Home Medical Equipment Market Market Revenue to Attain USD 45.31 Bn by 2033

Home Medical Equipment Market Market Revenue and Trends 2023 to 2033

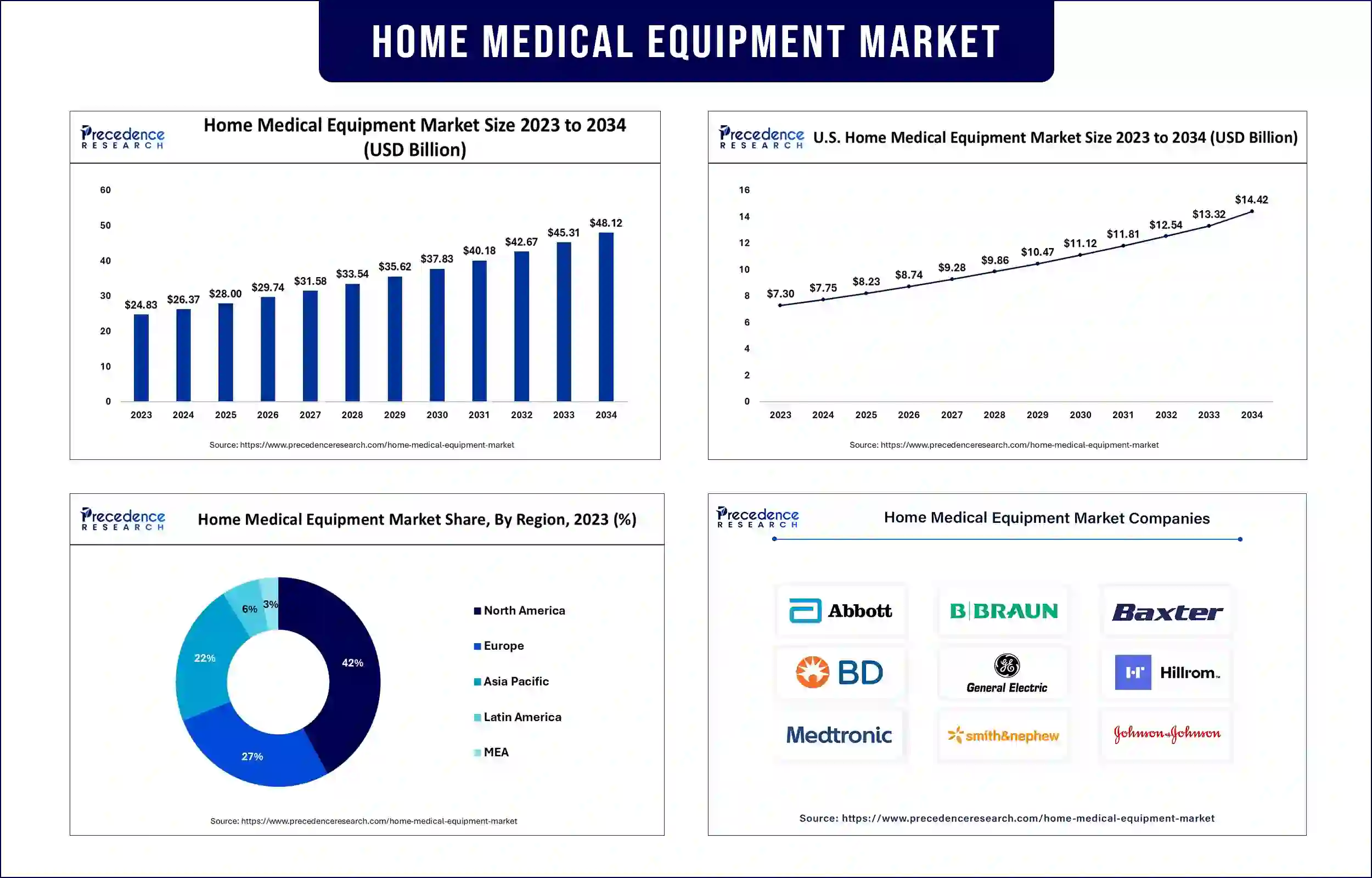

The global home medical equipment market size was estimated at USD 26.37 billion in 2024 and is predicted to attain around USD 45.31 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.20% during the forecast period 2024 to 2033. The demand for home medical equipment is rising due to the increasing awareness about self-care. Moreover, rising concerns about hospital acquired infections boost the market in the coming years.

Market Overview

The home medical equipment market is primarily driven by the increasing geriatric population. Older people are more prone to various diseases, often requiring medical devices, such as mobility aids, monitoring equipment, and therapeutic devices. Rising demand for advanced home healthcare solutions further contributes to market growth. Individuals are increasingly preferring home healthcare solutions, as they allow them to recover in the comfort of home, significantly reducing hospital visits and costs. Moreover, the rising cost associated with hospital and clinical procedures and treatments drives the need for home medical equipment.

Highlights of the Home Medical Equipment Market Report

- By equipment type, the therapeutic equipment segment dominated the global market with the largest share in 2023. The segment is driven by rising consumers’ preference toward home-based care and increasing awareness about preventive healthcare. Therapeutic equipment allows patients to manage their health conditions in a personalized manner at their home. Moreover, patients, especially older individuals, often prefer receiving therapy in the comfort of their home due to the rising healthcare costs. Receiving therapy at home significantly reduces hospital stays.

- By distribution channel, the retail medical stores segment accounted for the largest market share in 2023. The easy availability of medical equipment to these stores is a major factor contributing to segmental growth. Moreover, these stores allow patients to physically examine the product before purchasing. The immediate availability of the product also reduces the wait time as compared to online stores, enhancing consumer satisfaction.

Home Medical Equipment Market Trends

- Technological Advancements: Advancements in medical devices led to the development of wearable health devices, such as smartwatches and fitness trackers. These devices are able to detect vital signs, track physical activities, and provide real-time health data. Also, telemedicine is gaining traction, which allows remote consultations and medical guidance possible through video calls for timely access to healthcare professionals. In addition, integrating AI algorithms in medical devices enable real-time data collection, remote monitoring, and patient-doctor communication, thereby enhancing health outcomes.

- Rising Prevalence of Chronic Diseases: The prevalence of chronic illnesses like diabetes, chronic obstructive pulmonary disease, asthma, and heart failure is increasing worldwide. Chronic diseases are one of the major causes of mortality. According to the World Health Organization (WHO), chronic diseases like cancer, chronic obstructive pulmonary disease, and cardiovascular disease cause 60% of all mortality. However, some chronic diseases require regular monitoring to manage symptoms, leading to increased adoption of home medical equipment.

- Increasing Cases of HAI: With the significant increase in the incidence of hospital-acquired infections (HAI), there is a high demand for home healthcare solutions, contributing to market expansion. According to WHO, out of every 100 patients in acute-care hospitals, seven patients in high-income countries and 15 patients in low—and middle-income countries are affected by at least one health care-associated infection (HAI) during their hospital stay. On average, one in 10 affected patients dies from HAI.

Regional Insights

In 2023, North America dominated the global home medical equipment market by capturing the largest share. This is primarily due to the rapid adoption of cutting-edge technology and increased healthcare spending. The region is at the forefront of technological advancements, leading to the rapid development of advanced medical devices. In addition, the increasing geriatric population and rising prevalence of chronic disorders are expected to sustain North America’s dominance in the near future.

On the other hand, Asia Pacific is expected to witness the fastest growth during the projection period. This is mainly due to the increasing incidence of chronic diseases. Moreover, rising government funding to advance healthcare infrastructure, growing awareness of self-care and self-medication, and rising disposable income contribute to regional market growth.

Home Medical Equipment Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 26.37 Billion |

| Market Revenue by 2033 | USD 45.31 Billion |

| CAGR | 19.23% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In November 2024, Beurer India Pvt Ltd launched the GL 22 Blood Glucose Monitor for home as well as hospital use. The device features comprehensive monitoring capabilities, providing insights into blood glucose levels.

- In January 2023, Inogen Inc., a medical technology company offering innovative respiratory products for homecare, announced that it has achieved regulatory milestones in the EU and the US to support its portable oxygen concentrator products.

Key Market Players:

- Abbott

- B. Braun SE

- Baxter

- BD

- General Electric

- Hill-Rom Services, Inc.

- Medtronic

- Smith & Nephew

- Invacare Corporation

- Johnson & Johnson

Market Segmentation

By Equipment Type

- Therapeutic Equipment

- Respiratory Therapy Equipment

- Dialysis Equipment

- Intravenous Equipment

- Other Therapeutic Equipment

- Patient Monitoring Equipment

- Conventional Monitors

- Telemedicine Patient Monitoring Equipment

- Mobility Assist & Support Equipment

- Mobility Assist Equipment

- Medical Furniture

- Bathroom Safety Equipment

By Distribution Channel

- Retail Medical Stores

- Hospital Pharmacies

- Online Retailers

By End Users

- Hospitals

- Home Care Settings

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2239

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com| +1 9197 992 333