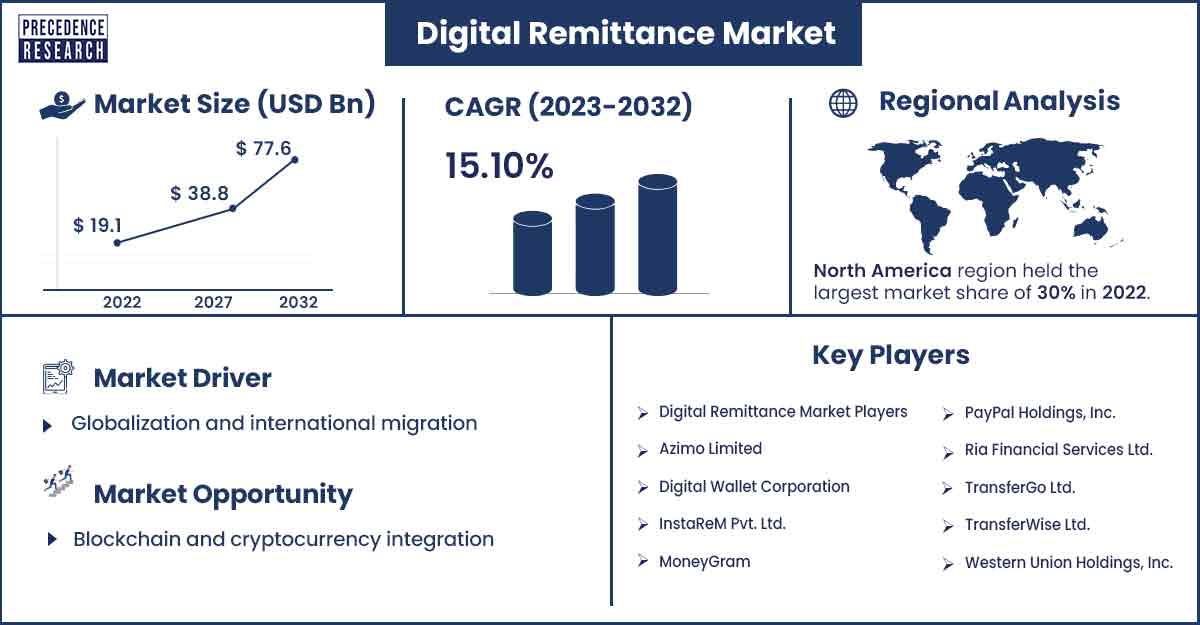

Digital Remittance Market Size To Attain USD 77.60 Bn By 2032

The global digital remittance market size was estimated at USD 19.1 billion in 2022 and is expected to reach around USD 77.60 billion by 2032, growing at a CAGR of 15.10% from 2023 to 2032.

Market Overview

Remittance is defined as the transfer of money between two individuals, and it usually takes place between two different countries. In earlier days, sending money for workers to their homes involved standing in a long queue at the bank or exchange agent. Cash-based remittances involved long hours, paperwork, and slow transfer speeds. In the modern era of digitalization, digital remittances play a pivotal role and have become an emerging trend in today’s world.

Digital remittance is the process by which workers who have migrated to foreign countries for work send money to their home countries using electronic modes of payment. They offer several benefits, such as rapid transfers, lower fees, and transfer status tracking. They are done via online payment modes or mobile applications connected to bank accounts or digital wallets. These are international transactions that do not involve the transfer of cash. Digital remittance is a significant process widely used by workers who have migrated abroad to send money to their respective home countries with the help of electronic modes of payment.

The growth of the digital remittance market is driven by several factors including rapid urbanization, advancement in digital technology, rising number of migrants worldwide, increasing adoption of digital payment solutions, rising use of smartphones, and increasing penetration of internet connectivity. Moreover, the market has grown as a result of the increasing use of online money transfer platforms, mobile wallets, and blockchain-based solutions among consumers. Furthermore, the supportive favorable government regulations and initiatives aimed at promoting digital payments are likely to accelerate the growth of the digital remittances market.

- In October 2023, Mbank partnered with LuLu Exchange to offer its customers digital remittances and account deposits. Customers of Al Maryah Community Bank (Mbank) will be able to send money internationally through the Mbank UAE and Mbank Wallet app. Moreover, they can deposit money into their accounts through any LuLu Exchange branch.

- In August 2023, Fasset, a digital asset company, launched the Super App to provide access to digital assets and remittances in emerging markets. The company is primarily targeting Pakistan, Indonesia, and Türkiye with its launch.

- In September 2023, MoneyGram launched a non-custodial digital wallet that will offer new ways to send and receive cross-border payments.

- In February 2023, the Reserve Bank of India announced person-to-person (P2P) remittances are allowed under the cross-border linkage between India and Singapore using their respective Fast Payment Systems—Unified Payments Interface (UPI) and PayNow. Remittances should be for “maintenance of relatives abroad” or “gift” under the liberalized remittance scheme.

Regional Insights

North America is expected to dominate the market during the forecast period. The growth of the region is attributed to the rapid pace of urbanization, technological advancement, increasing users of smartphones, sophisticated financial infrastructure, a supportive regulatory framework of government, and increasing internet penetration rates, which facilitate the high adoption of digital remittance services in the region. The increasing number of people migrate to the North American region for better education and job purposes, intending to get high salary packages. According to the report published by OCHA in March 2023, the immigrant population has been growing steadily.

As per the report of the Migration Policy Institute. Immigrants and their U.S.-born children number approximately 27% of the U.S. population in the 2022 CPS, an increase of roughly 20% from 2010. Moreover, the growing number of immigrants is projected to propel the growth of the digital remittance market in the region. The market has witnessed the introduction of several payment applications coupled with a wide range of features that have led to faster money transfers.

Asia Pacific market is growing at the fastest rate. The market encompasses the emerging trend of faster money transfer, increasing use of banking and financial services, rising use of smartphones, rising internet penetration, rapid economic growth, and increasing investment in establishing financial infrastructure. Countries such as China, India, and Japan are largely focusing on the adoption of cashless payments and mobile banking solutions. The migrant worker population uses mobile-based payment solutions to remit funds to their countries of origin, which is accelerating the market’s growth in the region. Thus, this is expected to propel the market growth in the region during the forecast period.

Digital Remittance Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 21.89 Billion |

| Projected Forecast Revenue by 2032 | USD 77.60 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.1% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase rate of immigration

The rising rate of immigration is anticipated to fuel the growth of the global digital remittance market in the coming years as the migrant workers' population, who often remit funds to their countries of origin, has boosted the adoption of cashless and online mobile payment platforms. According to the report published by the World Bank Group, in April 2023, nearly 184 million people, or 2.3% of the world's population, lived outside of their country of nationality. This also creates robust demand for cross-border remittance solutions, thus impacting the overall market's dynamics.

Increasing adoption of smartphones and rising internet penetration

The era of digitalization accelerated the adoption of smartphones and online payment platforms. The availability of affordable of smartphones coupled with rising internet penetration across the globe is projected to offer a lucrative growth opportunity during the forecast period. According to secondary sources, there are more than 5.3 billion active internet users around the globe, accounting for 65.4% of the global population in 2023. 58.33% of total traffic came from mobile devices globally. China is leading with the highest number of internet users, with 1.05 billion, followed by India, with 729 million, and the United States, with 311 million.

Restraint

Security concerns

The security concerns and risks associated with digital payments are projected to hamper the market's growth. Several security concerns, such as money laundering, data breaches, hacking incidents, fraudulent activities, and terrorist financing, are likely to limit the expansion of the global digital remittance market during the forecast period. The need for more awareness about digital remittance services and high remittance prices in underdeveloped countries are also limiting factors.

Opportunities

Rising adoption of technological advancement

Technology has helped migrants to send back their earnings back to their respective home countries. Consumers are extensively adopting popular digital remittance options such as online money transfer platforms, instant payment systems mobile wallets, and blockchain-based solutions which offer secure, fast, and cost-effective cross-border payment solutions. Therefore, the rapid advancements in fintech and digital payment technologies are expected to fuel the market's expansion at a higher rate in the coming years.

Supportive government initiatives

The rise in favorable government initiatives and implementation of supportive regulations aimed at promoting digital payments and financial inclusion is expected to propel the market's growth. Increasing government initiatives to promote digital payment solutions as well as extend digital payment services and provide digital payment facilities in a convenient, affordable, and secure manner. Initiatives of the Indian Government, such as Digi Dhan Abhiyan, Vittiya Saksharta Abhiyan (VISAKA) of MHRD, and others, promote digital payment in everyday financial transactions. In addition, the Indian Government UPI-PayNow linkage enables users of the two fast payment systems in either country to make easy, safe, and instant cross-border funds transfers. Such supportive government initiatives enable people to send money across borders conveniently, and digital remittance has become the preferred choice for immigrants.

Recent Developments

- In February 2023, Fintiv, a leading mobile commerce platform, collaborated with Geoswift, a payment technology company with significant expertise in Asian cross-border payments, to enable digital remittance payments into Asia through Fintiv’s versatile mobile wallets.

- In January 2023, PayPal’s Xoom Service expanded the debit card deposit feature to include cross-border remittances, which offers customers a way to send money in real-time to their friends and families eligible for Visa debit cards in 25 countries.

- In September 2022, Western Union introduced its digital banking offering in Europe and in February 2022 in Latin America. The Company acquired Te Enviei, a Brazil-based digital wallet that will accelerate the Western Union’s financial ecosystem offerings in Brazil.

Digital Remittance Market Players

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

Segments Covered in the Report

By Type

- Inward Digital Remittance

- Outward Digital Remittance

By Channel

- Banks

- Money Transfer Operators

- Online Platforms

- Others

By End-use

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

Buy this Research Report@ https://www.precedenceresearch.com/sample/3366

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308