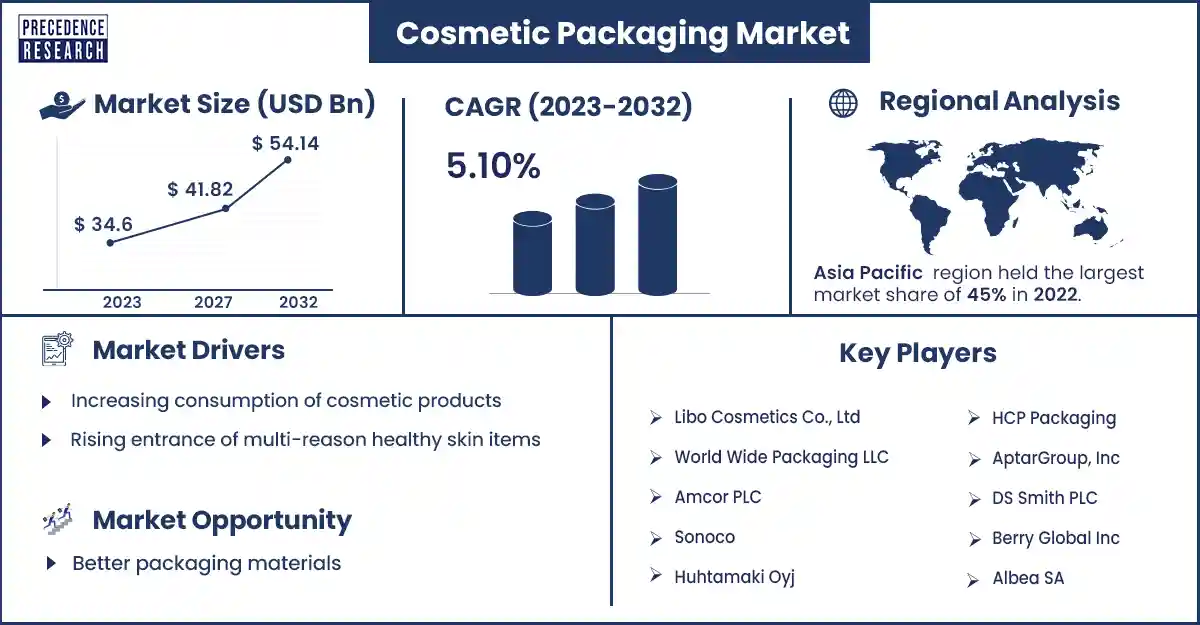

Cosmetic Packaging Market Size to Hit USD 54.14 Bn by 2032

The global cosmetic packaging market size surpassed USD 34.6 billion in 2023 and is estimated to hit around USD 54.14 billion by 2032, poised to grow at a CAGR of 5.10% from 2023 to 2032.

Market Overview

The cosmetic packaging market is a global industry that supplies packaging solutions for cosmetic products. Cosmetic packaging plays an important role in various kinds of cosmetic products. Various cosmetic packaging designs are generally used to make cosmetics packaging look engaging and attractive. The increasing need for cosmetics to help consumers improve their attractive appearance is expected to enhance market growth. Rising demands for reusable and fresh packaging lead to decreased waste and money.

In the forecast period, convenient packaging and travel-friendly options are driving the market growth of cosmetic packaging. In addition, changing grooming structures between both gender types is leading to the need for cosmetics. The expansion of the cosmetic packaging market has also been influenced by the rise in cosmetic sales over the globe, owing to the increasing growth and social lifestyles in the women's class over the years.

Regional Snapshot

Asia Pacific dominated the cosmetic packaging market in 2023. China is showcasing more than three-fifths of the total share of the Asia-Pacific region. Over three-quarters of the region's overall share was held by China alone. After the US, China is the second-largest cosmetics market in the world. In addition, it is anticipated that the usage of cosmetics would rise due to the region's and the nation's expanding youth population as well as the fastest-growing discretionary income flow. The usage of virtual entertainment platforms to reach and impact youth is just one way that digital transformation is fostering company growth in the area. Growing environmental consciousness among adults has resulted in a rise in the use of eco-friendly and sustainable packaging materials, including glass, paper, board, and hardwood designer packaging (particularly bamboo).

In Asia Pacific, NARS cosmetics has launched Indian beauty products. The president and CEO of Shiseido talked about the passion of Indian customers. With the launch of NARS in India, they said that the Indian cosmetic market and customers' expectations have developed outstandingly in the past few years, and Indian customers are actively adding global brands to their collection of cosmetic products. Further, they said they are focused on the meeting, product innovation, and cosmetic packaging.

North America is estimated to grow fastest in the forecast period. The United States was exceptionally overwhelmed due to North America getting second positions on the lookout. In beauty care and its bundling, the U.S. is the biggest market. The makers in the location are choosing green bundling arrangements and regular products. Not only do the big manufacturers in the U.S. export packaged materials to other countries, but the local manufacturers are also prominent in the market, which is shifting to more sustainable options.

Cosmetic Packaging Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 34.6 Billion |

| Projected Forecast Revenue by 2032 | USD 54.14 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.10% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing consumption of cosmetic products

In developing regions, the cosmetic packaging market is vastly increasing its footmark, and due to this, the requirement is also increasing. The major factors driving the demand for beauty products are rising customer consciousness towards cosmetic and beauty products and increasing disposable income. Customers have also become more comfortable purchasing cosmetics as clean products that are organic, chemical-free, and eco-friendly, and several greens are available in the market.

Moreover, cosmetic brands are smartly branding their products to attract more customers. Apart from that, digital transformation has also created a new approach to growth for the market as social media influencers are reaching out to more consumers. This factor has also raised the competition in customized and specialized cosmetic packaging space as small cosmetic industries are adopting these solutions to obtain identification and key players operating in this cosmetic packaging market. It will also help them to attract more buyers to their items.

Restraint

Increasing environmental concerns

In many industries, plastic is the most used packaging material, and most of it is dumped into waste materials. Many of the primary packaging is made of single-use plastics, and most of them are multipurpose to make them look attractive, which adds to the extra wastage of plastics. Moreover, it was found that personal care products. Small plastic particles are added to discard the skin in rinse-off personal care products because of significant damage to the marine environment and other water bodies.

Today, many regions have restricted the use of microbeads in cosmetics. These regions include South Africa, Sweden, Italy, New Zealand, Canada, France, the U.K., and many others. This represents the rising awareness of the usage of plastics in packaging and formulation all over the world and changing customer preferences. These factors may restrain the growth of the cosmetic packaging market.

Opportunity

Better packaging materials

Finding practical and creative packaging solutions that satisfy industry standards without compromising aesthetics is crucial because the majority of cosmetics are readily harmed by heat or light. The length of the cosmetic product's shelf life is largely determined by both the formulation and the material of the container. The packaging material must fulfill the demands of the intended audience and work well with the product's composition. Because of their limited shelf life, cosmetics should be kept as fresh as possible. These goods could stay on shop shelves and in warehouses for extended periods of time without being bought. They also traverse large distances.

Recent Developments

- In October 2023, Dow launched the SURLYN and REN CIR. These are the two new reusable ionomer grades that introduce the use of circular and renewable feedstocks. These new grades offer an important presence in the cosmetic packaging market and the plastics industry. The new SURLYN grades will authorize beauty brands and producers to create reusable and high-quality cosmetic packaging that catches the eye on the shelves.

- In October 2023, Eastman introduced the cosmetic packaging solutions provider. ICONS has launched the mono-material cosmetic compact. The eco-friendly packaging is the result of a co-innovation lead between highlights and partners in their commitment to reusable packaging solutions.

- In November 2023, Glass's primary packaging maker, SGD Pharma, launched manufacturers to use a new lightweight glass bottle named NOVA to decrease their environmental impact without visual appeal or compromising style.

- In June 2023, Oriflame and Albea Tubes will launch the Duologi range together, which is planned in line with Albea's sustainability aims for the packaging of Oriflame's “Rich Creme Conditioner.”

Key Market Players

- Libo Cosmetics Co., Ltd

- World Wide Packaging LLC

- Amcor PLC

- Sonoco

- Huhtamaki Oyj

- HCP Packaging

- AptarGroup, Inc

- DS Smith PLC

- Berry Global Inc

- Albea SA

- TriMas Corporation

Segments covered in the Report

By Type

- Flexible Plastics

- Aerosol Cans

- Containers

- Tubes

- Folding cartons

- Blister & Strip Packs

- Jars

- Others

By Application

- Oral Care

- Skin Care

- Hair care

- Beauty Care Products

- Nail Care

By Components

- Paper-based

- Glass Metal

- Flexible Packaging

- Rigid Plastic

By Capacity

- < 50 ml

- 50 ml – 100 ml

- 100 ml – 150 ml

- 150 ml – 200 ml

- >200 ml

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1876

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308