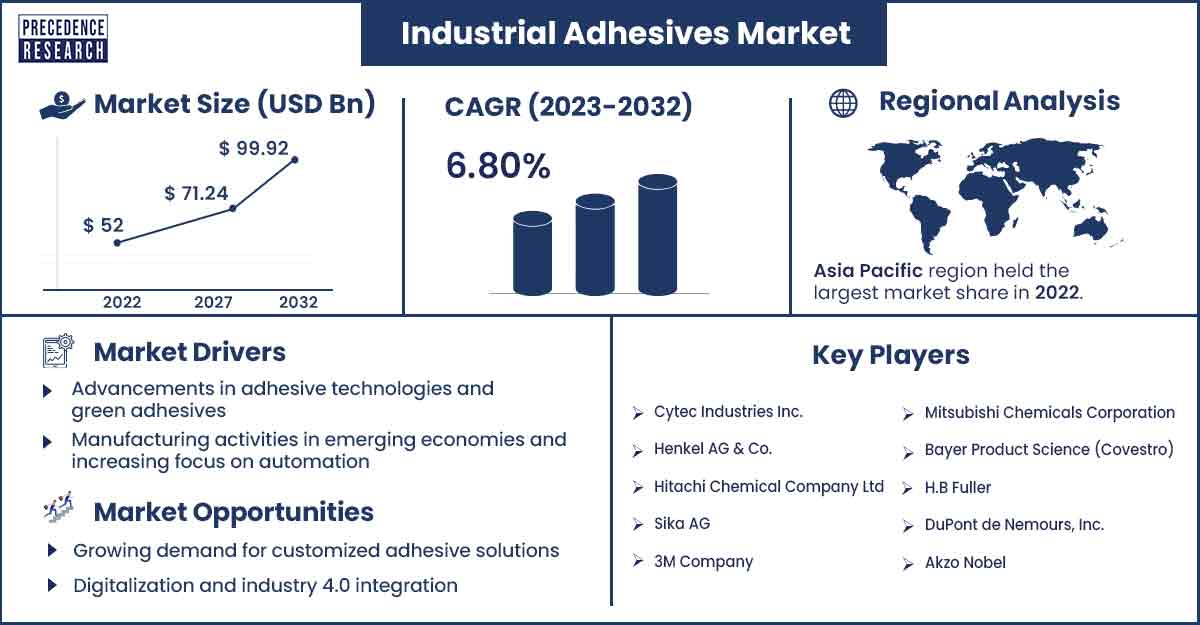

Industrial Adhesives Market Size To Attain USD 99.92 Bn by 2032

The global industrial adhesives market size surpassed USD 52 billion in 2022 and is projected to attain around USD 99.92 billion by 2032, growing at a CAGR of 6.80% from 2023 to 2032.

Market Overview

The industrial adhesives market encompasses various products used in multiple industrial applications across different sectors. A non-metallic substance is applied on two or more surfaces to stick or bind them together. The binding of materials is used in different industrial processes and hence increases the demand for adhesives. There are different types of adhesives, like optically clear, structural inserts, water-based, assembly films, die-to-attach, electrically conductive, hot melt, and so on. Each type has its unique property and is used in different processes.

The adhesives are capable of bonding metals, plastics, wood, composites, and ceramics. Adhesives are used in aerospace, packaging, electronics, automotive, and any industry that needs any kind of binding. Temperature and humidity can drying processes of adhesives; therefore, it is important to keep the products in proper condition for fast drying and avoiding any issues.

The industrial adhesives market growth includes increasing demand from end-use industries such as automotive, construction, packaging, electronics, and healthcare. Industrial adhesives offer advantages such as superior bonding strength, versatility, fast curing times, and resistance to harsh environmental conditions, contributing to their widespread adoption in industrial manufacturing processes.

The market is characterized by intense competition among key players, including multinational corporations, specialty chemical companies, and adhesive manufacturers. Companies focus on strategic initiatives such as mergers and acquisitions, partnerships, and product launches to expand their product portfolios, enter new markets, and strengthen their competitive position in the global industrial adhesives industry.

Regional Snapshot

In 2023, the North American region dominated the market. The industrial adhesives market in the United States is characterized by robust demand from key end-use industries such as automotive manufacturing, construction, electronics, and packaging. The United States is home to several leading adhesive manufacturers and suppliers, driving innovation, product development, and market competition. Stringent environmental regulations, VOC emission standards, and product labeling requirements influence market trends and product formulations in the US market.

Canada's industrial adhesives market shares similar trends with the United States, driven by industrial manufacturing activities, infrastructure projects, and technological advancements. Canada's automotive sector, construction industry, and aerospace manufacturing contribute to the demand for industrial adhesives for bonding, sealing, and assembly applications. Regulatory alignment with US standards and market integration within North America shape Canada's market's competitive landscape and market dynamics.

Industrial Adhesives Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 55.28 Billion |

| Projected Forecast Revenue by 2032 | USD 99.92 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in adhesive technologies and green adhesives

Technological advancements in adhesive formulations, curing methods, and application techniques drive product innovation and performance enhancements in the industrial adhesives market. Companies invest in research and development (R&D) to develop high-performance adhesives with improved bonding properties, durability, and environmental resistance. Innovations such as structural, reactive, and UV-curable adhesives expand the application scope and address evolving customer needs.

Increasing environmental awareness, regulatory pressures, and corporate sustainability initiatives drive demand for eco-friendly and sustainable adhesive solutions in the industrial sector. Manufacturers focus on developing water-based adhesives, solvent free formulations, and bio-based adhesives to reduce VOC emissions, minimize environmental impact, and meet regulatory requirements. Sustainable adhesives offer reduced carbon footprint, recyclability, and compatibility with green building standards.

Manufacturing activities in emerging economies and increasing focus on automation

The expansion of manufacturing activities, industrialization, and infrastructure development in emerging economies contribute to the growth of the industrial adhesives market. Countries such as China, India, Brazil, and Mexico experience increased demand for industrial adhesives in automotive production, construction projects, consumer goods manufacturing, and electronics assembly. Rising investments in manufacturing infrastructure, urbanization, and economic growth drive market expansion opportunities in emerging markets.

Restraints

Performance limitations and technical challenges

Depending on application requirements, substrates, environmental conditions, and end-use specifications, industrial adhesives may exhibit performance limitations and technical challenges. Temperature extremes, moisture exposure, chemical resistance, and surface preparation affect adhesive bonding performance and durability. Adhesive selection, formulation compatibility, and adhesive-substrate interactions require careful consideration to ensure optimal performance and reliability in industrial applications.

Market fragmentation and intense competition

The market is characterized by fragmentation, intense competition, and price pressures among adhesive manufacturers, suppliers, and distributors. Multinational corporations, specialty chemical companies, and regional suppliers compete for market share, driving price competition, product commoditization, and margin pressures. Differentiated product offerings, value-added services, and strategic partnerships are essential for manufacturers to differentiate their products, maintain profitability, and sustain competitiveness in the crowded industrial adhesives market landscape.

Opportunities

Growing demand for customized adhesive solutions

Customer demand for customized adhesive solutions tailored to specific application requirements, substrates, and performance criteria drives innovation and specialization in the industrial adhesives market. Adhesive manufacturers collaborate with customers to develop customized formulations, adhesive tapes, and bonding solutions optimized for their unique needs, including temperature resistance, chemical compatibility, and bonding strength. Customized adhesive solutions offer differentiation, value-added features, and competitive advantages in niche markets and specialized applications.

Digitalization and industry 4.0 integration

Adopting digitalization, automation, and industry 4.0 technologies in manufacturing processes presents opportunities for manufacturers to provide intelligent adhesive solutions, sensor-equipped adhesives, and digital connectivity for real-time monitoring and control. Digitalization enables adhesive tracking, quality assurance, and predictive maintenance, enhancing production efficiency, product reliability, and customer satisfaction. Integrating intelligent manufacturing systems and data analytics drives operational excellence and competitive advantage in the industrial adhesives market.

Adhesive bonding in lightweighting applications

The automotive, aerospace, and transportation industries' shift towards lightweight materials creates opportunities for adhesive bonding solutions as alternatives to traditional fastening methods. Adhesive bonding offers weight savings, design flexibility, and improved fuel efficiency in lightweighting applications. Opportunities exist for adhesive manufacturers to develop structural adhesives, composite bonding adhesives, and specialty adhesives optimized for bonding lightweight materials such as composites, plastics, and aluminum alloys.

Collaborative partnerships

Collaborative partnerships with customers, suppliers, and industry stakeholders enable adhesive manufacturers to offer value-added services, technical support, and customized solutions that address customer needs and market demands. Strategic alliances, joint ventures, and technology licensing agreements facilitate knowledge sharing, market expansion, and product innovation in the industrial adhesives market. Value-added services such as adhesive testing, application training, and aftermarket support enhance customer satisfaction and loyalty, driving long-term growth and profitability.

Recent Developments

- In February 2024, Intertronics launched a structural adhesive selector guide to help manufacturers find suitable materials for their applications.

- In October 2023, an iconic brand of bathware and tiles, Hindware Limited, announced its foray into the tile adhesive industry and expansion of its product offerings in the tiles category.

- In September 2023, Pidilite launched a new campaign highlighting Fevicol Glue Drops' instant bonding power.

- In May 2023, Brilliant Polymers announced the launch of two innovative new lines at Interpack 2023, held in Dusseldorf. The two innovative lines include Brilliant Max Cure, a new series of fast-curing solvent-free adhesives, and a GLYMO-free high-performance solvent-based adhesive suitable for retort applications.

Key Players in the Market

- Cytec Industries Inc.

- Henkel AG & Co.

- Hitachi Chemical Company Ltd

- Sika AG

- 3M Company

- Mitsubishi Chemicals Corporation

- Bayer Product Science (Covestro)

- H.B Fuller

- DuPont de Nemours, Inc.

- Akzo Nobel

- Lord Corporation

- Avery Denison Group

- Ashland Inc.

- Toyo Polymer Co. Ltd.

- Adhesive Films Inc.

Market Segmentation

By Product

- Polyvinyl Acetate

- Acrylic

- Epoxy

- Ethyl Vinyl Acetate

- Polyurethane

- Others

By Application

- Packaging

- Automotive

- Electrical & Electronics

- Industrial Machinery

- Medical

- Footwear

- Furniture

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1336

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308