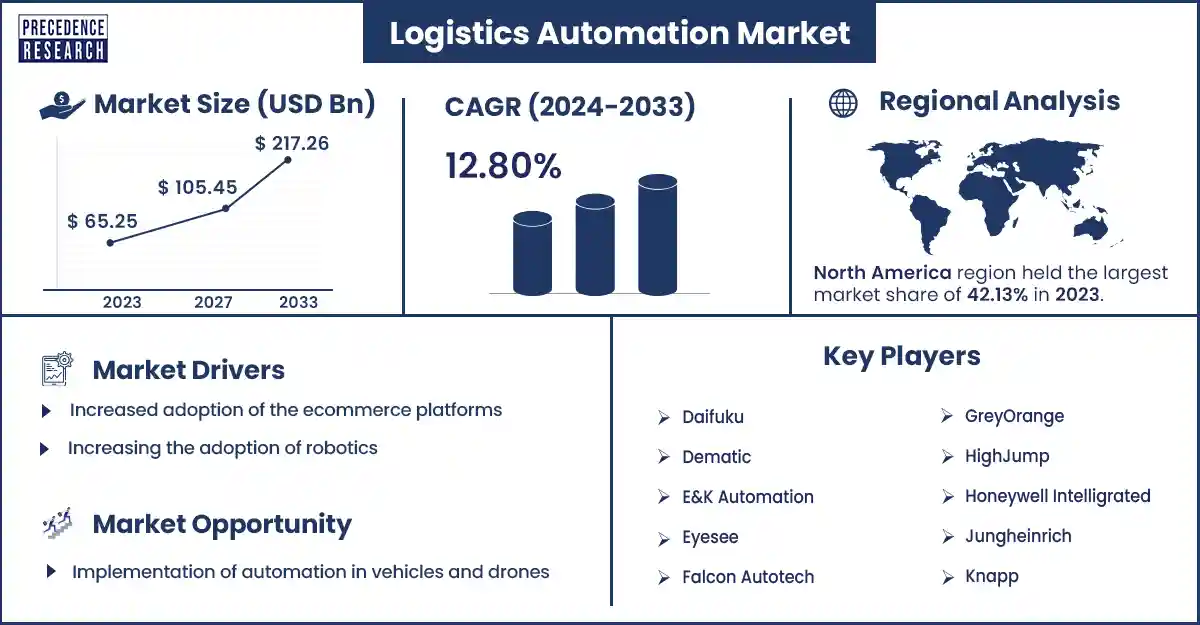

Logistics Automation Market is Representing 12.80% Growth by 2033

The global logistics automation market size was exhibited at USD 65.25 billion in 2023 and is anticipated to touch around USD 217.26 billion by 2033 expanding at a CAGR of 12.80% from 2024 to 2033. The market is growing due to the increased utilization of automated vehicles, mobile robots, robotic arms, and storage systems. Also, automation is adapting many companies and improving the service.

Market Overview

The logistics automation market deals with applying computer software or automated machinery to enhance the efficiency of logistics operations. Logistic automation is a game changer in the logistics industry. It implements automated technology in systems to optimize various things, including artificial intelligence, robotics, machine learning, and others. These technologies reduce manual labor and minimize errors. Due to several benefits, the market is growing, including enhanced efficiency, better management, increased accuracy, and improved customer satisfaction.

Automation technologies allow logistics companies to manage large volumes of goods more efficiently; automation is used in warehouse operations, inventory management, transportation of goods, and more, and automation logistics improve efficiency, productivity, and accuracy in these industries. Because of these benefits, the adoption of automation in logistics increased, which is growing the market.

Increasing the adoption of robotics fuels the market’s growth

Increasing the adoption of logistics robots can be a significant driver for the logistics automation market due to several advantages in e-commerce, which is a growing industry. As online shopping is increasing in the industry, consumers demand fast delivery, and same-day delivery is growing, and that increases the pressure on warehouses to manage the volume of orders. Companies like Amazon and Flipkart enhance and fasten their delivery service and adopt robotics. Robots are masters in packing, picking, and shipping products, reducing the processing times and human errors in these tasks. The adoption of robotics in warehouses also improves management because there is so much data, and it’s difficult to manage, but utilization of robotics can ease the workflow and manage the data. Robotics contribute to safety and risk prevention in warehouses; they handle physical tasks that can be dangerous for human workers and reduce the risk of injuries and accidents; these benefits increase the adoption of robotics.

However, the high investment cost can be a restraint for the logistics automation market. Implementing technologies such as robotics, artificial intelligence, and machine learning requires a high investment, and companies who want to improve their workflows have to invest a large amount, which can disturb their budget. This can reduce the adoption of these technologies and negatively impact the market growth.

Logistics Automation Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 65.25 Billion |

| Projected Forecast Revenue by 2033 | USD 217.26 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.80% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Top Companies in the Logistics Automation Market

- HighJump (Korber) (US)

- Honeywell Intelligrated (US)

- Jungheinrich (Germany)

- Daifuku (Japan)

- Dematic (US)

- Eyesee (Hardis Group) (France)

- Falcon Autotech (India)

- Manhattan Associates (US)

- GreyOrange (US)

- Seegrid (US)

- SSI Schaefer (Germany)

- Murata Machinery (Japan)

- System Logistics (Italy)

- SAP (Germany)

- SBS Toshiba Logistics (Japan)

- TGW Logistics Group (Austria)

- E&K Automation (Germany)

- Zebra Technologies (US)

- Swisslog (Switzerland)

- Oracle (US)

Recent Development by Jungheinrich

- In Jun 2023, Jungheinrich and Mitsubishi Logisnext Americas collaborated to launch the company Rocrish AGV, and the deal was to provide mobile automation solutions.

Recent Development by Falcon Autotech

- In August 2023, Falcon Autotech, a company that provides automation solutions, launched the NEO Warehouse innovation. The warehouse will have 3-dimensional robots for versatility and efficiency in warehouse operations.

Recent Development by Manhattan Associates

- In April 2024, Manhattan Associates Inc. launched a new Omni Channel technology advanced set to elevate retail operations and the customer experience in several areas such as point of sale, Customer Service & Engagement, store inventory & Fulfillment, and Order management.

Regional Insights

Asia Pacific is expected to grow at the fastest rate during the forecast period due to the increased adoption of automation in different industries, such as manufacturing and e-commerce for shipping, picking, and packing products. Many countries in the Asia Pacific face difficulties related to labor shortages and cost, and automation in warehouses reduces the problem and helps the market grow. In the Asia Pacific, governments also support companies in enhancing their workflow and improving their consumers' experience. Many companies in the Asia Pacific are using logistic automation, enhancing workflow, and growing the logistics automation market.

- In March 2023, German company Jungherich, specializing in warehouse equipment, opened a new integrated facility in Bhiwandi, Maharashtra, India.

North America dominated the market in 2023 due to the early adoption of technologies in the different industries to improve consumers' experience. As the various sectors are growing and increasing, such as e-commerce and manufacturing, the demand for robotics and other technologies increases and makes work easy for companies in North America, and because of these things, the logistics automation market is logistics automation growing.

- In March 2023, Unbox Robotics launched UnboxSort in the U.S. market, which has proven successful within the demodectic 3DL industry. The company is looking to make its tech available to meet the current demand for innovative plug-and-play automation solutions in the US.

Market Potential and Growth Opportunity

Implementation of automation in vehicles and drones

The adoption of automation in vehicles and drones presents a significant opportunity for the logistics automation market. Autonomous vehicles and drones are widely adopted, and they provide the potential to transform logistics operations, making them safer, more efficient, and environmentally friendly. Autonomous vehicles can handle tasks such as transportation, delivery, and even warehouse operations, reducing the need for humans and increasing operational speed and accuracy.

On the other hand, drones can be used for delivery, cameras to capture data inside the warehouse, and even package shorting in the warehouse; the development and deployment of these technologies in logistics are expected to optimize operations, reduce costs, and enhance customer satisfaction. Companies like Google and Tesla are leading the way in autonomous vehicle technology, while drone technology is rapidly evolving and offering new opportunities for logistics automation.

The Logistics Automation Market News

- In November 2023, the supply chain technology provider Emtec Digital and the logistics industry launched OptimatleQ, a platform to support and enhance supply chain processes through its automation-as-a-service capabilities.

- In January 2024, Accenture and Mujin, a leader in intelligent robotics, launched a joint venture for robotics and AI in logistics

- In May 2022, Tiger Logistics introduced a pricing discovery and supply-chain automation platform in India to guarantee efficiency and transparency in the highly fragmented domestic shipping sector.

- In August 2023, LogiNext launched an artificial intelligence (AI)--powered module to drive automation of finance in the logistics industry.

Market Segmentation

By Components

- Hardware

- Software

- Warehouse Management System (WMS) software

- Transportation Management System (TMS) software

- Services

- Consulting

- Implementation

- Support and Maintenance

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By End User

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods

- Retail and E-commerce

- Automotive

- Others

By Type

- Sales Logistics

- Production Logistics

- Recovery Logistics

By Mode of Freight Transport

- Air

- Road

- Sea

By Application

- Transportation

- Infotainment system

- Safety and alerting system

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2002

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308