Electric Mobility Market Will Grow at CAGR of 24.60% By 2032

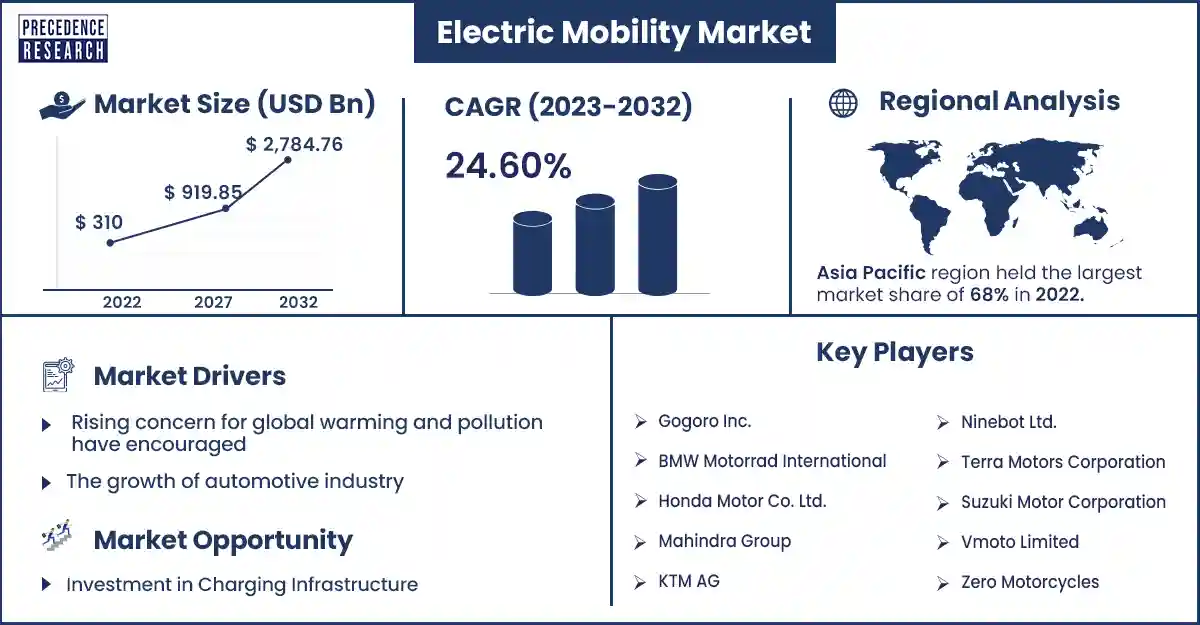

The global electric mobility market size was exhibited at USD 384.71 billion in 2023 and is anticipated to touch around USD 2,784.76 billion by 2032, expanding at a CAGR of 24.60% from 2023 to 2032.

Market Overview

The electric mobility market is a sub-sector of the automotive industry exclusively focused on developing and producing vehicles powered by electric propulsion systems. The market includes a variety of electric vehicles, such as electric cars, electric buses, electric scooters, and electric bicycles, along with the associated infrastructure and services. This includes charging stations, advanced battery technology, and software solutions that support the usage of electric vehicles. The primary objective of this electric mobility industry is to reduce the dependence on fossil fuels, minimize the negative environmental impact caused by traditional forms of transportation, and promote sustainable and eco-friendly alternatives.

The electric mobility market is witnessing remarkable growth due to a convergence of factors that are driving transformative change in the automotive industry. Among these, the most significant is the increasing global focus on sustainability and environmental responsibility. With growing concerns over climate change and air pollution, governments worldwide are implementing strict regulations to reduce emissions, incentivizing electric vehicle adoption. Rapid advancements in battery technology have significantly enhanced the performance and affordability of electric vehicles, making them increasingly competitive with traditional internal combustion engine vehicles.

Regional Snapshot

Asia Pacific is currently the largest and most dynamic market for electric mobility solutions, leading the way in the global transition towards sustainable transportation. The region's rapid urbanization, coupled with a strong focus on environmental concerns and the presence of dynamic economies, have all contributed to the increasing adoption of electric vehicles (EVs). China has emerged as a global leader in this space, with ambitious government policies, significant investments in infrastructure, and strong support for domestic EV manufacturers. Meanwhile, Japan and South Korea leverage their technological and automotive industry expertise to develop innovative EVs and battery technologies. The growing middle class and increasing urbanization in Southeast Asian countries present a vast EV electric mobility market opportunity.

Greaves electric mobility announced the launch of an electric cargo three-wheeler, which debuted in September 2023. This vehicle is designed to provide efficient and sustainable transportation for commercial purposes. The electric cargo three-wheeler is expected to have a high-performance motor and battery, enabling it to carry heavy loads while maintaining a low carbon footprint.

Europe has emerged as a crucial hub for electric mobility due to its rapid electric mobility market growth. The European Union (EU) has implemented stringent regulations and incentives to accelerate the adoption of electric vehicles (EVs) and combat climate change, which has propelled Europe to the forefront of electric mobility. Countries like Norway, the Netherlands, and Germany are leading the charge in EV adoption rates. European automakers are heavily investing in electric vehicle development, with a growing portfolio of EV models catering to diverse consumer needs.

Europe boasts a robust charging infrastructure network supported by public and private investments, further enhancing the appeal and feasibility of electric mobility. Moreover, Europe's strategic focus on establishing a sustainable and competitive electric mobility ecosystem is evident in initiatives such as the European Green Deal and investments in battery manufacturing facilities.

- In October 2023, Scania launched its latest battery-electric bus platform at Busworld Europe. This new platform promises to offer advanced technical features and enhanced performance, making it an attractive choice for transportation companies looking to upgrade their fleets with electric buses.

Electric Mobility Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 384.71 Billion |

| Projected Forecast Revenue by 2032 | USD 2,784.76 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 24.60% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Environmental imperatives

There has been growing global awareness of the harmful effects of greenhouse gas emissions on the environment, particularly regarding climate change. There has been a significant shift towards a more sustainable future, with EVs being one of the critical drivers of the electric mobility market. Governments worldwide are implementing strict regulations and offering incentives to encourage the adoption of EVs and manufacturers' production of eco-friendly vehicles. This shift is expected to significantly reduce the use of fossil fuels, thereby mitigating the negative impacts of climate change and creating a cleaner and greener future.

- In January 2024, Tata Passenger Electric Mobility introduced its maiden Pure EV. This new electric vehicle is expected to have advanced technical features and cutting-edge technology. The company has been working on this project for some time now. It is committed to delivering a high-performing, eco-friendly, cost-effective electric vehicle for the modern-day user.

Technological advancements

The electric mobility market has shown remarkable advancements due to significant technological breakthroughs. Battery technology has seen tremendous progress, leading to the development of more powerful and long-lasting batteries that can efficiently power electric vehicles for longer distances. Moreover, the charging infrastructure has been upgraded to provide greater convenience and accessibility to vehicle owners.

Restraints

Charging Infrastructure Challenges

Despite the remarkable progress made by electric vehicles, the lack of a widespread and comprehensive charging infrastructure remains a significant barrier to their widespread adoption. Limited accessibility to charging stations and the fear of running out of charge significantly affect consumers' willingness to switch to electric vehicles. Therefore, to instill confidence in electric vehicles' range and accessibility, it is imperative to have a robust and comprehensive charging infrastructure.

Market fragmentation and standardization

The electric mobility market is witnessing a surge in players, leading to a highly fragmented market and several interoperability challenges. This situation is primarily due to the absence of standardized charging protocols and regulatory frameworks, which are crucial for electric mobility systems' smooth integration and scalability. Without a uniform system, ensuring that electric vehicles can be charged anywhere, anytime, and by any charging station, regardless of the manufacturer becomes increasingly challenging.

Opportunities

Investment in Charging Infrastructure

The electric mobility market has witnessed unparalleled growth, which has led to an increased demand for charging infrastructure. This presents a unique opportunity for businesses and investors to invest in charging infrastructure. Three main types of charging infrastructure can be considered for investment: fast charging networks, residential charging solutions, and innovative battery-swapping technologies. Fast-charging networks are critical for long-distance travel and can charge an electric vehicle in under an hour. These networks can be installed along highways and other major roads to provide a seamless charging experience for drivers.

- In August 2023, Jupiter Wagons, a commercial vehicle manufacturer, announced its plans to venture into the electric mobility market. The company plans to introduce a range of electric commercial vehicles in early 2024. This move is a part of Jupiter Wagons' broader strategy to shift towards sustainable and eco-friendly transportation solutions.

Collaborative ecosystem development

Establishing a collaborative ecosystem that can effectively address the issues related to the fragmentation and standardization of the electric mobility market is imperative. This ecosystem should be all-encompassing, bringing together automakers, technology providers, utilities, and policymakers to work in tandem toward a mutual objective. By pooling their resources and expertise, these stakeholders can lay the groundwork for interoperable standards and regulatory frameworks that can pave the way for sustainable growth.

Recent Developments

- In December 2023, Jindal Mobilitric, a leading manufacturer of electric two-wheelers, announced the launch of three new electric two-wheelers. The company also plans to expand its production capacity by setting up a new plant in Ahmedabad with a capacity of 180,000 units.

- In November 2023, the Volkswagen Group's subsidiary Elli launched a pan-European charging solution for electric fleets. This solution will offer advanced technical features such as high-speed charging, intelligent charging capabilities, and real-time data analytics to optimize charging operations.

- In September 2023, Greaves Electric Mobility announced the launch of an electric cargo three-wheeler. This vehicle is designed to provide efficient and sustainable transportation for commercial purposes. The electric cargo three-wheeler is expected to have a high-performance motor and battery, enabling it to carry heavy loads while maintaining a low carbon footprint.

Major Key Players

- Gogoro Inc.

- BMW Motorrad International

- Honda Motor Co. Ltd.

- Mahindra Group

- KTM AG

- Ninebot Ltd.

- Terra Motors Corporation

- Suzuki Motor Corporation

- Vmoto Limited

- Zero Motorcycles

- Yamaha Motor Company Limited

- ALTA Motors

- NYCeWheels

- Lightning Motorcycles

- Accell Group

- Tesla

Market Segmentation

By Product

- Electric Bicycle

- Electric Skateboard

- Electric Car

- Electric Motorcycle

- Electric Wheelchair

- Electric Scooter

- Standing/Self-Balancing

- Retro

- Folding

By Battery

- NiMH

- Sealed Lead Acid

- Li-ion

By Voltage

- Less than 24V

- 24V

- 36V

- 48V

- Greater than 48V

By End-use

- Personal

- Commercial

By Drive

- Belt Drive

- Chain Drive

- Hub Drive

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1270

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308