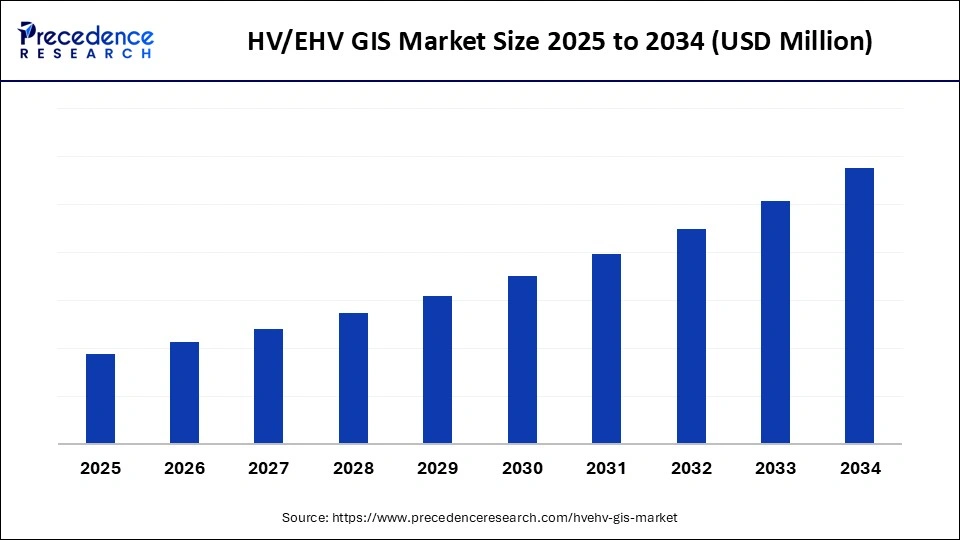

HV/EHV GIS Market Size and Forecast 2025 to 2034

The HV/EHV GIS market is expanding as governments and private players invest in high-voltage networks. Innovations in eco-friendly gases and smart monitoring enhance performance. The market is growing due to the rising demand for compact, reliable, and efficient power transmission solutions in urban and industrial areas.

HV/EHV GIS Market Key Takeaways

- Asia Pacific dominated the HV/EHV GIS market with the largest market share of 35% in 2024.

- Middle East & Africa is expected to grow at a notable CAGR during the forecast period.

- By voltage level, the extra high voltage (EHV) above 800kV segment held the largest share of 45% in 2024.

- By voltage level, the high voltage (HV) 245 kV to 420 kV segment is expected to grow at the fastest CAGR during the forecast period.

- By installation type, the indoor GIS segment captured the biggest share at 60% in 2024.

- By installation type, the outdoor GIS segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the power transmission & distribution segment contributed the maximum market share of 50% in 2024.

- By end-use industry, the commercial & residential segment is expected to grow at the fastest CAGR during the forecast period.

- By component, the circuit breakers segment generated the major market share of 40% in 2024.

- By component, the busbars segment is observed to grow at the fastest CAGR during the forecast period.

Market Overview

What Is Driving the HV/EHV GIS Market Forward, and Why Is It Gaining Traction Globally?

With utilities and developers battling with growing electricity demand, urban land constraints, and the integration of renewables, which is propelling a shift toward compact, dependable, and space-efficient switchgear, the HV/EHV GIS market is expanding globally. Rapid innovation in SF6-free and digital monitoring-enabled GIS systems is being driven by growing environmental regulations and the concerning greenhouse effect of SF6 gas. The end effect is a vibrant market expansion driven by the need for sustainability, smart grid upgrades, and changing infrastructure requirements.

- In May 2025, Hitachi Energy announced delivery of the world's first SF6-free 550 kV gas-insulated switchgear (EconiQ) to the State Grid Corporation of China, marking a significant leap in eco-efficient high-voltage infrastructure(Source: https://www.hitachi.com)

How are digital monitoring and IoT technologies transforming the HV/EHV GIS market?

The market for HV/EHV GIS is being revolutionized by digital monitoring and Internet of Things technologies, which integrate real-time sensors, edge devices, and communication protocols directly into switchgear systems. This allows for continuous tracking of vital parameters such as temperature, partial discharges, and gas density. Predictive maintenance, remote diagnostics, and integration into smart grid frameworks are made possible by this, improving asset performance, lowering unplanned outages, and increasing reliability.

- In August 2024, GE Vernova signed an MoU with Systems With Intelligence (SWI) to develop advanced substation monitoring solutions combining gas sensing, infrared thermography, AI, and ML for enhanced grid-asset diagnostics(Source: https://www.tndindia.com)

HV/EHV GIS Market Growth Factors

- Urbanization and space constraints: Growing cities face limited land availability, driving demand for compact Gas Insulated Switchgear (GIS) over traditional Air Insulated Switchgear (AIS).

- Rising Electric Demand: Rapid industrialization and digitalization are pushing utilities to expand high-voltage transmission networks.

- Integration of Renewable Energy: Increasing wind and solar power projects require efficient grid connections and reliable GIS infrastructure.

- Grid Modernization Initiatives: Governments and utilities are investing in smart grids and upgrading aging transmission infrastructure with GIS technologies.

- High Reliability and Safety Features: GIS offers superior performance in harsh environments, ensuring lower maintenance and fewer outages.

- Expansion of Power Infrastructure in Developing Economies: Emerging markets are heavily investing in HV/EHV substations to support industrial growth.

- Advancements in SF6-free Technologies: The Development of eco-friendly GIS solutions is encouraging wider adoption in line with global sustainability goals.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Voltage Level, Installation Type, End-Use Industry, Component, Gas Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Global Electricity Demand

Electricity consumption continues to grow with industrialization, urbanization, and the rapid expansion of digital infrastructure such as data centers and EV charging networks. This is placing immense pressure on transmission and distribution systems, especially at high voltage levels. HV/EHV GIS is being increasingly deployed to ensure stability and efficiency in handling high power flows.

Integration of Renewable Energy

Renewable energy projects are being developed at a record rate as governments concentrate on decarbonization. Connecting these projects to the main grid through dependable transmission solutions is necessary because they are frequently situated in isolated locations. When it comes to integrating variable renewable sources like solar and wind power while maintaining low transmission losses, HV/EHV GIS is essential. This promotes the global switch to clean energy and increases grid flexibility overall, leading to growth in the HV/EHV GIS market.

Restraints

High Initial Investment Costs

Gas-Insulated Switchgear (GIS) requires a significantly higher upfront investment compared to traditional Air Insulated Switchgear (AIS). The cost includes specialized materials, SF6 or eco alternative gases, digital monitoring systems, and complex installation. For developing regions with limited budgets, these costs can delay adoption, despite long-term efficiency benefits. This cost barrier makes utilities cautious in large-scale deployments, leading to obstacles in the HV/EHV GIS market.

Environmental Concerns Over SF6 Gas

One of the strongest greenhouse gases, SF6, is the main insulating medium in GIS and has a potential for 25200 times more global warming than CO2. There are increased environmental and compliance risks when leaks occur during installation, operation, or decommissioning. Manufacturers and utilities are under pressure to invest in pricey SF6-free substitutes as regulations tighten globally. Delays are increased by the need for new technologies and requalification procedures when switching to eco-friendly solutions.

Opportunities

Integration with digital monitoring and IoT

The rise of smart grids and predictive maintenance is creating opportunities for GIS equipped with digital sensors, IoT, and AI-based analytics. These solutions allow utilities to monitor gas density, detect leaks, and optimize performance remotely. Vendors offering end-to-end digital platforms will have an edge in modernization projects. The push for data-driven decision-making further expands opportunities for service revenues.

Expansion of renewable energy projects

New demand for grid infrastructure is being driven by massive global investments in hydropower, wind, and solar energy. Connecting transmission networks to renewable energy projects, particularly in desert and offshore environments, requires the use of HV/EHV GIS for vendors of reliable GIS systems that can endure challenging circumstances. This creates opportunities. The government setting goals for green energy will guarantee steady demand in the HV/EHV GIS market.

Voltage Level Insights

Why Did the Extra High Voltage (EHV) Above 800 kV Segment Dominate the HV/EHV GIS Market in 2024?

The extra high voltage (EHV) above 800 kV segment dominated the HV/EHV GIS market in 2024, supported by increasing demand for bulk power transmission across long distances with minimal losses. The growing integration of renewable energy into national grids and cross-border interconnections further boosted demand for EHV GIS systems, as they provide compact, reliable, and efficient solutions for handling ultra-high power loads. Rising investments in large-scale transmission projects in emerging economies cemented this segment's leadership.

The high voltage (HV) 245 kV to 420 kV segment is growing rapidly, fueled by industrialization and growing urban infrastructure. Because it strikes the ideal balance between cost and efficiency, this voltage range is frequently chosen for industrial applications, urban substations, and regional grid strengthening. Rapid adoption is being fueled by a growing emphasis on modernizing aging grid infrastructure in both developed and developing nations.

Installation Type Insights

Why Did the Indoor GIS Segment Dominate the HV/EHV GIS Market in 2024?

The indoor GIS segment dominated the market in 2024, owing to its compact footprint and suitability for urban and metropolitan areas where space is a major constraint. Its advanced safety features, low maintenance requirements, and ability to operate efficiently in harsh environments such as coastal or industrial zones made it the preferred choice for utilities and city planners. Growing adoption of underground substations in densely populated cities further strengthened this segment's dominance.

The outdoor GIS segment is growing rapidly in the HV/EHV GIS market, driven by its extensive use in projects involving the integration of renewable energy sources and large power transmission. Due to their affordability in managing large power loads, these systems are being used more in locations with available land, especially for utility-scale wind and solar farms. The need for outdoor GIS solutions is growing faster due to the increasing development of national and interregional grid infrastructure.

End Use Industry Insights

Why Did the Power Transmission & Distribution Segment Dominate the HV/EHV GIS Market in 2024?

The power transmission & distribution segment dominated the HV/EHV GIS market, driven by large investments in smart grid initiatives, grid modernization, and international electricity trade. To support rising electricity consumption, governments and utilities are placing a higher priority on safe, effective, and dependable transmission infrastructure, which makes GIS technology essential. The growing need to incorporate renewable energy sources into current networks is also advantageous to the sector.

Commercial & residential sectors are growing rapidly, driven by rising electricity demand in urban centers, smart city developments, and the need for reliable power in commercial complexes, high-rise buildings, and residential hubs. Indoor GIS systems are particularly in demand here due to their compactness and safety in populated areas. Expanding electrification in developing countries is also adding momentum to this segment's growth.

Component Insights

Why Did Circuit Breaker Segments Dominate the HV/EHV GIS Market in 2024?

The circuit breakers segment dominated the HV/EHV GIS market in 2024, because they are essential parts that guarantee the grid operates safely and dependably. High-voltage networks' need for quick fault detection and interruption is driving up demand for sophisticated circuit breakers. In line with international sustainability goals, their leadership has also been aided by ongoing developments in SF6-free and environmentally friendly breaker technologies.

Busbars are the fastest-growing component segment, driven by their essential role in distributing power across different circuits within GIS. Increasing demand for reliable, low-loss, and compact power distribution solutions in both utilities and industries is fueling their adoption. Technological improvements, such as insulated and modular busbars, are further supporting growth in this category.

Regional Insights

Why Did Asia Pacific Dominate the HV/EHV GIS Market in 2024?

The Asia Pacific segment is dominating the HV/EHV GIS market in 2024, supported by substantial expenditures on distribution and transmission networks. The need for GIS technology is growing as a result of rapid urbanization, industrialization, and the integration of renewable energy sources. The region's leadership position has been reinforced by government initiatives for cross-border electricity trade projects and grid modernization.

The Middle East & Africa is the fastest-growing regional market, driven by ambitious infrastructure projects, rising electricity consumption, and large renewable energy deployments, particularly solar and wind. Governments in the region are investing heavily in modernizing grid infrastructure and establishing high-capacity interconnections to meet growing power needs. The shift toward energy diversification and smart grids is fueling demand for GIS in this region.

HV/EHV GIS Market Companies

- ABB

- Siemens

- Schneider Electric

- General Electric (GE)

- Mitsubishi Electric

- Hitachi Energy

- Hyundai Electric

- Toshiba Corporation

- Toshiba Transmission & Distribution Systems

- Fuji Electric

- BHEL (Bharat Heavy Electricals Limited)

- Chengdu R & J Technology

- Nissin Electric Co., Ltd.

- Schneider Electric India

- LS Electric

- Beijing Sifang Automation Co., Ltd.

- Adani Transmission Limited

- Crompton Greaves

- Eaton Corporation

- Bharat Heavy Electricals Limited (BHEL)

Recent Developments

- In July 2025, Siemens Energy delivered the first SF₆-free GIS in Saudi Arabia and the Middle East, marking a major regional milestone in adopting SF₆-free high-voltage switchgear.(Source: https://www.saudigulfprojects.com)

- In July 2025, ABB entered a partnership with E.ON (Germany's largest distribution system operator) to supply its next-generation SF₆-free SafeRing and SafePlus Air 24 kV secondary GIS, using dry-air insulation to comply with the EU's upcoming SF₆ ban in medium-voltage equipment. This marks a clear step toward a gas-free, sustainable grid upgrade.(Source: https://www.altenergymag.com)

Segments Covered in the Report

By Voltage Level

- High Voltage (HV)

- 72.5 kV to 245 kV

- 245 kV to 420 kV

- Extra High Voltage (EHV)

- 420 kV to 800 kV

- Above 800 kV

By Installation Type

- Indoor GIS

- Outdoor GIS

By End-Use Industry

- Power Generation

- Power Transmission & Distribution

- Industrial

- Commercial & Residential

By Component

- Circuit Breakers

- Busbars

- Disconnectors

- Gas Insulated Bus (GIB)

- Isolators

By Gas Type

- SF6 (Sulfur Hexafluoride)

- Hybrid (SF6 and Alternative Gas)

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content