Essential Oils Market Size To Rake USD 43.87 Billion By 2032

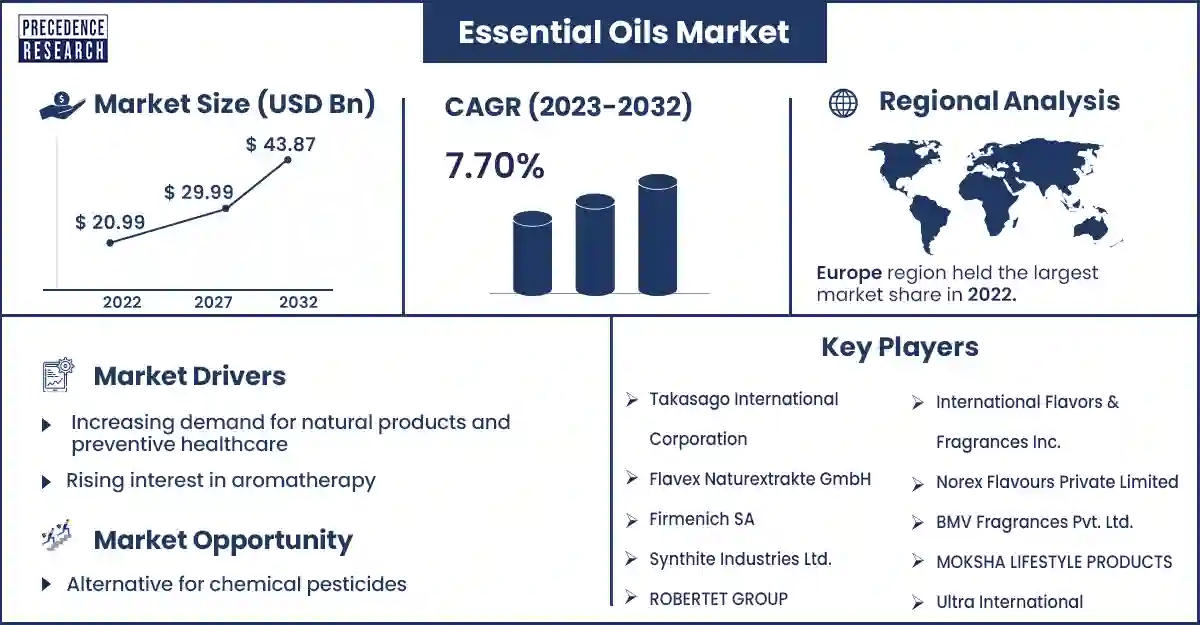

The global essential oils market size surpassed USD 20.99 billion in 2022 and is expected to rake around USD 43.87 billion by 2032, poised to grow at a CAGR of 7.70% from 2023 to 2032.

Market Overview

The essential oils market is a dynamic and rapidly growing sector within the broader natural products industry. Essential oils are concentrated plant extracts obtained through distillation or mechanical methods, renowned for their aromatic properties and therapeutic benefits.

The global market has experienced growth in recent years and is projected to continue expanding. Factors driving market growth include increasing consumer demand for natural and organic products, rising awareness of aromatherapy and natural remedies, and growing applications across various industries such as cosmetics, personal care, food and beverage, and pharmaceuticals. This market is poised for continued growth, driven by increasing consumer interest in natural and holistic health solutions, expanding applications across industries, and technological advancements in extraction techniques and product formulation.

The market presents opportunities for growth and innovation, driven by consumer demand for natural, aromatic, and therapeutic products across various industries and regions. As the market continues to evolve, companies that prioritize product quality, sustainability, and consumer education will be well-positioned to succeed in this dynamic and competitive landscape.

Regional Snapshots

In 2023, North America dominated the market for essential oils, driven by factors such as increasing consumer demand for natural products, growing awareness of aromatherapy, and the presence of established wellness trends. The United States and Canada are the major contributors to the North American essential oils market. The United States, in particular, has a large consumer base interested in natural and organic products, fueling the demand for essential oils. Consumers in North America are increasingly seeking out high-quality, sustainably sourced essential oils for use in aromatherapy, personal care, and household applications. There is also a growing interest in organic and certified essential oils, reflecting consumer preferences for purity and authenticity.

The Asia-Pacific region presents the fastest growth opportunities for the essential oils market, driven by factors such as rising disposable incomes, increasing urbanization, growing consumer interest in health and wellness, and a rich diversity of botanical resources. China, India, Japan, and Australia are key markets for essential oils in the Asia-Pacific region. India, in particular, has a long history of traditional medicine and aromatherapy, driving demand for essential oils such as sandalwood, jasmine, and vetiver. Asia-Pacific consumers are increasingly incorporating essential oils into their daily routines for aromatherapy, skincare, haircare, and household applications. There is also a growing interest in exotic and indigenous essential oils, reflecting consumer preferences for unique and culturally significant ingredients.

Essential Oils Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 22.5 Billion |

| Projected Forecast Revenue by 2032 | USD 43.87 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.70% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for natural products and preventive healthcare

Growing consumer awareness of the potential health benefits associated with natural products has driven demand for the essential oils market. Consumers are increasingly seeking natural alternatives to synthetic fragrances and chemical-based products, driving the adoption of essential oils in personal care, home care, and aromatherapy. The rising demand for natural and organic cosmetics has driven the incorporation of essential oils into skincare, haircare, and personal care products. Essential oils offer fragrance, antimicrobial, and antioxidant properties, making them popular ingredients in natural and organic formulations.

Rising interest in aromatherapy

Aromatherapy, which involves the use of essential oils market for therapeutic purposes, has gained popularity as a complementary therapy for stress relief, relaxation, and mood enhancement. The growing interest in holistic health and wellness practices has fueled the demand for essential oils as natural remedies for various health concerns. The growing popularity of spas, wellness centers, and aromatherapy treatments has driven demand for essential oils as key ingredients in massage oils, bath products, diffusers, and aromatherapy blends. Essential oils are valued for their therapeutic benefits and ability to create relaxing and rejuvenating experiences.

Restraints

Quality control and standardization issue

Ensuring the purity, authenticity, and quality of the essential oils market can be challenging due to variations in extraction methods, sourcing practices, and processing techniques. Adulteration, contamination, and mislabeling of essential oils pose risks to consumer safety and undermine trust in the market. Essential oils are potent concentrates that can cause skin sensitivities, allergic reactions, or adverse effects if used improperly. Consumer safety concerns, including the risk of skin irritation, photo-toxicity, and respiratory sensitization, may deter some individuals from using essential oils or influence their purchasing decisions.

Volatile components in essential oils

A significant restraint in the essential oils market is the presence of volatile components, which can impact the stability, quality, and consistency of essential oils. These volatile components, including certain chemical constituents and fragrance compounds, can exhibit variability in composition and concentration due to factors such as plant genetics, growing conditions, extraction methods, and storage conditions. Volatile components in essential oils are susceptible to oxidation, which can lead to the degradation of aroma compounds and loss of therapeutic efficiency. Volatile components may degrade or evaporate over time, leading to changes in fragrance intensity, complexity, and stability, affecting the overall sensory experience and consumer perception of the product.

Opportunities

Alternative for chemical pesticides

Essential oils have been shown as alternatives to synthetic pesticides in organic farming and integrated pest management (IPM) strategies. Certain essential oils, such as neem oil, peppermint oil, and citrus oils, exhibit insecticidal, repellent, and antifeedant properties against a wide range of pests, including insects, mites, and fungi.

Herbal extracts and botanical pesticides containing essential oils as active ingredients represent a growing segment within the crop protection industry. These natural plant-based formulations offer alternatives to conventional chemical pesticides, addressing concerns related to pesticide residues, environmental pollution, and pesticide resistance.

Pesticides based on the essential oils market can be incorporated into value-added products such as organic fertilizers, soil conditioners, and plant growth enhancers, offering multiple benefits for crop health, yield, and quality.

Genetic Improvement

Genetic improvement programs can focus on selecting and breeding plant varieties with enhanced essential oils market content, yield, and quality traits. Breeding for desirable traits such as high oil yield, specific chemical profiles, and disease resistance can lead to the development of improved cultivars tailored for essential oil production.

Biotechnological techniques, such as genetic engineering and gene editing, offer opportunities to manipulate metabolic pathways and enhance essential oil biosynthesis in plants. Targeted gene editing can enable precise modifications to key enzymes involved in essential oil production, leading to increased yields and improved quality attributes.

Marker-assisted selection techniques can accelerate the breeding process by identifying genetic markers associated with desirable traits related to essential oil production, such as oil content, composition, and aroma profile. MAS enables breeders to select elite plant genotypes with superior oil-related traits, facilitating the development of improved cultivars.

Recent Developments

- In March 2023, body mists, tropical fragrances & essential oils were launched by Panama Jack, and the new products are all vegan and cruelty-free.

- In October 2023, a range of plant-based fragrance oils was launched by Praan Naturals, which are made using pure essential oils, extracts, absolutes, and aromatic isolates derived from natural, raw botanical sources.

- In June 2023, ACTIZEET, a leading natural health and wellness brand, launched its new line of Pure Essential Oils in the Indian market.

Key Players in the Market

- Takasago International Corporation

- Flavex Naturextrakte GmbH

- Firmenich SA

- Synthite Industries Ltd.

- ROBERTET GROUP

- International Flavors & Fragrances Inc.

- Norex Flavours Private Limited

- BMV Fragrances Pvt. Ltd.

- MOKSHA LIFESTYLE PRODUCTS

- Ultra International

Market Segmentation

By Product

- Acorus Calamus

- Ajowan

- Basil

- Black pepper

- Cardamom

- Carrot Seed

- Cassia

- Cedarwood

- Celery

- Cinnamon

- Citronella

- Clove

- Cornmint

- Cumin Seed

- Curry Leaf

- Cypriol

- Davana

- Dill Seed

- Eucalyptus

- Fennel

- Frankincense

- Garlic

- Ginger

- Holy Basil

- Juniper Berry

- Lemon

- Lemongrass

- Lime

- Mace

- Mustard

- Neem

- Nutmeg

- Orange

- Palmarosa

- Pepper Mint

- DMO

- Rosemary

- Spearmint

- Turmeric

- Vetiver

- Ciz-3 Hexanol

- Tea Tree

- Others

By Application

- Medical

- Pharmaceutical

- Nutraceuticals

- Food & Beverages

- Bakery

- Confectionery

- Dairy

- RTE meals

- Beverages

- Meat, Poultry & Seafood

- Snacks & Nutritional Bars

- Spa & Relaxation

- Aromatherapy

- Massage Oil

- Personal Care

- Cleaning & Home

- Kitchen Cleaners

- Floor Cleaners

- Bathroom Cleaner

- Fabric Care

By Sales Channel

- Direct Selling

- Online Sales

- Others

By Method of Extraction

- Distillation

- Carbon dioxide extraction

- Cold press extraction

- Solvent extraction

- Other extraction methods (resin tapping and maceration)

By Type

- Singles

- Blends

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1694

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308