Food Processing and Handling Equipment Market Revenue to Attain USD 235.49 Bn by 2033

Food Processing and Handling Equipment Market Revenue and Trends 2025 to 2033

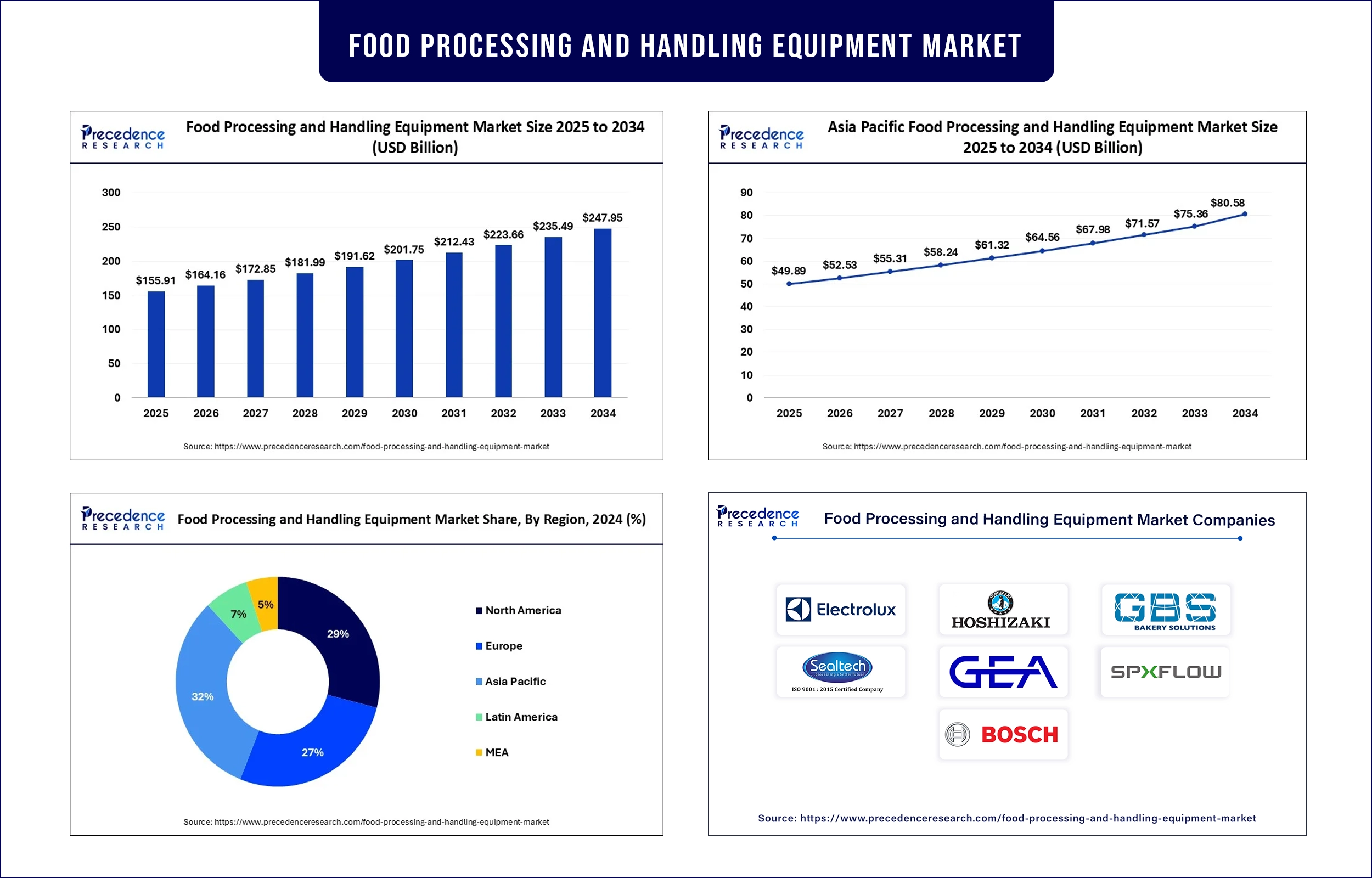

The global food processing and handling equipment market revenue reached USD 155.91 billion in 2025 and is predicted to attain around USD235.49 billion by 2033 with a CAGR of 5.29%. The growth of the market is attributed to the rising demand for processed and packaged foods.

Market Overview

The worldwide food processing and handling equipment market has experienced revolutionary changes, especially after the outbreak of COVID-19. Considering health concerns, regulatory bodies have imposed stringent regulations about food quality and hygiene, encouraging food manufacturers to adopt food processing and handling equipment to ensure food safety. The demand for processed, packaged, and ready-to-eat foods keeps rising, driven by urbanization, busy lifestyles, and changing dietary patterns. This significantly prompts the need for sophisticated, automated, and energy-efficient food processing equipment.

Several food manufacturing companies are now heavily investing in advanced equipment that ensures hygiene and sanitation throughout the production processes and adherence to regulatory standards. There is rising demand for equipment made up of energy-efficient and sustainable materials to achieve sustainability throughout the production processes.

Major Trends in the Food Processing and Handling Equipment Market

Technological Advancements

Ongoing technological innovations open up new avenues for the growth of the market. Technologies like artificial intelligence AI, internet of things IoT, automation, and robotics enhance the efficiency of food processing operations, leading to the development of high-quality food. Machine learning and artificial intelligence are transforming equipment design by facilitating real-time monitoring, predictive maintenance, and efficient process optimization. These technologies enhance operational efficiency with the added flexibility to easily adjust to changing consumer trends.

Growing Focus on Sustainability

Sustainability continues to be a key focus, with food manufacturing businesses seeking solutions to reduce energy and water consumption throughout the production processes and eliminate food waste. This encourages market players to develop energy-efficient food processing and handling equipment, which not only reduces operating costs but also conforms to stringent safety standards. Equipment today is being built with clean-in-place (CIP) technology, antimicrobial materials, and modular components so that it will be easy to sanitize and help reduce risks for contamination.

Convenience and Flexibility in Design

There is a high demand for multifunctional and readily adaptable equipment designs. Multifunctional and modular equipment enables food processors to produce a range of products with minimal changeover time. This adaptability is critical to address evolving consumer demands. As a response to economic uncertainty, there is likewise a powerful tendency toward value-priced processed foods that is prompting manufacturers to create new product lines to remain competitive.

Highlights of the Food Processing and Handling Equipment Market

Equipment Type Insights

The food processing equipment segment dominated the market with the largest share in 2024. The food processing equipment involves a wide range of machines for peeling, skinning, sorting, and cleaning. The segment’s dominance is mainly attributed to the increased demand for processed food across the globe. The increased consumer demand for hygienic and convenient food options further bolstered the growth of the segment. Meanwhile, the food packaging equipment segment is likely to grow at a significant rate during the forecast period. The growth of the segment can be attributed to the rising consumption of packaged foods.

Application Insights

The bakery & confectionery segment held the largest market share in 2024. This is mainly due to the increased consumption of bakery goods, particularly in regions like North America and Europe where bread is a staple food. On the other hand, the dairy products segment is expected to grow rapidly in the coming years. This is mainly due to the rapid expansion of small-sized dairies, especially in emerging countries. With the growing concerns regarding quality and safety, dairy product manufacturers are investing heavily in automated machinery to achieve hygiene and quality standards.

Regional Insights

Asia Pacific dominated the food processing and handling equipment market by holding the largest share in 2024. Increased population in the region is a key factor, leading to higher demand for food products. This significantly created the need for food processing and handling equipment. With the rapid urbanization and increased disposable incomes, the demand for processed food has increased, bolstering the growth of the market in the region. Moreover, the rapid expansion of commercial bakeries further contributes to the region’s dominance.

North America is expected to witness the fastest growth in the market. With the busy lifestyles, the demand for packaged, ready-to-eat meal is rising. This, in turn, boosts the need for food processing equipment. There is a high adoption of advanced equipment. Stringent food safety regulations imposed by regulatory bodies are encouraging food manufacturers to adopt food handling equipment throughout the production processes, supporting the market’s growth.

Europe is considered to be a significantly growing area. The growth of the food processing and handling equipment market in Europe is driven by the increasing consumption of bakery products. Strict food safety regulations further support regional market growth. In addition, there is a strong focus on sustainable practices, boosting the demand for energy-efficient food processing equipment. Germany, the UK, and France are embracing energy-efficient technologies and investing in smart processing machines that enhance both efficiency and quality control.

Food Processing and Handling Equipment Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 155.91 Billion |

| Market Revenue by 2033 | USD 235.49 Billion |

| CAGR | 5.29% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In March 2024, GEA announced a plan to launch a new cloud-based web application for food processing and packaging lines at the Anuga FoodTec trade show, taking place in Cologne, Germany, in March 2024. GEA InsightPartner for the food processing industry is the latest addition to its digital product family. The product is designed to support all food processing and packaging plants in achieving maximize production volume, minimize downtime, prevent unplanned shutdowns, and manage resources efficiently.

Food Processing and Handling Equipment Market Market Players

- Electrolux (Sweden)

- Hoshizaki (Japan)

- Global Bakery Solutions (UK)

- Sealtech Engineers (India)

- GEA Group (Germany)

- SPX Flow (US)

- Robert Bosch (Germany)

- IMA Group (Italy) ALFA LAVAL (Sweden)

- Bühler Holding AG (Switzerland)

- JBT Corporation (US)

- Multivac (Germany)

- Krones Group (Germany)

- Tetra Laval International S.A. (Switzerland)

- Middleby Corporation (US)

- Dover Corporation (US)

- Ali Group S.r.l (Italy)

- Dairy Tech India (India)

- Spheretech Packaging India Pvt Ltd (India)

- Align Industry (India)

Market Segmentation

By Equipment Type

- Food Processing Equipment

- Food Service Equipment

- Food Packaging Equipment

By End-Product Form

- Solid

- Liquid

- Semi-solid

By Application

- Bakery & Confectionery

- Meat & Poultry

- Fish & Seafood

- Dairy Products

- Alcoholic Beverages

- Non-alcoholic Beverages

- Other

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2462

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344