Construction Equipment Rental Market Revenue to Attain USD 71.32 Billion by 2033

Construction Equipment Rental Market Revenue and Trends

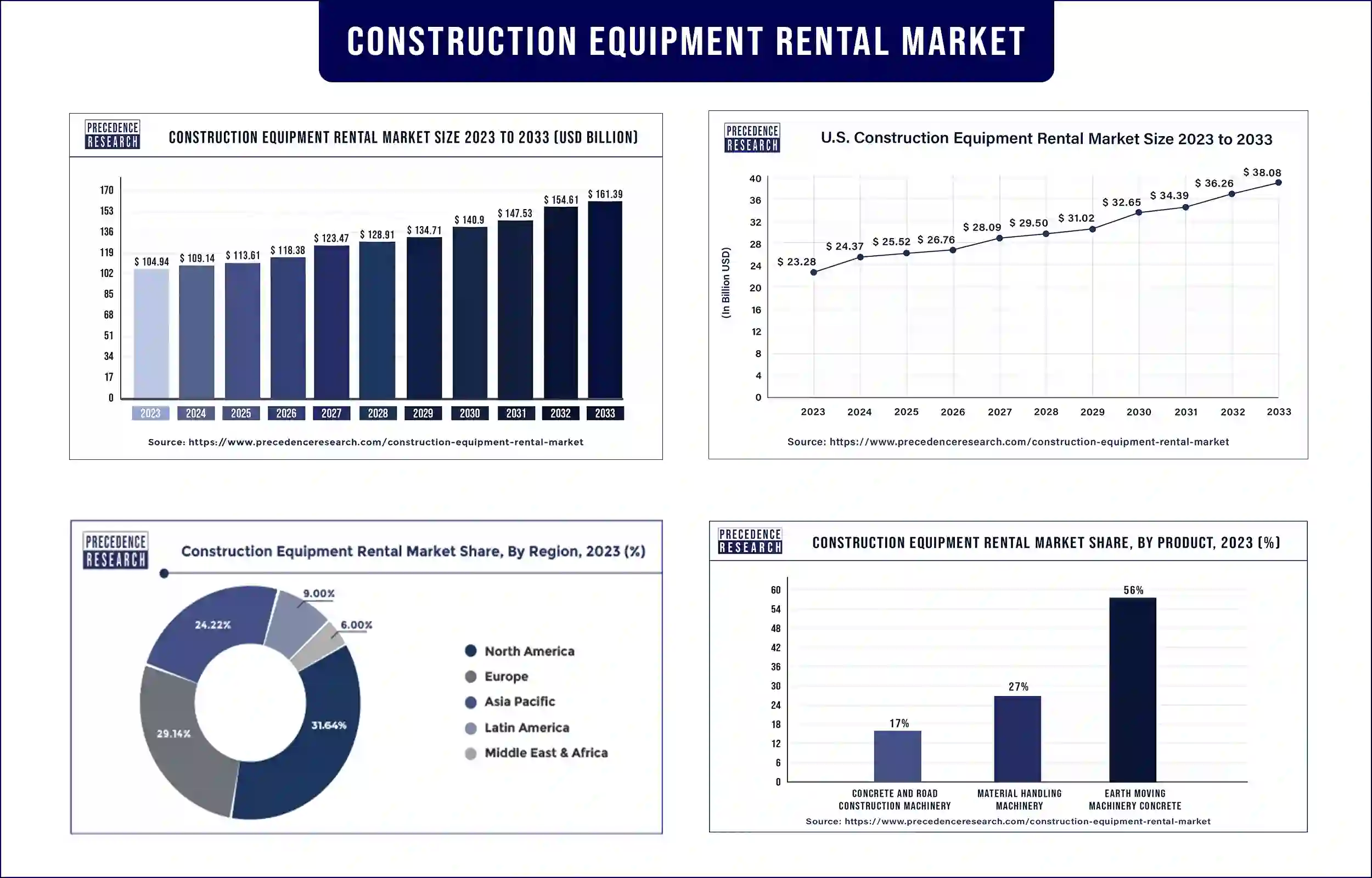

The global construction equipment rental market revenue was valued at USD 104.94 billion in 2023 and is predicted to attain around 161.39 billion by 2033, at a CAGR of around 4.44% from 2024 to 2033. The market is driven by rising construction activities worldwide and rising government spending on infrastructure development. Technological advancements are further expected to boost the market in the coming years.

Market Overview

Equipment rental, also known as plant hire, is a service that allows companies to rent out construction equipment, machinery, and tools of all types and sizes to end-users, primarily construction businesses, for a particular period. Renting is defined as receiving equipment to assist individuals who are unable to purchase it. This service allows construction businesses to hire machinery or equipment on a temporary basis, rather than purchasing it. The market is experiencing rapid growth due to the increasing government spending on public infrastructure and smart cities. Construction businesses and contractors are shifting to construction equipment leasing due to the high initial purchase cost of modern construction equipment.

Major players in the market use various business strategies, such as collaborations, mergers, acquisitions, partnerships, developing a new product line, and innovating existing products, to expand their customer base and maintain their market position.

Report Highlights

- On the basis of product, the earthmoving machinery segment led the construction equipment rental market in 2023. This is mainly due to the increased usage of earthmoving machinery, such as excavators, bulldozers, trenchers, and backhoe loaders, in mining and construction industries due to their high performance. These machineries are in high demand in the mining and construction sectors, as well as the agriculture sector. The rising construction of bridges, high-rise buildings, and public infrastructure further contributed to segmental dominance.

Construction Equipment Rental Market Trends

- Rapid Technological Advancements: Ongoing technological advancements are revolutionizing the entire construction equipment rental industry. Technological advancements have led to several innovations, such as digital service for automation and tracking and mapping, that have been proven to be extremely beneficial for the construction industry. Moreover, construction businesses are embracing automation technology to reduce labor costs and improve efficiency.

- Rising Government Investments: Governments in many countries are investing heavily in construction and mining operations. For instance, in July 2024, the Central Government of India took several initiatives to promote the exploration and mining of Critical Minerals in the country. Moreover, the rising government focus on expanding public infrastructure and improving existing ones is projected to fuel the growth of the market.

- Widespread Adoption of Automation: The construction industry is undergoing several revolutionary trends, including the deployment of autonomous and self-driving machines and automation renovation. The integration of CAD-based software programs into AGVs' maps has intensified the machines' overall operational efficiency, along with real-time routing decisions and easy navigational adjustments.

Construction Equipment Rental Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 109.14 Billion |

| Market Revenue by 2033 | USD 161.39 Billion |

| CAGR | 4.43% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in unitsLargest Market |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot

North America led the construction equipment rental market with the largest share in 2023. This is mainly due to the increased construction of residential and commercial buildings. In addition, technological advancements in construction equipment and the rapid development of public infrastructure contributed to regional dominance. However, Asia Pacific is expected to witness rapid growth in the market throughout the forecast period due to the rising mining and other industrial activities. In addition, governments in various nations, such as India and Japan, are investing heavily in the development of highways, metros, and airports, thus boosting the regional market growth.

Recent Developments in the Construction Equipment Rental Market

- In May 2024, Volvo Construction Equipment, a leading manufacturer of construction equipment, introduced its latest range of excavators, which include the ECR145 short swing, EC210, EC230, EC370, EC400, and EC500 crawler excavators, in North America that will intensify the overall safety, performance, and operatorations.

- In March 2024, Kiloutou, a France-based company specializing in rental equipment, unveiled machine-sharing technology that will help contractors share machines on a single site.

- In February 2024, CASE Construction Equipment, an Italian construction machinery manufacturer, introduced rental businesses with the latest machines and hip-pocket support.

Segments Covered in the Report

By Product

- Material Handling Machinery

- Shelves

- Bins

- Silos

- Conveyors

- Pallet trucks

- Fork lifts

- Frames

- Sliding racks

- Bulk containers

- Platform trucks

- Hand trucks

- Cranes

- Others

- Earth Moving Machinery Concrete

- Excavators

- Loading shovels

- Site dumpers

- Dump trucks

- Others

- Concrete and Road Construction Machinery

- Pavers

- Trenchers

- Planers

- Rollers

- Hot boxes

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1078

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344