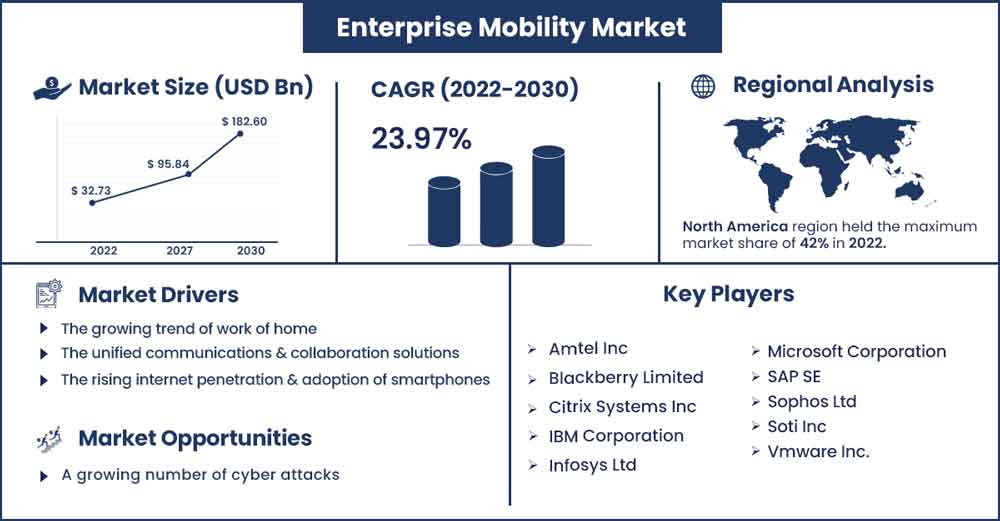

Enterprise Mobility Market is Expected to Increase at a 23.97% of CAGR by 2030

The global enterprise mobility market size surpassed USD 32.73 billion in 2022 and is expected to attain around USD 182.6 billion by 2030, expanding at a strong CAGR of 23.97 percent throughout the projection period 2022 to 2030.

The Unified Communications and Collaboration solutions are often used to help remote employees communicate, which is driving the growth of the global enterprise mobility market. Smartphones are being increasingly used for business purposes. Thus, the rising internet penetration and adoption of smartphones are boosting the enterprise mobility market growth. Increasing employee productivity by encouraging them to work in pleasant locations outside of the workplace. This is regarded as key trend in the global enterprise mobility market. Cloud-based worker mobility tools are becoming more popular. Organizations are under pressure from competitors to implement flexible work arrangements in order to increase operational efficiency. As a result, all of these factors are contributing towards the growth of the global enterprise mobility market.

Report Highlights:

- On the basis of components, the solutions segment holds the largest market share in the global enterprise mobility market. Enterprise mobility solutions help businesses acquire new consumers, retain existing customers, and improve profitability and customer satisfaction. In order to boost efficiency and maintain corporate continuity, firms must manage data effectively and accurately.

- On the basis of deployment modes, cloud segment holds the largest market share in the global enterprise mobility market. Cloud storage also ensures that sensitive information is only accessible via the cloud and not saved locally on personal devices.

- On the basis of application, BFSI segment holds the largest market share in the global enterprise mobility market. The popularity of enterprise mobility solutions has increased as the Bring Your Own Devices trend has grown in the BFSI industry. Many of the BFSI firms are progressively highlighting workplace mobility as a means of promoting employee output and gratification.

Regional Snapshot:

North America is the largest segment for the enterprise mobility market in terms of region. The U.S. is dominating the enterprise mobility market in the North American region. The existence of prominent market players in the region is credited with the growth of the North American enterprise mobility market. Because of the severe competition in the North American market, numerous market competitors strive for increased sales and business expansion.

Europe region is the fastest-growing region in the enterprise mobility market. The UK holds the highest market share in the Europe enterprise mobility market. The healthcare industry has a lot of promise for analytics, especially with the growing usage of big data analytics in the country's healthcare ecosystem. This is projected to aid enterprise mobility in the country over the forecast period. Prediction also assists hospitals in reducing provider-payer costs.

Enterprise Mobility Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 40.57 Billion |

| Projected Forecast Revenue in 2030 | USD 182.6 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 23.97% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Drivers:

The growing trend of work of home

As a result of the COVID-19 pandemic, more businesses are embracing remote working. The modern workforce's wish for mobility is growing, owing in part to the COVID-19 epidemic, which is pushing a move to remote employment. Enterprise mobility solutions are becoming more popular because they allow businesses to remotely control, update, and delete data from devices.

Restraints:

Lack of customization

Enterprise mobility market players are unable to modify their products to meet specific corporate needs. Enterprises frequently lament the enterprise mobility solution's inability to handle multi-user connections with flexibility and agility. For mobile devices that connect to the corporate network, each company has various security requirements.

Opportunities:

A growing number of cyber attacks

Enterprise mobile frauds have risen in recent years, according to Lookout's study. Globally, the number of workplace mobile phishing attacks has increased by 37% since Q4 2019. With a 66 percent spike since the end of 2019, the United States has witnessed some of the worst. Phishing attacks targeting mobile devices are growing more widespread as more mobile devices are deployed in the workplace, necessitating staff training on adequate mobile security protocols. Thus, this factor is supporting the growth of the market.

Challenges:

The poor condition of enterprise system integrators

Each business should have numerous workflow automation systems that function together. Various systems should be linked in order to communicate crucial information. Mobile devices, such as smartphones and laptops, should also be able to seamlessly interface with complicated business processes. Failure to connect mobile devices with complicated systems resulted in data silos, which happen when vital data is only available on a single device and is not shared with the company's network. As a result, this is a major challenge for market growth.

Recent Developments:

- During the COVID-19 outbreak, Microsoft and Citrix collaborated in July 2020 to create new flexible workspaces. Citrix Workspace will be chosen as a favored digital workspace solution by Microsoft, while Microsoft Azure will be chosen by Citrix as a favored cloud platform, allowing Citrix's existing on-premises clients to work anywhere across devices.

- Infosys released the Live Workplace Suite in September 2019, a collection of digital tools designed to accelerate and enhance enterprise mobility settings.

- Cisco declared the contract to buy IMImobile in December 2020. Cisco and IMImobile have agreed to the parameters of a recommended cash offer in which Cisco would pay 595 pence per share in return for each share of IMI mobile.

Major Key Players:

- Amtel Inc

- Blackberry Limited

- Citrix Systems Inc

- IBM Corporation

- Infosys Ltd

- Microsoft Corporation

- SAP SE

- Sophos Ltd

- Soti Inc

- Vmware Inc.

Market Segmentation:

By Component

- Solutions

- MDM

- MAM

- MCM

- Identity and Access Management

- Mobile Expense Management

- Services

- Professional Services

- Consulting

- Support and Maintenance

- Deployment and Integration

- Managed Services

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Device Type

- Laptop

- Tablet

- Smartphones

By Deployment Modes

- Cloud

- On-premises

By Application

- BFSI

- Retail and eCommerce

- Healthcare and Life Sciences

- IT and Telecom

- Manufacturing

- Government

- Transportation and Logistics

- Travel and Hospitality

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2251

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333