PDU Power Cords Market Size and Forecast 2025 to 2034

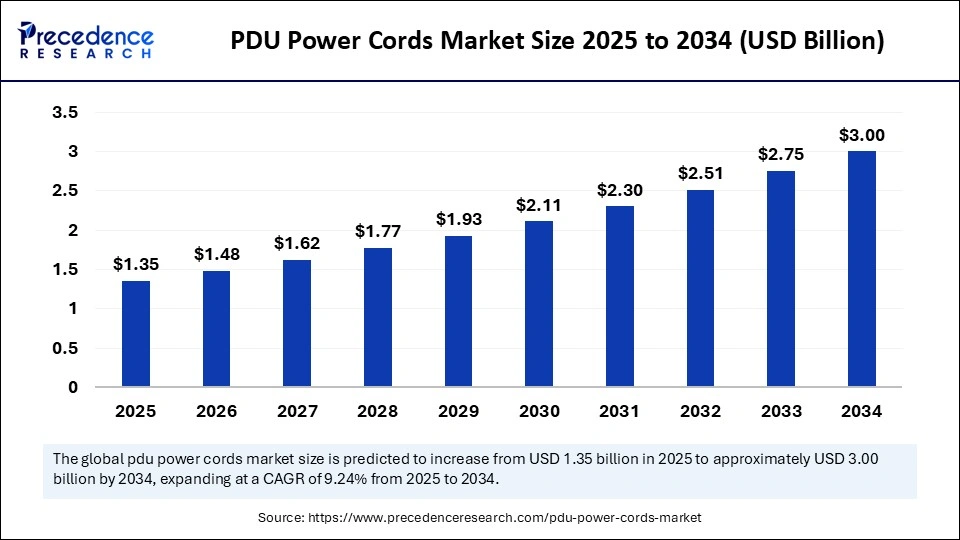

The global PDU power cords market size was calculated at USD 1.24 billion in 2024 and is predicted to increase from USD 1.35 billion in 2025 to approximately USD 3.00 billion by 2034, expanding at a CAGR of 9.24% from 2025 to 2034. The PDU power cords market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. As of 2024, the market size is estimated at USD 1.24 billion. The global PDU power cords market is emerging as a critical segment in the electrical and electronics industry, owing to its durability, flexibility, and resistance to harsh environments.

PDU Power Cords Market Key Takeaways

- In terms of revenue, the global PDU power cords market was valued at USD 1.24 billion in 2024.

- It is projected to reach USD 3.00 billion by 2034.

- The market is expected to grow at a CAGR of 9.24% from 2025 to 2034.

- North America dominated the PDU power cords market in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the standard off-the-shelf cordsets segment held the biggest market share in 2024.

- By product type, the custom-molded & modular cord assemblies segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By connector/plug type, the IEC C13/C14 and C19/C20 families segment accounted for a considerable share in 2024.

- By connector/plug type, the locking/high-density segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By voltage/current rating type, the 16 A–32 A class segment led the market t in 2024.

- By voltage/current rating type, the high-current and three-phase cord sets segment is expected to experience the fastest CAGR from 2025 to 2034.

- By cable conductor & insulation type, the standard copper with PVC/thermoplastic insulation segment captured the biggest market share in 2024.

- By cable conductor & insulation type, the LSZH is the fastest growing from 2025 to 2034.

- By length type, the standard rack lengths segment captured the highest market in 2024.

- By length type, the Short jumpers are the fastest-growing segment from 2025 to 2034.

- By PDU type, the basic and metered PDU cordsets segment captured the highest market share in 2024.

- By PDU type, the smart/managed PDU-compatible cord assemblies are the fastest growing in the market, from 2025 to 2034.

- By end-user type, the data centers & colocation segment contributed the maximum market share 2024.

- By end-user type, the edge & telco micro-sites are the fastest growing in the market, from 2025 to 2034.

- By installation type, the field-installed site-procured cordsets segment accounted for a considerable share in 2024.

- By installation type, the pre-terminated harnesses and quick-disconnect modular segment is projected to experience the highest growth rate in the market between 2025 and 2034.

A Growing Demand Curve

The PDU power cords market has witnessed steady growth over the past few years, supported by rising investments in manufacturing, renewable energy, and electric vehicles. Industrial sectors are prioritizing safer and long-lasting cabling systems to reduce downtime and enhance operational efficiency. The superior resistance of PDU power cords to oil, chemicals, and mechanical stress gives them a clear edge over conventional PVC cords. Additionally, the market is benefiting from rapid urbanization and infrastructure expansion across emerging economies. Manufacturers are increasingly innovating designs to meet evolving safety regulatory standards. Overall, the market trajectory points towards sustained expansion in both volume and value terms.

How AI Is Impacting the PDU Power Cords Market?

Artificial intelligence is transforming the PDU power cords market by enabling smarter design, predictive maintenance, and optimized supply chain operations. AI-powered material simulations help in developing cords with enhanced thermal stability and conductivity. In industrial plants, AI-driven monitoring systems can predict potential cord failures, reducing downtime and maintenance costs. Machine learning models are also assisting manufacturers in demand forecasting and improving inventory efficiency. Additionally, AI integration in testing processes ensures higher quality and compliance with global safety standards. This convergence of AI with material engineering is accelerating the innovation cycle within the PDU power cords market.

Market Key Trends

- Rising adoption of eco-friendly and recyclable polyurethane materials in cord production.

- Another is the integration of smart features, such as embedded sensors for monitoring current flow and heat levels.

- Demand for lightweight yet durable cords is growing, particularly in robotics and portable electronics.

- There is also a clear shift towards customized solutions tailored for specific industries, such as healthcare and aerospace.

- Hybrid cords combining power and data transmission are gaining traction, especially with IoT-enabled devices.

- These trends collectively indicate the PDU power cords market moving towards innovation, sustainability, and multifunctionality.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.00 Billion |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2024 | USD 1.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Connector / Plug Type, Voltage / Current Rating, Cable Conductor & Insulation Type, Length / Form Factor, PDU Type / Compatibility, Application / End-Use, Installation Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Forces Behind Growth

The rapid expansion of industrial automation and robotics is a major driver fueling demand for the PDU power cords market. Rising safety concerns in high-voltage applications are pushing industries to adopt more reliable cabling solutions. Growth in renewable energy projects, such as wind and solar, requires cords with high endurance in extreme conditions. The global shift toward electric vehicles also creates opportunities, as durable cords are vital for charging infrastructure. Additionally, the demand for heavy-duty cords in the construction and mining sectors continues to rise. Together, these factors are creating a robust demand landscape for PDU power cords.

Restraint

Challenges Ahead

Despite the strong growth outlook, the PDU power cords market faces challenges such as higher production costs compared to PVC alternatives. Volatility in raw material prices, especially polyurethane, can impact profitability for manufacturers. Regulatory compliance across different regions adds complexity to production and distribution. The market also faces competitive pressures from substitute materials and cheaper cord options. Additionally, recycling polyurethane remains a technological and economic challenge. These constraints may slow adoption in price-sensitive markets, despite the clear performance advantages of PDU power cords.

Opportunities

Unlocking Potential

Opportunities lie in developing biodegradable and recyclable polyurethane materials for sustainable cord solutions. Emerging applications in electric vehicle charging stations and smart grids represent lucrative growth areas. Expanding industrial infrastructure in Asia and Africa provides a vast untapped market for PDU power cords. Manufacturers also have opportunities in creating hybrid cords that combine power with real-time data transmission. The growing use of robotics in the healthcare and logistics sectors opens another avenue for specialized cord designs. Ultimately, innovation and diversification will be the key drivers of future opportunities in this market.

Product Type Insights

Why Standard Off-the-Shelf Cordsets Dominated the Market?

Standard off-the-shelf cordsets continue to dominate the PDU power cords market because of their mass availability, affordability, and ease of replacement in global supply chains. These cords are widely used across data centers, industrial plants, and commercial settings where standardized dimensions and specifications are sufficient. Their reliability in low-to-medium complexity applications makes them the go-to choice for IT managers and facility operators. Manufacturers prefer producing them in bulk due to lower production costs and high demand consistency. They also benefit from universal regulatory certifications, ensuring compliance across multiple geographies. Overall, their cost-effectiveness and wide adaptability secure their dominance in the market.

Custom-molded and modular cord assemblies are the fastest-growing segment, driven by the need for flexibility in modern data centers and industrial automation. These assemblies allow operators to tailor solutions for high-density racks, specialized machinery, and compact equipment layouts. Modular designs reduce clutter and simplify cable management, which is crucial for efficiency and optimal cooling. Enterprises are increasingly seeking pre-engineered solutions that reduce on-site installation time and risk. The growing adoption of Industry 4.0 practices further accelerates demand for modular connectivity solutions. As customization and efficiency become top priorities, this segment is expected to outpace traditional offerings.

Connector / Plug Type Insights

What Connectors Are Leading the PDU Power Cords Market?

IEC C13/C14 and C19/C20 connectors lead the market for PDU power cords because they are the global standard in IT and data center environments. Their widespread adoption is linked to compatibility with most PDUs, servers, and rack-level devices. Bulk production and international acceptance make these connector families cost-efficient and readily available. They provide the right balance of reliability and current capacity for the majority of IT workloads. Regulatory acceptance across regions further cements their leading role. In essence, they form the backbone of current power distribution in critical infrastructure.

Locking and regionally specialized connectors are the fastest-growing, as operators demand more secure, compact, and site-specific solutions. High-density racks in hyperscale data centers require connectors that minimize footprint while ensuring robust connections. Locking mechanisms prevent accidental disconnections, which is vital in mission-critical environments. Regional variations also drive the adoption of specialized connectors tailored to local standards and regulations. Their growth is further fueled by increasing deployments of edge sites, which demand resilient and compact solutions. This category is rapidly gaining traction as density and uptime requirements intensify.

Voltage / Current Rating Insights

What Voltage Ratings Are Currently Dominating the Market for PDU Power Cords?

The 16 A–32 A class dominates because it suits the majority of mid-tier servers, switches, and rack-mounted equipment. These ratings align with standardized PDU outputs and are widely supported across global data center infrastructure. Their balance of capacity, safety, and cost-efficiency makes them the default option for most operators. High production volumes have also lowered unit costs, making them accessible at scale. They ensure compliance with international safety codes, further boosting adoption. This class remains the sweet spot for mainstream deployments worldwide.

High-current and three-phase cordsets are the fastest-growing, driven by the rise of hyperscale computing, AI workloads, and HPC clusters. These environments require greater power density and efficiency, pushing demand for advanced cord solutions. Three-phase systems reduce energy loss and support higher rack utilization, making them attractive for operators. The adoption of GPUs and energy-intensive hardware accelerates this trend. Custom three-phase cordsets are being integrated into smart PDU architectures for load balancing. This segment is expanding rapidly as power-hungry digital infrastructure scales up.

Cable Conductor & Insulation Type Insights

Which Cable Conductors Are the Dominant Choice for the PDU Power Cords Market?

Copper with PVC or thermoplastic insulation is the dominant choice due to its cost-effectiveness, electrical performance, and ease of mass production. These cords offer adequate protection for most industrial and IT settings where regulatory requirements are moderate. Their flexibility and durability meet the needs of mainstream environments without significantly raising costs. PVC's proven track record for insulation reliability makes it a safe, trusted choice. Additionally, legacy infrastructure across many regions is already configured for these cord types. Their familiarity and affordability guarantee their continued dominance.

Low-smoke zero-halogen (LSZH), high-temperature, and armored cords are the fastest-growing, especially in hyperscale, telecom, and regulated industries. Growing emphasis on fire safety, sustainability, and resilience is driving this shift. LSZH cords reduce toxic emissions in case of fire, aligning with stricter building and data center codes. Armored and high-temp constructions provide superior durability for demanding environments like mining, offshore, and telecom towers. These premium solutions are gaining preference where uptime and compliance are paramount. Their expansion reflects the global move towards safer and more robust power infrastructure.

Length / Form Factor Insights

Why Did Standard Rack Lengths Dominate the Market?

Standard rack lengths dominate because they align with the most common data center and enterprise setups. Predefined lengths simplify procurement and ensure consistent installation practices. Their mass production makes them more affordable and widely stocked. Standardization also supports global compatibility and faster deployment. Many facility managers prefer these cords due to their predictable design and easy replacement. As a result, they remain the industry's default option.

Short jumper cords and custom-length assemblies are the fastest-growing, as operators focus on optimizing airflow and cable management. These cords reduce clutter in dense racks and improve energy efficiency. Custom lengths eliminate excess cable slack, reducing risks of tangling and overheating. Growing demand for high-density racks and micro-data centers is accelerating this trend. Enterprises value the improved aesthetics and operational efficiency that tailored cords provide. This segment is rapidly rising as efficiency and space optimization become critical.

PDU Type / Compatibility Insights

Why Did Basic and Metered PDU-Compatible Cordsets Lead the PDU Power Cords Market?

Basic and metered PDU-compatible cordsets are in high demand due to their large installed base in traditional data centers. They provide sufficient functionality for operators focused on cost control and baseline monitoring. Their widespread availability ensures easy replacement and low procurement hurdles. Many legacy infrastructures continue to rely on them for routine operations. Cost efficiency also drives preference, especially in mid-market deployments. Thus, they maintain leadership in volume sales.

Smart and managed PDU-compatible cords are the fastest-growing in the PDU power cords market due to the rising adoption of rack-level telemetry and power optimization. These cord assemblies integrate with monitoring systems to provide real-time data on energy usage and load balancing. The shift towards intelligent infrastructure and automation makes them highly valuable. Operators adopting AI-driven data centers increasingly require cords that enable digital connectivity. Edge deployments also prefer managed cords for remote visibility and control. This category is surging in demand as digital infrastructure grows smarter.

Application / End-Use Insights

Which Facilities Saw the Most Applications in the Market for PDU Power Cords?

Data centers and colocation facilities dominate as the largest consumers of the PDU power cords market. Their scale and reliance on consistent uptime drive massive demand for reliable power distribution. The standardization of racks, PDUs, and power connections further consolidates demand. With cloud adoption surging, colocation hubs remain steady buyers. Industrial and enterprise data centers alike rely on standard cords for day-to-day reliability. This end-use segment has cemented itself as the market's backbone.

Edge computing and telco micro-sites are the fastest-growing application areas due to distributed infrastructure needs. These sites require compact, resilient cord solutions tailored to limited space and variable conditions. Telecom rollouts for 5G and IoT are expanding rapidly, multiplying demand for site-specific cord systems. Edge deployments prioritize space efficiency and modular connectivity, fueling the adoption of customized cords. Operators are also seeking cords with advanced insulation to handle outdoor or mobile conditions. This segment is expanding quickly as networks decentralize.

Installation Type Insights

Which Installations Were the Most Popular in the PDU Power Cords Sector?

Field-installed, site-procured cord sets dominate the PDU power cords market because they offer flexibility for on-site adjustments and replacements. They are cost-effective for facilities that prefer direct procurement and installation by in-house teams. Their ubiquity ensures availability across global supply channels. Many legacy sites are still reliant on these cords due to entrenched procurement processes. They provide operators with control over specifications at the installation stage. This entrenched model secures their leadership in the market.

Pre-terminated harnesses and modular quick-disconnect systems are the fastest-growing, driven by demand for faster, safer, and error-free installations. They significantly reduce deployment time in hyperscale and edge environments. Pre-engineered designs also minimize human error and improve reliability. Modular cord systems enable easier scaling and reconfiguration as infrastructure evolves. Operators value the reduced labor costs and enhanced standardization these solutions offer. This installation type is accelerating as efficiency becomes a top priority in large-scale rollouts.

Regional Insights

How Is North America Dominating the Market?

North America continues to dominate the global PDU power cords market, driven by strong demand from industrial automation and renewable energy sectors. The region's robust infrastructure for EV charging further fuels cord adoption. Advanced manufacturing practices and stringent safety regulations have accelerated the shift from PVC to PDU power cords. The presence of leading technology companies has also created demand for high-performance cords in electronics and data centers. Additionally, government initiatives supporting clean energy projects are stimulating market growth. Overall, North America remains the innovation hub for the industry.

In addition, rising investments in AI-powered smart factories have increased demand for durable, long-lasting cords. North American companies are prioritizing predictive maintenance solutions, further boosting the adoption of PDU power cords. The surge in robotics and industrial automation has created new applications across automotive, aerospace, and logistics. The region is also a frontrunner in developing eco-friendly polyurethane formulations. Growing collaborations between cord manufacturers and renewable energy firms are reshaping the supply landscape. Together, these dynamics strengthen North America's position as the leading region for PDU power cords.

How Is Asia Pacific Setting Up Its Lead?

The Asia-Pacific region is emerging as the fastest-growing market for PDU power cords, driven by the rapid growth of industrialization and urbanization. Countries like China, India, and Japan are witnessing rising demand across manufacturing, consumer electronics, and EV infrastructure. Cost-effective production capabilities make the region attractive for global manufacturers. Expanding renewable energy projects in Asia are creating a parallel demand for heavy-duty cords. Increasing safety awareness and adoption of global standards are pushing industries toward PDU power cords. As a result, the region is experiencing exponential growth in both production and consumption.

Moreover, Asia-Pacific's booming e-commerce and logistics industries are accelerating automation, further driving cord demand. Investments in smart cities and digital infrastructure also require high-performance cord systems. The rapid adoption of electric vehicles across the Asia-Pacific strengthens the need for reliable charging solutions. Governments are supporting local manufacturing, creating favourable policies for polyurethane-based innovations. Strategic partnerships with global players are boosting technology transfer and product quality. Collectively, these factors make Asia-Pacific the engine of future growth in the PDU power cords market.

PDU Power Cords Market Companies

- Amphenol

- Belden

- Eaton / Tripp Lite

- HellermannTyton

- Hubbell

- Legrand / Eaton

- Molex

- Molex / Amphenol

- NEXANS

- Nidec

- Panduit

- Prysmian Group

- Schneider Electric / APC

- Southwire

- Tripp Lite

Recent developments

- In September 2025, Windjammer Capital, a national private equity firm specializing in control equity investments in middle-market companies, announced that it had acquired PDU Cables (PDU) and Engineered Products Company (EPCO) in partnership with management and the Lee Family. The transaction closed in August, and financial terms were not disclosed.(Source: https://finance.yahoo.com)

Segments Covered in the Report

By Product Type

- Standard PDU power cords / cordsets (fixed-length, off-the-shelf)

- Custom-molded corsets & factory-terminated assemblies

- Removable / hot-swap PDU cordsets (detachable connectors)

- Extension cords & jumper leads for PDU interconnects

- Modular / custom harnesses and multi-outlet cord assemblies

By connector / Plug Type

- IEC family (C13/C14, C19/C20, C15/C16)

- NEMA (5-15, 5-20, L6-20, L6-30, L14-30, etc.)

- Regional mains (BS1363, Schuko, AS/NZ, etc.)

- High-density / locking connectors (IEC Lock, CS/IEC variants)

- Specialized inlets (CEE-form, stage/industrial connectors)

By Voltage / Current Rating

- Low voltage / domestic (≤16 A)

- Medium (16–32 A)

- High current (32–63 A and above)

- Multi-phase / three-phase cord assemblies

By Cable Conductor & Insulation Type

- Copper (tinned/untinned) conductor cordsets

- High-temp / silicone-insulated cords

- LSZH (low-smoke, zero-halogen) sheathed cords

- Armored/braided/shielded cable assemblies (EMI-sensitive sites)

- Flexible H05/H07/H07RN-F grade constructions

By Length / Form Factor

- Short jumper cords (<0.5 m)

- Standard rack lengths (0.5–3 m)

- Extended lengths (>3 m)

- Coil/retractable and space-saving flat cords

By PDU Type / Compatibility

- Basic / non-intelligent PDU cords

- Metered / switched PDU cords (for PDUs with monitoring/control)

- Smart/managed PDU-specific cord assemblies (integrated sensor connectors)

- High-power PDU cordsets for modular PDUs / power shelves

By Application / End-Use

- Data centers & colocation facilities

- Hyperscale / cloud provider deployments

- Enterprise IT & corporate data rooms

- Edge & telco sites (micro data centers, 5G edge)

- Industrial & mission-critical facilities (manufacturing, energy)

By Installation Type

- Factory-installed / OEM-bundled cordsets

- Field-installed / site-procured cordsets

- Quick-disconnect modular installs (for hot-swap racks)

- Pre-terminated rack/cabinet harnesses

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting