Diesel Exhaust Fluid Market Revenue to Attain USD 78.68 Bn by 2033

Diesel Exhaust Fluid Market Revenue and Trends

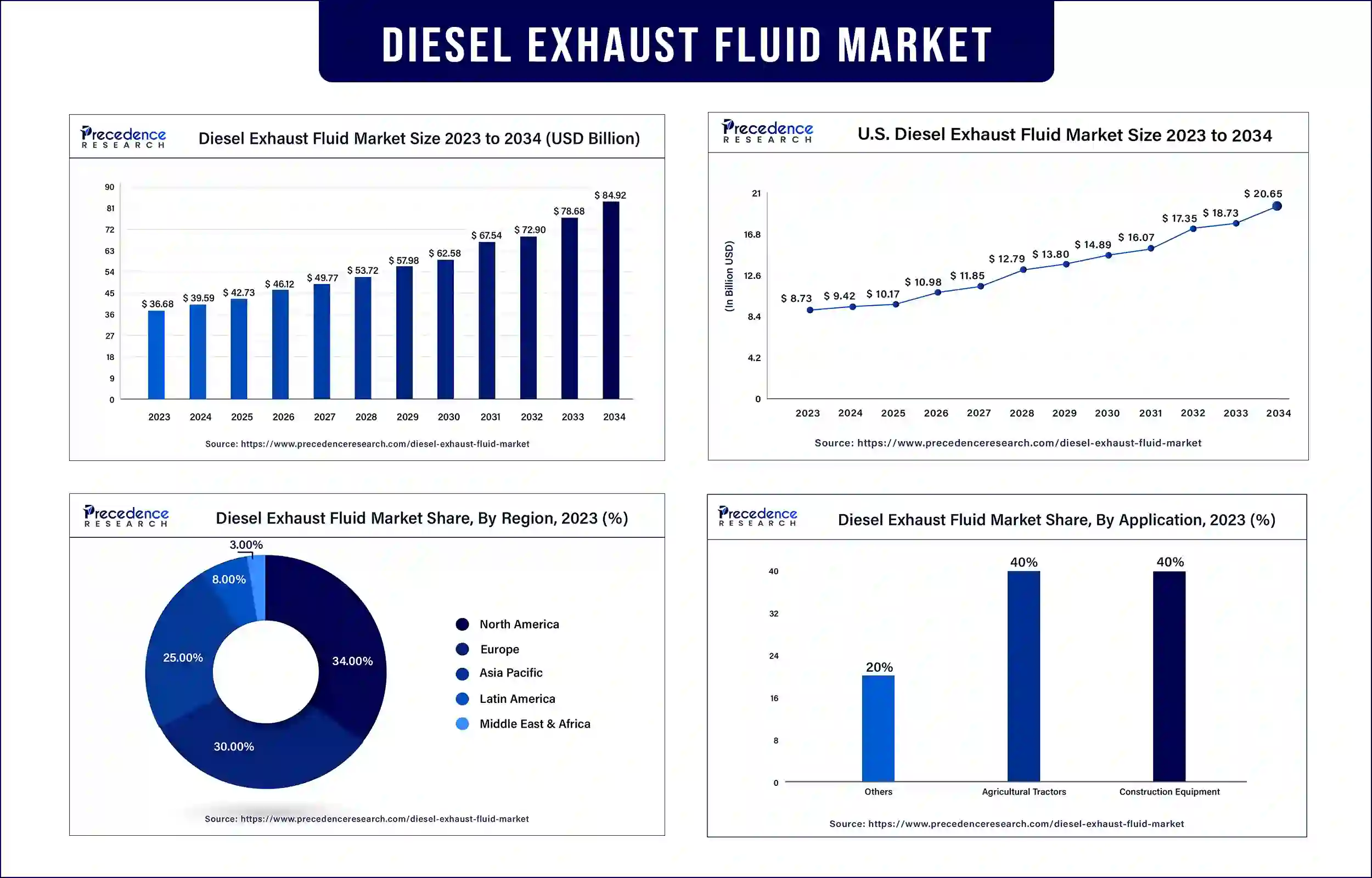

The global diesel exhaust fluid market revenue surpassed USD 36.68 billion in 2023 and is predicted to attain around USD 78.68 billion by 2033, expanding at a solid CAGR of 7.93% during the forecast period. The demand for the application in the fields of construction and agriculture equipment contributes for the diesel exhaust fuel. Also strict government regulations imposed for the reduction of the air pollution and improve air quality and environmental awareness across various industries drives for the adoption of the DEF.

Market Overview

Diesel exhaust fuel is the liquid that is used to reduce that amount of air pollution which is a aqueous urea solution made with 32.5% and deionized water 67.5%. it is consumed in a selective catalytic reduction that lowers the concentration of nitrogen oxide in the diesel exhaust emissions from a diesel engine. This fluid is used with selective catalytic reduction or SCR technology to decrease the pollutants, and these pollutants are stored in the tank which is connected to exhaust container. The increase number of vehicles and strict government regulations propel the growth of the diesel exhaust fluid market.

Report Highlights of the Diesel Exhaust Fluid Market

- By vehicle type, the light commercial vehicles dominated the market for the largest share in 2023 as these vehicles meet the strict emission rules and are also environment friendly. This indicates the importance of the diesel exhaust fuel to improve the air quality in the transportation sector.

- By component type the catalyst segment led the global diesel exhaust fluid market in 2023 as it is effective to carry out various operations of catalytic reduction as it is composed of deionized water and urea that acts as a reductant in the SCR process also it is significant in reducing the NOx emission.

- By application type, the construction segment dominated the diesel exhaust fluid market as its use in the construction equipment like loaders, bulldozers and excavators for the smooth operations. It also ensures heavy machinery operations by contributing to cleaner and sustainable sources.

Diesel Exhaust Fluid Market Trends

Advancements in catalytic reduction technology:

- Innovations made in the SCR technology to improve the performance and efficiency of the diesel exhaust fuel is gaining demand by various sectors. The automotive industry is also adopting for the SCR systems as it meets the strict emission regulations and improve the efficiency of the fuel.

- For instance, since 2018 Volkswagen was only using SCR exhaust gas systems with its diesel engines to reduce the nitrogen oxides, but has now developed its new stage named twin dosing which is injected upstream of two catalytic convertors that are arranged in series wherein it is located in the underbody of the vehicles. This expands the window for after treatment of exhaust gases even at gas temperature of +5000 C where it’s still achieves high conversion rates.

Rising age of vehicles and miles driven:

- Increasing average age of vehicles, improved infrastructure, average miles driven; rising maintenance concerns are increasing the demand for the DEF aftermarket. The improved road infrastructure, technological advancements and safety features drive the market.

- For instance, ZP launches new WABCO diesel exhaust fuel for BS-VI vehicles which is expected to reduce the nitrogen oxide emission (NOx) by 70% with a decrease in hydrocarbon emission and particulate matter. This WABCO DEF is essential for smooth free operations of selective catalytic reduction after-treatment systems.

Increasing demand for the renewable energy fuels:

- The rise in the renewable energy fuels plays a significant part as these products are more clean and also be created from bio-based feedstock that help in carbon reduction.

- For instance, in February 2024, Saudi Arabia launched a clean diesel and Euro-5 gasoline into the market that aims at reducing the emission and achieving the environment sustainability as compared to the traditional fuels, which can be used for all modes of transportation and provide high efficiency and reduced emission.

Regional Insights

North America dominated for the largest share in diesel exhaust fluid market in 2023 due to its increasing growth in the construction sector in both non-residential and commercial sectors like hospitals, building and colleges. Moreover the market is growing due to increase in the real-estate properties. In addition the increasing number for the heavy and medium duty vehicles that makes it easy to port the manufactured goods to the consumers. Canada also held’s the largest share as the rising awareness to reduce the pollution, especially from the heavy duty vehicles.

For instance, on March 2024, Cummins has launched its efficient heavy duty diesel engine that will be the next product in the HELM 15-litre fuel agnostic platform and is designed to meet the future emission regulations by 2027. This X15 utilizes belt-driven high output 48-volt alternator and after treatment heater solutions.

Diesel Exhaust Fluid Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 39.59 Billion |

| Market Revenue by 2033 | USD 78.68 Billion |

| CAGR | 7.93% from 2023 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In February 2024, Bharat Petroleum Corporation Ltd unveiled its first mobile MAK Adblue dispenser with a new innovative approach to making DEF more accessible particularly for BS-VI vehicles by reducing the NOx emission that promises flexibility and zero installations costs.

- In November 2021, Indian oil launched new XtraGreen diesel fuel that provides more clean and efficient fuel. This diesel uses a modified diesel-multi functional additive to lower the emission and improve vehicles fuel efficiency. It aims to reduce the carbon emission of net-zero goal by 2070 by enhancing the user experience.

Market Segmentation

By Vehicle Type

- Passenger Cars

- Lcvs

- Hcvs

By Component

- Catalysts

- Tanks

- Injectors

- Sensors

- Others

By Application

- Construction Equipment

- Agricultural Tractors

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5067

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344