Combined Heat and Power Market Revenue to Attain USD 47.11 Bn by 2033

Combined Heat and Power Market Revenue and Trends 2025 to 2033

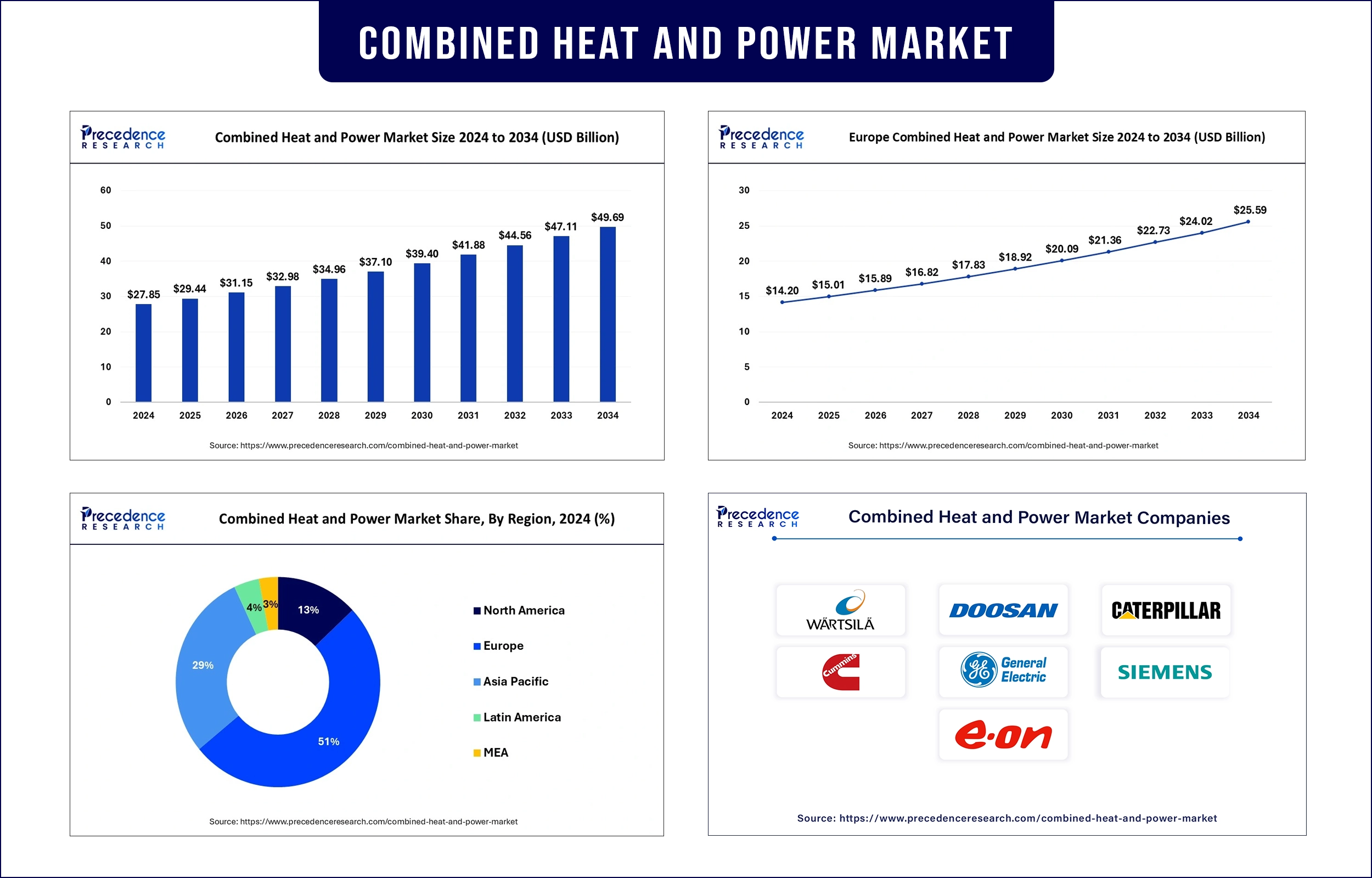

The global combined heat and power market revenue reached USD 29.44 billion in 2025 and is predicted to attain around USD 47.11 billion by 2033 with a CAGR of 5.96%. The global market is anticipated to experience significant growth, driven by increasing demand for energy efficiency and favourable government initiatives promoting sustainable energy solutions.

Market Overview

The combined heat and power market consists of systems that generate electrical power and thermal output using one continuous fuel supply. The electricity and heat-generating systems operate in chemical plants, food industries, and paper manufacturing facilities, plus residential buildings and commercial establishments worldwide. The market is seeing increasing energy-saving system adoption, matched with carbon emission reduction efforts from governmental bodies.

The U.S. Environmental Protection Agency (EPA) reports that in 2025, combined heat and power (CHP) systems will reach efficiency levels superior to 80% while traditional distinct heat and power systems will reach only 45%. Furthermore, the market for micro-CHP systems among residential properties and small businesses creates additional opportunities for technological growth.

Report Highlights

- By type, the large-scale segment represented the highest combined heat and power market share in 2024, driven by its widespread adoption across heavy industries, district heating networks, and large institutional facilities requiring substantial and consistent power loads. These systems offer higher overall efficiency and significant cost savings compared to separate heat and power generation. Meanwhile, the small-scale segment is expected to grow at a significant rate, propelled by increasing interest in decentralized energy systems.

- By technology, the fuel cell segment accounted for the largest revenue share in 2024, supported by the growing emphasis on energy efficiency and climate targets. The steam turbine segment is anticipated to grow at a steady pace throughout the projection period. Steam turbines remain favored in industrial applications due to their ability to utilize various fuels and deliver high operational reliability.

- By fuel, the coal segment is estimated to account for a considerable share of the market in terms of revenue, due to the fuel’s cleaner combustion profile, cost-effectiveness, and wide availability. The biomass segment is anticipated to grow at a steady pace throughout the projection period. Natural gas-fired systems help facilities meet stringent emission regulations while maintaining high operational efficiency, making them a preferred choice for industrial and commercial applications.

- By end user, the commercial segment dominates the market, accounting for the majority share. Government incentives and regulatory frameworks promoting high-efficiency cogeneration further reinforce the adoption across these end-user groups. The industrial segment is growing rapidly. Industries such as chemicals, refining, food processing, and pharmaceuticals increasingly invest in CHP systems to secure reliable on-site power, lower operational costs, and meet sustainability targets.

Market Trends

Rising Demand for Energy Efficiency

Facilities across the board are adopting CHP systems to achieve two major operational benefits, which include reduced fuel consumption and increased productivity. The U.S. Environmental Protection Agency (EPA) shows that CHP systems decrease energy consumption levels by about 30% versus using traditional separate power-generation systems. Operational savings with emission reductions benefit both environmental targets and financial performance indicators because of enhanced efficiency. Furthermore, the CHP systems gain traction in crucial service industries because they deliver environmental advantages, reliable operation, and economic benefits.

Government Policies Encouraging Low-Carbon Solutions

The expansion of CHP deployment relies heavily on supportive regulations and appropriate incentives. High-efficiency cogeneration receives continued support through the ongoing European Union’s Energy Efficiency Directive. The U.S. DOE has established official direction about CHP's responsibilities in both decarbonization plans and emergency power backup efforts. The market base gains support through national policies that motivate decentralized local energy generation.

Advancements in Micro-CHP Technologies

Measures of technological advancement lead to smaller yet more dependable and diverse CHP system designs. Micro-CHP technologies help expand the market for small commercial buildings and residential areas by advancing their adoption. Renewable fuels, including biogas and hydrogen, serve as operating sources for these systems to advance their capacity in low-carbon energy solutions. Clean energy transitions within important sectors get a boost through advancements in modular CHP units with fuel-adaptive turbines and improved system scalability capabilities.

- In 2024, the World Health Organization (WHO) stated that expanding low-emission energy technology use through CHP helps achieve global urban air quality goals, which decreases chronic illness risks.

Decentralized Energy Generation Supporting Grid Stability

Microgrids alongside critical infrastructure installations rely on CHP systems because these systems support self-operation while maintaining dependable performance. The combination of CHP systems provides power backup capacity to military bases and hospitals, and universities. This maintains operation stability during blackouts and severe weather conditions. Global grids continue to adopt localized energy needs through modernization efforts that lead to this expansion.

Regional Outlooks

Europe dominates the global combined heat and power market, due to the widespread use of CHP for clear environmental targets and major investments in sustainable infrastructure development. The European Union’s Energy Efficiency Directive, together with national energy transition plans, promotes high-efficiency cogeneration systems throughout every member state.

Public and private organizations maintain initiatives to expand decentralized energy distribution throughout industrial clusters with public facilities. 2024 EEA data shows that CHP systems played a major role in lowering urban zone carbon emissions, especially in Germany and the Netherlands, and Denmark. Additionally, the sustainable and reliable energy strategies and health-conscious leadership enable Europe to maintain its position as a worldwide advocate.

Asia Pacific is anticipated to witness the fastest growth in the combined heat and power market, led by China, Japan, and India, where increasing industrial activities and a growing focus on energy security fuel CHP adoption. According to IRENA International 2023 reports, Asia Pacific states are enhancing their investment in dispersed power systems, including CHP systems, to fulfill expanding electricity needs and decrease emissions.

China operated as the only country that deployed 35 GW of decentralized power capacity during the assessed period, with numerous high-efficiency CHP systems forming a significant part of the expansion. The Japan Ministry of Economy, Trade, and Industry (METI) provided additional subsidies in 2024 to promote residential and commercial micro-CHP system adoption. The regional governments designed new policies that supported CHP technologies powered by renewable resources, thus further fuelling the market in this region.

Combined Heat and Power Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 29.44 Billion |

| Market Revenue by 2033 | USD 47.11 Billion |

| CAGR | 5.96% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In February 2023, Bloom Energy introduced a new application to enhance the efficiency of its Bloom Energy Server platform, targeting markets with growing energy demand, constrained grids, and aggressive climate goals. The updated Bloom Energy Server can now be ordered with compatibility for CHP applications, increasing overall system efficiency and economic value.

- In January 2025, Catalyst Power Holdings LLC expanded the availability of its cogeneration systems to Connecticut and Massachusetts. Catalyst, through its joint venture with cogeneration specialist OHA Power, previously installed CHP systems for small and mid-sized businesses in New York and New Jersey.

- In August 2023, Bloom Energy launched the Bloom Energy Server as an industrial-grade CHP solution utilizing high-temperature exhaust streams (above 350°C) for industrial steam production and absorption chilling. Given that around 50% of global industrial energy use is directed toward steam generation, this innovation enables industries to produce clean electricity and high-temperature steam simultaneously without additional fuel input.

Combined Heat and Power Market Key Players

- Wartsila

- Doosan Fuel Cell America, Inc.

- Caterpillar

- Cummins Inc.

- Aegis Energy Services Inc.

- General Electric

- Siemens

- E.ON SE

- Tecogen Inc.

- Elite Energy Systems, LLC

- Capstone Turbine Corporation

- Clarke Energy

Market segmentation

By Type

- Large Scale

- Small Scale

By Fuel

- Coal

- Natural Gas

- Biomass

- Others

By Technology

- Gas Turbine

- Steam Turbine

- Reciprocating Engine

- Fuel Cell

- Microturbine

- Others (stirling engine and combined cyle power plants)

By Capacity

- Up to 10 MW

- 10-150 MW

- 151-300 MW

- Above 300 MW

By End user

- Residential

- Space Heating/Cooling

- Water Heating

- Cooking

- Lighting & Others

- Commercial

- Educational Institution

- District Energy

- Office Buildings

- Government/Military

- Others

- Industrial

-

- Chemicals

- Petroleum Refining

- Food

- Paper

- Primary Metals

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1892

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344