PDU Power Cords Market Revenue to Attain USD 2.75 Bn by 2033

PDU Power Cords Market Revenue and Trends 2025 to 2033

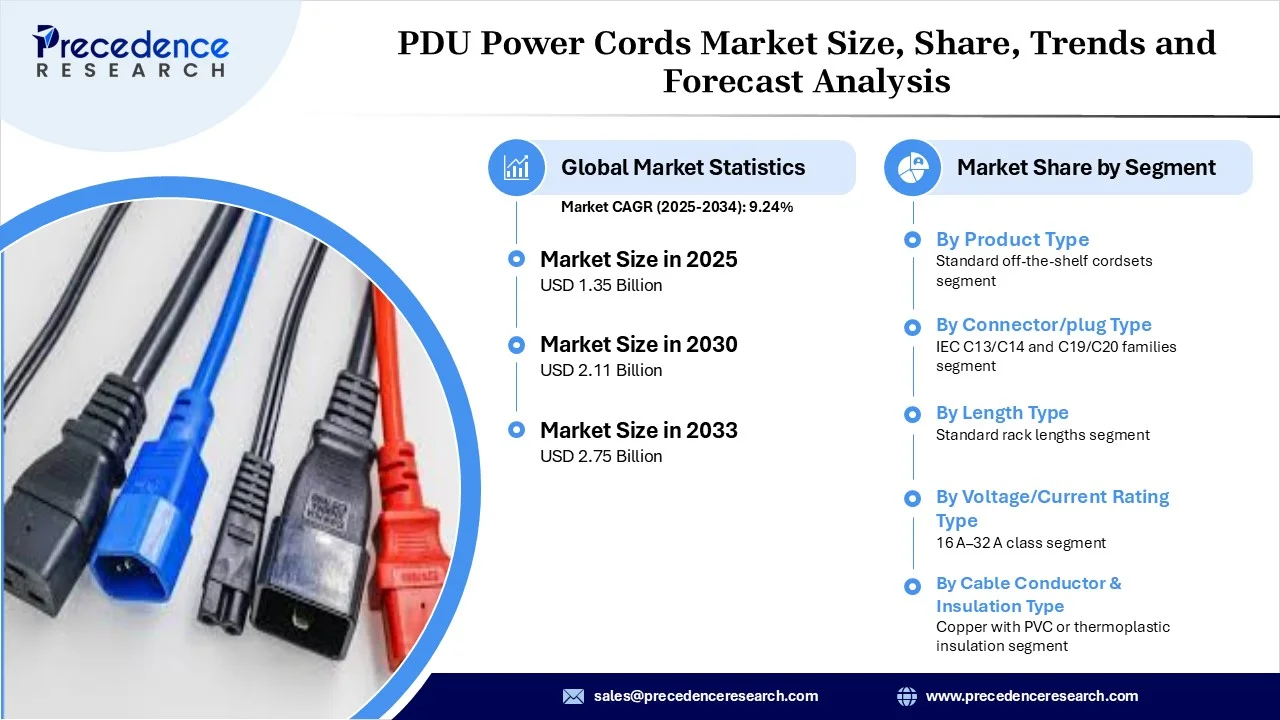

The global PDU power cords market revenue reached USD 1.35 billion in 2025 and is predicted to attain around USD 2.75 billion by 2033 with a CAGR of 9.24%. The PDU power cords market is rising because exponential growth in data center infrastructure, cloud adoption, and Internet of Things drives a surge in demand for reliable power delivery solutions that ensure uptime and efficiency.

Key drivers influencing the growth of the PDU power cords market:

The PDU power cords market is being propelled primarily by the rapid growth of data centers worldwide, especially hyperscale and co-location facilities with reliable power infrastructure, which is an element of resilience. Growth in public cloud computing is forcing organizations to accelerate the scaling of server farms, which creates high-end cordset usage to maintain power integrity under heavy loads, a requirement on many enterprise computing systems. Energy efficiency regulations and environmental impact concerns are driving manufacturers and end-users to adopt PDU power cords and materials that will minimize power losses and conform to safety/eco standards – as well as more resilient materials once again. Increasing automation levels and trends towards more edge computing applications will also demand flexible, modular, redundancy, and resilient power cord options.

Segment Insights

- By product type, standard off-the-shelf cordsets dominate this market segment because they are the least expensive, fastest-to-acquire, and most universally compatible with installations of PDUs.

- By connector/plug type, the IEC C13/C14 and C19/C20 families dominate the market, based on universal acceptance in server, network, and telecom equipment for both enterprise/data center and colocation data centers.

- By voltage/current rating, the 16 A-32 A class dominates the PDU power cords market, since they reflect the typical power draw and safety/regulatory limits for mounted, rack-based equipment in today's data halls.

- By cable conductor & insulation material, standard copper conductors with PVC or other thermoplastic insulation dominate the market, as they provide an adequate balance of cost, safety compliance, and flexibility.

- By length/form factor, standard rack lengths (0.5-2 m) dominate the market, consistent with the majority of racks and cabinets layouts, which minimizes voltage drop and site clutter.

- By PDU type/compatibility, basic and metered PDU cordsets dominate the market, since most facilities want accurate power measurement but do not demand switching or monitoring by individual outlet.

- By application/end use, data centers & colocation dominate the power cords market, since they represent the vast majority of the demand for high-reliability, high-density PDU power cords.

- By installation type, field-installed, site-procured cordsets dominate the market, as many data center and IT facility builds customize cord lengths, flexibility and compatibility on site.

PDU Power Cords Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.35 Billion |

| Market Revenue by 2033 | USD 2.75 Billion |

| CAGR from 2025 to 2033 | 9.24% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

North America is the leading market for PDU power cords. The U.S. accounts for most of the demand driven by investment in hyperscale data center expansion in states like Virginia and California. There is early, though strong, adoption of intelligent PDU solutions, remote power analytics, and regulatory pressure to create energy efficient and green power infrastructure products. North America also has mature supply chains, high power densities per rack, and importantly, companies willing to pay the premium to ensure they have high-reliability power connecting hardware.

Asia-Pacific is the fastest-growing region, also dominating in terms of growth rate. Countries like China, India, Japan and other Southeast Asian markets are constructing data centers at an unprecedented pace while also investing heavily in cloud and edge infrastructure and benefiting from strong government support to accelerate digital transformation. Local manufacturing, lower labor costs and a growing OEM presence will also help to facilitate adoption in the region. The Asia-Pacific region is forecasted to capture over 40% of the global market share in the coming years.

PDU Power Cords Market Key Players

- Amphenol

- Belden

- Eaton / Tripp Lite

- HellermannTyton

- Hubbell

- Legrand / Eaton

- Molex

- Molex / Amphenol

- NEXANS

- Nidec

- Panduit

- Prysmian Group

- Schneider Electric / APC

- Southwire

- Tripp Lite

Recent Developments

- On 7 July 2025, Chatsworth Products (CPI) introduced its new eConnect PDUs with QuadLock Outlets, supporting C13, C15, C19, and C21 outlets in one PDU with integrated locking mechanisms, designed for high-density workloads including AI and liquid cooling and targeting flexibility without requiring proprietary cords. (Source: https://wgno.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6772

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344