Mobile Robots Companies | Forecast by 2033

Mobile Robots Market Growth, Trends and Report Highlights

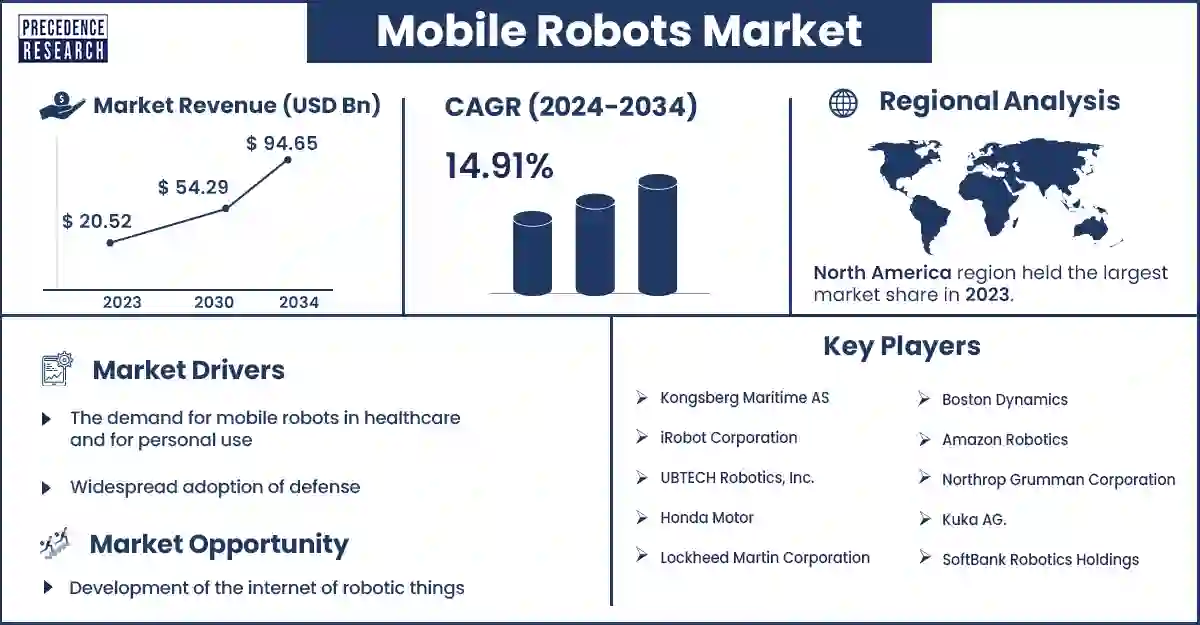

The global mobile robots market surpassed USD 20.52 billion in 2023 and is estimated to cross around USD 82.37 billion by 2033, growing at a CAGR of 14.91% during the forecast period. Order fulfillment procedures that are automated and efficient are becoming more and more in need as online shopping expands. Due to their autonomous navigation skills, mobile robots are becoming indispensable for optimizing operations, cutting human costs, and increasing order accuracy in warehouses and distribution centers.

Market Overview

The industry is focused on creating, manufacturing, and deploying semi-autonomous or autonomous robots that can navigate and function in a variety of contexts without the need for human assistance. These robots employ sensors, software, and occasionally artificial intelligence to travel areas, carry out activities, and interact with their surroundings.

The market for mobile robots is substantial because of their wide range of applications in several sectors, such as manufacturing, healthcare, logistics, agriculture, and defense. By taking over tedious, dangerous, or precise jobs, mobile robot adoption increases operational efficiency, lowers labor costs, and improves safety. This market is driving the fourth industrial revolution and is also essential to the advancement of automation and smart systems.

- In 2023, investments in robotics total over $12.9 billion. Manufacturers of mobile autonomous robots for interior uses, like e-commerce fulfillment, were well-represented in December 2023. GreyOrange ($135M), Instock ($3.2M), Cyngn ($5M), and SWARM Robotics are a few examples.

Mobile Robots Market Trends

- The rise in e-commerce has led to a greater need for effective logistics and warehousing operations. Mobile robots increase efficiency and accuracy by automating order picking, sorting, and transportation processes.

- Advancements in sensor technology, artificial intelligence, and machine learning allow mobile robots to become more cooperative, intelligent, and flexible. This increases their potential use and strengthens their skills.

- Manufacturers are increasingly using automation to increase output, lower labor costs, and improve quality. Mobile robots are perfect for dangerous, repetitive jobs like material handling, assembly, and inspection.

- Healthcare settings are using mobile robots for duties like medicine delivery, patient care assistance, and sterile environment tasks. The desire for increased patient safety and efficiency drives this trend.

Rising adoption in healthcare is driving the mobile robots market

Mobile robots are increasingly being deployed in healthcare settings to save expenses and streamline processes. These robots can carry out jobs like supplies, delivering equipment, and medication, freeing up employees to concentrate on more important patient-facing duties. This lowers labor expenses and increases operational efficiency, which saves healthcare facilities a lot of money. One significant aspect propelling the use of mobile robots is the need for such affordable solutions. There is a lack of labor in many healthcare systems, especially for nurses and support personnel.

By handling repetitive and ordinary chores, mobile robots help mitigate these difficulties and free up healthcare staff to focus on more difficult and complex tasks.

Mobile Robots Market Top 10 Companies

- Kongsberg Maritime AS

- iRobot Corporation

- UBTECH Robotics, Inc.

- Amazon Robotics

- Northrop Grumman Corporation

- Kuka AG.

- SoftBank Robotics Holdings

- Honda Motor

- Lockheed Martin Corporation

- Boston Dynamics

Recent Innovation in the Mobile Robots Market by Pramac

| Company Name | Pramac |

| Headquarters | Località Il Piano, 53031, SI, Italy |

| Development | In March 2024, BlueBotics and Pramac have partnered, supplying fleet management software and ANT navigation technology for Pramac's new X-ACT mobile logistics robot line. |

Recent Innovation in the Mobile Robots Market by ABB Robotics

| Company Name | ABB Robotics |

| Headquarters | Oerlikon, Zurich, Switzerland |

| Development | In March 2024, With the help of AI-based Visual SLAM navigation technology and the brand-new AMR Studio software, ABB Robotics unveiled the Flexley Tug T702. This autonomous mobility robot can efficiently program and manage whole fleets of mobile robots, even for novice robot users. With a severe lack of experienced labor, the new capabilities simplify configuration and commissioning time by as short as 20 percent, opening the door to a workplace were intelligent robots function independently. |

Regional Insights

North America dominated in the mobile robots market in 2023. Major IT firms and cutting-edge robotics research institutes are based in North America. Leading companies developing advanced mobile robots, such as drones, industrial robots, and autonomous cars, are Boston Dynamics, iRobot, and Tesla. North America remains at the forefront of innovation due to the region's concentration on research and development. The need for mobile robots in logistics and storage has increased dramatically due to the explosive growth of North America's e-commerce industry. Mobile robots are being extensively invested in by corporations such as Amazon and Walmart to sort, pack, and move products across their distribution centers.

- In April 2024, Rapyuta Robotics, a leading manufacturer of autonomous mobile robot solutions, is pleased to announce that Hypertherm Associates is the first client in the US for its ground-breaking Pick Assist Autonomous Mobile Robots (AMRs).

Asia-Pacific is observed to be the fastest growing in the mobile robots market during the forecast period. Asia-Pacific is a significant player in global manufacturing, with Japan, and China playing critical roles in international supply chains. Mobile robot use has surged due to manufacturing's growing need for automation to improve efficiency and save labor costs. The demand for automation in warehouses and distribution centers has increased significantly due to the growth of e-commerce in the area.

An increasing number of businesses, including Alibaba, and Rakuten, are using mobile robots to perform duties such as picking, packing, and carrying items. Due to manpower constraints and the need to boost productivity, the agriculture sector in nations such as China and India are starting to use mobile robots for crop monitoring, spraying, and harvesting.

- In January 2024, Chinese entrepreneurs who specialize in warehouse robots are eager to get orders in Japan, where businesses are trying to find a way to clear a backlog in the logistics sector.

Market Opportunity and Growth Potential

Technological innovations in sensors and connectivity

Mobile robots can gain a full understanding of their environment by integrating input from various sensors, a process known as sensor fusion. This enhances decision-making processes and makes it possible for robots to adjust to changes in their surroundings, such as moving objects or shifting lighting, which increases operational safety and efficiency.

Advances in connectivity make it easier to construct swarm robotics, in which a group of robots cooperate to accomplish a common objective. This is especially helpful for large-scale activities like farming, where hordes of robots may work together to plant, monitor, and harvest crops simultaneously

Mobile Robots Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 23.58 Billion |

| Market Revenue by 2033 | USD 82.37 Billion |

| CAGR | 14.91% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mobile Robots Market News

- In September 2024, with contributions from additional shareholders and current investors Giant Eagle Inc. and G2 Venture Partners, Seegrid Corp. finalized its $50 million Series D funding round.

- In March 2024, At the global AI conference NVIDIA GTC, Leopard Imaging Inc. revealed that it will debut its Nova Orin Development Kit, driven by the high-speed Owl cameras, 3D Depth Stereo Hawk Camera, and NVIDIA Jetson AGX Orin.

Market Segmentation

By Product

- Unmanned Ground Vehicles (UGVs)

- Unmanned Aerial Vehicles (UAVs)

- Unmanned Surface Vehicles (USVs)

- Autonomous Underwater Vehicles (AUVs)

By Component

- Industrial

- Service

By Application

- Logistics & Warehousing

- Military & Defense

- Healthcare

- Domestic

- Entertainment

- Education

- Agriculture & Forestry

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4932

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344