Corrugated Box Packaging for Electronics Market Set for Strong Growth by 2034

Corrugated Box Packaging for Electronics Market Size, Demand and Trends Analysis

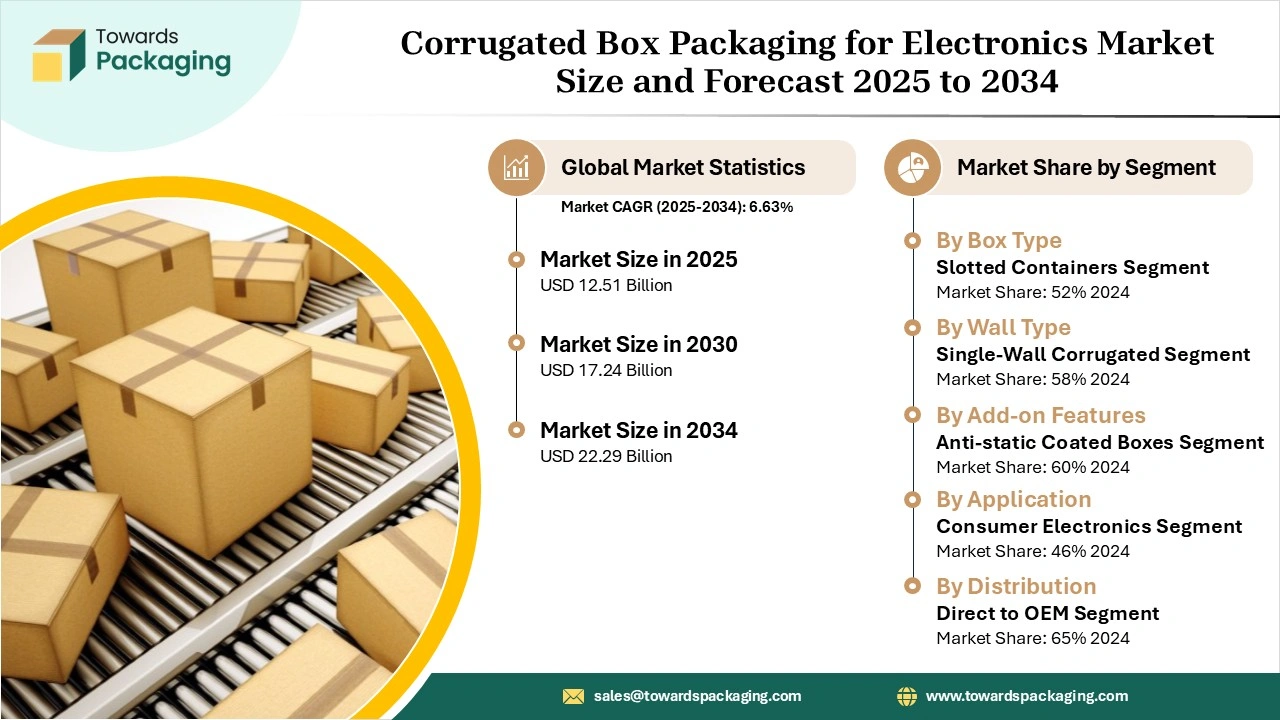

The global corrugated box packaging for electronics market size was estimated at USD 11.73 billion in 2024 and is anticipated to reach around USD 22.29 billion by 2034, growing at a CAGR of 6.63% from 2025 to 2034. Superior protection from environmental hazards, reliable cost, and logistics efficiency drive the growth of the packaging market.

Global Outlook

The corrugated box packaging for the electronics market is driven by the increased demand for online shopping and the expansion of e-commerce. The increased focus on sustainability has brought several sustainable products into the market, which include recycled and renewable materials, biodegradable adhesives, and recycled plastic. Furthermore, the integration of smart technologies facilitated real-time tracking, enhanced security, and custom-fit designs of products.

Market Opportunity

The corrugated boxes are popular and are experiencing growth in the global market due to their unique features related to sustainability, durability, cost, and primary use. They are becoming more affordable for shipping and bulk packaging. They are extensively used for shipping larger electronics and outer packaging.

Key Growth Factors

A rising emphasis on sustainable packaging, the e-commerce boom, and optimized logistics raised the importance of the corrugated box packaging for the electronics market.

The specialized features of products, enhanced brand image, and reduced plastic usage accelerated the manufacturing and packaging of innovative products.

Market Restraint

The prominent challenges in the corrugated box packaging for the electronics market are associated with supply chain issues, e-commerce demands, sustainability, and the need for protective features in products. The higher costs from inefficient packaging impose potential concerns for e-commerce and shipping.

Segmental Outlook

Box Type Insights

How does the Regular Slotted Containers Segment Dominate the Corrugated Box Packaging for Electronics Market in 2024?

The regular slotted containers segment dominated the market in 2024, owing to their major role in providing structural protection, cost efficiency, and sustainability. They offer customization options and solutions to enhance security. They deliver reduced shipping costs, recyclability, and storage and assembly efficiency.

The die-cut corrugated boxes segment is expected to grow at the fastest CAGR in the market during the forecast period due to superior protection, high-quality branding, and visual appeal. They offer reduced shipping costs, reduced waste, and efficient storage. They exhibit features such as moisture resistance, enhanced durability, and integrated inserts.

Wall Type Insights

What made Single-Wall Corrugated the Dominant Segment in the Corrugated Box Packaging for Electronics Market in 2024?

The single-wall corrugated segment dominated the market in 2024, owing to the availability of this cost-effective, sustainable, and customizable solution. It provides branding opportunities, and its surface is ideal for printing high-quality graphics. These types of boxes are environmentally friendly packaging solutions.

The double-wall corrugated segment is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced durability, superior protection, and reliability provided by these products. It enhances brand reputation and is ideal for heavy-duty applications. They provide good protection for electronics during shipping.

End-Use Application Insights

How did the Consumer Electronics Segment Dominate the Corrugated Box Packaging for Electronics Market in 2024?

The consumer electronics segment dominated the market in 2024, owing to the excellent features such as improved customer experience, branding, cost-effectiveness, etc., offered by consumer electronics products. These products also offer recyclable, renewable, and biodegradable options. The custom-printed boxes are available in the market with a professional appearance, which raises their consumer demand.

The industrial and automotive electronics segment is expected to grow at the fastest CAGR in the market during the forecast period due to exciting advantages from precision manufacturing, quality control, reduced production costs, and predictive maintenance. The products from automotive electronics help in real-time monitoring, tracking, and environmental condition sensing. It enables controlled and advanced automated manufacturing processes that enhance the functionality of packaging.

Add-On Features Insights

Which Segment by Add-On Features Dominated the Corrugated Box Packaging for Electronics Market in 2024?

The anti-static coated boxes segment dominated the market in 2024, owing to their key role in preventing electrostatic discharge (ESD) damage and ensuring product reliability. They reduce costly returns and replacements while meeting industry standards. They offer mechanical protection and improve operational efficiency.

The ESD safe packaging segment is expected to grow at the fastest CAGR in the market during the forecast period due to decreased product failures and simplified inventory management. It plays a vital role in ensuring product quality and meeting industry compliance. It provides strong protection, moisture resistance, customization, and sustainability.

Distribution Channel Insights

How does the Direct-to-OEM Segment Dominate the Corrugated Box Packaging for Electronics Market in 2024?

The direct-to-OEM segment dominated the market in 2024, owing to the potential in delivering cost-efficiency and improving the supply chain. It facilitates more efficient transportation and optimized logistics. It encompasses high-quality materials, customized and precise design, and consistent quality control.

The e-commerce retail packaging segment is expected to grow at the fastest CAGR in the market during the forecast period due to brand building, marketing, logistical efficiency, and smart packaging. It reflects brand quality, increases business loyalty, and improves consumer trust. It impacts cost management, brand perception, and everything involved in retail businesses.

Geographical Outlook

North America

North America dominated the corrugated box packaging for electronics market in 2024 owing to the sustainability initiatives by the government regulations, the growing consumer demands, and significant policy changes. These rationales are driving increased investments in sustainable manufacturing and product packaging. The expanded number of manufacturers, numerous business acquisitions, and more efficient facilities in North America increase production capacity for sustainable packaging solutions. The region is witnessing the production of recyclable products by manufacturers, along with meeting stringent government regulations.

U.S.

The U.S. government adopted a national strategy for advanced packaging under the CHIPS for America program. This initiative aims to ensure the security and resiliency of the U.S. supply chain for advanced electronics.

- In January 2025, the U.S. Department of Commerce announced $1.4 billion to support the next generation of U.S. semiconductor advanced packaging.

- In October 2024, the Biden-Harris Administration announced the funding competition for up to $1.6 billion to boost the U.S. semiconductor advanced packaging technologies.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR in the corrugated box packaging for electronics market during the forecast period due to various government initiatives launched to enhance electronics manufacturing and promote sustainable packaging for corrugated boxes. The various Asian Pacific countries, like India, China, South Korea, and Australia, have taken initiatives and have set packaging reforms. The region focuses on adopting biodegradable, recyclable, and environmentally friendly products and services. The e-commerce evolution in Asia and the Pacific creates several opportunities and challenges.

India

India provides incentives under the ECMS for domestic production of electronic components. These financial incentives help to overcome manufacturing disabilities and achieve economies of scale.

- In April 2025, Shri Ashwini Vaishnaw, the Union Minister for Electronics and Information Technology, introduced the guidelines and portal for the Electronics Component Manufacturing Scheme (ECMS) that will strengthen India’s electronics manufacturing ecosystem.

Strategic Moves by Key Players

- In May 2025, International Paper launched a transformative construction of the state-of-the-art corrugated box plant in Waterloo, Iowa.

- In January 2024, WestRock announced the establishment of a new corrugated box plant in Wisconsin.

Corrugated Box Packaging for Electronics Market Companies

- International Paper

- WestRock

- DS Smith

- Mondi PLC

- Smurfit Kappa Group

- TGI Packaging Pvt. Ltd.

- Econovus Packaging Pvt. Ltd.

- Silicon Safepack Pvt. Ltd.

- Square Solutions

- Packman Packaging

Corrugated Box Packaging for Electronics Market Segments covered in the report

By Box Type (Product Type)

- Regular Slotted Container (RSC)

- Half-Slotted Container (HSC)

- Die-Cut Corrugated Boxes

- Telescopic Boxes

- Fold-Over or Wrap-Around Boxes

By Wall Type

- Single-Wall Corrugated

- Double-Wall Corrugated

- Triple-Wall Corrugated

By End-Use Application

- Consumer Electronics (Smartphones, Laptops, TVs)

- Electronic Components & Accessories

- Industrial & Automotive Electronics

By Add-On Features

- Anti-Static/ESD Protection

- Cushioned/Foam Lined Interiors

- Tamper-Evident or Printed Packaging

By Distribution Channel

- Direct to OEMs / Electronics Manufacturers

- Packaging Converters & Custom Box Suppliers

- E-commerce / Retail Distributors

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: https://www.towardspackaging.com/insights/corrugated-box-packaging-for-electronics-market-sizing