Offshore Support Vessel Companies | Forecast by 2033

Offshore Support Vessel Market Growth, Trends and Report Highlights

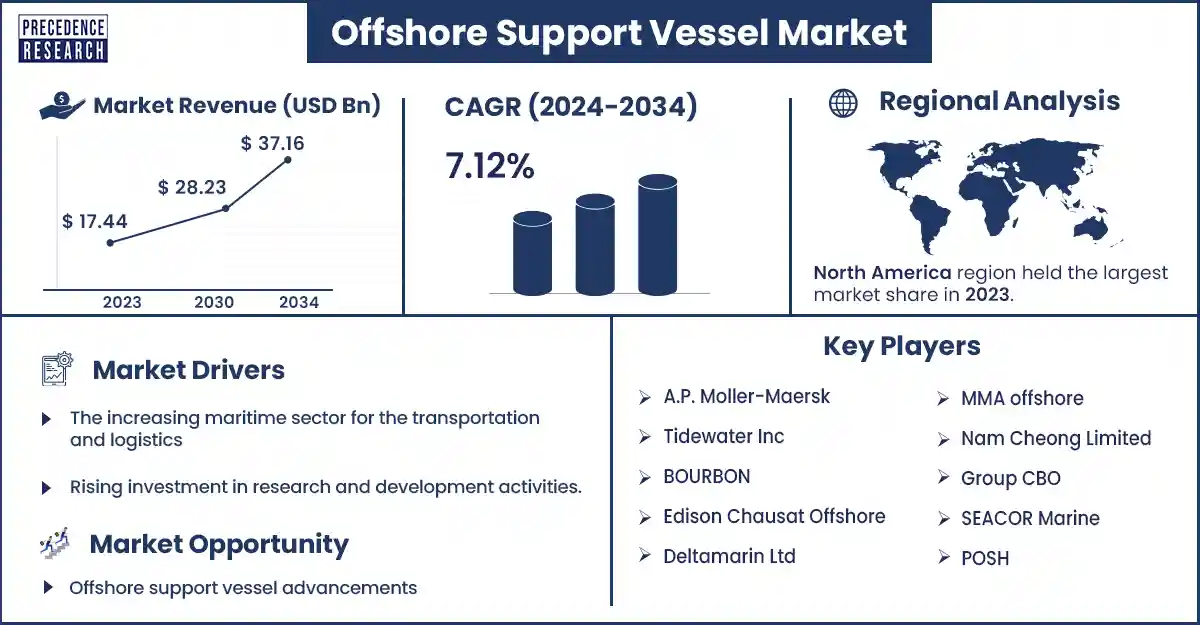

The global offshore support vessel market was exhibited at USD 17.44 billion in 2023 and is projected to attain around USD 34.69 billion by 2033, poised to grow at a CAGR of 7.12% during the forecast period. The rising government investment in the offshore activities expansion such as oil and gas mining, energy generation, and others are driving the growth of the market.

Market Overview

Offshore support vessels are specialty ships that are designed to enhance efficiency in maritime activities. They are used in the different sectors of the industry. It is used for transportation to the rigs to repair offshore wind turbines. There are different types of offshore support vessels used according to the demand of the operations, including supply OSVs, support OSVs, Anchor Handling Tug Supply OSVs, Dive Support OSVs, Anchor Handling Tug Supply OSVs, Fracture/Stimulation OSVs, Utility OSVs, lift and crew boat OSVs, large OSVs, and others.

Growth Factors

- The rising industrialization across the economically developing and developed countries and the rise in the global trade activities and international export and import of goods and materials are driving the growth demand for the offshore support vessels for the cargo activities.

- The rising investment in the growing infrastructure in the maritime sector, along with the rising adoption of smart technologies and equipment in the manufacturing process and the end-products or vessels, are driving the growth of the market.

- The increasing awareness for the renewable power sources and energy generation from the sea like wind power plants related construction activities drives the demands for the large size vessels for the transporting the required equipment and construction components.

- The increasing adoption of sustainable sources of energy is contributing to the growth of the market

- The rapid expansion in the maritime sector for multi-faced purposes such as transportation, cargo activities, logistics, energy generation, and other related construction activities are driving the growth of the offshore support vessel market. The rising utilization of marine wind for power generation is due to the rising awareness about the environmental impacts of conventional sources of energy. The rising global population and the demand for energy are driving the demand to find and adopt alternative sources of energy generation that are environmentally friendly and sustainable.

- The rising implementation or the installation of wind power plants on oceans causes the demand for offshore support vessels to transport the equipment and components that are essential in the construction or development of wind power plants in a safer and cost-efficient way.

- On the other hand, the cost of operations and government policies for offshore activities by several regional governments are limiting the expansion of the offshore support vessel market.

Offshore Support Vessel Market Top Companies

- A.P. Moller-Maersk

- Tidewater Inc

- BOURBON

- Edison Chausat Offshore

- Deltamarin Ltd

- MMA offshore

- Nam Cheong Limited

- Group CBO

- SEACOR Marine

- POSH

- Delta marine

- FEG

- GC Rieber

Recent Innovation by Tidewater Inc. in the Offshore Support Vessel Market

| Company Name | Tidewater Inc. |

| Headquarters | Houston, Texas, United States |

| Development | In July 2023, Tidewater Inc. announced the completion of its acquisition with the Solstad Offshore ASA’s 37 platform supply vessels and related assets. In association with the Company’s financing of the Solstad acquisition, it completed the formerly announced bond offering in the Nordic bond market on July 3, 2023. |

Recent Innovation by Deltamarin Ltd in the Offshore Support Vessel Market

| Company Name | Deltamarin Ltd. |

| Headquarters | Turku, Finland |

| Development | In September 2024, Deltamarin agreed to the contract with China Merchants Jinling Shipyard (Weihai) for the engineering and designing of the 14th and 15th vessels in Stena RoRo’s E-Flexer series. The contract covers the basic and complete details of the two new multi-fuel E-Flexer RoPax vessels, which will be methanol-ready. |

Regional Insights

North America is expecting the fastest growth during the forecast period. The growth of the market is attributed to the rising development in industrialization, and the growing international trade between continents is driving the growth of the maritime sector. The rising advancement in the manufacturing of offshore vessels with more integrated features that help enhance operational efficiency and cost-effectiveness, as well as the availability of the major market players in the region, collectively drive the growth of the market.

Additionally, the rising awareness and the stringent government policies for the development and use of renewable sources of energy are driving sustainability in operations, which collectively drives the growth of the offshore support vessel market in the region.

Asia Pacific is expecting accountable growth during the predicted period. The growth of the market is owing to the rising global trade activities in countries like India and China, which are causing a higher demand for the offshore support vessel market in the region.

Market Potential and Growth Opportunity

The oil and gas field is driving the opportunity in the market’s growth opportunity

The growing investment in the oil and gas field development by the various regional countries is driving the growth opportunity for the offshore support vessels market. The oil and gas field needs large-sized ships or vessels for the transportation of crude oil and other related activities. Additionally, the rising awareness among the government in sustainable sources of energy by the oceans is positively impacting the market’s growth.

Offshore Support Vessel Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 18.68 Billion |

| Market Revenue by 2033 | USD 34.69 Billion |

| CAGR | 7.12% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Offshore Support Vessel Market News

- In May 2024, the well-known Brazilian state-run oil and gas company Petrobras PBR launched two significant tenders by the end of the year. The contract aims to build 26 new build offshore support vessels, which marks a significant impact on Brazil's shipbuilding industry.

- In July 2024, DOF Offshore Holding Denmark acquired all the shares in Maersk Supply Service for roughly USD 1.1 billion, including a deal of 22 vessels, consisting of 13 anchor handling tug supply vessels, eight construction support vessels, and one cable layer.

- In January 2024, Cadeler was launched by Cosco Shipyard in China; it is the newly built vessel Wind Peak designed to transport and install up to seven complete 15 MW offshore wind turbine sets per load.

Market Segmentation

By Material

- Offshore Vessel Support Material

- Cladding Material

By Fuel

- Fuel Oil

- Liquefied Natural Gas (LNG)

By Type

- Volume and Volume Based Market Analytics

- Anchor Handling Tug Supply Vessels

- Platform Supply Vessels

- Multipurpose Support Vessels

- Standby & Rescue Vessels

- Crew Vessels

- Seismic Vessels

- Chase Vessels

- Other Vessels

By Application

- Shallow Water

- Deep Water

By End-Use

- Offshore Wind

- Offshore Oil and Gas

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4961

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308