Microcrystalline Cellulose (MCC) Companies | Forecast by 2033

Microcrystalline Cellulose (MCC) Market Growth, Trends and Report Highlights

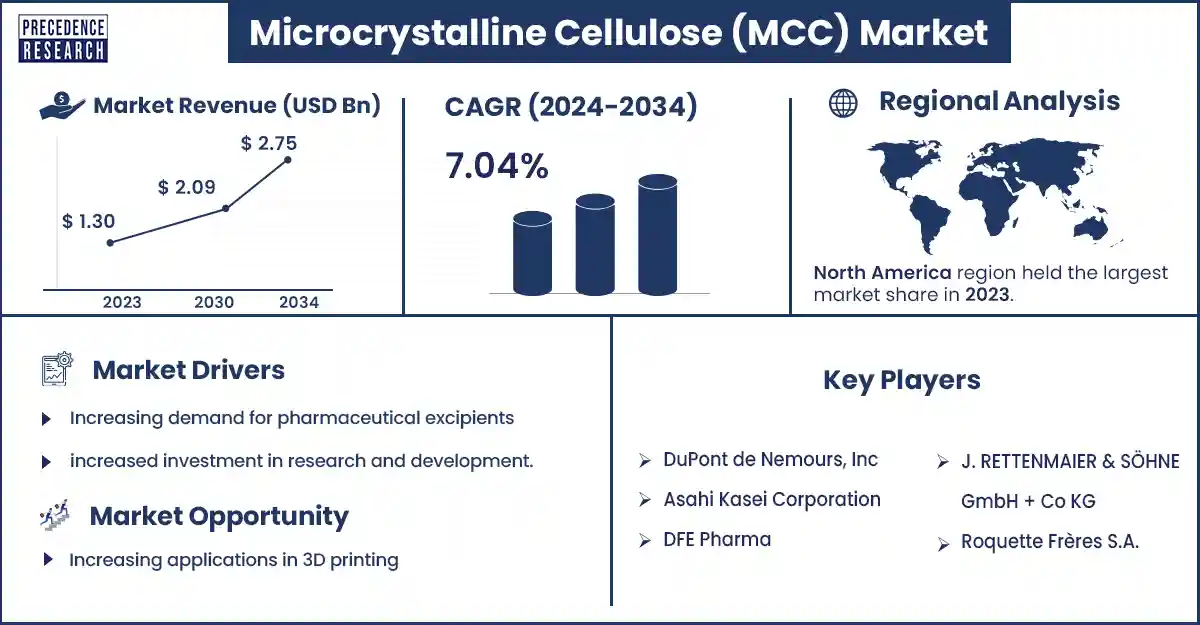

The global microcrystalline cellulose (MCC) market was exhibited at USD 1.30 billion in 2023 and is projected to attain around USD 2.57 billion by 2033, poised to grow at a CAGR of 7.04% during the forecast period. The increasing focus of cost-effective formulation by pharmaceutical industries are projected to expanse the market in forecast period. Increased awareness of quality and safety of cosmetic products are driving the market growth. Additionally, market is growing by dynamic requirement of functional food and beverages supplements.

Market Overview

Microcrystalline cellulose is an excipient frequently uses in pharmaceutical field. Pharmaceutical industry is one of the major platforms for MCC due to its capability of drug formulation and improvement in tablet stability. Ongoing expansion of the pharmaceutical industries are increasing adaption of microcrystalline cellulose globally. Additionally, the microcrystalline cellulose (MCC) market is projected to grow due to increased use of microcrystalline cellular in food and beverage industry. Trends in food and beverage sector are emphasizing the various use of microcrystalline cellulose in this industry, uses as stabilizer, thickening, anti-caking agents. This demand in food and beverages are anticipated to increase the manufacturing capacities.

However, sustainability concern related to sourcing is one of the main factors restricting the microcrystalline cellulose (MCC) market growth. Industries has struggled to find stable and sustainable sources of raw materials. This limitation emphasizes the importance for industry companies to adopt eco-friendly practices, and focusing on finding alternate raw material sources, and develop partnerships with companies in order to address sustainability issues. Due to growing awareness for purchasing of environmentally sustainable products, microcrystalline cellulose market needed to promise its sustainable viability.

As effect of COVID-19 pandemic in 2020, China’s government has started to invest and encourage the pharmaceutical companies and providing opportunities for research and development. As a result, China has become the second-largest healthcare sector worldwide.

Growing use of microcrystalline cellulose in cosmetic sector

Microcrystalline cellulose has the characteristics of texturizer, exfoliant, anti-caking agents, film former, humectants. Cosmetic sectors are preferring the use of microcrystalline cellulose to enhance stability and quality of the products. Cosmetic sectors have been expanded due to young generation has been more conscious about their looks, and skincare products. Cosmetic industries are contributing in improvement of cosmetic products along with sustainability and accelerating manufacturing of natural products rather than artificial products. Majorly North American countries have been dominating the microcrystalline cellulose (MCC) market with highest demand of MCC in the cosmetic industry for the eco-friendly alternative and this growth is projected to continue in forecast period.

Growth Factors

- Expanding pharmaceutical and food manufacturing industries are increasing the demand of microcrystalline cellulose leading growth in emerging economy.

- Increased demand of clean-label and natural ingredients in food industry is raising the global microcrystalline cellulose (MCC) market.

- MCC have been enhanced due to novel manufacturing methods, that improved the functionality, quality, safety, and cost-effectiveness.

- Growing awareness of eco-friendly sources like agriculture west, and less expensive is leading to increase the demand of non-wood MCC.

- COVID-19 pandemic impacted the work culture, growing preference of remote work culture, increased the demand for Pharmaceutical Grade Micro Crystalline Cellulose (MCC) solutions that encourage communication, collaboration, driving market growth.

Increasing incidence of chronic disease and raising demand of novel medication are driving the microcrystalline cellulose market.

Novel treatments methods has been in demand because of chronic disease are becoming common since recent period. Microcrystalline cellulose is a flexible excipient in production of new drugs. Due to expansion in innovation and development in pharmaceutical manufacturing technology, along with growing awareness of patient-centric formulation, driving the global market.

However, production cost of microcrystalline cellulose is the biggest challenge for the global market. For production of final product, microcrystalline cellulose has to go through various process such as bleaching, washing, dying, and acid hydrolysis. As a result, it increases the expense of microcrystalline cellulose production.

However, manufacturers are stepping towards non-wood based microcrystalline cellulose. Non-wood sources are harmless to environment and agriculture waste. Additionally, these sources are less expensive compared to wood-based cellulose. Increased the adaption of non-wood-based sources by manufacturers probably going to shoe the expansion opportunity for global microcrystalline cellulose (MCC) market in coming years.

Top Companies in the Microcrystalline Cellulose Market

- DuPont de Nemours, Inc

- Chemfield Cellulose

- Asahi Kasei Corporation

- DFE Pharma

- Rayonier Advanced Materials

- FMC Corporation

- Sigachi Industries Pvt. Ltd.

- J. RETTENMAIER & SÖHNE pharma

- Accent Microcell Pvt. Ltd.

- Ming Tai Chemical Co. Ltd.

- Roquette Frères S.A.

Recent Developments

Innovation of Asahi Kasei Corporation in market growth

| Company Name | Asahi Kasei Corporation |

| Headquarters | Chiyoda city, Tokyo, Japan |

| Recent Developments | In January 2023, the construction of second plant for Ceolus™ microcrystalline cellulose (MCC) was completed by Asahi Kasei Corporation. |

Innovation of Roquette Frères S.A. in market growth

| Company Name | Roquette Freres S.A. |

| Headquarters | Lestrem, France |

| Recent Developments | In May 2024, Roquette announced the introduction of its new LYCAGEL® Flex hydroxypropyl pea starch premix, which will be used for nutraceutical and pharmaceutical softgel capsules. Roquette is the leading provider of pharmaceutical and nutraceutical excipients. |

Regional Analysis

North America dominated the microcrystalline cellulose market in 2024. The availability of competitive landscape, healthcare development and increased demand of processed food are the factors driving the high adaption of microcrystalline cellulose in the region. United States holds the largest share of market in region due to increased demand of microcrystalline cellulose by end user industries. The United States is leading nation for cosmetic, pharmaceutical and chemical industry. Their steady production of industries is projected to open doors for novel opportunities for market growth in forecast period.

- In September 2022, Lattice® NTC 90 colloidal microcrystalline cellulose was introduced by IFF which is USA based company. Lattice® NTC 90 is used as suspension aid and emulsion aid and emulsion stabilizing agent due to its water-dispersible microcrystalline cellulose (MCC) powder.

Asia Pacific is projected as fastest growing region in microcrystalline cellulose (MCC) market in coming years. Growing pharmaceutical and food industries in region where manufacturers always search for high-quality excipients for production of different products. Countries like China and India are accelerated to hold largest market share due to its expanding demand of microcrystalline cellulose in pharmaceutical and cosmetic industries.

As per Indian Government, countries pharmaceutical industries market is projected to reach USD 130 billion by 2030. India has progressed in transportation of pharmaceutical products to more than 200 nations, and Government is expected to encourage India in future as well.

World’s exceptional beauty market is hold by South Korea. Market is expected to continue its growth in country because of high demand of featuring sophisticated ingredients, novel trends in beauty and investments, aesthetically appealing packaging. Cosmetic industry in South Korea is highly contributing in driving the market growth.

Market Potential and Opportunity

Adaption of artificial intelligence in production industries have the high potential of global microcrystalline cellulose (MCC) market’s growth. The use of AI to improve product quality, supply chain, and production methods, are contributing in productivity growth. For instant, manufacturing industries use automated algorithms to calculate working parameter in real time and estimation chance of equipment, that improve efficiency and reduce the costs. AI is helpful tool to offer standard quality production by altering companies.

Furthermore, microcrystalline cellulose have ability of easily blending with other process, like composites and coating. Additionally,3D printing industries has increased use of microcrystalline cellulose as environmentally friendly feedstock. Increased awareness sustainability has increased the demand of eco-friendly materials and growing interest of customers in high-value manufacturing techniques are driving the support for adaption of microcrystalline cellulose in 3D printing applications. Search 3D materials hold the huge growth opportunities for market.

Microcrystalline Cellulose (MCC) Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 1.30 billion |

| Market Revenue by 2033 | USD 2.57 billion |

| CAGR | 7.04% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In January 2024, Asahi Kasei Corporation, a Japan based company has started operating competitively at its second CeolusTM microcrystalline cellulose manufacturing plant which was announced in 2023.

- In May 2024, Sigachi has planned to grow its microcrystalline cellulose production capacity by above 50%, from 14,000 metric tons each year to above 21,000 metric tons each year.

Market Segmentation

By Application

- Food & Beverage

- Cosmetics & Personal Care

- Pharmaceutical

- Others

By Source Type

- Non-Wood Based

- Wood-Based

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4916

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308