Oil Storage Market Will Expand at 8.24% Growth by 2030

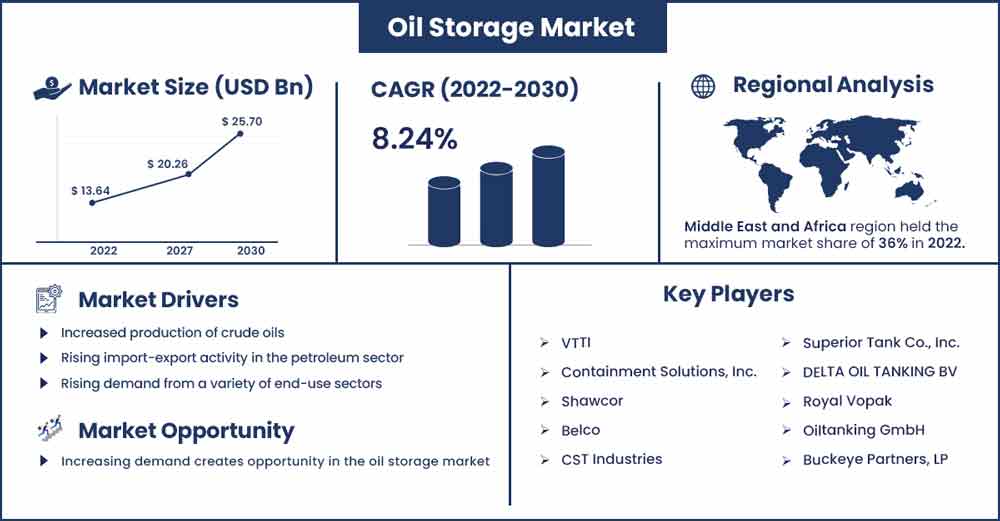

The global oil storage market size was exhibited at USD 13.64 billion in 2022 and is projected to attain around USD 25.7 billion by 2030, poised to grow at a strong CAGR of 8.24 percent during the projection period from 2022 to 2030.

In order to produce, refine, and distribute petroleum products, oil storage tanks are necessary. The best tanks for production fields are small bolted ones, whereas refineries and distribution centers all over the world employ bigger welded storage tanks. The tank selection procedure may be impacted by the product's operating circumstances, storage capabilities, and special design difficulties. The sorts of goods used to supply refineries worldwide have seen substantial change in the petroleum sector. The industry has had to look to alternative sources of supply due to the rise in the consumption of petroleum products.

The advantage of oil storage is protection against short-term variations in the availability of crude oil and its derivatives. The growth rate of oil production is substantially larger than the market from end-use sectors. There are many different sizes and shapes of storage tanks. Depending on their intended usage, tanks may need to be rectangular, shaped like horizontal cylinders, or even spherical. Chemical or hydrocarbon compounds are commonly kept in horizontal cylinders and spheres in full loads. The design that is used the most frequently is the vertical, cylinder-shaped storage tank.

Regional Snapshots:

The biggest market share was held by the LAMEA in the oil storage market during the forecast period. Due to the expanding demand for petroleum products across several industrial and commercial sectors in numerous nations around the region, the Middle Eastern market will continue to lead the market in terms of revenue over the projected period.

According to estimates, the market will be driven by increased oil production and efficient refinery throughput in nations like the UAE, Saudi Arabia, and Kuwait. It is anticipated that the need for storage tanks in the area would continue to increase as a result of the demand for petroleum and distillates in the industrial sectors. With 300.9 billion barrels or 18.2% of the world's oil reserves in 2021, Venezuela has the highest oil reserve in the world. Venezuela has the greatest oil reserves in the world, but the majority of that oil is offshore or underground. The oil reserves and demands from end user industry has driven the regions highest market share during the forecast period.

Oil Storage Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 14.76 Billion |

| Projected Forecast Revenue in 2030 | USD 25.7 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 8.24% |

| Largest Market | Middle East and Africa |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

On the basis of product type, the crude oil segment will have a larger market share in the coming years period, the amount of revenue generated through the use of this product will grow well in the coming year. The market for oil storage across the world is dominated by crude oil. Many products including diesel, gasoline, aviation fuel, kerosene, and others are created from crude oil and utilized all over the world.

On the basis of storage type, the fixed roof segment has the biggest market share in the oil storage market during the forecast period. The high level of containment provided by fixed Roof, which lowers the likelihood of a fire, is principally responsible for the segment's expanding penetration. Lower installation costs for permanent roof designs contribute to the segment's expansion.

Market Dynamics:

Drivers:

The oil and gas industry has remarkably expanded during the last several decades as a result of increased demand from a range of end-use sectors. Since the demand for various types of oil, including gasoline, aviation fuel, intermediate distillates, and crude oil, is still increasing swiftly, oil storage has become an urgent necessity. Players in the oil storage market are aggressively committing resources to the development of new technologies, oil storage product production, and oil storage techniques in order to establish a solid footing in the competitive market environment. Since oil and gas are often transported over great distances around the world, oil storage is an essential part of the whole oil supply chain. This aspect is projected to fuel new developments and improvements throughout the oil storage market over the course of the projection.

The emphasis on oil storage has remained relatively high due to the necessity of massive storage systems for maritime transit, notably at export-import ports. Over the course of the assessment period, it is anticipated that this aspect will boost the growth of the worldwide oil storage market. Over the past few decades, there has been a steady rise in the need for oil storage to hold strategic reserves to ensure the supply of oil during a crisis.

Restraints:

The market's growth is anticipated to be constrained throughout the forecast period by the high cost associated with oil storage tanks.

Opportunities:

Since crude oil is a raw ingredient for the creation of refined products, there is a direct correlation between the demand for crude oil and the need for petroleum-based products. The IEA reports that as a result of lockdowns implemented to combat the COVID-19 epidemic, worldwide oil demand decreased by 16.4 mb/d year over year in Q2 2020. As a result, the amount of oil in storage increased, driving up demand for crude oil storage facilities. As a result, throughout the time of forecasting, a discrepancy between the supply and demand of crude oil is expected to present lucrative possibilities.

Challenges:

The market for oil storage is being significantly constrained by the rising use of renewable energy sources to generate electricity. Since renewable fuels tend to be less polluting, environmental concerns have surpassed energy security as the primary motivator of government programs to support them. Research and development on alternative automobile fuel technologies has recently concentrated on fuels made from oil and natural gas, biofuels made from plant material, such as ethanol or biodiesel, electric vehicles (EVs), and fuel cells made from hydrogen.

Recent Developments:

- In April 2018 - A facility expansion for Buckeye Partners L.P.'s Chicago Complex has been announced. Due of its importance as a Midwest logistics center, the corporation committed over $80 million in the expansion. In order to meet the growing demands of clients, the expansion includes improved storage, component blending, throughput capacity, and service capabilities in the Chicago Complex. The extension also include the renovation of an existing truck rack and the building of an extra tankage capacity of around 600,000 barrels for product mixing.

Major Key Players:

- VTTI

- Containment Solutions, Inc.

- Shawcor

- Belco

- CST Industries

- Superior Tank Co., Inc.

- DELTA OIL TANKING BV

- Royal Vopak

- Oiltanking GmbH

- Buckeye Partners, LP

Market Segmentation:

By Product Type

- Crude Oil

- Gasoline

- Aviation Fuel

- Middle Distillates

- LPG

- Diesel

- Others

By Storage Type

- Open Top Tanks

- Fixed Roof Tanks

- Floating Roof Tanks

- Other Storage Facilities

By Material

- Steel

- Carbon Steel

- Fiberglass-reinforced Plastic (FRP)

By Reserve Type

- Strategic Petroleum Reserve

- Commercial Petroleum Reserve

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2296

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333