supports its leading position in the market.

Application Insights

The aesthetic segment is anticipated to expand at a significant CAGR during the forecast period. This is mainly due to the increasing demand for non-surgical cosmetic procedures. The rising awareness of facial rejuvenation options, improvements in technique, and growing availability of skilled practitioners contribute to the expansion of this segment. Botulinum toxin is used in aesthetic procedures to treat wrinkles.

End User Insights

The dermatology clinics segment dominated the market in 2024 due to their specialization in facial aesthetics and growing patient preference for targeted cosmetic services. These clinics are equipped with experienced professionals and advanced tools, making them a preferred choice for botulinum toxin procedures.

Regional Insights

North America

North America held the largest share of the botulinum toxin market in 2024 and is expected to continue its growth trajectory in the coming years. This is mainly due to its advanced healthcare infrastructure and the presence of skilled dermatologists. There is a heightened demand for aesthetic treatments. Leading pharmaceutical companies such as AbbVie and Revance Therapeutics are allocating funds to the research of botulinum toxin. The U.S. FDA approved botulinum toxin for neurological and dermatological indications. The CDC’s 2024 National Ambulatory Medical Care Survey showed a notable rise in outpatient visits for botulinum toxin therapies, encompassing both therapeutic and cosmetic applications.

Asia Pacific

Asia Pacific is projected to exhibit the fastest growth during the forecast period due to rising disposable incomes, medical tourism, and the demand for aesthetic procedures. Recently, countries in East and Southeast Asia have reported increased use of botulinum toxin treatments in both therapeutic and cosmetic applications, driven by an aging population. The NIH highlighted that collaborative research trials are underway in South Korea and Singapore, evaluating long-term outcomes of botulinum toxin in neurological care.

Botulinum Toxin Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 9.48 Billion |

| Market Revenue by 2033 | USD 19.68 Billion |

| CAGR | 9.57% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Botulinum Toxin Market News

- In July 2025, Merz Aesthetics, the world’s largest dedicated medical aesthetics business, announced that the U.S. Food and Drug Administration (FDA) approved XEOMIN (incobotulinumtoxinA) as the first and only neurotoxin for simultaneous treatment of upper facial lines – forehead lines, frown lines, and crow’s feet. Initially approved in 2011, XEOMIN was indicated for temporarily improving the appearance of moderate to severe glabellar lines, or frown lines. This new FDA approval for upper facial lines adds the indication for treating horizontal forehead lines and lateral canthal lines, or crow’s feet, in addition to the prior frown lines indication.

- In February 2025, Daewoong Pharmaceutical (Co-CEOs Seongsoo Park and Chang-Jae Lee), a leading healthcare company in Korea, announced the official launch of its high-purity, high-quality botulinum toxin product, NABOTA, in Saudi Arabia. The launch follows a detailed quality evaluation conducted by the Saudi Food and Drug Authority (SFDA). With approvals from the U.S. FDA, the European Medicines Agency (EMA), and Health Canada, Daewoong Pharmaceutical’s botulinum toxin has demonstrated excellent quality and safety. This milestone is expected to serve as a gateway for Daewoong Pharmaceutical’s expansion into the Middle Eastern market.

- In September 2024, Allergan Aesthetics, an AbbVie company, announced that BOTOX Cosmetic (onabotulinumtoxinA) is now approved for treating masseter muscle prominence (MMP) in China. The masseter, one of the lower face muscles involved in chewing, can result in a wide and square lower face when prominent. BOTOX Cosmetic recently received approval from the China National Medical Product Administration (NMPA) for temporary improvement in marked to very marked MMP in adults. BOTOX Cosmetic is China’s first approved neurotoxin for MMP and brings established dosing, clinical evidence, and physician training with on-label treatment.

- In June 2024, Evolus, Inc., a performance beauty company focused on building an aesthetic portfolio, has launched Nuceiva (botulinum toxin type A) commercially in Spain. The product is now available for direct order and delivery to healthcare professionals in Spanish medical aesthetics. Nuceiva is approved by the European Commission for temporary improvement in moderate to severe vertical lines between the eyebrows at maximum frown (glabellar lines), where the severity of these lines has significant psychological impact in adults under 65 years of age.

Botulinum Toxin Market Key Players

- Eisai Co., Ltd

- Evolus, Inc.,

- Galderma laboratories.

- HUGEL, Inc. (Korea)

- Hugh Source (International) Ltd.

- Ipsen Pharma

- Lanzhou Institute of Biological Products Co., Ltd. (China)

- Medy-Tox, Inc.

- Merz Pharma GmbH & Co. KGaA

- Metabiologics, Inc.

- Pfizer Inc

- Revance Therapeutics, Inc. (U.S.)

- Teijin Pharma Ltd

- US WorldMeds, LLC

Market Segmentation

Product Type

- Type A

- Botox

- Dysport

- Xeomin

- Others

- Type B

By Application

- Therapeutic

- Chronic Migraine

- Overactive Bladder

- Cervical Dystonia

- Spasticity

- Others

- Aesthetic

- Glabellar Lines

- Crow’s Feet

- Forehead Lines

- Others

By End-Use

- Hospitals

- Dermatology Clinics

- Spas & Cosmetic Centres

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2604

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344