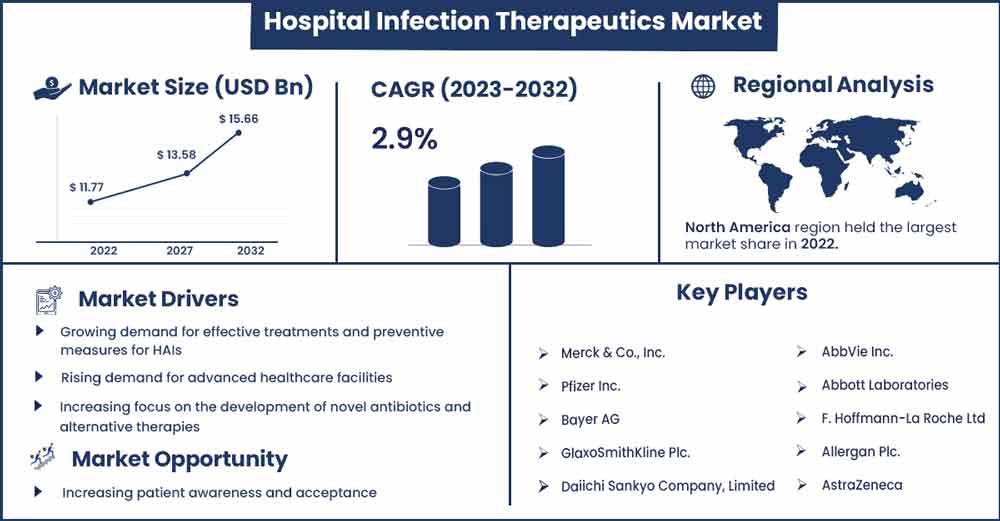

Hospital Infection Therapeutics Market To Attain Revenue USD 15.66 Bn By 2032

The global hospital infection therapeutics market revenue was evaluated at USD 11.77 billion in 2022 and is expected to attain around USD 15.66 billion by 2032, growing at a CAGR of 2.9% from 2023 to 2032.

The growth of the market is driven by the increasing focus on the development of novel antibiotics and alternative therapies to combat the rising incidence of drug-resistant infections. With the growing prevalence of antibiotics resistant bacteria, there is a pressing need for new treatments that can effectively target these pathogens.

As a result, pharmaceutical companies are investing heavily in the research and development of new antibiotics and alternative therapies such as phage therapy, immunotherapy, and monoclonal antibodies. Additionally, there is a push for the development of combination therapies that can target multiple pathways in bacteria, thereby reducing the likelihood of resistance development. This trend is likely to continue as the healthcare industry grapples with the challenges posed by antibiotic resistance and seeks innovative solutions to combat hospital-acquired infections.

Hospital Infection Therapeutics Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 12.11 Billion |

| Projected Forecast Revenue by 2032 | USD 15.66 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 2.9% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising incidence of drug-resistant infections

The emergence of drug-resistant infections is a critical factor driving the growth of the hospital infection therapeutics market. Overuse and misuse of antibiotics and other antimicrobial drugs have contributed to the development of drug-resistant strains of bacteria, viruses, and fungi. The World Health Organization (WHO) reports that drug-resistant infections cause an estimated 700,000 deaths worldwide annually, a number that is projected to increase in the coming years. Antibiotic resistance is particularly concerning as it poses a significant threat to public health. Infections caused by drug-resistant bacteria are challenging to treat, and in some cases, there are no effective treatments available. As a result, there is an urgent need for new and effective antibiotics to combat drug-resistant infections. This has led pharmaceutical companies to invest in the development of new antibiotics and other antimicrobial drugs, which are expected to fuel market growth in the hospital infection therapeutics market.

Restraint

High cost of drug development

Developing new drugs is an expensive and time-consuming process, and it takes several years and significant financial resources to bring a drug to market. The high costs associated with drug development are often passed on to consumers in the form of high drug prices, which limit access to essential medications, particularly in low- and middle-income countries. Moreover, strict regulatory requirements and lengthy approval processes further delay drug development, making it difficult for pharmaceutical companies to introduce new therapies to the market.

Opportunity

Rising healthcare expenditure

Increased healthcare spending, particularly in emerging markets, is expected to drive the demand for hospital infection therapeutics. As healthcare infrastructure improves and access to healthcare increases in emerging markets, demand for hospital infection therapeutics is likely to rise. The growing middle class in these markets is also expected to drive demand for higher-quality healthcare services, including the prevention and treatment of HAIs. In addition, healthcare expenditure is increasing in developed markets as well. Aging populations, rising incidence of chronic diseases, and increasing demand for healthcare services are all driving up healthcare spending in these markets. This is expected to result in increased demand for hospital infection therapeutics, as these populations are at a higher risk for developing HAIs.

Regional Landscape

The Asia Pacific region is expected to witness significant growth in the hospital infection therapeutics market due to several factors. The region has a large and growing patient population, which is driving demand for effective treatments for hospital-acquired infections. Moreover, increasing healthcare expenditures in countries such as China and India are creating opportunities for market growth.

Furthermore, improving healthcare infrastructure and increasing awareness about the importance of infection prevention and control are also contributing to market growth. China is the largest market for hospital infection therapeutics in the Asia Pacific region, driven by the country's large patient population and increasing healthcare expenditure. The government's focus on improving healthcare infrastructure and promoting infection control measures is also contributing to market growth.

Drug Type Landscape

Antifungal drugs are used to treat and prevent fungal infections in hospital settings. These drugs are used to treat a range of fungal infections, including candidiasis, aspergillosis, and cryptococcosis, among others. The antifungal drugs segment is expected to witness significant growth in the coming years due to the rising incidence of fungal infections, particularly in immunocompromised patients. The major classes of antifungal drugs include azoles, echinocandins, and polyenes. Azoles are the most prescribed antifungal drugs and are used to treat a wide range of fungal infections.

The segment is expected to witness significant growth due to the increasing use of azoles for the treatment of invasive fungal infections, such as candidemia, as well as the development of new azole drugs that target drug-resistant strains. Therefore, the antifungal drugs segment is expected to witness significant growth in the coming years due to the rising incidence of fungal infections, particularly in immunocompromised patients, and the need for new and effective drugs to combat drug-resistant strains. The development of new antifungal drugs, including those that target drug-resistant strains, is expected to drive market growth in this segment.

Application Landscape

Pneumonia is a common hospital-acquired infection that can be a serious complication, especially in patients with mechanical ventilation. The segment is expected to witness significant growth in the hospital infection therapeutics market due to the increasing incidence of ventilator-associated pneumonia (VAP) and the need for new antibiotics to combat drug-resistant strains.

Antibiotics are the most common treatment for pneumonia, but the prevalence of drug-resistant strains of bacteria has led to the development of new antibiotics that target these strains. Several pharmaceutical companies are currently developing new antibiotics that specifically target drug-resistant strains of bacteria, which are expected to be launched in the market in the coming years.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the hospital infection therapeutics market. The demand for these therapeutics has increased significantly due to the high number of COVID-19 cases and the need to prevent hospital-acquired infections. On the one hand, the pandemic has created new opportunities for the hospital infection therapeutics market. Many pharmaceutical companies have ramped up their production of drugs and therapies used to treat COVID-19 patients, such as antivirals, antibiotics, and immunomodulators. Moreover, the increased focus on infection control and prevention in hospitals has led to a higher demand for disinfectants, sterilization equipment, and other infection-control products.

On the other hand, the pandemic has also created several challenges for the hospital infection therapeutics market. The disruption of global supply chains due to lockdowns and travel restrictions has led to shortages of critical raw materials and finished products, causing delays in manufacturing and delivery. Additionally, the economic downturn caused by the pandemic has led to budget cuts in healthcare systems, reducing their ability to invest in new infection prevention and treatment technologies.

Recent Developments

- In March 2023, GSK and SCYNEXIS signed an exclusive licensing agreement for Brexafemme, an antifungal medication approved by the US FDA for treating vaginal candidiasis. GSK will have exclusive rights to market the drug for this purpose, while SCYNEXIS will continue to develop it for the treatment of invasive candidiasis. This partnership is a major step in improving the treatment of fungal infections.

- In September 2022, GSK and Spero Therapeutics have signed an exclusive licensing agreement for tebipenem HBr, a late-stage antibiotic that could potentially treat complicated urinary tract infections caused by certain bacteria, including pyelonephritis. This marks a significant milestone in the development of the first oral carbapenem antibiotic for this purpose.

Major Key Players:

- Merck & Co., Inc.

- Pfizer Inc.

- Bayer AG

- GlaxoSmithKline Plc.

- Daiichi Sankyo Company, Limited

- AbbVie Inc.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Allergan Plc.

- AstraZeneca

Segments Covered in the Report

By Drug Type

- Antibiotics Drugs

- Antifungal Drugs

- Antiviral Drugs

- Others

By Applications

- Bloodstream Infections

- Pneumonia

- Surgical Site Infections

- Urinary Tract Infections

- Gastrointestinal Disorders

- Other Hospital Infections

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2797

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333