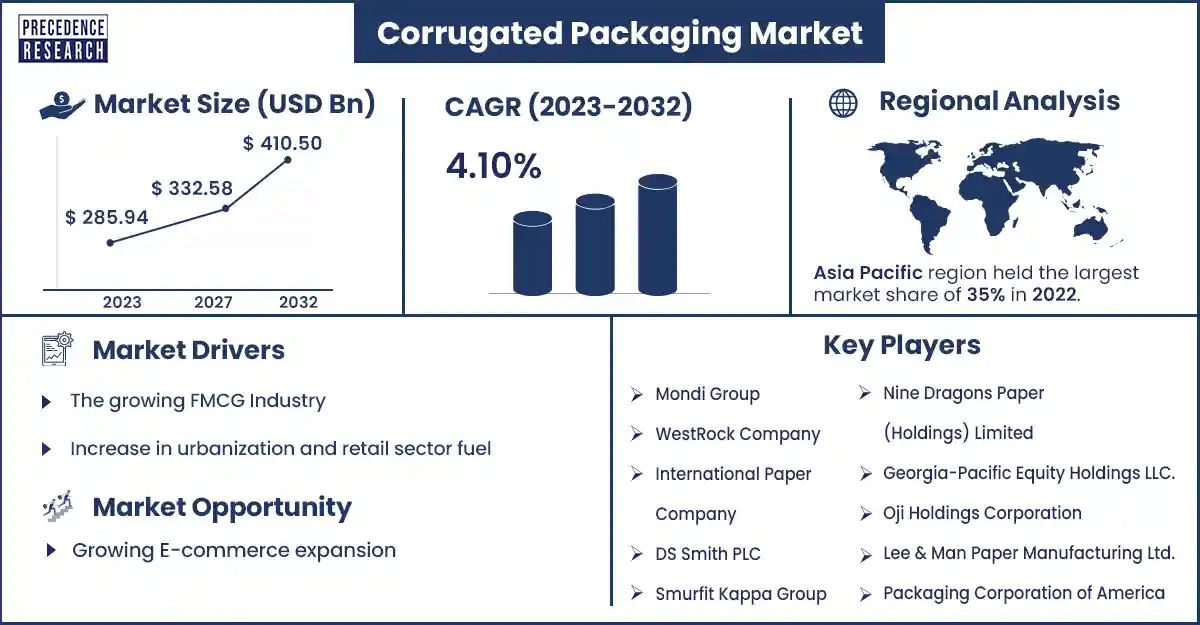

Corrugated Packaging Market Size to Attain USD 410.50 Bn by 2032

The global corrugated packaging market size surpassed USD 285.94 billion in 2023 and is estimated to attain around USD 410.50 billion by 2032, growing at a CAGR of 4.10% from 2023 to 2032. Corrugated packaging material is used in the retail sector and is gaining more grip as e-commerce sales are increasing worldwide.

Market Overview

The corrugated packaging market includes corrugated retail display stands, primarily corrugated boxes, and secondary shipping corrugated boxes, which are used for packing retail trade services, non-manufacturing items trade, durable products, and non-durable products. Corrugated Packaging consists of three or more layers of paper, known as corrugated fiberboard. Corrugated board packaging is a product that effectively preserves, protects, and transports several goods. Its benefits include recyclability, being lightweight, cost-effective, flexible, durable, and biodegradable. The market deals with personal and household care, fresh food and beverages, processed food, electronic goods, and paper products. The major factors boosting the market growth are the growing demand for sustainable packaging and the expansion of e-commerce platforms.

The growing FMCG Industry and increase in urbanization and retail sector fuel the corrugated packaging market growth

The Fast-moving consumer goods sector (FMCG) plays a pivotal role in the corrugated packaging industry. FMCG products, including food, beverages, personal care items, and household products, require reliable packaging solutions. Corrugated Packaging, with its durability, printability, and protection, ensures product safety, ease of transportation, and visual appeal on store shelves, instilling confidence in retailers.

The demand for corrugated Packaging is rising due to the growing urbanization and retail sector in developing countries. The increase in urban population and the expansion of retail infrastructure create a need for efficient packaging solutions to transport goods from manufacturers to retailers. Corrugated Packaging is the answer due to its versatility, strength, and cost-effectiveness.

However, competition from alternative packaging materials and extreme weather conditions can restrain the growth of the corrugated packaging market. Corrugated Packaging faces competition from other packaging materials like flexible Packaging, plastics, and rigid Packaging. These materials have advantages like being durable and lightweight and offering unique design options. Companies exploring different packaging solutions may shift away from corrugated Packaging, impacting its demand.

Corrugated Packaging Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 285.94 Billion |

| Projected Forecast Revenue by 2032 | USD 410.50 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.10% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Corrugated Packaging Market Top Companies

- WestRock Company

- Smurfit Kappa Group

- Georgia-Pacific Equity Holdings LLC.

- Cascades Inc

- Mondi Group

- Packaging Corporation of America

- DS Smith PLC

- Oji Holdings Corporation

- Nine Dragons Paper (Holdings) Limited

- International Paper Company

- Lee & Man Paper Manufacturing Ltd.

- Cascades Inc.

- Kite Packaging

Recent Development by Kite Packaging

- In February 2024, a UK-based premier packaging supplier launched corrugated fan-fold sheets of cardboard. Large-scale businesses can produce bespoke boxes with these fan-fold corrugated sheets using automated box-making machines. The boxes will be resistant to compression and crushing.

Recent Development by Cascades Inc.

- In January 2024, Cascades launched corrugated packaging basket designs. These innovative baskets are made from 100% recycled fibers. The company said that recycled corrugated cardboard supports the consumers by decreasing their environmental significance while meeting customer needs for increasingly eco-friendly packaging.

Regional Insights

North America is estimated to grow fastest in the forecast region. The strict government rules towards the use of environmentally friendly packaging materials, coupled with the increased customer awareness related to the usage of eco-friendly products, have driven the growth of the corrugated packaging market. The major countries that dominated the market growth are the U.S. and Canada in North America.

In the USA, the majority of all the material transportation is handled by corrugated box manufacturers. According to research, the market value is in billions. Due to the increasing demand and expansion of industry, there are more corrugated packaging manufacturers in the United States than before. There is an abundance of skilled labor and low production costs due to the various advantages of manufacturing.

- For instance, in October 2023, ISRI, the Fiber Recycling Readiness Tool, was launched in the U.S. This innovative tool focused on corrugated packaging, paperboard, and paper recycling in the U.S. It is the biggest development for the recycled product industry in the U.S.

Asia Pacific dominated the corrugated packaging market in 2023. The increasing expansion of e-commerce and several online shopping platforms in Asia Pacific is driving the demand for corrugated packaging. Most of the healthcare, homecare, and electronics products are manufactured in the region and supplied worldwide. China and India are the leading countries in the APAC region that use corrugated packaging.

The market is expanding further due to the rising demand for eco-friendly packaging options. Initiatives by governments, such as the ban on plastic Packaging in India, also contribute to the growing preference for paper packaging. Moreover, the region is seeing a significant influx of foreign direct investments (FDIs) and investments in various packaging projects, leading to a substantial boost in the Asia Pacific corrugated packaging market.

In China, corrugated packaging is used extensively by e-commerce companies such as Amazon and Flipkart. This will help to develop a corrugated packaging business and import from China. There are various types of corrugated boxes manufactured in China, such as printed corrugated boxes, ply corrugated boxes, folding cardboard boxes, heavy-duty cardboard boxes, corrugated mailer boxes, etc. Cardboard packaging boxes are made to be recycled. So, many corrugated packaging box producers will recycle and resell them to consumers from all parts of the globe. In China, corrugated packaging paper imports have risen rapidly due to the increasing cost of China’s reduction of import tax rates and domestic corrugated base packaging paper production.

- For instance, in June 2023, P&G and Dow partnered with Gamble & Procter China for reusable air capsule e-commerce packaging. The reusable air capsule packaging decreases the weight of the material by 40% compared with corrugated packaging parcel boxes.

- For instance, in China, Shanghai DE printed box is the major corrugated packaging manufacturer and supplier. There are so many customized corrugated boxes and corrugated die-cut boxes, fruit cartons, shipping cartons, and folding cartons.

Market Potential and Growth Opportunities

E-commerce expansion

The popularity of online shopping is increasing the demand for corrugated Packaging. Due to the growth of e-commerce, the demand for safe, adaptable, and environmentally friendly packaging solutions is also rising. Companies that can meet the needs of online retailers, such as simple assembly, tamper-proof closures, and ideal size and weight, have opportunities.

Technological advancements

Advanced technologies are revolutionizing the corrugated packaging industry. Digital printing enables businesses to print custom packaging for smaller orders on demand, increasing flexibility. Automation and AI optimize packaging design and logistics, enhancing sustainability and reducing costs. These technologies offer opportunities for companies to improve efficiency and personalization, meet customer demands, and foster growth. These major opportunities may drive the demand for corrugated packaging market in the coming years.

Corrugated Packaging Market News

- In May 2023, International Paper proposed a $100 million investment to increase its corrugated packaging capacity in North America. The investment included improving corrugated packaging operations in Texas and Wisconsin as well as building a new corrugated sheet mill in Georgia.

- In April 2023, Smurfit Kappa Group purchased renowned corrugated packaging manufacturer Corrugated Containers, Inc., increasing its market share in the United States corrugated packaging industry and strengthening its standing as a dominant power in the sector.

Market Segmentation

By Package Type

- Single Wall Boards

- Double Wall Boards

- Triple Wall Boards

- Single Face Boards

By Application

- Electronics & Electricals

- Food & Beverages

- Transport & Logistics

- E-Commerce

- Personal Care Goods

- Healthcare

- Homecare Goods

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1526

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308