Carbon Credit Trading Platform Market Revenue, Top Companies, Report 2033

Carbon Credit Trading Platform Market Revenue and Trends

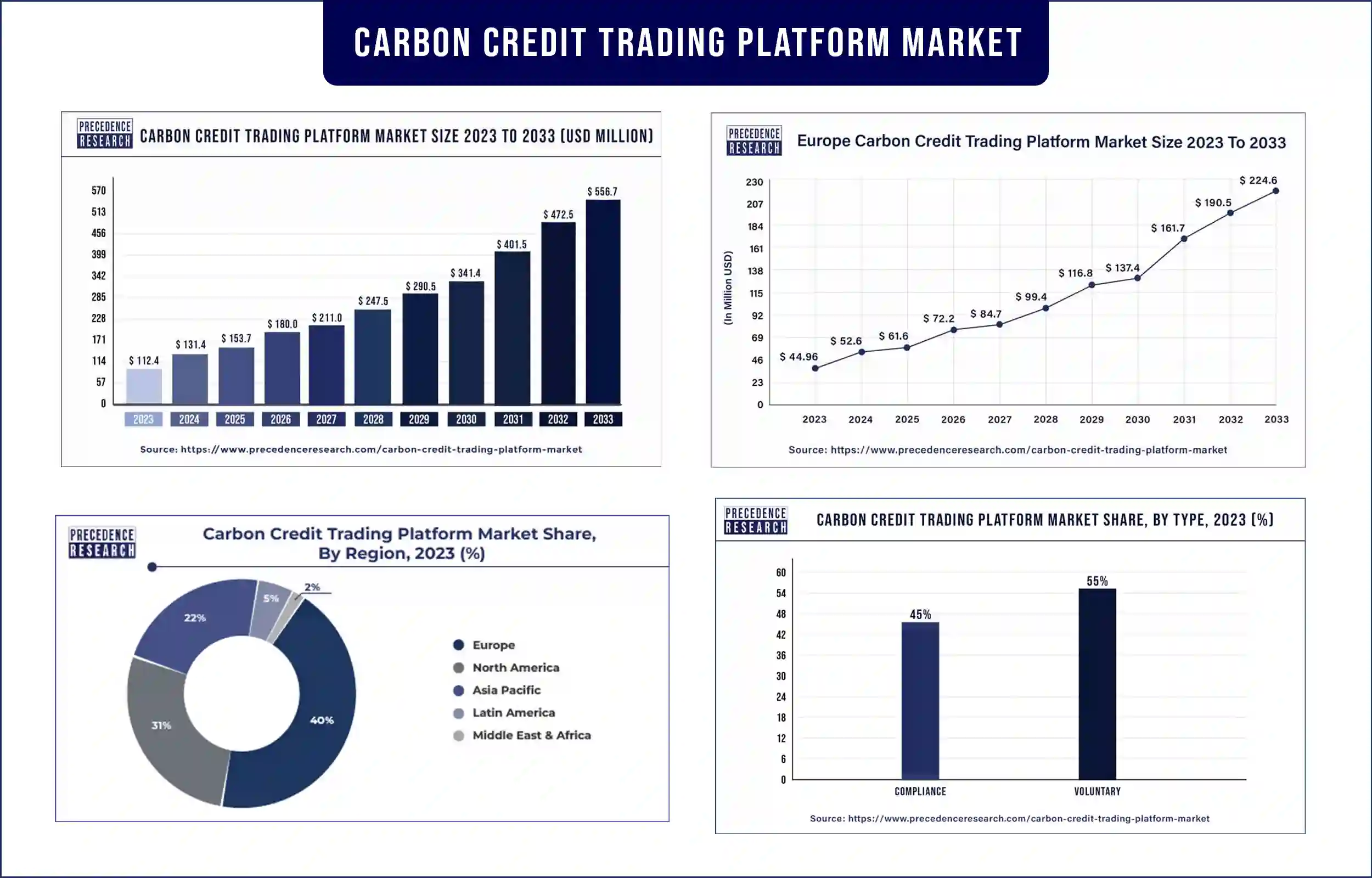

The global carbon credit trading platform market revenue was valued at USD 112.4 million in 2023 and is poised to grow from USD 131.4 million in 2024 to USD 556.7 million by 2033, at a CAGR of 17.40% during the forecast period 2024 – 2033. The continuous growth of the carbon credit trading platform market is due to the awareness of industries and brands to focus on climate conditions and global warming.

Market Overview

A carbon credit trading platform is a digital place for buying and selling carbon credits to remove the entire carbon footprint. Carbon trading is a process where the buying and selling of permits and credits are allowed, and the credit holder is allowed to emit carbon dioxide. Such platforms for buying and selling carbon credits play a very important role in nurturing a change to a low-carbon budget, suggesting new solutions to industries searching to balance their carbon footprint and contributing to the decrease of greenhouse fuel discharges. Due to awareness among people about carbon emissions and their harmful effects on the environment, many companies are taking serious steps towards their reduction and finding effective solutions.

Government initiatives towards it are also a reason to raise concern among people towards carbon footprints and effective methods. Several policies have been developed to control carbon emissions from the industries of various regions, and now people from all sectors are concerned about this. Most power companies are now concentrating on being environmentally friendly and following advanced methods and global best performs for decreasing carbon emissions significantly.

Carbon Credit Trading Platform Market Trends

- Influencing industries to include strong, sustainable methods: The commitment to adopt the sustainable method driving the carbon credit trading platform market. Several companies ranging from multinational to small enterprises are equally concerned about incorporating sustainability strategies in their workplace. Carbon credit trading platforms help industries understand the environmental impact because of the methods they are adopting. This trend of incorporating sustainability strategies drives the carbon credit trading platform market.

- Incorporation of renewable energy projects: The increasing funding for renewable energy projects is influencing the source of carbon credits. By providing a marketplace for both buyers and sellers, such platforms encourage eco-friendly projects. The active integration of such projects can be beneficial from both a market and environmental point of view.

- Financial investment support: Such guidelines provide financial support to the companies investing in projects to reduce carbon emissions, encouraging them to do so. The carbon credit trading platform market provides a wide spectrum of shareholders as well.

Rising concern for changing climate is driving the carbon credit trading platform market

Rapidly rising concern about climate change and the necessity to reduce greenhouse gas emissions increase the importance of awareness regarding the carbon credit trading platform to save the ecology. Strong guidelines for this and the involvement of the government with robust policies with a target to decrease carbon emissions are influencing the carbon credit trading platform market. Setting some standard rules for corporations to measure carbon emissions and get certified as active participants in reducing this will be helpful. The carbon credit is considered an economic tool that can help to decrease carbon emissions and keep them safe in the future.

A cap and trade method is now extensively used by corporations, in which a cap is used over a company that emits maximum carbon and warns to reduce it. This method is used according to the market to decrease the rate of pollutants by putting a cap on the amount of pollutants that can be released. The government gives an emission allowance authority that permits certain levels of emission. Such allowances charge some price for some limit, and corporates can buy and sell them as they are tradable.

Different guidelines for different markets can lead to some problems across the region among market participants. The continuously increasing charges for carbon credits may create challenges for industries. In some specific regions, the accessibility and good quality of carbon credits generated from authentic and trustworthy projects will be hampered. Lengthy verification procedures can lately discourage project participants from entering into the carbon credit trading platform market and hence create hindrances in market development.

Carbon Credit Trading Platform Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 131.4 Million |

| Market Revenue by 2033 | USD 556.7 Million |

| Market CAGR | 17.40% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Top Companies in the Carbon Credit Trading Platform Market

- Carbon Trade Xchange

- Climate Impact X

- The Chicago Mercantile Exchange

- Carbon Credit Capital

- CarbonChain

- ClimateTrade

- Likvidi

- B3 SA

- Nasdaq, Inc.

- XPANSIVE

- Carbonplace UK Limited

- Carbon Crypto Space

- AirCarbon Exchange (ACX)

- CBL Market

- APX, Inc.

- Bluesource

- Redshaw Advisors

- South Pole

- Karbone

- Power Exchange India Limited (PXIL)

- Climex

- ClearBlue Market

- Markit

- EEX Group

Recent Development by Power Exchange India Limited (PXIL)

- In March 2024, Power Exchange India Limited (PXIL), India’s first institutionally promoted Power Exchange that provides innovative and credible solutions to transform the Indian Power Markets, launched its carbon credit trading platform.

Recent development by B3 SA

- In March 2024, B3 SA, which is a provider of securities, commodities, and futures exchange, launched a carbon credit trading platform in partnership with ACX Group for carbon credits, securities issued to neutralize greenhouse gases.

Regional Insights

Europe held the largest market share of the carbon credit trading platform market in 2023 due to awareness of climatic changes. With the constant support of the government and other corporations, their participation in environmental sustainability is highly active. The EU Emissions Trading Systems (ETS) plays an important role in controlling the climatic conditions of the Europe region.

The North American region is showing rapid growth during this predicted period, 2024 to 2033, as people are gradually becoming aware of climate change and greenhouse gas adverse effects, thus searching for methods to fight against it. Many organizations in that region are constantly working with commitments to decreasing carbon footprints and leading to sustainable surroundings. These steps promote the carbon credit trading platform market in that region.

Asia Pacific can observe notable development in the carbon credit trading platform market due to several factors associated with it. With the rise of government initiatives and industries' efforts to adopt methods that will reduce carbon emissions, the market will grow rapidly. China is now looking for an emission trading system (ETS) that suits its situation, has bid flexibility, is short of chief burdens, and can progress operations.

Market Potential and Growth Opportunities

Technological advancements and international market expansion

The governments and international contracts are striking stringent guidelines on carbon emissions. This generates a mandate for companies to counterbalance their carbon print, influencing the requirement for carbon credits. Many corporations are setting determined sustainability goals, together with trying to be carbon neutral or attain net-zero releases. Carbon credits support them to attain these objectives by capitalizing on carbon reduction projects.

Advancements in technology, like artificial intelligence and blockchain, are being used to enhance transparency, efficacy, and availability in carbon credit trading platforms. The carbon credit trading platform market is expanding worldwide by opening up new markets in different regions beyond old-style centers.

Carbon Credit Trading Platform Market News

- In November 2023, Dubai Financial Market (DFM) announced a pilot program for carbon credits trading, which is scheduled to debut at COP28.

- In October 2023, HCM CITY CT Group launched a carbon credit trading platform named ASEAN, which is proactively acclimating to international trade policies and focusing on low-carbon development.

Market Segmentation

By Type

- Voluntary

- Compliance

By System Type

- Cap and Trade

- Baseline and Credit

By End-use

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3733

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308