Genotyping Market

Genotyping Market Revenue and Trends

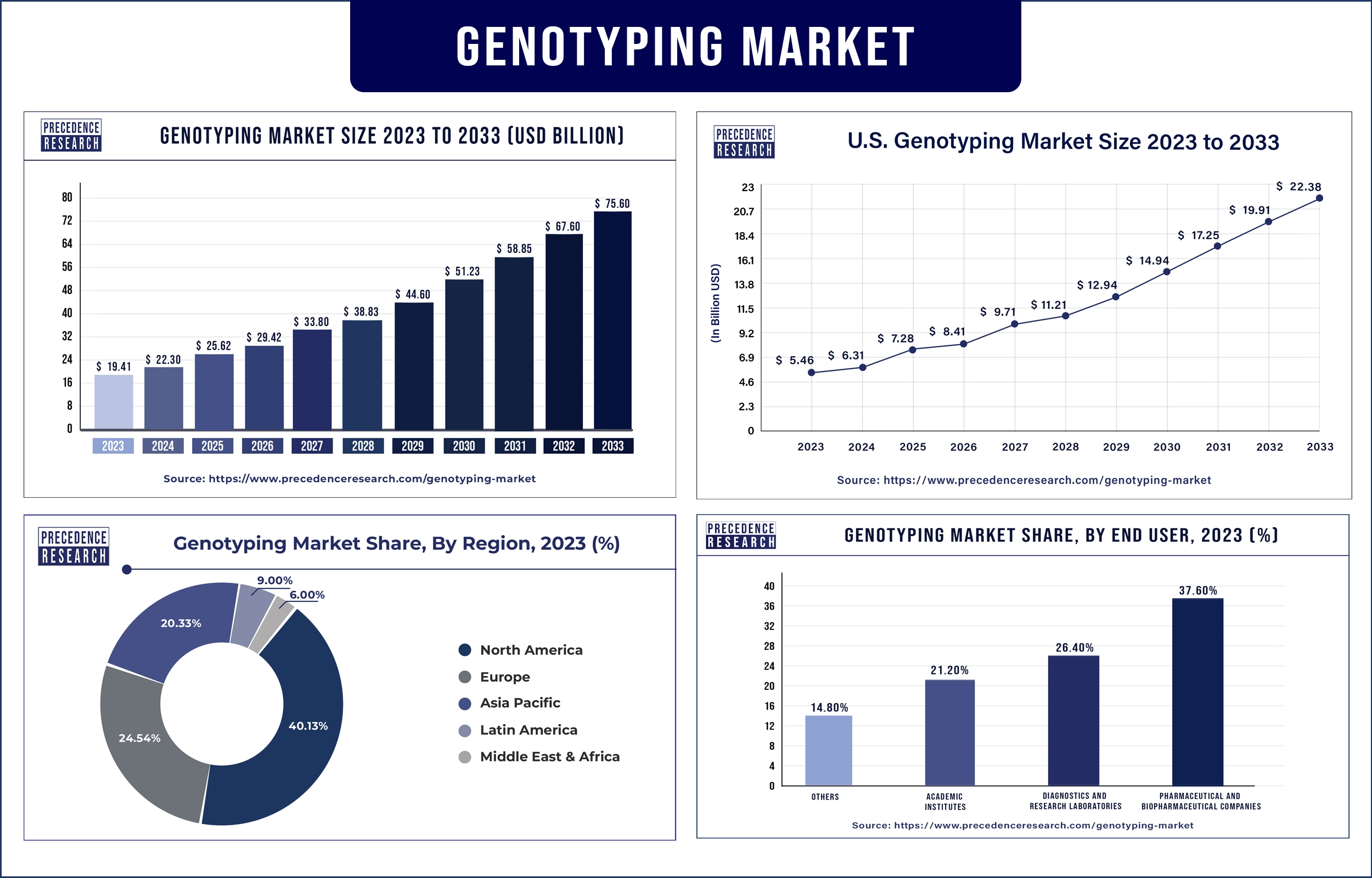

The global genotyping market revenue was valued at USD 19.41 billion in 2023 and is poised to grow from USD 22.30 billion in 2024 to USD 75.60 billion by 2033, at a CAGR of 14.53% during the forecast period 2024 - 2033. The increasing prevalence of various target diseases such as Alzheimer’s, diabetes, and cancer is expected to drive the growth of the genotyping market.

Market Overview

The genotyping market deals with the technique in which individuals can recognize genetic makeup differences via biological assays by monitoring the individual’s DNA sequence. This technique helps researchers in exploring genetic variations such as single nucleotide polymorphism and large structural changes in DNA. Genotyping is the procedure of monitoring the DNA sequence at positions through an individual’s genome.

The growing significance of genomics in treatment planning and disease diagnostics and increasing interest in understanding correlation and genetic variations with health outcomes, treatment response, and disease susceptibility are anticipated to enhance the market growth. In addition, the increasing awareness of personalized medicine and decreasing prices of DNA sequencing are further estimated to drive the growth of the genotyping market during the forecast period.

The Genotyping Market Trends

- The growing importance of genotyping in drug development is expected to drive market growth.

- The increasing demand for bioinformatics solutions in data analysis is anticipated to enhance the growth of the genotyping industry.

- The rising technological advancements and increasing research and development activities for precision medicine research are further expected to drive market growth.

Technological advancements and reducing cost of DNA sequencing to fuel the market growth

Technological advancements have allowed the incorporation of multi-parameter testing, operational flexibility, cost reductions, automation, and miniaturization. Many of these have improved the uses of DNA sequencing and versatility significantly, releasing doctors to focus on important choices like selecting and identifying therapeutic targets via diverse genotyping investigations.

Due to this, technologies such as sequencing, PCR, microarrays, and capillary electrophoresis have surged in areas like drug development and clinical research. In addition, in DNA sequencing, accurate sequencing has been made possible by technological advancements such as NGS, which have high productivity. As a result, due to technological advancements, DNA sequencing costs are reduced significantly. These are the major driving factors expected to accelerate the growth of the genotyping market.

However, the high cost of equipment and strict regulations are major factors that may restrain market growth. Genetic information is very sensitive, and regulations such as the Accountability Act and Health Insurance Portability, as well as ethical considerations, necessitate strict data protection. Additionally, new genotyping tests need regulatory approval and rigorous clinical validation before entering the market, leading to expensive and lengthy development procedures, which may also restrain market growth. Genotyping equipment includes analysis tools and complex sequencing, making ongoing maintenance and initial investments expensive, especially for clinics and smaller labs. These are the major challenging factors expected to restrain the growth of the genotyping market.

Genotyping Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 22.30 Billion |

| Market Revenue by 2033 | USD 75.60 Billion |

| Market CAGR | 14.53% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The Genotyping Market Top Companies

- Pacific Biosciences of California

- Bio-Rad Laboratories Inc.

- GE Healthcare Inc.

- Eurofins Scientific Inc.

- Agilent Technologies

- Danaher Corporation

- Fluidigm Corporation

- F. Hoffmann-La Roche Ltd.

- Qiagen Inc.

- Thermo Fisher Scientific Inc.

- Illumina Inc.

Recent Innovation in Genotyping Market by Bio-Rad Laboratories

- In September 2023, Bio-Rad Laboratories launched new thermal cyclers for genotyping, cloning, and sequencing. The new PTC Tempo 384 and PTC Tempo 48/48 provide enhanced usability and superior thermal performance. These new cyclers are the latest additions to the conventional PCR thermal cyclers of the Bio-Rad portfolio.

Recent Innovation in Genotyping Market by Thermo Fisher Scientific

- In January 2024, the new Axiom PangenomiX Array was launched by Thermo Fisher Scientific. It is the most ethnically diverse array to date and provides optimal genetic coverage for pharmacogenomic research and population-scale disease studies.

Regional Insights

North America dominated the genotyping market in 2023. The increasing prevalence of chronic diseases such as diabetes and cancer, increasing government funding, growing adoption of technologically advanced products, increasing presence of major market players, rising advancements in the healthcare infrastructure, and increasing presence of biopharmaceutical and pharmaceutical companies are expected to drive the market growth in North America. The U.S. and Canada are the major leading countries in North America.

The universal genotyping of culture-confirmed tuberculosis cases facilitates in the U.S. Tuberculosis is a common disease in the U.S. and has become a commonly used tool for investigations and detection in the U.S. Genotyping data such as state public health departments to focus interventions on the epidemiologic clusters and many cases identified. As a result of the increasing prevalence of chronic diseases like tuberculosis, the U.S. is the largest country in genotyping and is expected to enhance the growth of the genotyping market in North America.

- For instance, in November 2023, an international clinical trial was launched by the Tuberculosis Trials Consortium. It was a CRUSH-TB or Combination Regimens for Shortening Tuberculosis Treatment. The aim behind this launch was to identify new combinations of drugs via genotyping to offer additional options to reduce the treatment of TB disease in the U.S.

Europe is expected to grow at a significant rate during the forecast period. The increasing number of clinical trials, growing government investment, increasing research and development activities, rising technological advancements, and increasing rapid growth of biopharma and pharma companies are anticipated to accelerate the growth of the genotyping market in Europe. Clinical applications have been refined and expanded in Europe. In Germany, blood group genotyping is very common, especially in pregnant women. For patients with immunohematologic problems and patients with transfusion, genotyping helps to cure these diseases. These are the major factors expected to drive the growth of the genotyping market in Europe.

Market Potential and Growth Opportunity

Rising initiatives by key players and the government

The increasing government support for genotyping research is expected to enhance the opportunity in this market. Governments are working hard to put into place various programs to help organizations that research customized medicine all over the world. In addition, the strategic initiatives that major players implement are expected to drive market growth.

The various key players have released the platform, planning to push the limits of genetic medicine by making it more potent, durable, and efficient. Many companies' innovative technology allows the production of thousands of genomes yearly. These are the major opportunities expected to accelerate the growth of the genotyping market in the coming years.

The Genotyping Market News

- In January 2024, in the UK, a new ‘blood matching’ genetic test was launched by the National Health Service. The aim behind this launch was to improve transfusions for patients with inherited blood disorders. This genetic test was in personalized healthcare for patients with thalassemia and sickle cell disorder.

- In January 2024, BioResource developed a new genotyping program with the Blood Transfusion Genomics Consortium (BGC), an international consortium of partners, using the STRIDES cohort of BioResource volunteers to test the DNA array.

- In June 2023, in Europe, Zoetis launched the new PCV2 vaccine with two genotypes. It was the new Porcine Circovirus type 2 vaccine that involves two genotypes, offering protection and broader coverage against PCV2 threat. CircoMax has demonstrated protection against PCV2d, PCV2b, and PCV2a.

Segments Covered in the Report:

By Product

- Instruments

- Sequencers & Amplifiers

- Analyzers

- Reagents & Kits

- Software and Services

- Genotyping Services

By Application

- Pharmacogenomics

- Diagnostics and Personalized Medicine

- Agricultural Biotechnology

- Animal Genetics

- Others

By Technology

- PCR

- Real-time PCR

- Digital PCR

- Capillary Electrophoresis

- Amplified Fragment Length Polymorphism

- Restriction Fragment Length Polymorphism

- Single-Strand Conformation Polymorphism

- Microarrays

- DNA Microarrays

- Peptide Microarrays

- Others

- Sequencing

- Next Generation Sequencing

- Pyro Sequencing

- Sanger Sequencing

- Matrix-Assisted Laser Desorption/Ionization-Time of Flight (Maldi-TOF) Mass Spectroscopy

- Others

By End User

- Pharmaceutical And Biopharmaceutical Companies

- Diagnostics And Research Laboratories

- Academic Institutes

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2983

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308