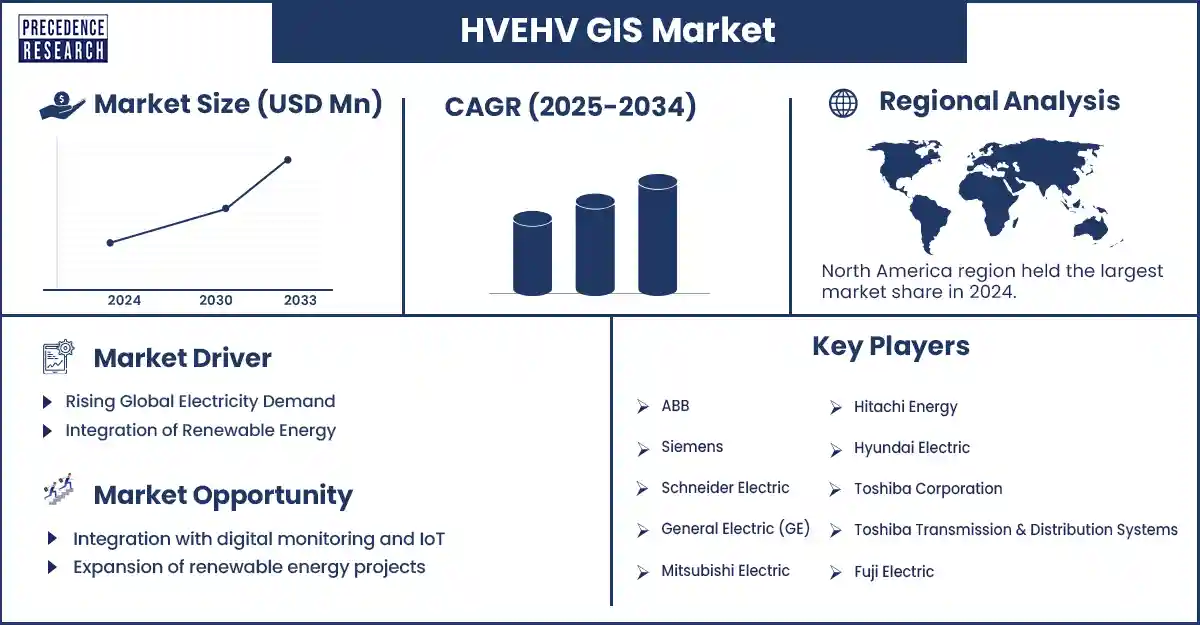

HV/EHV GIS Market Revenue and Forecast by 2033

HV/EHV GIS Market Revenue and Trends 2025 to 2033

The global HV/EHV GIS market is driving compact, high-voltage solutions for modern substations with growing demand for reliable grid infrastructure. The market growth is attributed to surging investments in smart grid modernization, rising renewable integration, and high demand for compact and resilient substation technology. Stringent regulations regarding safety and environmental compliance are also supporting market growth.

What are the Major Factors Influencing the Growth of the HV/EHV GIS Market?

The market is experiencing rapid growth due to the increasing demand for reliable power transmission infrastructure, where GIS plays a vital role. The increasing global population, urbanization, and industrialization is boosting the electricity demand, which is likely to influence the market growth. The rapid transition toward renewables and the need for efficient, low-footprint transmission options are also boosting the market growth. As utilities and governments focus on reducing footprint, lower maintenance costs, and enhancing reliability in extreme conditions, the adoption of HV/EHV GIS increases to meet changing load demands and stabilize operations.

Segment Insights

- By voltage level, the extra high voltage (EHV) segment held the largest share of the market in 2024. This is mainly due to the increased demand for long-distance, high-capacity power transmission.

- By installation type, the indoor GIS segment led the market in 2024 due to its compact design with a lower exposure to the external environment, less maintenance than outdoor formats, and suitability for urban and industrial environments where land is limited.

- By end-use industry, the power transmission & distribution segment dominated the HV/EHV GIS market with the largest share in 2024, as utilities have prioritized the resilience of transmission and distribution grids and demand for reliable, high-capacity electricity infrastructure.

- By component, the circuit breakers segment held a major share of the market in 2024 because they are vital for isolating faults and enhancing the safety of overall systems.

- By gas type, the SF6 (Sulfur Hexafluoride) segment dominated the market in 2024 due to its enhanced dielectric strength and reliability. Its superior insulating and arc-quenching properties make it critical for high-voltage applications.

Regional Insights

Asia Pacific maintained dominance in the HV/EHV GIS market by holding the largest share in 2024. This is mainly due to increasing investments in infrastructure development, rapid urbanization, and renewable energy expansion, particularly in China, India, and Southeast Asia. Focus on grid modernization and government-led energy projects further solidifies its leading position in the market. The growing focus on upgrading aging grids and integrated renewable energy sources further propels the demand for GIS systems, as they play a crucial role in ensuring efficient, stable, and compact solutions for high-voltage transmission.

The Middle East & Africa is expected to grow at the fastest rate during the forecast period, driven by rising upgradation and modernization of aging grids, new urban electrification projects, and the development of new greenfield energy hubs. Utilities and oil-and-gas stakeholders across the region are making strategic investments in GIS systems. Moreover, increasing investments in energy infrastructure and industrial expansion contribute to regional market growth.

HV/EHV GIS Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- In February 2023, ABB India inaugurated a new state-of-the-art GIS factory in Nashik, doubling its production capacity. The facility will produce primary and secondary GIS to serve sectors such as power distribution, smart cities, data centers, transport, and infrastructure. (Source: https://new.abb.com)

HV/EHV GIS Market Key Players

- ABB

- Siemens

- Schneider Electric

- General Electric (GE)

- Mitsubishi Electric

- Hitachi Energy

- Hyundai Electric

- Toshiba Corporation

- Toshiba Transmission & Distribution Systems

- Fuji Electric

- BHEL (Bharat Heavy Electricals Limited)

- Chengdu R & J Technology

- Nissin Electric Co., Ltd.

- Schneider Electric India

- LS Electric

- Beijing Sifang Automation Co., Ltd.

- Adani Transmission Limited

- Crompton Greaves

- Eaton Corporation

- Bharat Heavy Electricals Limited (BHEL)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6758

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344