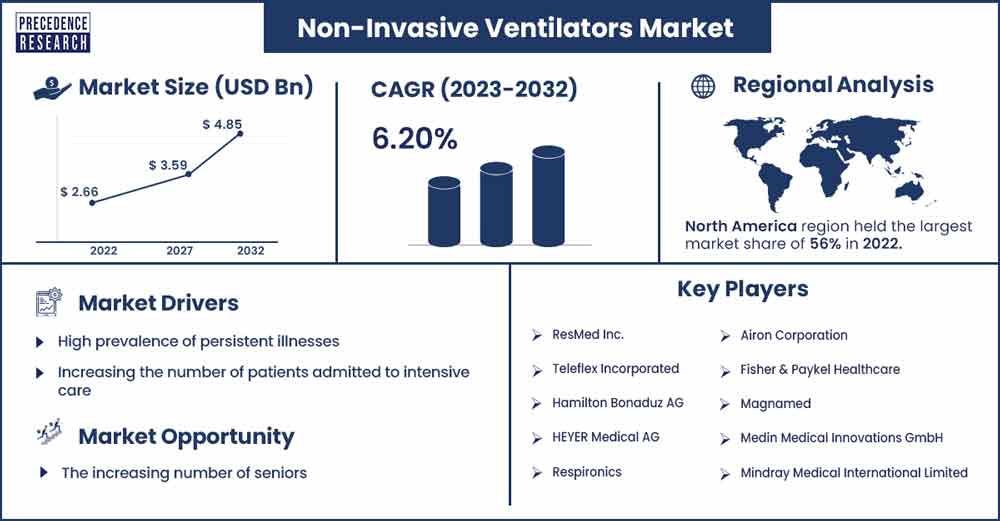

Non-invasive ventilators Market To Attain Revenue USD 4.85 Bn By 2032

The global non-invasive ventilators market revenue was evaluated at USD 2.66 billion in 2022 and is expected to attain around USD 4.85 billion by 2032, growing at a CAGR of 6.20% from 2023 to 2032.

Over the course of the forecast period, the market for non-invasive ventilators is anticipated to expand significantly due in large part to the rising incidence of respiratory illnesses. Worldwide, the prevalence of mild to severe chronic obstructive pulmonary disease (COPD) is estimated to be 65 million.

The market for non-invasive ventilators is expanding as a result of numerous technical developments in ventilation devices with improved working efficiency and the rising elderly population. In the near future, it is anticipated that risk factors like obesity and diabetes, unhealthy behaviors like drinking and smoking, and abnormal sleep patterns that lead to respiratory issues will push the market for non-invasive ventilators.

Another significant factor that is anticipated to propel the market for non-invasive ventilators is the accumulated demand for new technological devices among doctors. Additionally, over the course of the projection period, demand for non-invasive ventilators is anticipated to increase due to their advantages over intrusive ventilators. The market for non-invasive ventilators is anticipated to expand, but their expensive price will likely impede that development. The market for non-invasive ventilators is also anticipated to expand slowly due to the danger of inadequate ventilation as a result of an improper setup.

Report Highlights

- Over the forecast timeframe, a substantial increase in COPD and asthma prevalence is expected. Given the high incidence of respiratory conditions like asthma and COPD, it is expected that more NIV will be used, which will hasten segmental growth.

- The hospitals business segment dominated in 2021, accounting for a revenue share of over 45.0%. This is due to increased institutional expenditure, which makes it possible to use ventilators equipped with cutting-edge technology.

- North America dominated the market in 2021 with a revenue share of more than 55.0%. The market in the area is mainly being pushed by a rise in the number of COVID-19 patients with severe illnesses in the United States and the adoption of output increases by leading producers.

Non-invasive ventilators Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.82 Billion |

| Projected Forecast Revenue by 2032 | USD 4.85 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.20% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshots

North America is anticipated to hold a significant share of the market, and it is forecasted to maintain its growth over the forecast term. The rising incidence of different respiratory illnesses and the rising number of product clearances are the main drivers of market development in the area.

Asthma is one of the major illnesses that significantly lowers the quality of life for most Americans, and respiratory disease is one of the major contributors to the region's healthcare load. According to the American College of Allergy, Asthma & Immunology (ACAAI) organization's January 2023 report, there are nearly 1.3 million ER visits and 439,000 hospitalizations linked to asthma each year in the United States. Additionally, according to the aforementioned source, the yearly economic expense of asthma in the nation is estimated to be USD 56,000 million.

Market Dynamics

Drivers

The start of the COVID-19 epidemic had a sizable effect on the industry under investigation. Because of the pandemic's sudden start, there was originally a negative effect on the market because fewer patients were visiting hospitals and clinics. However, as the pandemic progressed and patients with COVID-19 and other chronic respiratory diseases began to require more NIV, the market experienced tremendous development.

According to a research paper that was released in the Clinical Respiratory Journal in March 2021, NIV was frequently used to manage patients with moderate to severe acute respiratory failure (ARF) in addition to continuous positive airway pressure (CPAP). The researchers also came to the conclusion that NIV was effective in 48% of the overall population investigated when a group of patients with mild to severe COVID-19 infection were examined, and a 57% mortality rate was observed among the patients in the intensive care unit (ICU) incubation after NIV.

The high percentage of survival among the intended patients led to a rise in demand for NIVs. This had a sizable impact on the market's expansion and is predicted to keep doing so throughout the projection term.

During the projection period, it is anticipated that factors like rising respiratory disease instances and a quick rise in demand for minimally invasive treatments will propel market development. Other reasons contributing to the growing use of the devices and the expansion of the market include the benefits connected with different types of non-invasive (NIV) ventilators.

Restraints

The market for non-invasive ventilators is constrained by the low adoption rate of expensive ventilators. Globally, respiratory diseases are the main cause of mortality. As supportive instruments for quick healing and long-term hospital management, respiratory devices are necessary. One major obstacle to the affordability of respiratory systems for lower-middle and lower-income groups is their expense.

Additionally, because medical devices are technology-driven, the market for non-invasive ventilators will see a rise in demand and price as new technology is introduced. Non-invasive ventilator utilization is hampered by expense growth.

Therefore, it is expected that the market will be constrained during the projection period due to the poor adoption rate of expensive non-invasive ventilators.

Opportunities

Increasing COPD prevalence

Breathlessness is a symptom of COPD, a respiratory condition that worsens with exercise and puts a person at risk for exacerbations. Furthermore, a severe sickness may result in a long-term increase in the need for emergency care. In addition, among the target population's complicated heterogeneous inflammatory airway diseases, asthma is one of the most prevalent cases. Thus, it is anticipated that more NIV will be applied as a result of the high prevalence of respiratory crises like asthma and COPD, which will quicken segmental development.

Nearly 1 in 10 individuals worldwide are affected by COPD each year, according to a September 2022 piece in the American Journal of Respiratory and Critical Care Medicine. Additionally, according to data released on World Lung Day 2022 by the Global Initiative for Chronic Obstructive Lung Disease, an estimated 200 million people had COPD in the previous year, and asthma, one of the most common respiratory illnesses, affects roughly 262 million people each year.

Numerous studies indicate that NIV is more advantageous for people with asthma and COPD. As a result, it is expected that the high prevalence of diseases will increase demand for NIV usage and propel the segment's development.

Additionally, ipratropium bromide combined with non-invasive ventilation is efficient in the therapy of people with COPD and respiratory failure, according to a study released in the American Journal of Translational Research (AJTR) in May 2022. The devices can greatly reduce circulatory inflammation, enhance patient pulmonary function, blood gas levels, and therapy effectiveness.

Thus, it is expected that the systems' advantages will support the segment's expansion during the forecast era. Therefore, it is expected that the benefits of the systems and apps in treating COPD patients will spur competition among the participants and aid in the segment's expansion.

Challenge

Globally, respiratory diseases are the main cause of mortality. As supportive instruments for quick healing and long-term hospital management, respiratory devices are necessary. One major obstacle to the affordability of respiratory systems for lower-middle and lower-income groups is their expense.

Additionally, because medical devices are technology-driven, the market for non-invasive ventilators will see a rise in demand and price as new technology is introduced. Non-invasive ventilator utilization is hampered by expense growth.

Therefore, it is expected that the market will be constrained during the projection period due to the poor adoption rate of expensive non-invasive ventilators.

Recent Developments

- In November 2021, Movair, a respiratory therapy company formerly known as International Biophysics Corporation, commercially launched Luisa, an advanced ventilator intended for use in homes, institutions, hospitals, or portable applications for invasive and Non Invasive ventilation. Luisa is one of the first residential ventilators to feature high-flow oxygen treatment. It is lightweight and small. Luisa, a tiny eight-pound device with an 18-hour battery life, offers patients eight programmable comfort levels for individualized, custom treatment. Patients can integrate the ventilator into their daily habits by using Luisa's rotating 10-inch monitor and range of communication options, such as resting on one side of the bed.

- The Philips Ventilator BiPAP A40 EFL was unveiled in November 2020 by Royal Philips, a leader in medical technology worldwide. With the introduction of this non-invasive ventilator, Philips expands its homecare options to include a novel ventilation treatment function for COPD patients to breathe more easily. Expiratory flow restriction (EFL) people with COPD can now be identified by pulmonologists, who can then treat them with specialized medicine to reduce symptoms and enhance slumber. Based on the requirements of the patient, the BiPAP A40 EFL respirator continuously and effectively regulates pressure.

Key Market Players:

- ResMed Inc.

- Teleflex Incorporated

- Hamilton Bonaduz AG

- HEYER Medical AG

- Respironics

- Airon Corporation

- Fisher & Paykel Healthcare

- Magnamed

- Medin Medical Innovations GmbH

- Mindray Medical International Limited

- O-Two Medical Technologies Inc.

- Phoenix Medical Systems Pvt. Ltd.

- Phillips Healthcare

- Smiths Medical

- WILAmed GmbH

Segments Covered in the Report

By Application

- Respiratory Distress Syndrome

- Asthma & COPD

- Others

By End User

- Ambulatory Surgical Centers

- Hospitals and Clinics

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2831

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333