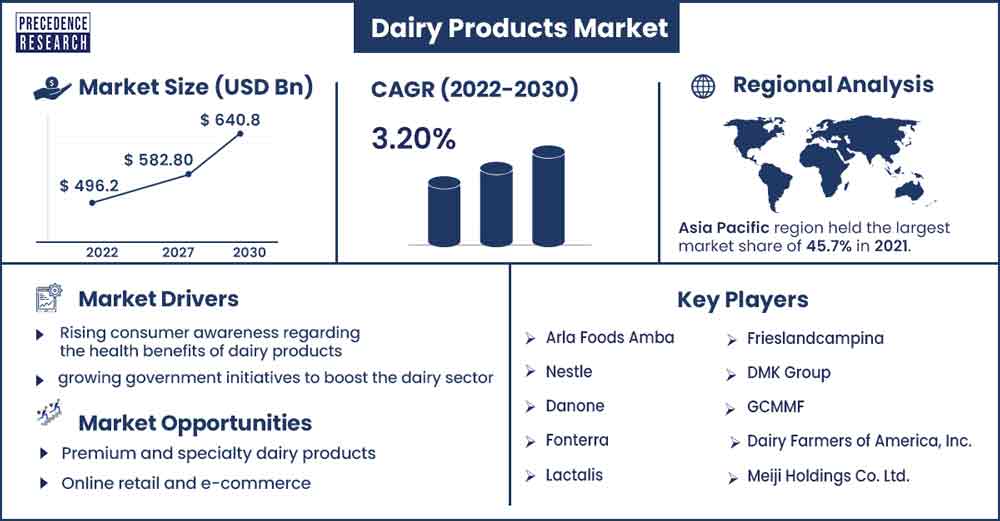

Dairy Products Market Size To Attain USD 640.8 Bn By 2030

The global dairy products market size surpassed USD 496.2 billion in 2022 and is projected to attain around USD 640.8 billion by 2030, growing at a CAGR of 3.2% from 2022 to 2030.

Market Overview

Dairy products contain a diverse range of food items derived from milk, such as ghee, cheese, yogurt, and butter. These products are integral to various cuisines worldwide and provide essential nutrients like calcium and protein. The increasing global dairy products market is being driven by dynamic shifts in customer preferences and eating habits.

Milk, a basic household necessity, comes in a variety of forms, including cow, goat, and plant-based alternatives. This diversity is being pushed by rising knowledge of lactose sensitivity and the growing popularity of vegan diets. Plant-based milk substitutes like almond, soy, and oat milk are becoming increasingly popular as consumers seek healthier and more sustainable options.

The dairy business is undergoing tremendous transformations driven by sustainability, quality control, and ethical dairy production practices. Consumers are becoming more aware of the industry's environmental impact, resulting in a greater demand for items made using sustainable and eco-friendly processes. The COVID-19 epidemic has had a significant impact on the market, with an increasing emphasis on nutritious, home-cooked meals. This has increased demand for dairy products, which are seen as vital for a well-balanced diet.

Looking ahead, as the world population grows, the dairy products industry is likely to increase even further. Emerging economies, characterized by rising incomes and urbanization, offer enormous potential to market actors. Furthermore, the rise of online shopping and e-commerce is making dairy goods more accessible, which is fuelling market expansion. The industry's trajectory is influenced not only by changing consumer preferences but also by developments in manufacturing methods and technology, highlighting the necessity of sustainability and ethical standards in satisfying the demands of an increasingly discerning consumer base.

Regional Snapshot

The Asia Pacific area stands out in the global dairy products market due to its large population, rising milk demand, and significant increase in milk production. The Asia Pacific region has a massive and rapidly growing population. With countries like China and India, which have large populations, there is a substantial consumer base for dairy products. The sheer size of the population creates significant demand for various dairy products. As economies in the region have grown, there has been a shift in dietary patterns. Rising incomes and urbanization have led to an increase in the consumption of dairy products, including milk, yogurt, cheese, and butter.

The middle class in many Asian countries has become more receptive to Western-style diets, which often include a variety of dairy products. The globalization of food culture has led to the integration of various dairy products into local cuisines. Western-style foods that use dairy, such as pizzas, burgers, and desserts, have gained popularity in many Asian countries. Some governments in the region have actively supported the dairy industry through policies, subsidies, and investments in infrastructure. These initiatives have helped boost the production and distribution of dairy products.

Dairy Products Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 511.6 Billion |

| Projected Forecast Revenue by 2030 | USD 640.8 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 3.2% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health and wellness trends

The dairy products industry is driven by a more significant health and wellness movement, wherein customers are more aware of the nutritional value of their food. Dairy products are recognized for their high protein and calcium content and are regarded as necessary components of a healthy diet. Furthermore, the market is experiencing an increase in demand for functional dairy products that provide health advantages beyond basic nutrition. Probiotic-rich yogurts, for example, correspond to customer preferences for items that support gut health. As health-conscious consumers seek out foods that benefit their well-being, the market responds with novel dairy products that cater to these changing trends, resulting in total market growth.

Awareness of A2 milk

A2 milk is gaining popularity as people become more aware of its potential digestive benefits over ordinary A1 milk. Some claim that A2 milk is easier to digest because it solely contains the A2 form of beta-casein protein, rather than the A1 type found in conventional milk. This trend in consumer preferences is particularly noticeable in North America, where people are looking for options that are friendlier on their digestive systems. The purported health benefits of A2 milk have helped to drive market expansion, and dairy producers are responding by developing A2 milk products to fulfil demand.

Restraint

Concerns about perceived health impacts

Increased health worries about hormones and antibiotics in regular dairy products have caused consumers to reconsider their options. Increased understanding of these issues has reduced faith in traditional dairy, leading to a shift toward organic and natural alternatives. This shift in consumer perception has had a substantial impact on market dynamics, resulting in increased demand for cleaner labels and transparent sourcing processes. Producers are adapting by selling products that meet these expectations, stressing organic farming processes, and providing detailed information about sourcing and production methods. This trend is part of a larger push in the dairy products sector for more health-conscious and informed consumer choices.

For example, organic milk sourced from farms following sustainable and ethical practices has gained popularity, reflecting a shift in consumer choices driven by health consciousness and a desire for more transparent and responsibly produced dairy options in the Asian market.

Opportunities

Premium and specialty dairy products

The market for premium and specialty dairy products offers a chance to differentiate and cater to discriminating customers. Artisanal cheeses, made with distinct flavours and manufacturing methods, provide a unique experience for consumers who value the craftsmanship of cheesemaking. Organic yogurts, made with high-quality ingredients and natural procedures, cater to the growing need for healthier alternatives. High-quality butter, produced from grass-fed cows, appeals to consumers looking for higher flavour and nutritional value. This specialist market category enables dairy producers to charge higher prices and establish brand loyalty among consumers, who value unique and elevated dairy experiences.

Online retail and e-commerce

The growing trend of online retail provides a new way for dairy producers to connect with customers. Establishing a strong online presence and leveraging e-commerce platforms makes dairy goods more accessible and convenient for consumers. Direct-to-consumer sales via online platforms allow companies to reach a larger geographic market and engage with a more tech-savvy consumer base. Online platforms also provide options for marketing, tailored promotions, and obtaining valuable consumer feedback. As consumers increasingly embrace online buying, dairy producers can boost their competitiveness by adopting digital methods and developing smooth online experiences for their customers.

Browse: Fruit Preparation For Dairy Market Demand till 2030

Recent Developments

- In January 2024, Mother Dairy successfully introduced its new variant of pure buffalo milk in the Delhi NCR area. Featuring a creamy texture and rich taste profile, it contains 6.5% fat content and 9% SNF (Solid, Not Fat). This offering, inclusive of A2 protein, was strategically designed to align with specific health preferences.

- In April 2023, Imagindairy, an Israeli food tech company, launched animal-free milk proteins produced through precision fermentation. The proteins are identical to cow’s milk but sourced without animals or plants.

Major Key Players

- Arla Foods Amba

- Nestle

- Danone

- Fonterra

- Lactalis

- Frieslandcampina

- DMK Group

- GCMMF

- Dairy Farmers of America, Inc.

- Meiji Holdings Co. Ltd.

- The Kraft Heinz Company

Market Segmentation

By Product Type

- Milk

- Cheese

- Butter

- Desserts

- Yogurt

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1322

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308