What is Diesel Exhaust Fluid Market Size?

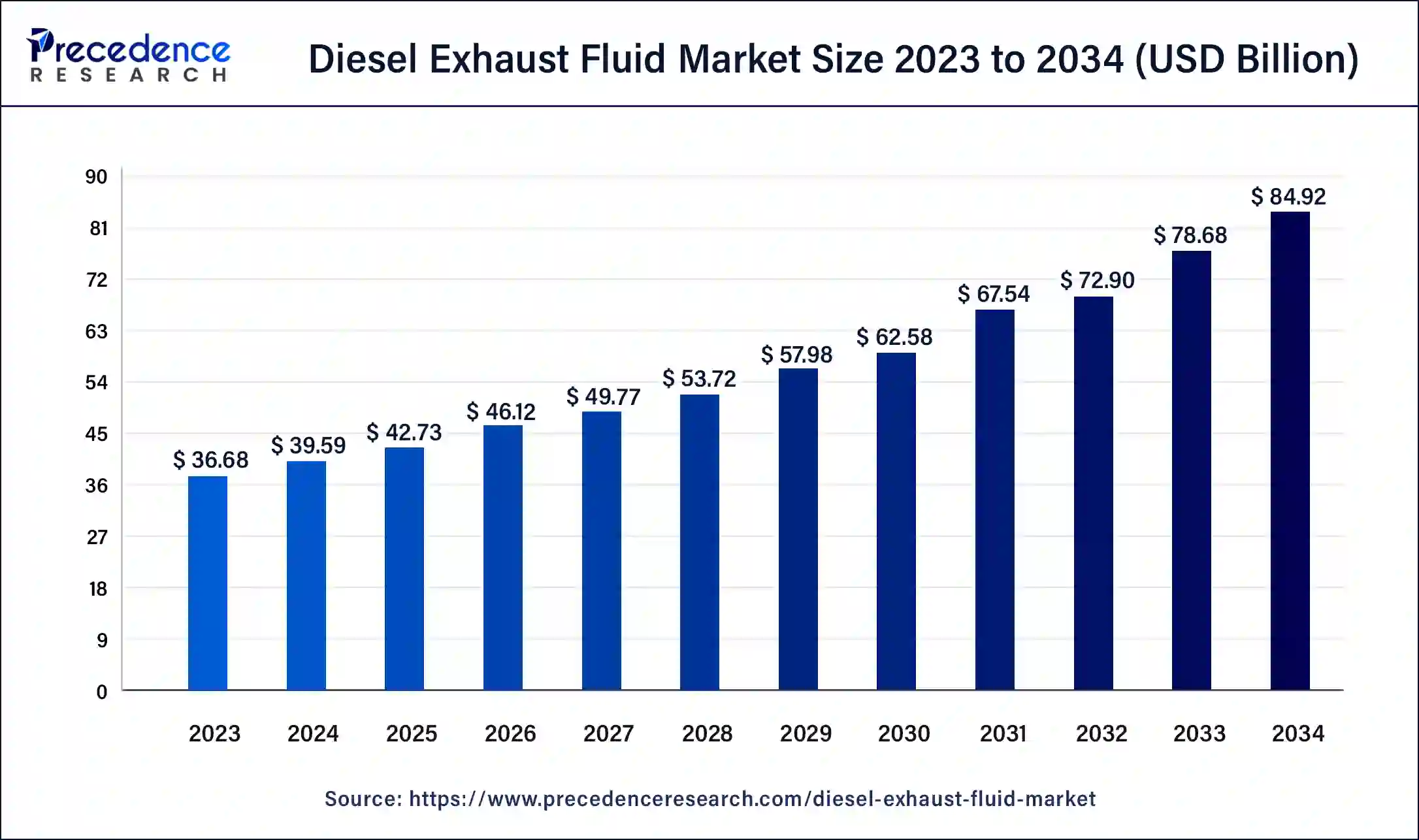

The global diesel exhaust fluid market size is expected to be worth USD 42.73 billion in 2025, and is anticipated to reach around USD 90.85 billion by 2035, growing at a solid CAGR of 7.83% over the forecast period 2026 to 2035. The rising application of diesel exhaust fluid in construction and agricultural equipment is a key diesel exhaust fluid market driver.

Market Highlights

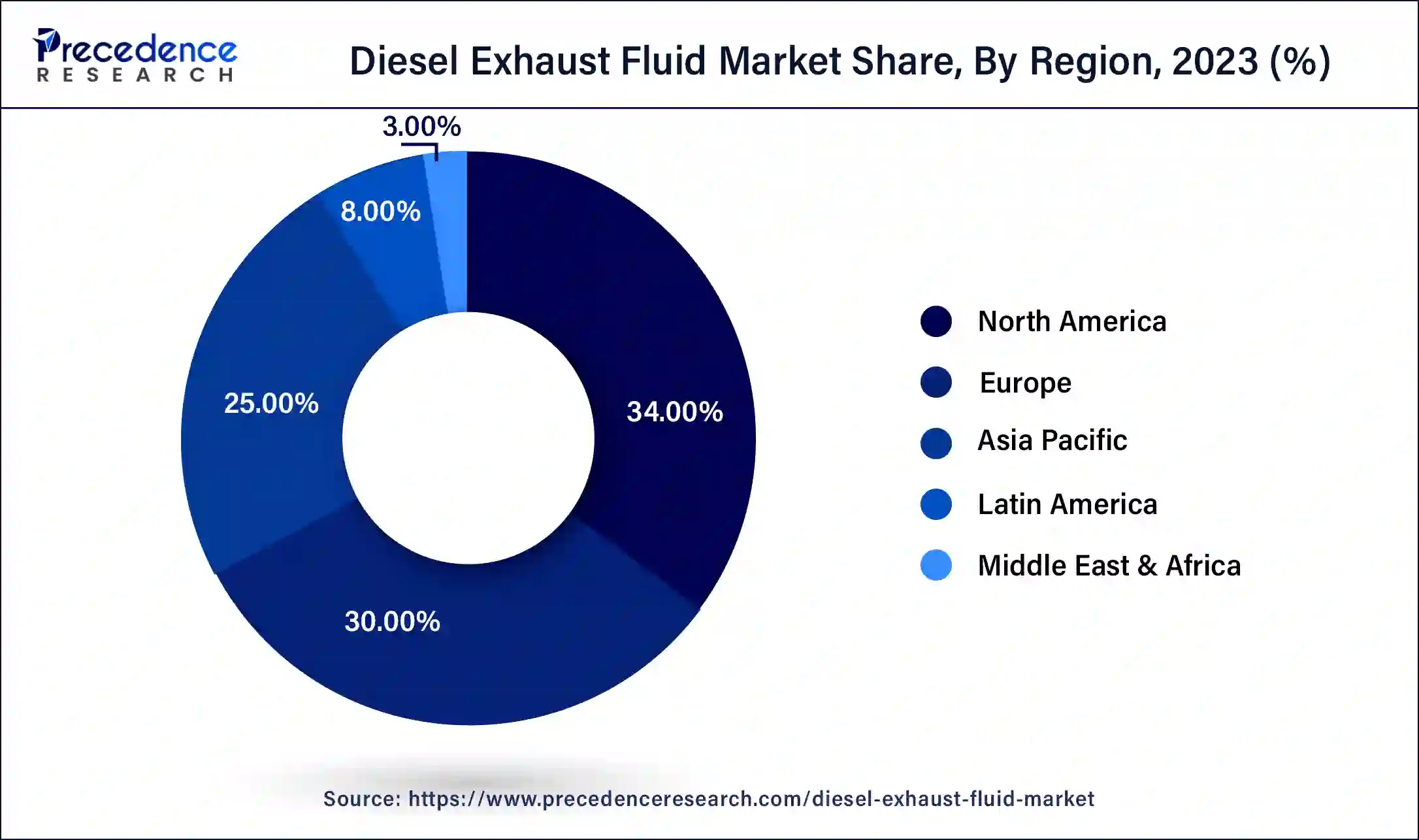

- North America dominated the diesel exhaust fluid market with the highest market share of 34% in 2025.

- Asia Pacific is expected to grow significantly in the market over the projected period.

- By vehicle type, the light commercial vehicles segment generated the biggest market share of 26% in 2025.

- By vehicle type, the passenger car segment will show notable growth in the market during the projected period.

- By component, the catalysts segment recorded the largest market share of 41% in 2025.

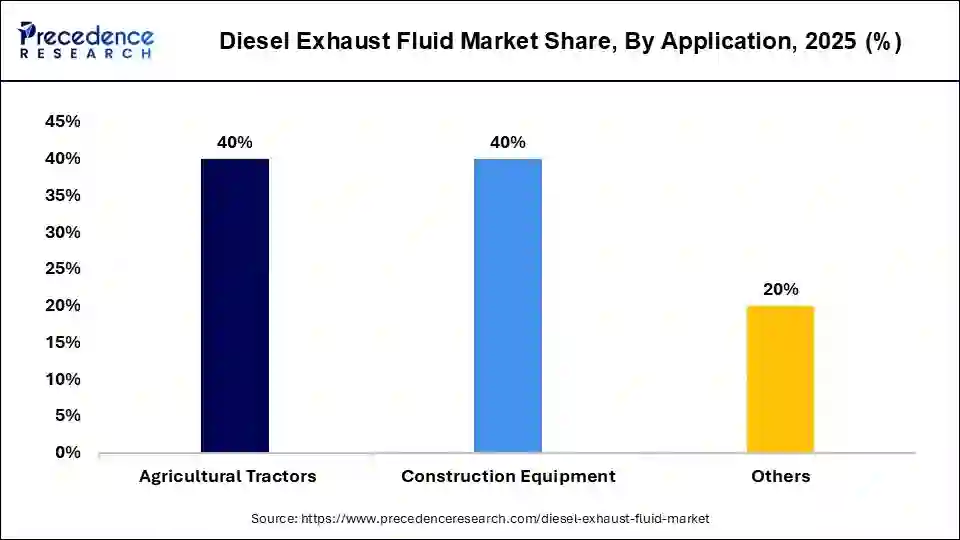

- By application, the construction equipment segment captured the market share of 40% in 2025.

- By application, the agricultural tractors segment will witness the fastest growth in the market over the forecast period.

What is the Diesel Exhaust Fluid?

Diesel exhaust fluid (DEF) is a mixture of 67.5% deionized water and 32.5% urea. It is colorless, odorless, and non-flammable. DEF's quality is preserved in special storage tanks made of stainless steel or polyethylene plastic because the shelf life of the substance depends on the temperature at which it is stored. To reduce diesel exhaust emissions, selective catalytic reduction (SCR) uses AUS 32 as a consumable to lower nitrous oxide (NOx) levels in engines.

Impact of AI on the Diesel Exhaust Fluid Market

Artificial Intelligence (AI) is substantially influencing market-driven analytics, and ML algorithms are improving the accuracy of diesel exhaust fluid dosage and enhancing the efficiency of exhaust systems. Furthermore, automation in the diesel exhaust fluid market technology has led to reduced operational costs and higher production rates. As AI and automation evolve, their integration into diesel exhaust fluid systems is anticipated to further stimulate fuel consumption and emission control.

- In March 2024, Digital Twin solution provider Intangles Lab Pvt. Ltd. unveiled its diesel particulate filter (DPF) technology. Developed by the Technology & Innovation Group at Intangles, this AI-powered feature is set to transform the commercial vehicle industry by offering advanced insights into DPF regeneration quality.

Key Factors Influencing Future Market Trends

- Stringent emission regulations: Strict emission standards are adopted by governments across the world to check the emission of nitrogen oxides (NOx) from diesel engines. The EURO VI and EPA Tier standards require the use of selective catalytic reduction (SCR) systems, which need the use of Diesel Exhaust Fluid (DEF).

- Growth in commercial vehicle production: Increased development of the transportation and logistics industries is enhancing the demand for commercial diesel vehicles. The greater the number of trucks and buses installed with SCR technology, the greater becomes the requirement of DEF, especially in developing economies where there is infrastructure development and fleet expansion.

- Rising adoption of SCR technology: It is due to the efficiency of selective catalytic reduction (SCR) technology in reducing emissions that it is being adopted widely for on-road as well as off-road diesel engines.

Diesel Exhaust Fluid Market Growth Factors

- Growing demand for diesel exhaust fluid in end-use sectors like automotive, marine, and aerospace is expected to propel market growth soon.

- The stringent emission regulations imposed by the government to regulate air pollution are expected to fuel the diesel exhaust fluid market growth further.

- Increasing environmental awareness and sustainability goals across various industries can boost market growth shortly.

- An increase in demand for the product in the automobile industry can drive market growth over the forecast period.

- Rapid industrialization and logistics infrastructure innovations will likely contribute further to the diesel exhaust fluid market expansion.

Market Outlook

- Industry Growth Overview: DEF demand increases as emission control measures become stricter in transportation, logistics, construction, and agricultural equipment usage globally.

- Sustainability Trends: The consumption of non-toxic DEF is such that it not only controls emissions but also contributes to the company's sustainability goal since it keeps the combustion cleaner without negatively affecting diesel engine durability.

- Global Expansion: The unification of the emission standards accelerates the adoption of DEF across the North American, European, and rapidly industrializing Asia-Pacific transport corridors.

- Major Investors: The key players in the market are Yara International, BASF SE, Shell plc, TotalEnergies, and Cummins Inc.; they are the ones who constantly innovate and make the supply chain more secure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 42.73 Billion |

| Market Size in 2026 | USD 46.12 Billion |

| Market Size by 2035 | USD 90.85 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.83% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Innovations in selective catalytic reduction technology

Innovations in SCR technology improved the performance and efficiency of the diesel exhaust fluid market by extensively gaining its usage in many sectors. Additionally, the demand for more innovative SCR systems from the automotive industry rises because products have strict emission regulations and want to enhance their fuel efficiency. The utilization of advanced SCR systems in agriculture and construction has helped fulfill environmental standards and boost the performance of diesel-based equipment.

- In May 2022, the press release says that Yanmar Power Technology Co., Ltd. (YPT) a group company of Yanmar Holdings Co., Ltd. will start offering its proprietary selective catalytic reduction exhaust gas purification system 1 with connected functionality and a dedicated management app from mid-May.

Restraint

Fluctuating cost of raw materials

The growth of the market can be hampered by the fluctuating cost of raw materials such as urea, along with the increasing demand for electric vehicles worldwide. Also, the overall growth of the global diesel exhaust fluid market can be constrained by adulteration, which has a negative effect on the quality of diesel exhaust fluid.

Opportunity

Rise of renewable diesel fuels

The advent of renewable diesel fuels presents a crucial opportunity to integrate the diesel exhaust fluid market into a wide platform. Renewable diesel products are cleaner options than traditional diesel and can be created from bio-based feedstocks, which in turn reduces carbon emissions compared to their conventional counterparts. Furthermore, the increase in renewable diesel development builds a complementary relationship with diesel exhaust fluid and impacts.

- In September 2024, Global Partners will launch Connecticut's first renewable diesel. Renewable diesel is made from fats, oils, and waste products from the food and restaurant industries and delivers the same performance as petroleum diesel, with up to 78% lower emissions, according to the EPA.

Segment Insights

Vehicle Type Insights

The light commercial vehicles segment held a significant share of the diesel exhaust fluid market in 2025. The dominance of the segment can be attributed to the increasing use of diesel exhaust fluid in light commercial vehicles to meet strict emissions regulations and improve environmental performance. Additionally, the segment's dominance indicated its crucial role in the diesel exhaust fluid market and influenced the overall demand for this product in the transportation sector.

The passenger car segment will show notable growth in the diesel exhaust fluid market during the projected period. The growth of the segment is driven mainly by the rising popularity of diesel-engine cars. Diesel exhaust fluid is a most common feature in passenger cars. It can be used in combination with selective catalytic reduction technology to clear exhaust gas before it's emitted into the atmosphere. The DEF is utilized in a variety of passenger vehicles, such as pickups, SUVs, and cars.

Component Insights

The catalysts segment led the global diesel exhaust fluid market in 2025. This is because the catalyst component of the product is important for the efficient operation of selective catalytic reduction systems in diesel engines. DEF is mainly composed of deionized water and urea which acts as a reductant in the SCR process. Moreover, catalytic reaction is essential for decreasing NOx emissions and fulfilling stringent environmental regulations.

- In July 2024, Volvo Trucks North America released an engine that complies with the California Air Resources Board (CARB). Omnibus regulation requirements for low nitrogen oxide (NOx) and particulate matter (PM) emissions standards. The regulation calls for a 75% reduction in NOx emissions and a 50% reduction in PM from heavy-duty on-road engines for model years 2025 through 2026, compared to current U.S. EPA standards.

Application Insights

The construction equipment segment dominated the global diesel exhaust fluid market. The dominance of the segment can be credited to the increased utilization of Construction equipment like bulldozers, excavators, and loaders in the construction industry as they operate smoothly under demanding conditions. Furthermore, diesel exhaust fluid is crucial for construction equipment to match with modern emissions regulations and support environmental sustainability.

The agricultural tractors segment will witness the fastest growth in the diesel exhaust fluid market over the forecast period. This is due to DEF helping tractors fulfill the EPA's Tier 4 Final emissions standards by ensuring a substantial decrease in air pollution. This application can enhance engine efficiency and longevity by stimulating combustion and decreasing toxic emissions. Also, regular refilling of DEF and Proper storage are necessary for regulating tractor performance and sustainability during tedious agricultural operations.

- In February 2024, John Deere announced the launch of three new models in the 9RX tractor range, as well as its new S7 combine. The new 9RX models are equipped with the 18-litre JD18X engine, which provides up to 913 maximum horsepower at low specific fuel consumption and up to 4,234 Nm of torque with the top model. Notably, it achieves full Stage 5 compliance without the need for diesel exhaust fluid /AdBlue.

Regional Insights

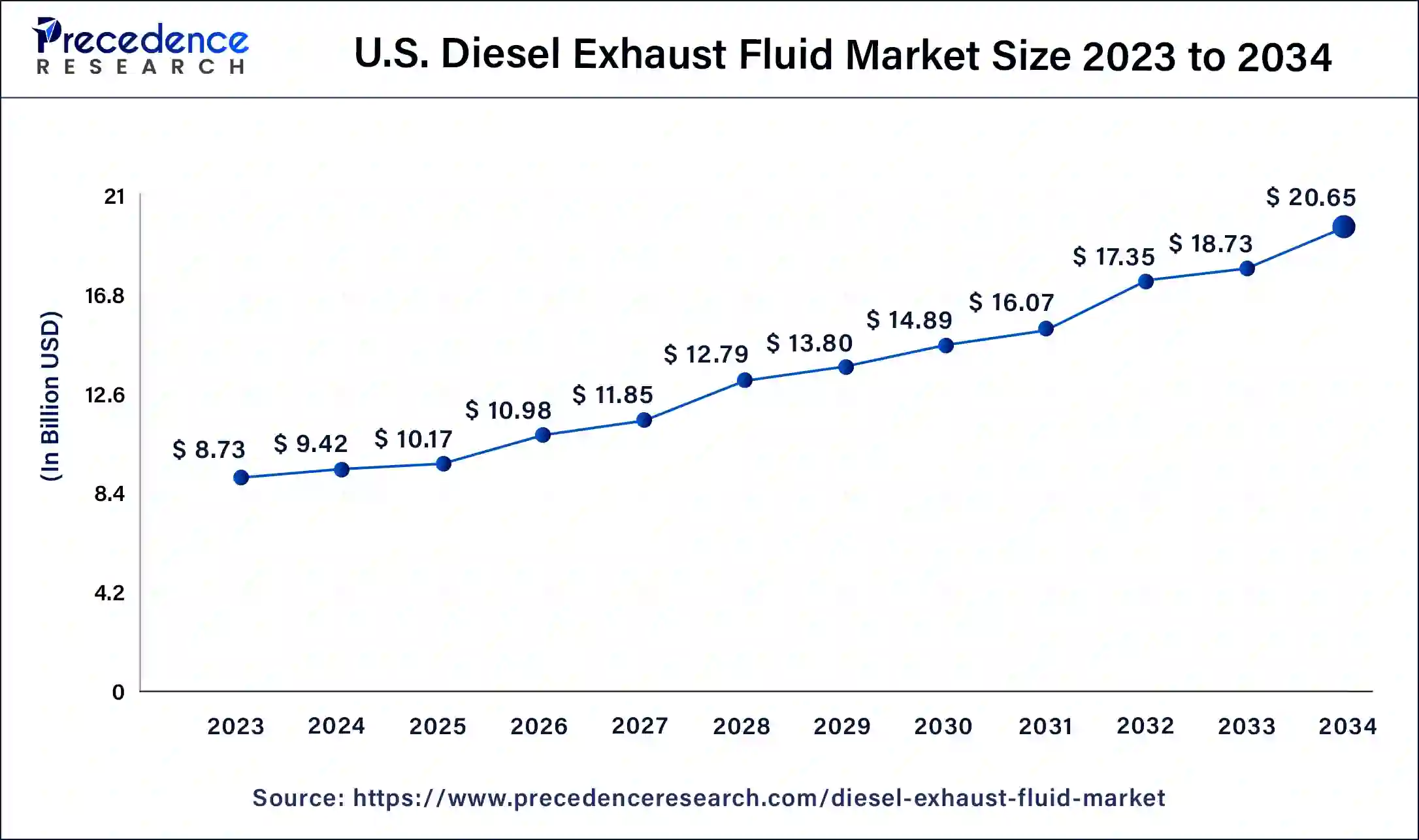

U.S. Diesel Exhaust Fluid Market Size and Growth 2026 to 2035

The U.S. diesel exhaust fluid market size is exhibited at USD 10.17 billion in 2025 and is projected to be worth around USD 22.21 billion by 2035, poised to grow at a CAGR of 8.12% from 2026 to 2035

U.S. Diesel Exhaust Fluid Market Trends:

The U.S. is the largest market for diesel exhaust fluid in North America, all heavy-duty engines are fitted with SCR systems, and thus, there is a high-DEF demand in the U.S. Besides the heavy-duty vehicles, the entry of the light-duty vehicles into the market also creates a demand in the aftermarket, and hence, telematics integration and increased consumption from construction and agricultural equipment are the other factors contributing to the rising DEF demand.

North America dominated the diesel exhaust fluid market in 2025. The dominance of the segment can be attributed to the significant growth of the construction industry in the region coupled with the rising demand for non-residential construction projects like commercial buildings, hospitals, and colleges. Furthermore, the market in the U.S. is expanding at a substantial rate because of positive market fundamentals for real estate and a strong economy.

- In October 2024, Monomoy Capital Partners sold Shaw Development, the leading manufacturer of diesel exhaust fluid, to Madison Dearborn Partners, a successful exit from Monomoy's investment in Shaw Development.

Asia Pacific is expected to grow significantly in the diesel exhaust fluid market over the projected period. The growth of the region can be linked to the urbanization and swift industrialization occurring in nations like China and India, along with the stricter emission standards to counteract air pollution.

China Diesel Exhaust Fluid Market Trends:

China is exhibiting rapid diesel exhaust fluid market growth, as it is mainly driven by the industrial sector's expansion and tightening of emission regulations. Increasing production of commercial vehicles, domestic supply supported by the government, and infrastructure for refilling that is extending are the factors that will support the long-term establishment of DEF across the transport networks in both urban and rural areas.

Europe Diesel Exhaust Fluid Market Trends

Europe is experiencing a huge development due to the widening of construction works in some of the key countries such as the UK, Germany, France, Italy, and Spain, among others. The countries are experiencing the development of large infrastructure, and the European Union (EU) is offering a huge amount of funding and policy contributions for such endeavours. Demand for diesel-powered construction machinery that has SCR installations is increasing, hence driving the consumption of DEF.

European strict emission norms like Euro VI standards also contribute greatly to the acceleration of DEF adoption. Increased availability of DEF refilling infrastructure and growing consciousness towards environmental sustainability are promoting fleet operators and manufacturers of equipment to embrace greener technologies.

What are the Driving Factors of the Diesel Exhaust Fluid market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is characterized as a developed diesel exhaust fluid market that has been greatly influenced by legislation on emissions and environmental concerns. The increase in sales is mainly due to the use of eco-friendly formulations, the need to upgrade existing systems, and continuous public-sector purchases, which are in line with the aims of providing cleaner transport and good urban air quality.

Germany Diesel Exhaust Fluid Market Trends:

Germany has a well-established diesel exhaust fluid market that can be referred to as a stronghold for the automotive industry and a stringent emission policy in the country. Expanding adoption is seen in the logistics sector, while the focus for technology development remains on winter performance, additives, and system efficiency for both passenger and commercial diesel vehicles.

List of countries by motor vehicle production

| Country | Year 2023 |

| China | 30,160,966 |

| United States | 10,611,555 |

| Japan | 8,997,440 |

| India | 5,851,507 |

| South Korea | 4,244,000 |

| Germany | 4,109,371 |

| Mexico | 4,002,047 |

| Spain | 2,451,221 |

| Brazil | 2,324,838 |

| Thailand | 1,841,663 |

Value Chain Analysis of the Diesel Exhaust Fluid Market

- Feedstock Procurement: Urea of high purity and deionized water are obtained to acquire quality inputs that are constant in the manufacturing process of Diesel Exhaust Fluid.

Key players: Yara International, CF Industries Holdings, Inc., and BASF SE. - Chemical Synthesis and Processing: The chemical processing is performed under controlled conditions that satisfy the requirements specification of the emission requirements.

Key Players: Yara International ASA, BASF SE, and CF Industries Holdings, Inc - Formulation and Blending of Compounds: The solution synthesized is currently being blended with very high precision to maintain the desired concentration, stability, and performance.

Key Players: Old World Industries, LLC, KOST USA, Inc., and TotalEnergies SE - Quality Testing and Certification: The laboratory tests and inspections are done strictly before it can be released into the commercial market to comply with the legal requirements.

Key Players: Intertek Group plc, SGS SA, and Bureau Veritas - Diesel exhaust fluid Packaging and Labelling: Containers are filled, sealed, and labeled with a design to provide the safety of the storage, transport, regulatory requirements, as well as convenience to the users all over the world.

Key Players: ExxonMobil, Shell, and Yara International ASA

Top Diesel Exhaust Fluid Market Companies and their Offerings

- TotalEnergies: Guarantees purified AdBlue containing anti-crystallization agents, introduces other package designs, and can be found in a large variety at service stations by both commercial and consumer diesel engine users.

- Shell: Exported odor-free AdBlue that meets the international standards of quality, which also allows performing continuous SCR and significant nitrogen oxide emission throughout the heavy-duty and off-highway engines.

- BASF SE: Produces AdBlue and high-technology SCR additives and concentrates in large volume production, and reliability of supply and efficiency of global uses of diesel, as well as emissions.

Other Diesel Exhaust Fluid Market Companies

- Sinopec

- Cummins Filtration

- CF Industries Holdings, Inc.

- Dyno Nobel

- Agrium Inc.

- Honeywell International Inc.

- Faurecia SE

Recent Developments

- In September 2025, Tata Motors launched the Tata Ace Gold+ Diesel mini-truck at ₹5.52 lakh, making it the most affordable diesel variant. Designed for small businesses, it features a Dicor engine with Lean NOx Trap technology, ensuring Bharat Stage VI compliance without Diesel Exhaust Fluid, simplifying operations. (Source:https://www.drivespark.com)

- In March 2025,Hindustan Petroleum and Tata Motors partnered to launch a co-branded Genuine Diesel Exhaust Fluid. This high-quality DEF enhances vehicle performance, efficiency, and longevity, distributed through HPCL's 23,000 fuel stations nationwide for easy customer access. (Source:https://www.tatamotors.com)

- In May 2024, Rislone introduced a new product called diesel exhaust fluid Crystal Clean to upgrade diesel exhaust fluid systems and enhance SCR emissions by cleaning deposits while improving engine performance.

- In November 2023, the government of Delhi in India announced that only CNG-powered and Bharat stage VI diesel vehicles, as well as electric buses, will be allowed to operate within the regional public transport setup.

- In January 2022, the German Association of the Automotive Industry (VDA) awarded accreditation to Cross Chem International's Hong Kong branch, authorizing it to start manufacturing AdBlue Diesel Exhaust Fluid. This certification confirms that the product meets top-tier standards and will support the company's growth in the diesel exhaust fluid sector.

- In January 2022, BP is set to sell its retail network and logistics assets to Total Energies. This deal also includes a chain of twenty-six service stations, a commercial customer portfolio, and SAMCOL, which is 50% owned by both Total Energies and BP, and it manages Nacala, Beira, and Matola petroleum import terminals.

Segments Covered in the Report

By Vehicle Type

- Passenger Cars

- Lcvs

- Hcvs

By Component

- Catalysts

- Tanks

- Injectors

- Sensors

- Others

By Application

- Construction Equipment

- Agricultural Tractors

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting