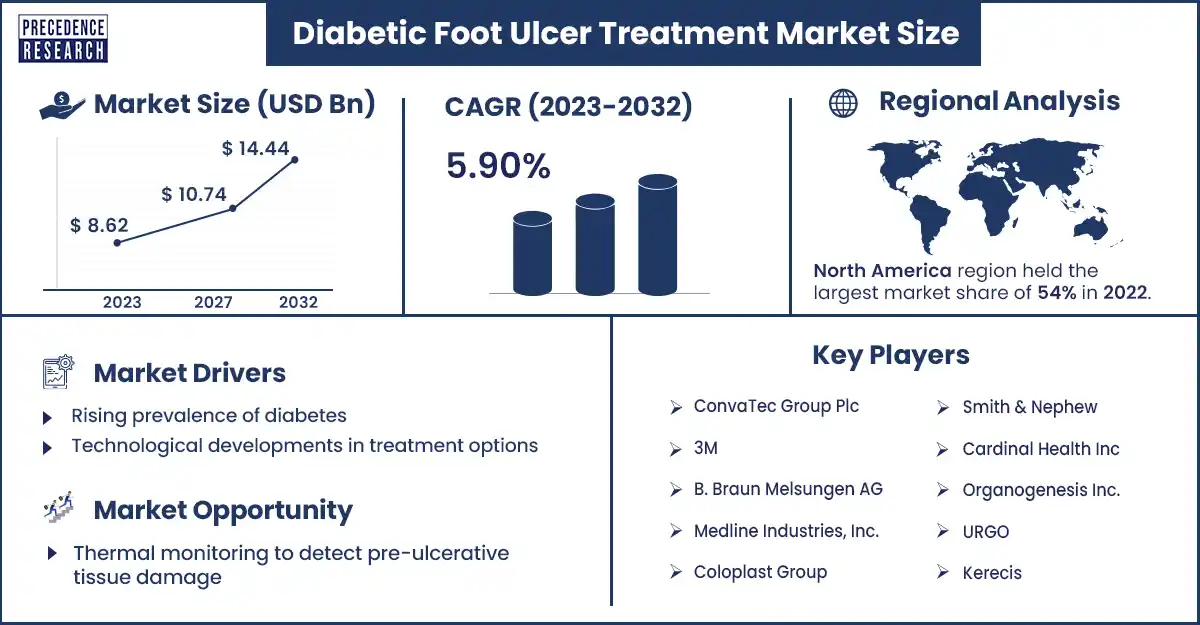

Diabetic Foot Ulcer Treatment Market Size to Attain USD 14.44 Bn by 2032

The global diabetic foot ulcer treatment market size was evaluated at USD 8.62 billion in 2023 and is projected to attain around USD 14.44 billion by 2032, growing at a CAGR of 5.90% from 2023 to 2032.

Market Overview

The diabetic foot ulcer treatment market deals with the procedures, medicines, biologics, and devices for treating foot ulcers that are caused by diabetes. The market is mainly driven by factors such as the increasing adoption of novel wound care appliances for treatment and the continuously increasing frequency of diabetic foot ulcers. Diabetic foot ulcer is a common issue in diabetic patients, especially in geriatric people. The increasing awareness about the accessibility of treatment options for diabetic foot ulcers, an increase in healthcare infrastructure, and an increase in advanced treatment processes are expected to drive the market during the forecast period.

Regional Snapshot

North America dominated the diabetic foot ulcer treatment market in 2023. North America has a huge geriatric population. Diabetes is the most common disorder in this age group, which frequently leads to diabetic foot ulcers. Due to the static lifestyle followed by the people, diabetic foot ulcer cases are rapidly increasing. Every second person in North America is suffering from diabetes, which increases the need for diabetes foot ulcer treatment.

- For instance, in March 2024, The International Working Group on the Diabetic Foot (IWGDF) collaborated with the Infectious Diseases Society of America (IDSA) and announced the improvement of the previous guidance for the management and diagnosis of diabetic foot infections.

Asia Pacific is estimated to grow fastest in the forecast period. In the Asia Pacific region, the presence of diabetic foot ulcers is growing, with increasing threat of mortality, morbidity, and amputation. The International Diabetes Federation (IDF) anticipates that 537 million people will be living with diabetes, by 2045, this number may increase to more than 700 million. Southeast Asia and Western Pacific countries are included in the area where diabetes is considered to grow most rapidly.

India is one of the dominant countries, with more than 77 million population with diabetes, and that number is expected to increase to 35.7 million by 2045. In India, 25% of individuals with diabetes patients have developed diabetic foot ulcers. To improve the issues, India is focusing on research and development of treatment and medicines related to foot ulcers.

For instance, in January 2024, Kerala collaborated with Cuba and launched drugs to heal the diabetic foot ulcer.

In China, the herbal dressings had approximately shorter ulcer healing times, effectiveness rates, higher healing rates, and decreased ulcer areas. These major factors are showing good clinical efficacy in diabetic foot ulcer treatment with these dressings.

Diabetic Foot Ulcer Treatment Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 8.62 Billion |

| Projected Forecast Revenue by 2032 | USD 14.44 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.90% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of diabetes

The rising prevalence of diabetes mellitus (DM) worldwide, with an expected 642 million people with diabetes by 2040. The prevalence of diabetic foot ulcers was found to be 18.1%. It is a destructive element of the progression of diabetes, with an expected 15% of patients with diabetes foot ulcers between the different metabolic. Several factors, such as the longer duration of diabetes mellitus, steady lifestyle, and advancing age, have been accountable for increasing the prevalence of diabetic foot ulcers. Growing awareness about the accessibility of treatment and increase in healthcare costs among the patient population in developing regions is expected to further boost the diabetic foot ulcer treatment market during the forecast period.

Technological developments in treatment options

Constant technological developments in treatment options, such as miscellaneous therapeutic agents, extracellular matrix proteins, and bioengineered skin substitutes, are expected to enhance the market growth. Mobile phones with digital cameras have innovatively captured foot ulcer pictures. Patients can send their foot ulcer images to doctors for remote monitoring. With the use of mobile apps, artificial intelligence-based technologies have been improved to develop this remote monitoring of diabetic foot ulcers. That's why the increasing number of such technological developments is expected to aid in the expansion of the diabetic foot ulcer treatment market during the forecast period.

Restraint

Lack of awareness about DFU treatment

From surveys, it was found that patients have a lack of awareness of foot ulcer treatment and have not yet realized the importance of effective estimates in the prevention of diabetic foot ulcers, especially in rural and underdeveloped regions. In rural hospitals and pharmaceutical centers, there is a deficiency of DFU treatment devices. These factors may restrain the growth of the diabetic foot ulcer treatment market.

Opportunity

Thermal monitoring to detect pre-ulcerative tissue damage

A focus of recent technological advances has been the identification of pre-ulcerative damage to the grower tissue of the feet. A variation of thermal appraisement is being used to verify pre-ulcerative in the feet. Continuous monitoring of foot temperature has been manifested as predictive of forthcoming diabetic foot ulcers and can be used to warm individuals to reduce their physical activity engagement and decrease their possibility of developing a diabetic foot ulcer.

For instance; Investigators indicated a clinical monitoring protocol to compare the temperatures between locations on the right and left leg. Persistent differences in contradance temperatures excelling 2.2 degrees were used as a marker for risk and to initiate preventive care.

Private companies and researchers are developing smart socks to maintain foot temperatures. Moreover, thermal monitoring socks offer the opportunity for continuous temperature measurement throughout the day. A future option for socks is the development of smart shoes to monitor the temperature on the surface of the feet.

Recent Developments

- In December 2023, in New Delhi, Varco Leg Care introduced the launch of a new flagship product with the name “Ulsr Soothe Max.” This product is a curation of diabetic foot ulcer treatment.

- In December 2023, In Chennai, medical education director J. Sangumani launched the ‘MV Surgi boot’ device. This developed hospital provides cost-effective footwear. This footwear improves the healing of foot infections.

- In January 2022, in India, Aleken Laboratories introduced the launch of technology for foot ulcer management. This modern technology of diabetic foot ulcer management has a high possibility of preventing amputations in diabetic patients.

- In October 2022, in the US, India, and Canada, Healthium launched a personalized dressing product. According to the company, Theruptor NOVO is a non-toxic and anti-microbial wound dressing technology. This product is for the management of chronic wounds like diabetic foot ulcers.

- In July 2023, Researchers from Queen’s University Belfast launched 3D printed bandage. This bandage heals a safe and innovative treatment for diabetic foot ulcers.

Key Market Players

- ConvaTec Group Plc

- 3M

- B. Braun Melsungen AG

- Medline Industries, Inc.

- Coloplast Group

- Smith & Nephew

- Cardinal Health Inc

- Organogenesis Inc.

- URGO

- Kerecis

- Mölnlycke Health Care AB.

- MiMedx

Segments Covered in the Report

By Type

- Advanced Wound Care

- Biologics

- Dressings

By Ulcer Type

- Neuropathic Ulcers

- Neuro-ischemic Ulcers

- Ischemic Ulcers

By Grade

- Grade 1

- Grade 2

- Grade 3

- Grade 4

- Grade 5

By Treatment Type

- Wound Care Dressings

- Wound Care Devices

- Active Therapies

- Others

By End User

- Hospitals

- Home Care

- Ambulatory Surgical Center

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1896

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308