Cardiovascular Devices Market Revenue to Attain USD 137.26 Bn by 2033

Cardiovascular Devices Market Revenue and Trends

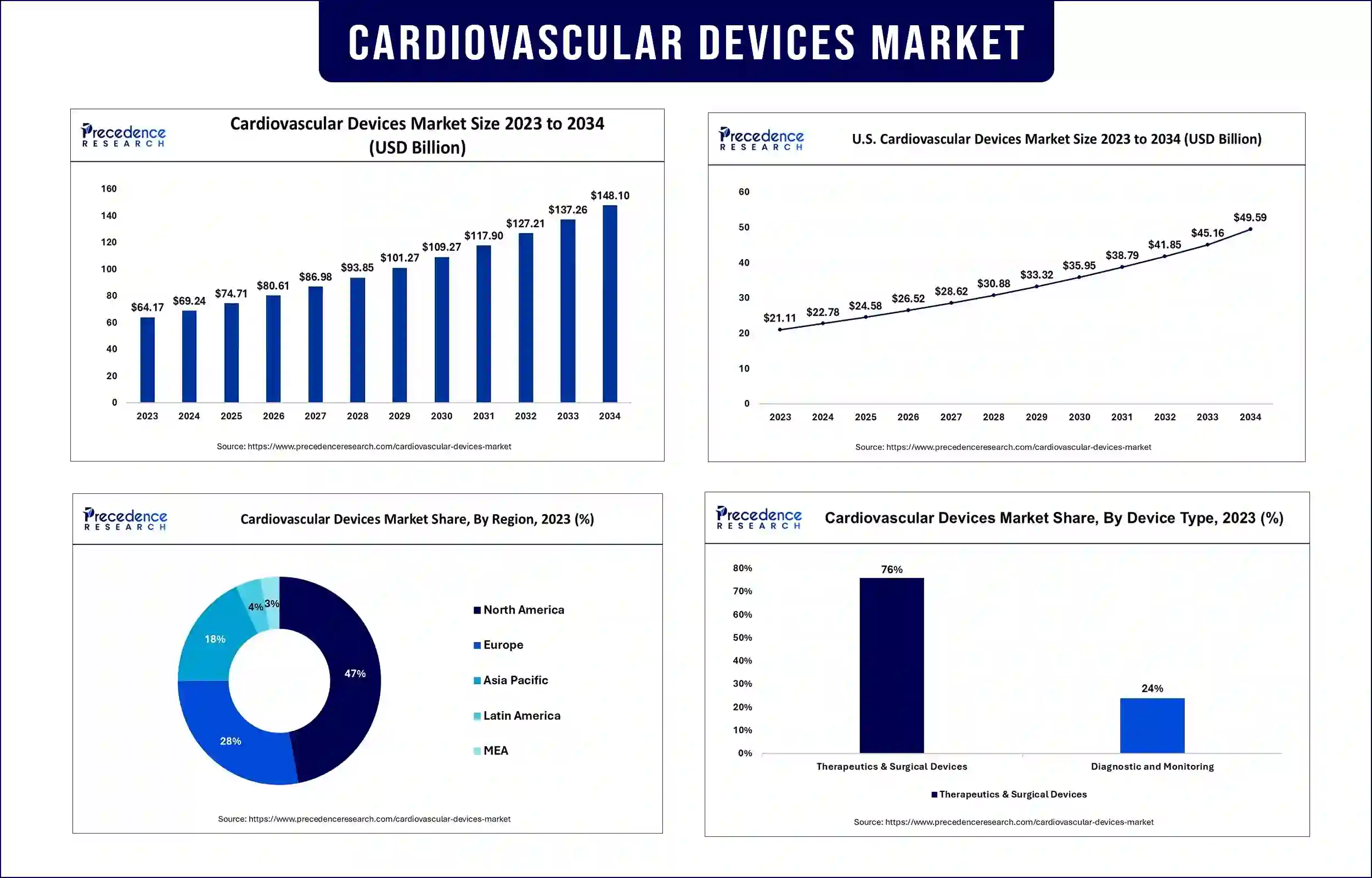

The global cardiovascular devices market revenue was valued at USD 69.24 billion in 2024 and is expected to reach around USD 137.26 billion by 2033, expanding at a noteworthy CAGR of 7.90% over the forecast period 2024 to 2033. The demand for cardiovascular devices is increasing due to the rising instances of heart patients across the globe. In addition, the rising development of advanced cardiovascular devices with cutting-edge features boosts the market.

Market Overview

Cardiovascular devices are a broad category of medical equipment used to diagnose and treat heart conditions and other related health issues. They are made to support surgical operations and illness monitoring. Stents, heart valves, grafts, catheters, electrocardiograms (ECG), remote cardiac monitoring, and cardiac assist devices are a few of the frequently utilized cardiovascular equipment.

Cardiovascular devices are widely used in the healthcare industry because they help to successfully manage life-threatening illnesses, reduce patient suffering, and improve quality of life. These days, manufacturers are concentrating on creating cutting-edge implantable cardiovascular devices, which is driving up demand for them all around the world.

Highlights of the Cardiovascular Devices Market

- On the basis of device type, the therapeutic & surgical devices segment accounted for the largest share of the market in 2023. This is mainly due to the significant increase in bypass surgeries performed worldwide. In addition, the rising demand for cardiac rhythm control devices, stents, and catheters further contributed to segmental dominance. On the other hand, the diagnostic and monitoring segment is anticipated to expand rapidly during the projection period due to the increasing awareness about the early diagnosis of the condition to prevent life-threatening risks.

- Based on application, the coronary artery disease segment led the global market in 2023. This is due to the rising prevalence of coronary artery disorders. The growing popularity of coronary stents in the treatment of coronary artery disease further bolstered the segment. However, the cardiac arrhythmia segment is projected to grow at the fastest rate during the forecast period, owing to the increasing prevalence of cardiac arrhythmia.

Market Trends

- Increasing prevalence of cardiovascular illnesses: The increasing prevalence of cardiovascular diseases around the world is a major driving of the global cardiovascular devices market. According to the World Health Organization (WHO), cardiovascular disease is one of the main causes of death, leading to 17.9 million deaths each year.

- Growing demand for advanced cardiovascular devices: With the changing lifestyle and dietary patterns, the number of patients with cardiovascular disease has increased in recent years, which significantly boosts the demand for cardiovascular devices with cutting-edge features. Heart-related diseases are not limited to only the older population. Rather, it has also become a common cause of death among the youth as well. Therefore, the cardiovascular devices market has undergone escalation in recent years which has made the public more aware than before.

- Advancements in technology: Advancements in healthcare technology led to the development of cutting-edge medical devices with the capability to monitor heart conditions remotely and provide accurate information for the treatment.

Regional Insights

In 2023, North America led the cardiovascular devices market. There is a huge demand for cardiovascular devices in the region as a result of growing prevalence of cardiovascular disorders. According to the American Heart Association, there were 18.6 million deaths related to cardiovascular illnesses in 2019. Improved access to healthcare and rising healthcare expenditures in the region contributed to regional market growth. In addition, the presence of numerous prominent manufacturers of medical devices bolstered the market in North America.

Asia Pacific is anticipated to witness rapid growth in the market in the coming years due to the increasing prevalence of chronic diseases, such as CVD, and increased government investment to expand healthcare infrastructure. Furthermore, the increasing awareness about early disease diagnosis and prevention contribute to regional market growth.

Cardiovascular Devices Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 66.57 Billion |

| Market Revenue by 2033 | USD 146.03 Billion |

| CAGR | 9.12% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In May 2024, Teijin Limited, a Japanese chemical, pharmaceutical, and information technology company, announced the introduction of a cardiovascular surgical patch for the treatment of congenital heart disease.

- In January 2024, Cleerly, Inc., a digital healthcare company, unveiled the Cleerly ISCHEMIA solution for heart disease analysis, which uses AI and machine learning algorithms to detect heart disease-associated ischemia.

- In October 2023, Abbott Laboratories, an American multinational medical devices and healthcare company, introduced its latest vascular imaging platform in India, which is powered by Ultreon 1.0 software and combines OCT with AI to provide physicians with a wide view of blood flow and blockages within coronary arteries.

Segments Covered in the Report

By Device Type

- Diagnostic & Monitoring

- ECG

- Holter Monitors

- Event Monitors

- Implantable Loop Recorders

- Echocardiogram

- Pet Scan

- MRI

- Cardiac CT

- Doppler Fetal Monitors

- Therapeutic & Surgical Devices

- Pacemakers

- Stents

- Catheters and accessories

- Guidewires

- Cannulae

- Electrosurgical Procedures

- Valves

- Occlusion Devices

- Others

By Application

- Cardiac Arrhythmia

- Coronary Artery Disease

- Heart Failure

- Others

By End User

- Hospitals

- Specialty Clinics

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1481

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344